Support CleanTechnica’s work through a Substack subscription or on Stripe.

The news from Hyundai this week was stunning. It announced it is slashing the price of the IONIQ 5 — its best selling electric car in the US — by nearly $10,000! In a press release, the company said:

“Hyundai Motor America today announced substantial pricing reductions across the 2026 IONIQ 5 lineup, reinforcing the brand’s commitment to making EVs more accessible and competitive in the rapidly evolving EV market.

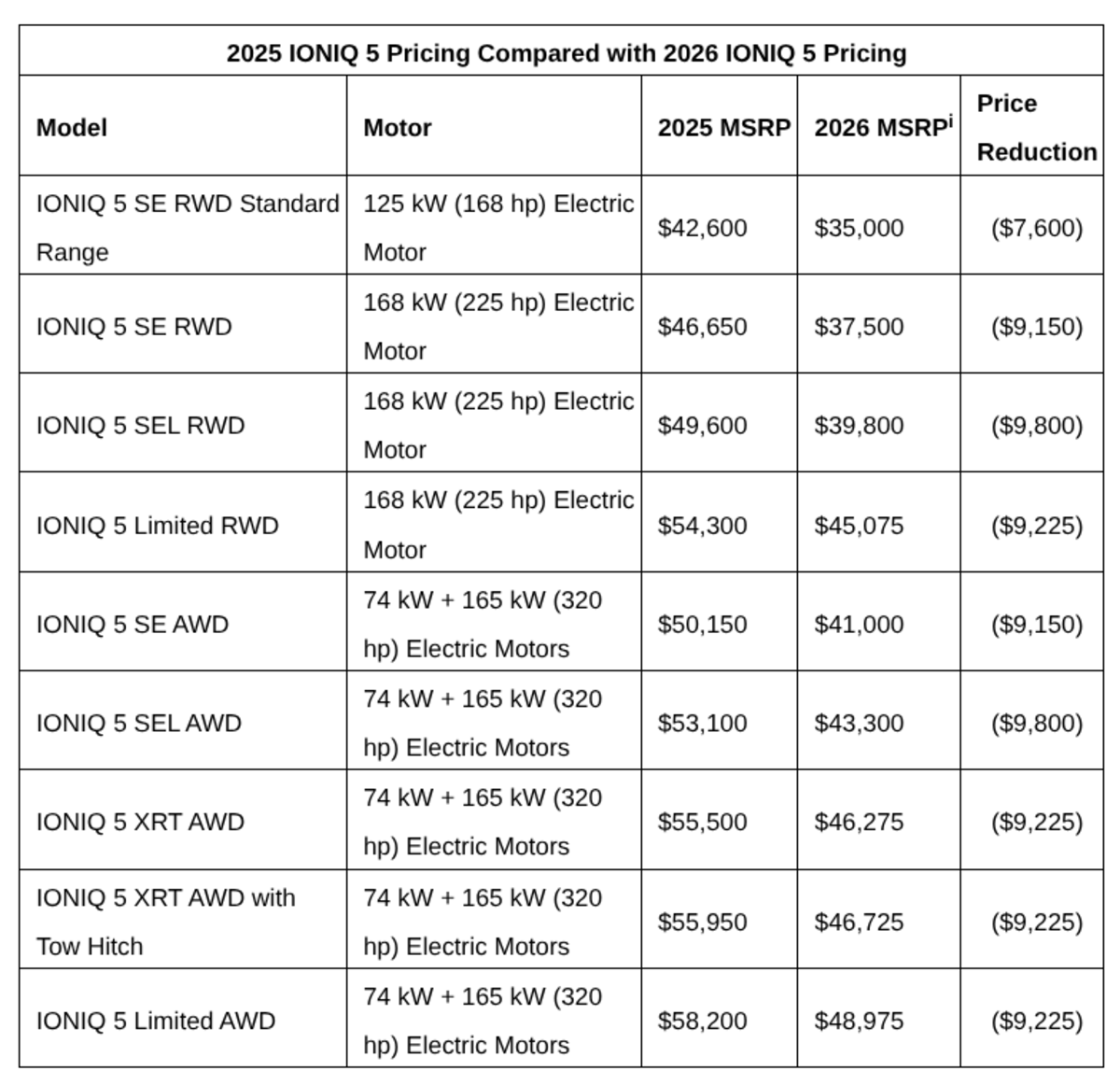

“The repositioning effort includes model price reductions ranging from $7,600 to $9,800, enabling Hyundai to better align with current market dynamics and support increased U.S. production volume. These changes come as part of a broader strategy to maintain the IONIQ brand’s leadership in the electric vehicle space while responding to shifting consumer expectations and competitive pressures.

“‘Hyundai is taking bold steps to ensure our award-winning IONIQ 5 remains a top choice for EV buyers,’ said Randy Parker, president and CEO, Hyundai Motor North America. ‘This pricing realignment reflects our commitment to delivering exceptional technology and innovation without compromise.’”

Rather than discuss all the change and permutations that apply to various trim packages for the IONIQ 5, below is a helpful chart that was part of that press release. Prices do not include a $1,600 transportation charge.

That is certainly wonderful news for people who are worried the EV revolution in America is dead, thanks to insane ravings about the “new green scam.”

For more than a decade, the biggest knock on EVs was that they cost so much more than conventional cars. True believers, like readers of CleanTechnica, always maintained that, once the upfront price of EVs reached parity with cars powered by infernal combustion engines, it would be game over for those inferior products of yesteryear.

