Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

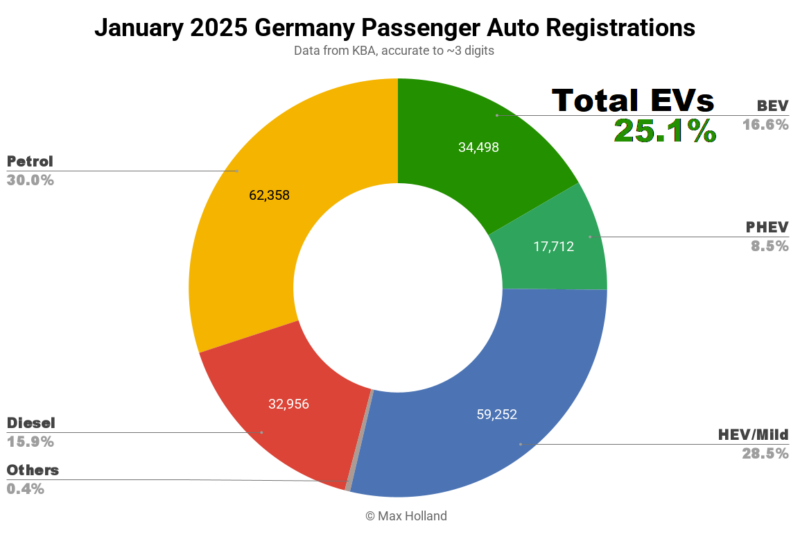

January saw plugin EVs at 25.1% share in Germany, up from 17.3% year-on-year. BEV volume shot up over 53% YoY, though from an anomalously low baseline, while PHEVs grew 23%. Overall auto volume was 207,640 units, down 2.8% YoY. January’s best-selling BEV was the Volkswagen ID.7.

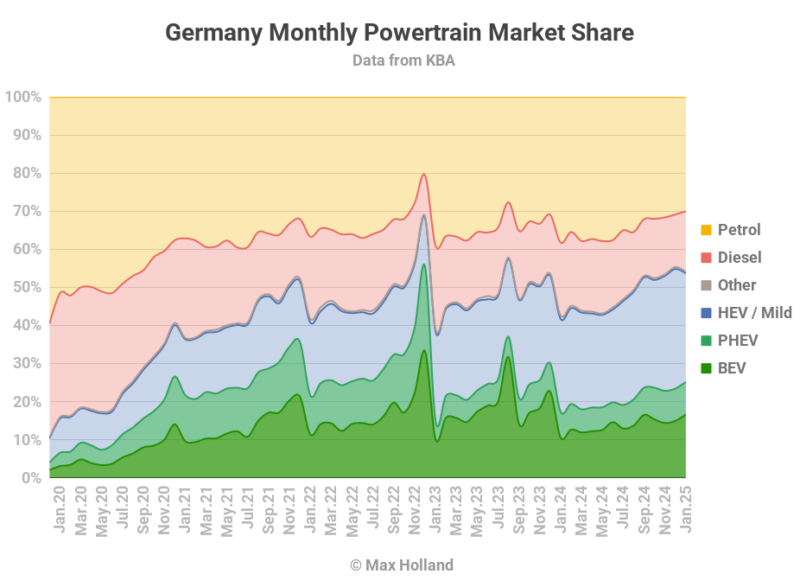

January’s sales saw combined EVs at 25.1% share in Germany, with full electrics (BEVs) at 16.6% share, and plugin hybrids (PHEVs) at 8.5%. These compare with YoY figures of 17.3% combined, 10.5% BEV and 6.7% PHEV. Recall that January 2024 was the first month following the surprise cancellation of BEV incentives, and was thus very weak for sales volume. This gives the YoY BEV comparison a low baseline.

If you want a catch up on Germany’s longer-term situation regarding the EV transition, take a look at my 2024 end-of-year roundup report from last month. In short, the German economy is contracting, BEV incentives were cut in late 2023, BEVs are still (deliberately) overpriced and reluctantly sold in Europe by legacy auto, and 2024’s regulations didn’t require any BEV growth in Europe.

Without incentives (which ultimately go to automaker’s profits), Germany is not an attractive market to sell into compared to neighbouring countries (those with incentives), so was heavily deprioritized in 2024. And keep in mind that’s deprioritization relative to the shrinking-overall Europe region. All these negative forces combined to see 2024’s BEV volume fall by a devastating 41% in Germany, and market share fall from 2023’s 18.4% back down to 13.5%.

Things can only get better (less bad) for Germany’s EV transition in 2025, and initial signs are somewhat positive, with some of the more affordable BEV models already seeing their volumes starting to increase in January compared to recent months. Don’t expect miracles though, since the continuing lack of any BEV incentives in Germany still means that other countries will get higher priority in foot-dragging legacy auto’s quest to (reluctantly) sell a few more BEVs, in order to meet this year’s tighter fleet emissions requirements across Europe.

Petrol-only vehicles saw the biggest YoY volume hit in January, down by almost 24%, and close to a record low market share of 30.0%. Diesels only fared slightly better, down in volume 19.5% YoY, at a market share of 15.9%.

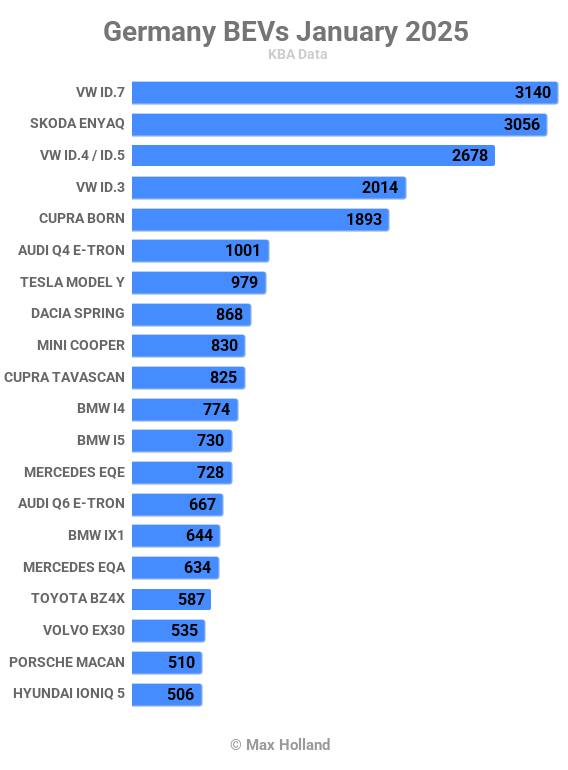

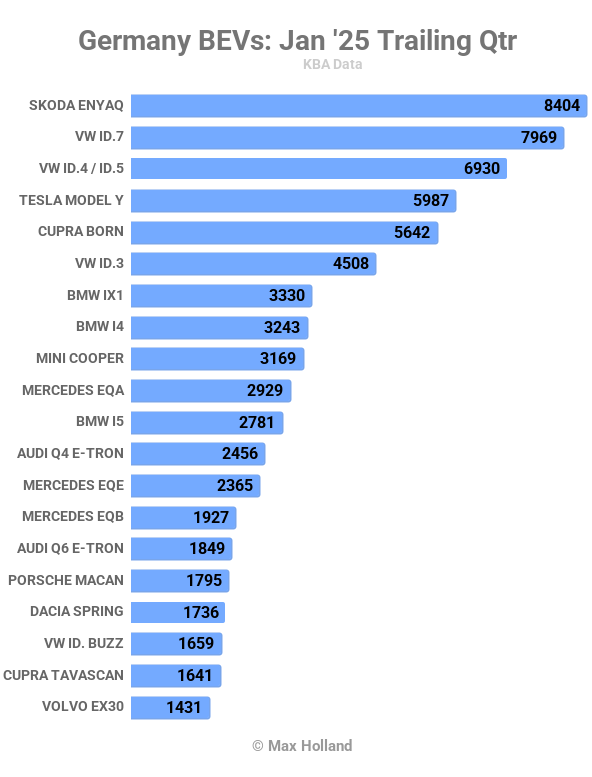

Best-Selling BEV Models

After 5 trailing months consistently inside the top four, the Volkswagen ID.7 finally stepped up to take the pole position in January, with a record volume of 3,140 units.

Long-term frequent favourite, the Skoda Enyaq, was just behind in second, with 3,056 units. The Volkswagen ID.4 / ID.5 came in third, with 2,678 units.

Notable performance came from the Dacia Spring, which has recently started selling in volume again. The Spring is finally back in the top 10, despite Europe’s profiteer-protection tariffs designed to slow down these kinds of innovative and great value BEVs from China.

A good step up was also seen from the new Cupra Tavascan, which has steadily climbed since its August launch, delivering an impressive 825 units in January, taking 10th place.

Just outside the top 20, the new Hyundai Inster put in a monster performance in just its second month on sale, jumping up from its debut 27 units in December, to 408 units in January, and quickly grabbing 22nd spot. Depending on the Inster’s production ramp and availability, it should continue to rapidly climb. Being such a well considered and intelligently designed small-and-affordable BEV, I wouldn’t bet against it getting into the top 10 in the near future (though, given the macro context, let’s see if the German market is prioritised).

The Inster’s close relative, the also-new Kia EV3 also stepped up to a personal best 386 units, and took 24th spot. The EV3 also has potential to climb further. Let’s keep an eye on these two.

Two more local newbies also stepped up a bit in January. The Skoda Elroq saw a new high of 280 units (32nd spot) following its November launch. Similarly, the Opel Grandland increased to a high of 271 units (34th spot) following its launch last summer.

Further back still, the Leapmotor T03 small hatchback returned to over 100 units (127), following its decent November debut (107 units) and its December “breather” (54 units). The T03 is close to the Dacia Spring in price, but offers about 50% more real world range and 60% faster (km/min) DC charging, for only 12% more money (18,900€ vs 16,900€). The T03 is much closer to being capable as serving as an “only car” if urban and nearby regional trips are all that’s required. Neither is well-suited to long road-trips – unless you are in no hurry, and feeling adventurous. Let’s keep an eye on the T03.

Whilst we’re on small cars, the new Citroen e-C3 has been stuck below 100 monthly units since its October launch, though this may be only due to a temporarily low allocation priority, I am sure it will see volume climb over the longer-term.

Doing better, but still fairly flat, is the e-C3’s legacy-auto rival, the Renault 5, which saw 347 units in January, which is on-par with the previous two months. Again, this may be due to temporary allocation, whilst other markets are prioritised. The Renault 5 is winning lots of awards, so we have to assume it is a sales hit waiting to happen in Germany also.

Speaking of the Renault 5, its sportier-badged cousin, the Alpine A290 saw its German debut in January, with 46 units delivered. Roughly speaking, Alpine is to Renault what Abarth is to Fiat, in other words, the “sportier” version, in both styling and in actual performance specs. The Alpine has the same body and battery as the Renault, but motors are unlocked to a max of 162 kW (on some variants) compared to the Renault 5’s 110 kW maximum. This is a substantial difference, so those really wanting “hot hatch” performance might be swayed by the A290, even though the entry versions of each see the Alpine 40% more expensive (38,700€ vs 27,900€). Variety is good, let’s keep an eye on these cousins.

Another January debut came from the BYD Atto 2, which saw 10 initial units. This is a smaller SUV than its BYD Atto 3 sibling, at 4,310 mm in length (the same as the Kia EV3, and similar to the Hyundai Kona, and Peugeot e-2008). Zach covered the BYD Atto 2’s design and specs a year ago, take a look over there for more information. The 45.1 kWh (LFP) version is priced from 29,990€ in Germany. Let’s see how it gets on.

In not-quite-a-debut news, Mercedes registered 4 units of the upcoming A-class sedan, presumably for in-house use, early press reviews, and similar. We can thus expect this new BEV model from Mercedes to see its customer deliveries starting fairly soon.

Let’s now look at the 3-month results:

As expected, there’s now a decent tussle between the VW Group cousins, the Skoda Enyaq and the Volkswagen ID.7, with yet another family member just behind (the ID.4 / ID.5).

None of the names in this table come as a surprise, but note that the Dacia Spring and Cupra Tavascan have recently entered inside the top 20. The new Audi Q6, and the Porsche Macan, have both consolidated their position inside the table also. There will be others entering soon, some of which we have discussed above – my bet is on the Hyundai Inster. What do you think?

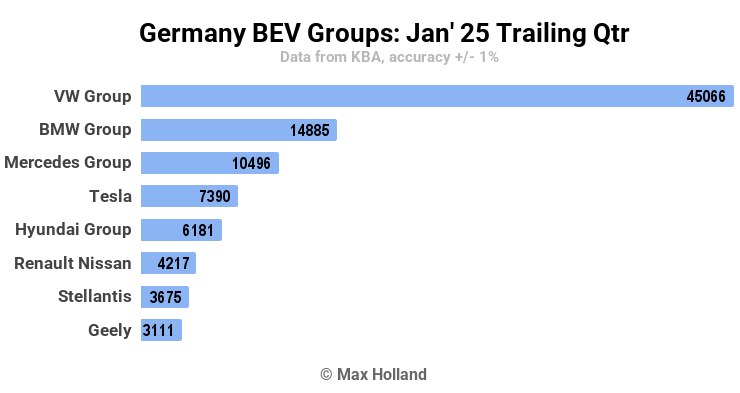

Since Germany remains Europe’s largest auto market, let’s check in on the combined figures for the manufacturing groups over the trailing 3 months:

With a strong performance in January, Volkswagen Group again grew its share compared to the August-October period, gaining a further 4.5% slice of the BEV market, climbing to 44.4% share.

Most other groups took a slight trim in share as a consequence, although Renault Group bucked that trend, and climbed from their earlier 1.8% share up to a more respectable 4.2% share.

Hyundai Motor Group’s share slipped a bit compared to the prior period, from 7.8% to 6.1%, but that might reverse soon, with the Hyundai Inster and the Kia EV3 both poised to grow to decent volume this year.

Outlook

Germany remains the worst performing of Europe’s large economies in recent times, mainly thanks to steeply rising energy costs (related to the Ukraine conflict) impacting the country’s substantial manufacturing industries. We now have 2024 Q4 economic data, and the recession still continues, albeit at a somewhat lesser GDP contraction rate of negative 0.2% YoY. This marks close to two continuous years of zero or negative economic output.

Inflation moderated to 2.3% in January and ECB interest rates have just been lowered to 2.9%. Manufacturing PMI rose decently to (a still negative) 45.0 points in January, from 42.5 in December.

In these economic conditions, we can’t expect spectacular growth for Germany’s BEV market in 2025, though it should be much better than 2024, with at least there now being somewhat-affordable models available. There’s still the issue of no BEV incentive to go into the pockets of auto makers, whereas some nearby markets do still offer incentives — thus Germany won’t be prioritised for BEV allocation.

What are your thoughts on Germany’s auto market and EV transition? Which models are you looking out for? Please share your perspective in the comments.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy