Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

September saw the UK EV share at 23.4% of the auto market, up from 22.4% year on year. Full electric sales grew in volume by 19% YoY, slightly less growth than the overall market. Overall auto volume was 272,610 units, up 21% YoY, though still far below pre-2020 seasonal norms. Tesla was again the UK’s most popular BEV brand.

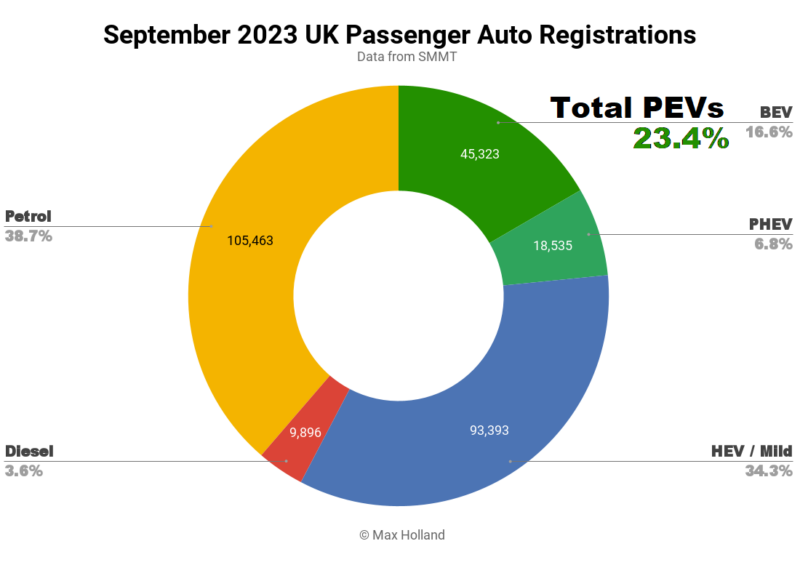

September’s results saw UK combined EV share at 23.4%, comprising 16.6% full electrics (BEVs), and 6.8% plugin hybrids (PHEVs). This compares with YoY shares of 22.4%, with 16.9% BEV, and 5.5% PHEV. We can see that BEVs have marginally lost share compared with September 2022, whilst PHEVs have slightly gained.

In volume terms, BEVs were up 19.0% YoY to 45,323 units, with PHEVs up 51% to 18,535 units.

With PHEVs and HEVs the only powertrains to actually gain share YoY, petrol-only share dropped from 40.7% to 38.7%, and diesel-only share dropped from 4.6% to 3.6%.

The BEV fall in share YoY was simply due to Tesla having a relatively low UK delivery month, down by 31% (down by roughly 2,700 units) compared to September 2022, whereas other BEV brands combined saw a growth of 85%, and 17,000 units. Had Tesla matched other BEVs delivery growth rate, we would be looking at September BEV share of near 20%, rather than 16.6%.

Some may wonder whether this was just an temporary allocation decision from Tesla, or whether Tesla demand in the UK is not growing as quickly as it did previously. The data strongly suggests only a temporary allocation variation. Year to date prior to September, Tesla’s volume has increased by 48.4% YoY, a healthy clip, including growth across all recent months. That growth rate is higher than the UK’s overall BEV growth rate of 40.5% over that same period. It is also possible that perhaps news about the recent slight tweaks to the Model 3 and Model Y might also be a factor, causing some short term fence sitting until the updates can arrive.

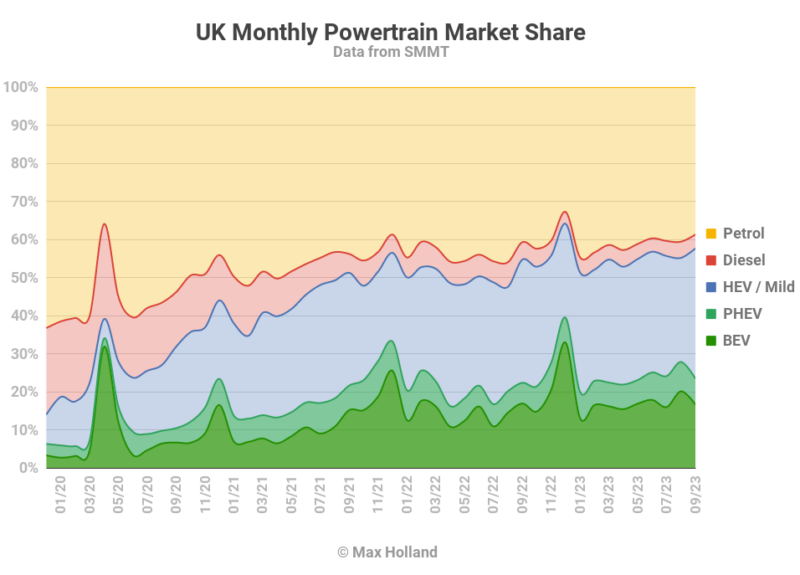

Despite the overall market’s growth, diesel-only powertrains are in bad shape, losing 5% volume YoY in September, and taking just 3.6% share of the market. Year to date, they have lost 15% volume, and cumulative share stands at 3.9%.

Bestselling BEV Brands

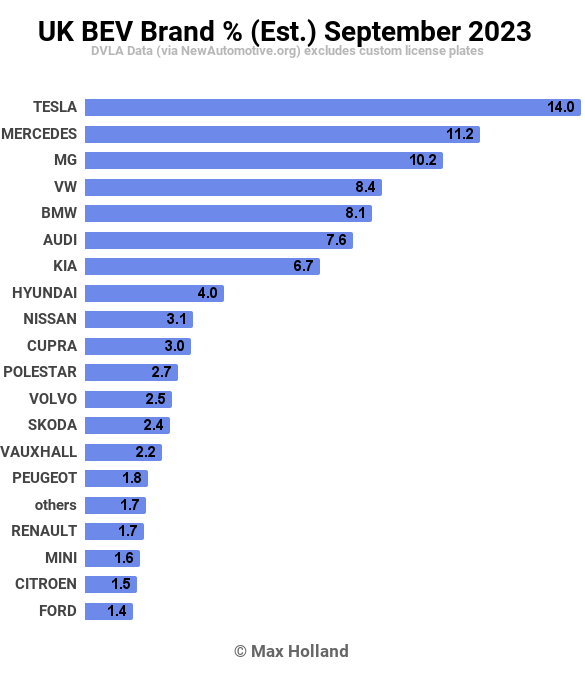

Tesla was again the best selling brand in September, with 14% of the UK’s BEV market. The Model Y was not in the overall UK top 10 this month, but remains the UK’s 4th best selling vehicle year to date, as noted above.

In a surprise second place was Mercedes, just ahead of the MG Motor in 3rd spot.

Mercedes is more usually in the lower half of the top 10, so second place is a great result. The brand’s September volume was some 4.4x higher than recent monthly averages, at close to 5,000 units, and 11.2% of the market, not far from Tesla. Again, this was likely a temporary allocation decision, albeit in the opposite direct to Tesla, probably because the home market in Germany was due for a hangover in September (report coming soon) following incentive changes.

Other changes in the top 10 ranking were more minor, although Nissan stepped up to 9th (from 15th in August).

Let’s look at the trailing 3 month data:

Tesla still has a strong lead, though its share dropped to 16% from 17% in the previous period (Q2). MG Motor maintains its second position with share up 0.3% to 10.6%

Thanks to the strong September, Mercedes grew share to 8.2% from 4.9% previously, and climbed from 9th to 5th. Other changes in ranking were more muted.

Outlook

Beyond the auto market’s decent YoY growth, the overall UK economy remains in the doldrums, with latest GDP annual growth at 0.6%. Inflation remains high at 6.7%, and interest rates are steady at 5.25%, their highest since 2008-2009. Manufacturing PMI improved slightly to 44.3 points in September, from 43 in August.

Obviously this economic situation does not bode well for consumer spending on expensive items like vehicles, which is why BEV sales are now kept up more by company or fleet spending, rather than private consumer purchases.

The UK’s industry association, the SMMT, said “BEV volume increases were driven entirely by fleet purchases, which rose by 50.6% as buyers were drawn to the advanced technology, outstanding performance, reduced environmental impact and compelling tax incentives. Conversely, private BEV registrations fell -14.3% with less than one in 10 private new car buyers opting for electric during the month.”

What are your thoughts on the UK’s auto market transition? Please join in the discussion below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

EV Obsession Daily!

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

Tesla Sales in 2023, 2024, and 2030

CleanTechnica uses affiliate links. See our policy here.