People love the instant torque and silence of electric cars. Many of them have learned to love the convenience of regenerative braking, which allows brakes to last almost indefinitely and requires less footwork down by the pedals. Eliminating the need for oil changes and greatly reducing repair bills were also big pluses for many drivers. It was just that big number on the window sticker that put people off.

Yeah, charging scared a lot of people, but in the past few years, that concern is fading into the background as more Level 3 chargers proliferate across the land and many are discovering that their EV works just fine for their daily driving needs if they simply plug it into a standard wall outlet when they are done with their daily driving.

But, but, but … the PRICE! OMG!! EVs are SO expensive! The federal government had to slap a $7,500 incentive on new electric cars to try to narrow the gap and convince more people to buy an EV. But now that federal incentive is gone (sort of), which means manufacturers need to figure out how to compete on a level playing field. What Hyundai has done with IONIQ 5 prices is a pretty good start, don’t you think?

The Motoring Press Weighs In

Jonathan Gitlin, automotive editor for ArsTechnica, writes: “Unlike the tax credit, there’s no income cap applied to Hyundai’s price cut. But the cuts have only been applied to IONIQ 5s built in the US — the IONIQ 5 N, built in Korea, was absent from Hyundai’s press release, as was the IONIQ 6 sedan or the IONIQ 9 three row SUV. However, Hyundai said that those MY25 cars are still eligible for a manufacturer’s incentive of $7,500.”

Car and Driver weighed in with this analysis: “The IONIQ 5 has been among the bestselling EVs since its introduction for the 2022 model year. Between a refresh for the 2025 model year and these new price cuts, Hyundai’s boxy, retro-futuristic EV is among the best deals on the market. Only time will tell if these price reductions will be able to make up for the loss of the federal EV tax credit.”

Hyundai’s EV sales nearly doubled in the third quarter as buyers rushed to take advantage of the federal incentive before it expired. Customers drove home 21,999 IONIQ 5 cars — up from 11,590 during the same period last year. In September alone, Hyundai sold 8,408 IONIQ 5 models, a 152 percent year-over-year growth. Of course, that is a blip. The question now is, how many EVs will Hyundai sell in the third quarter of 2026?

Analysts are projecting a steep decline in EV sales now that the federal incentive is toast, but automakers are responding with discounts and special offers. The financing arms of General Motors and Ford figured out they could still leverage the $7,500 incentive for lease customers by making down payments on electric cars before the end of September.

If those cars get leased before the end of this year, the federal credit will still be available. That is some very creative — and clever — thinking by both companies. It is interesting that apparently nobody at Tesla tumbled to that opportunity. Or perhaps they couldn’t since they don’t have a separate dealer network.

“Hyundai’s approach, however, signals a longer-term play. By cutting prices on future models while keeping incentives alive for current ones, the automaker is positioning the IONIQ 5 to remain one of the most attractive EVs well into next year,” InsideEVs says.

The EV Road Ahead

“It’s going to be a choppy period of time ahead,” says Aleksandra O’Donovan, head of electrified transport at BloombergNEF. Sales of electric cars were up 30 percent in the third quarter, but BNEF expects sales to plummet by 24 percent compared to last year in the fourth quarter, and then expects no sales growth over 2025 next year.

Most industry observers expect sales of electric cars in the US to increase over time, but at a much slower pace than they would had the federal tax incentives remained in place. “We’re not going to see the astronomical growth we saw over the past few years, but we’re going to see some growth come back,” said Sam Fiorani, of AutoForecast Solutions. He projects a 12.8% EV market share in 2030, up from around 8% last year.

“Really the future is down to, for lack of a better word, the goodwill of automakers on delivering on the plans that they had previously, on delivering those more affordable EVs and those desired vehicle segments,” O’Donovan said. BNEF now projects that EVs and plug-in hybrids will make up around 27 percent of US car sales by 2030. That’s double Fiorani’s estimate, but a far cry from the 48 percent share it forecast a year ago.

Elaine Buckberg is a senior fellow at Harvard’s Salata Institute for Climate and Sustainability and a former chief economist at General Motors. She said recently, “[EVs] continue to become better substitutes for buying an internal combustion engine car. GM market research going back years basically said people are perfectly open to an EV as long as they don’t have to give up anything they like about their conventional car.”

The Price, The Price, The Price

O’Donovan summed it up best: “The biggest driver long term is really the improving economics of electric cars. There’s no doubt about the fact that consumers will always choose the cheaper technology.”

She is not saying anything new. Anyone who has spent any time in the sales game knows price is often the determining factor in any buying decision. But something jumps out at me here. Two days after the federal EV incentive expired, Hyundai cuts the price of the IONIQ 5 by almost $10,000. Does that tell us anything about how incentives distort markets?

We wrote recently that some believe that eliminating incentives for rooftop solar may actually make those installations cheaper in the future because a lot of the federal tax benefit went into the pockets of sales and finance people and did little to lower the actual cost of the hardware. Does anyone else think slashing sticker prices is a “tell” that suggests automakers were keeping prices artificially high to divert most of the incentive money into their corporate coffers?

Put another way, is it possible the prior federal incentive plan, which helped new players in the EV space get a toehold in the market but ended after a certain number of cars were sold, was fairer and more effective?

Here’s my take, and worth precisely what you paid for it: Norway started its support for electric cars with generous incentives and policy support, but as the EV revolution picked up speed, it dialed back its support. Yet nevertheless, sales of cars with plugs in Norway are now consistently at or above 95 percent every month.

If, in fact, US automakers were to price their EV offerings at or below the price of conventional cars (if Hyundai can do it, why can’t others?), is it possible their market penetration could still get to 50 percent by 2030? I think the answer is yes and invite you to share your thoughts in the comments.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy