Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

South Africa has a decently sized new vehicle sales market. In 2024, just over half a million new vehicles (515,712) were sold in South Africa, a decrease of 3% from the 531,775 units sold in 2023. However, 99% of all the new vehicles sold in South Africa are still internal combustion engine vehicles. There is some steady progress. Sales of battery electric vehicles (BEV) breached the 1,000 units per year mark in South Africa for the first time ever in 2024. Last year, 1,257 BEVs were sold there, up 35% from 929 units sold in 2023. So, BEVs were up 35%, which is quite impressive, although this is coming from a very small base (BEVs make up only 0.24% of sales in South Africa). How did PHEVs perform in South Africa?

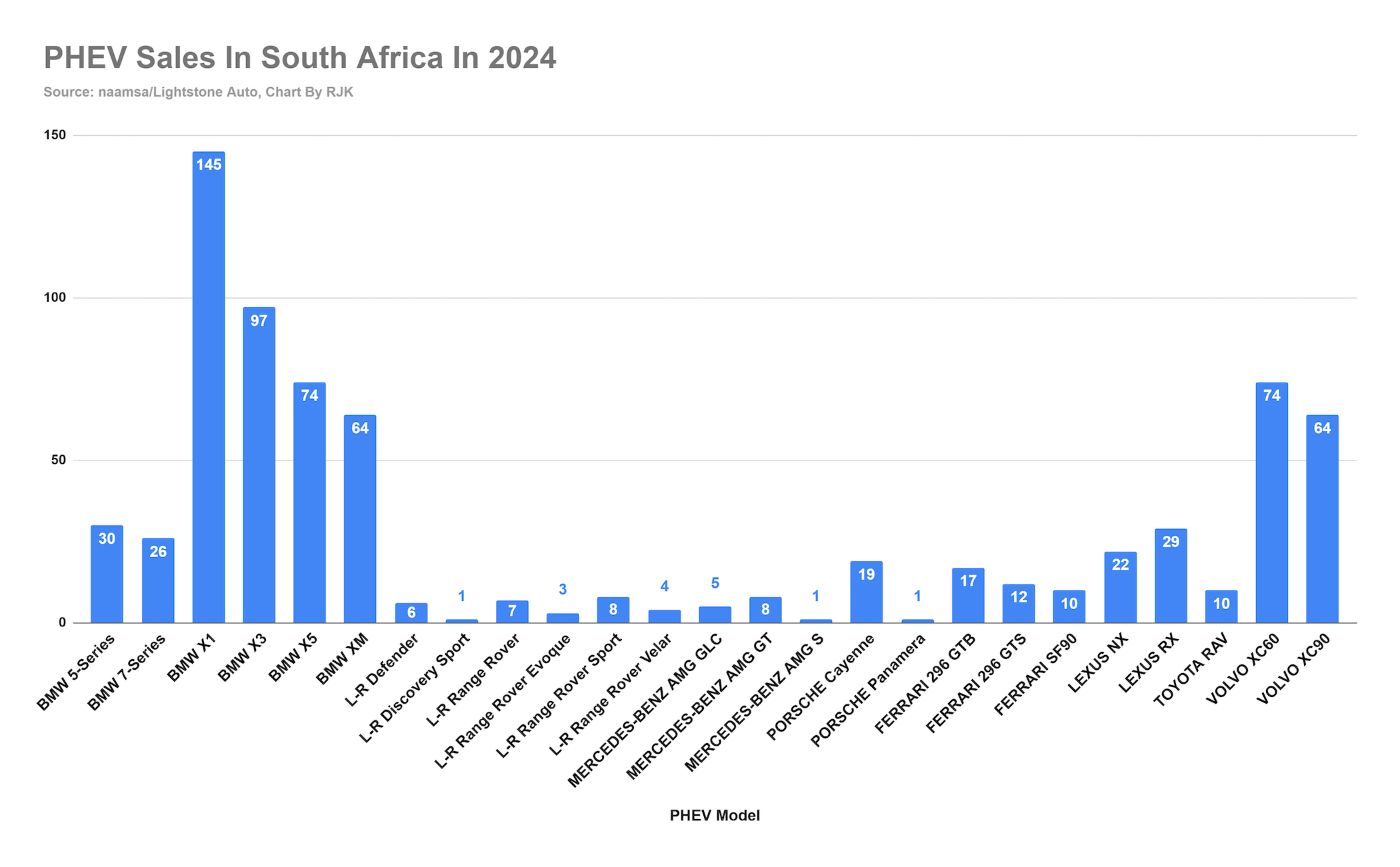

737 PHEVs were sold in 2024, up 100% from 368 units sold in 2023. However, PHEVs only made up 0.14% of total vehicle sales in South Africa in 2024. Let’s have a look at the top selling PHEVs in South Africa. BMW’s X1 plugin hybrid topped the charts in 2024, selling 145 units. BMW took second place as well. The X3 registered 97 units in 2024. The plugin hybrid version of the BMW X3 is actually built in Pretoria, South Africa, which is a nice boost for South Africa’s assembly and manufacturing industry, which is dominated by ICE vehicle production. The other plugin hybrid vehicle that will be built in Pretoria is the Ford Ranger PHEV. BMW’s X5 was joint 3rd, along with the VolvoXC60, with both models registering 74 units. These were followed by the BMW’s XM and Volvo’s XC90, which registered 64 units each.

So, BMW and Volvo dominated the sales charts in South Africa’s PHEV market. Interestingly, Volvo and BMW also dominate South Africa’s small but growing BEV market. BMW has been leading the charge to bring EV models to South Africa since the introduction of the first generation i3, and it looks like the German automaker and Volvo will play a key role in increasing adoption of EVs in South Africa.

Looking at BEVs and PHEVs, PHEV sales were up 100% in 2024 as compared with 2023, whilst BEVs registered more modest growth at 35% over the same period. Could this be due to the supply of models in South Africa, or could it point to a new trend similar to other markets such as China where PHEVs shined in 2024? For example, BYD PHEVs were up a whopping 73% from 1,438,084 in 2023 to 2,485,378 in China in 2024. BYD sales for 2024 saw PHEVs taking 58% of total sales, a big contrast to 2023 when BEVs had a higher share at 52.3%. Could we see more of this in South Africa soon? We probably will, as BYD is launching two significant PHEV models in South Africa, the BYD Sealion 06 and the highly anticipated Shark 06 plugin hybrid pickup. Ford will also probably launch the PHEV version of its popular Ranger pickup truck.

Pickup trucks are a big deal in South Africa, with the likes of the ICE version of the Toyota Hilux, the Ford Ranger, and the Isuzu D-max dominating in the South African sales charts over the years. There is already a lot of buzz around the Shark 06, which has now been confirmed to be launching in South Africa at the end of next month, and it looks like it will do well in this market.

Plugin hybrid electric vehicles (PHEVs) divide opinion all the time, as they have for years. A lot of people feel that with the way BEV tech has advanced in recent times, PHEVs are no longer needed as a transition option to full electric. However, as Dr. Maximilian Holland says, “BEVs pollute less than PHEVs, but the latter still have a critical role in certain niches where BEVs may not yet fully meet users’ needs. PHEVs (or EREVs) — when plugged in as designed — pollute a lot less than HEVs, which in turn pollute less than diesels!”

The BYD Shark 06 PHEV has a real world range in electric mode of about 80 km from its 29.6 kWh battery, and the Ford Ranger PHEV has a range of about 45 km from a smaller battery pack. Perhaps PHEVs with electric ranges of 200–300 km would appeal to non-early adopters, especially in markets such as South Africa where the BEV market is still quite small compared with similar markets around the world. Perhaps this is what some Chinese automakers are thinking, as quite a number of them are contributing to a new wave of new-generation PHEVs with battery packs of over 50 kWh and electric ranges of about 200 km, thereafter complemented by a 1.5T or 2.0T ICE engine. Over the past couple of years, these “longer range” PHEVs were mostly sold in the local Chinese market, but we are now starting to see them being exported to several markets including in Asia and in Central and South America.

Quite a number of Chinese New Energy Vehicle manufacturers have recently launched a number of ICE and hybrid models in South Africa. These include Chery (along with its Omoda brand), GAC, JAC, GWM, Dongfeng, and SAIC’s Maxus and MG brands. This could be a precursor to a larger onslaught in this market that will hopefully include longer range PHEVs and of course more affordable BEVs. The South African market is starved of more affordable BEVs. Most of the models on sale in South Africa besides the GWM ORA, Volvo EX30, BYD Atto 3 and Dolphin cost well over R1 million ($53,540).

PHEV versions of common ICE models found in the market could help introduce more affordable plugin models to the South African market. These could help non-early adopters of EVs and new tech in general to ease into the world of electrified vehicles. In China and some other markets, PHEVs are now cheaper to buy compared to equivalent full ICE vehicles — from both an upfront purchase perspective as well as an operating or total cost of ownership (TCO) perspective. If this was to be the case in South Africa, it could help drive sales of plugins and ultimately grow sales of BEVs in the country once more people get used to driving electrified models such as longer range PHEVs. Just over 3,000 BEVs have been sold in South Africa since 201, which is a very small number compared to similar markets around the world.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy