London, February 11, 2025 (Oilandgaspress) –- Oil prices climbed on Monday despite the real threat of a global trade war erupting after U.S. President Donald Trump announced wide-ranging tariffs on U.S. imports, this time targeting steel and aluminium. On Monday, Trump announced he will impose a 25% import tax on all steel and aluminium entering the U.S., with Canada likely to be hardest hit. Trump also talked about reciprocal tariffs on all countries that tax imports from the U.S., although he did not give the specifics, “If they charge us, we charge them,” Trump said. Brent crude for April delivery was up 1.8% to trade at $75.98 per barrel at 15.40 p.m ET while WTI crude for March delivery gained 2.0% to trade at 72.41. It appears that Trump’s end-game is to keep the markets on their toes, but that strategy might not be working, this time around. Read More

| Oil and Gas Blends | Units | Oil Price | Change |

| Crude Oil (WTI) | USD/bbl | $73.29 | Up |

| Crude Oil (Brent) | USD/bbl | $76.93 | Up |

| Bonny Light 06/02/25 CBN | USD/bbl | $76.86 | Down |

| Dubai | USD/bbl | $77.04 | — |

| Natural Gas | USD/MMBtu | $3.50 | Up |

| Murban Crude | USD/bbl | $79.21 | Up |

| OPEC basket 10/02/25 | USD/bbl | $77.22 | Up |

CME Group, announced its new physically-delivered Ethanol futures and options are now available for trading. A total of five futures contracts traded on February 7, 2025. “We are pleased to see industry support for our latest Ethanol contracts, which have enhanced specifications and are complementary to our existing suite of renewable fuel products,” said Peter Keavey, Global Head of Energy and Environmental Products at CME Group. “Ethanol is an increasingly important component of the transportation fuel mix, and the physically-delivered futures will allow gasoline blenders and other commercial users to hedge their price exposure and more effectively manage the differential between other refined products.” Ethanol futures are sized at 42,000 gallons, which is in line with CME Group’s benchmark RBOB Gasoline futures and NY ULSD Heating Oil futures. Ethanol futures offer flexibility to market participants by providing options for delivery.

Denatured Ethanol futures and options are listed by and subject to the rules of NYMEX. Read More

China’s BYD on Monday started offering advanced autonomous driving features on most of its models including ones priced as low as $9,555, far undercutting competitors such as Tesla in a move analysts say is set to start a new price war.

The electric vehicle giant has equipped all of its BYD-branded models priced above 100,000 yuan ($13,688) with the company’s proprietary “God’s Eye” advanced driver-assistance system, BYD founder Wang Chuanfu told an event livestreamed from Shenzhen.

It has also installed the system in three models priced below 100,000 yuan, the cheapest being the Seagull priced from 69,800 yuan. It began sales of those models, 21 in total, immediately after the event. Wang said these would be the “first batch”. Read More

Renault Group announce that Bruno Laforge, currently Chief Human Resources Officer within Capgemini, will join the company, as Chief Human Resources Officer starting April 1st, 2025. He will succeed François Roger and will be a member of the Leadership Team, reporting to Luca de Meo, CEO of Renault Group. Bruno Laforge, 56, has spent most of his career in Human Resources, in various tech-centric sectors (Digital Services Companies, pharmaceuticals, oil & gas, automotive). During these years spent in fast-moving and technologically advanced fields, Bruno has worked on talent and organizational development, making him an expert in skills and business transformation.With extensive experience in tech, R&D and industrial companies, Bruno has worked in the energy sector as Vice President of Human Resources and Head of Mergers and Acquisitions. He then joined the pharmaceutical industry and Sanofi where he successively held, for 12 years, the position of VP HR in R&D, the position of SVP HR of the Vaccines BU, then that of SVP Europe, and finally SVP, Chief Human Resources Officer & CSR with a view to a new organization of the chemical industry. He is currently Chief Human Resources Officer within Capgemini, a company he joined at the beginning of 2023, to lead its transformation. Read More

BYD is celebrating another year of phenomenal growth in the UK. The company, which officially launched in the UK in March 2023, increased its volume by 658% to over 8,700 cars in 2024 – making it the UK’s fastest growing car brand. In March 2023, BYD UK launched with the ATTO 3 C-segment SUV and since then has launched four new models in under two years – with the eagerly-anticipated SEALION 7 joining the line-up in the coming months. The company has grown from 14 retail sites to 60 retailers across the UK, with plans to add more sites in 2025.

The company’s best-selling model remains the ATTO 3, with the BYD DOLPHIN hatchback being BYD’s best-selling car in the retail sector. Brand awareness continues to grow with brand recognition increasing from 1% in 2023, to 31% in 2024. A huge contributor to brand growth was the company’s sponsorship of the EURO 2024 football tournament which reached a global audience of over a billion. Brand awareness also received a significant boost thanks to the launch and media campaign in Q4 2024 of SEAL U DM-i, which has quickly established itself as a core model in the BYD UK range. BYD will continue investing in brand awareness throughout 2025. Read More

The Trump administration’s attempt to halt funding for a national electric vehicle charging network on Feb. 6 is part of its efforts to roll back Biden-era policies that had encouraged the EV transition. The new Department of Transportation Secretary Sean Duffy is spearheading the effort, also removing a greenhouse gas measurement requirement for project funding and moving to reconsider fuel economy standards. The new administration has also suggested that changing the corporate average fuel economy standards will lower vehicle costs. That may be easier said than done given the complicated factors that drive vehicle prices. Read More

Trump slaps 25% tariffs on steel and aluminium imports .The tariffs would hit allies as the four biggest sources of steel imports are Canada, Brazil, Mexico and South Korea, according to the American Iron and Steel Institute. Read More

Benchmark gas futures have climbed for four weeks in a row and hit €58.75 per megawatt-hour on Monday, roughly double the levels seen at the start of last year and the highest since February 2023 Households face an increase in their energy bills as power generation from renewable sources such as wind farms proves unreliable, analysts have warned. European natural gas prices soared to their highest level in two years on Monday as the continent scrambles to refill its rapidly depleting reserves. Read More

Next Ocean, has secured Seed Investment from Arches Capital to drive its expansion and enhance maritime safety worldwide. This funding will accelerate Next Ocean’s growth, enabling the company to scale production, expand into new markets, and further develop its predictive radar technology. Over the past years, Next Ocean has successfully delivered numerous Vessel Motion Radar systems to leading companies in the Offshore Wind and Oil & Gas industries. The technology provides real-time insights into wave-induced vessel motions, enabling operators to anticipate conditions up to three minutes ahead. This precision allows for safer and more efficient offshore operations, minimizing operational risks and maximizing uptime, even in rough weather. With this investment, Next Ocean will enhance its commercial reach and solidify its leadership in maritime safety technology. Partnering with Arches Capital and their network of successful former entrepreneurs brings strategic expertise to help Next Ocean expand its impact globally. “This partnership marks a significant milestone for Next Ocean, reinforcing our long-term commitment to the offshore industries. We are confident that Arches Capital will be a key partner in further establishing our market position. By accelerating our growth, we can bring our potentially life-saving technology to operators worldwide and strengthen the relationships we’ve built with our existing clients. Together, we can drive safer and more efficient maritime operations.”

— Karel Roozen, CEO, Next Ocean

“At Arches Capital, we seek out transformative technologies, and Next Ocean embodies that vision perfectly. Their predictive radar technology is reshaping offshore safety and efficiency. We are excited to support their global expansion and help bring this innovation to more maritime professionals, making offshore operations safer and more reliable.”

— Frank Appeldoorn, Managing Partner, Arches Capital Read More

Horisont Energi is progressing the commercial work and has now passed a milestone for the Barents Blue project by signing the first term-sheet (non-binding) for gas supply from the Snøhvit LNG facility at Melkøya in Northern Norway. The term sheet (non-binding) is a key part of the commercial work required to reach the concept select milestone later this year and the first step towards securing the required gas supply for an annual production of 1 million tonnes of clean ammonia. This term-sheet creates a good basis for the further commercial work towards the realisation of the Barents Blue project and the upcoming concept select milestone, say Co-CEO’s Bjørgulf Haukelidsæter Eidesen and Leiv Kallestad. The next step for the gas supply agreements, following completion of the non-binding term-sheets, include negotiating Sales and Purchase Agreements (SPAs) targeted for completion in 2026. The Barents Blue project is mature from a technical, contractual and zoning perspective.

It is an EU IPCEI Hydrogen project setting the highest environmental standards for clean ammonia production. As the project moves towards achieving the concept select milestone, when the first FEED study phase will be initiated, the key focus is to achieve the same level of maturity for the commercial work. Towards this end, the project has been working on commercial agreements for the supply of gas, offtake of clean ammonia and storage of CO2. Read More

Saab has received an order from BAE Systems Hägglunds for the sighting and fire control system UTAAS (Universal Tank and Anti-Aircraft System) for Combat Vehicle 90. The order value is approximately SEK 700 million. BAE Systems Hägglunds in Örnsköldsvik, Sweden, developer and producer of the Combat Vehicle 90 (CV90), has placed an order with Saab for the UTAAS (Universal Tank and Anti-Aircraft System) sighting and fire control system. ”UTAAS was specifically developed for the Combat Vehicle 90, as a result Saab and BAE Systems Hägglunds have a long and strong partnership. Combat Vehicle 90 is an effective and appreciated combat vehicle which is now in high demand by different armed forces worldwide. To meet the increased demand, we have strengthened our production capacity,” says Carl-Johan Bergholm, Head of Business Area Surveillance at Saab. UTAAS is a modular constructed, integrated sight- and fire control system for Combat Vehicle 90. UTAAS is used for both aerial and land targets. Read More

Google Maps has officially changed the name of the Gulf of Mexico to the Gulf of America for users in the United States.

This update comes after an executive order signed by former US President Donald Trump, which led to the formal change by the Geographic Names Information System (GNIS), a US government database responsible for place names. The company said it would update Maps in the US after the Geographic Names Information System (GNIS) made the changes. People using Maps in the U.S. will see “Gulf of America,” and people in Mexico will see “Gulf of Mexico.” Everyone else will see both names.. Read More

To ensure that commercial vehicles can keep our economy and society moving in the future, commercial vehicle manufacturers are investing billions to make them emission-free. The vehicles are ready – but manufacturers are still facing draconian penalties. Meanwhile, Europe is increasingly being challenged by non-European competitors. What is currently going wrong. And what matters now. An article by Andreas Gorbach.

— Trucks and buses are and will remain the backbone of our economy and society.

— Battery-electric and hydrogen-powered trucks and buses are needed for CO2-neutral transportation – carbon-neutral fuels can also play a role.

— Emission-free vehicles are ready, but manufacturers still face draconian penalties – because there is a lack of cost parity and infrastructure for the vehicles. Read More

Baker Hughes Rig Count: U.S. +4 to 586 Canada -9 to 249

U.S. Rig Count is up 4 from last week to 586 with oil rigs up 1 to 480, gas rigs up 2 to 100 and miscellaneous rigs up 1 to 6.

Canada Rig Count is down 9 from last week to 249, with oil rigs down 9 to 177, gas rigs unchanged at 72 and miscellaneous rigs unchanged at 0.

International Rig Count is down 4 rigs from last month to 905 with land rigs up 1 to 713, offshore rigs up 5 to 197. International Rig Count is down 60 rigs from last year’s count of 965, with land rigs down 27, offshore rigs down 33.

The Worldwide Rig Count for January was 1,696, up 36 from the 1,660 counted in December 2024, and down 87, from the 1,783 counted in January 2024.

| Region | Period | Rig Count | Change |

| U.S.A | 07 February 2025 | 586 | +4 |

| Canada | 07 February 2025 | 249 | -9 |

| International | January 2025 | 905 | -4 |

The Originals Renault Services is deploying a comprehensive range of new services for enthusiasts, collectors and owners of classic Renault vehicles. In 2022 already, Renault set up a service to verify vehicle compliance, enabling owners to obtain a classic vehicle registration document, alongside certificates showing the date on which their vehicles left the factory, with the chassis number, engine and gearbox numbers, colours and options. Today, collectors can also find spare parts through a network of Renault after-sales sites, selected for their expertise in classic vehicles, as well as through the brand’s long-standing partners specialising in areas such as sports cars (Arnaud Ventoux Pièces), upholstery (ASCI Sellerie) and mainstream cars (Melun Retro Passion).

Further, 50 repair manuals from the Renault archives are available free of charge on the new site, alongside a number of online educational tutorials, to help collectors everywhere service and repair their classic cars The Originals Renault Garage is rolling out this service in France with a network of eight sites that are already trained and ready to welcome customers. The brand’s objective is to gradually expand this service to 25 sites across France, covering 80% of the country, enabling collectors to find an expert within 100 km of their home. The next step will be to expand this offering internationally, extending the network of after-sales sites to other countries. Read More

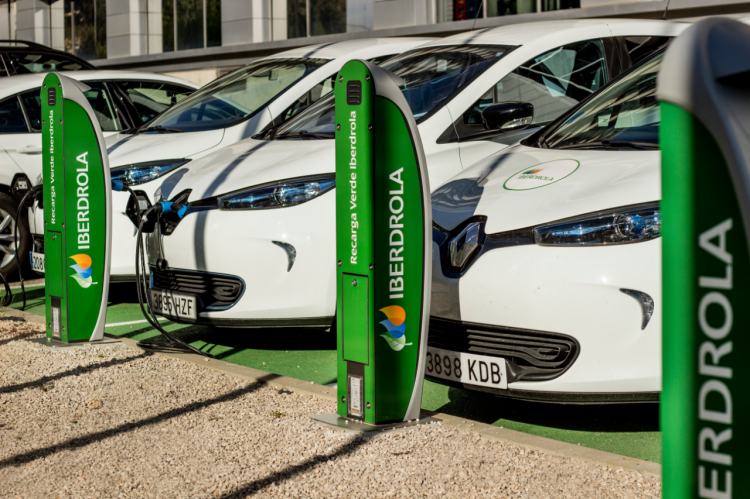

Iberdrola signs a PPA with AMP to provide power to Ohio homes and businesses by the Blue Creek project . Iberdrola, through its US subsidiary Avangrid, has signed a short-term power purchase agreement (PPA) with American Municipal Power, Inc. (AMP) for clean energy generated at the Blue Creek wind farm in Ohio. The new PPA will ensure that Blue Creek continues to provide reliable power to the region and support Ohio’s rural communities economically with jobs, rent and tax revenues.

AMP is the wholesale energy supplier and services provider to more than 130 members in nine states. AMP members receive their energy supply from a diversified mix of resources that includes wholesale energy purchases through AMP and power produced at facilities owned by AMP and its members. AMP has a total of approximately 650,000 customers.

Blue Creek is a 304 MW wind farm located in Van Wert and Paulding counties in northwest Ohio. The project created more than 500 jobs during construction and came online in 2012. Most of the equipment was manufactured and assembled in Wisconsin, Texas, Illinois, Pennsylvania and North Dakota. Blue Creek generates enough energy each year to power the equivalent of about 76,000 homes. Read More

Tesla reported that in 2024 it experienced its first annual drop in deliveries. The bad news continued in January, with key markets flashing warning signs for the EV maker. Tesla sales in France plunged 63 percent last month over the previous January, and sunk 59.5 percent in Germany in the same month-to-month period amid a backlash against Musk over his support for the far-right Alternative for Germany (AfD) party. That was the worst January since 2021 for Tesla sales in Germany. Sales were also down in the UK. In China, one of the company’s largest markets, sales were down 11.5 percent in January year-over-year, while Tesla’s Chinese rival BYD hit a nearly 50 percent increase during the same period. In markets with high concentrations of EVs like Sweden and Norway, the indications were little better. New Tesla registrations were down 44 percent compared to last year in the former, and 38 percent in the latter, despite high demand for cars in both countries. Read More

Oil and Gas News Undiluted !!! �The squeaky wheel gets the oil�

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

OilandGasPress.com is a website that provides news, updates, and information related to the oil and gas industry. It covers a wide range of topics, including exploration, production, refining, transportation, distribution, and automotive market trends within the global energy sector. Visitors to the site can find articles, press releases, reports, and other resources relevant to professionals and enthusiasts interested in the energy, oil and gas industry.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: on Twitter | Instagram

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,

Nissan Formula E Team is looking to continue its strong form in the first ever Jeddah E-Prix, the maiden double-header of the 2024/25 ABB FIA Formula E World Championship campaign. The event will also see the introduction of Pit Boost during the first race of the weekend.

Last month, Oliver Rowland secured his first win of Season 11 with a trio of dramatic late overtakes in Mexico City to ensure maximum points. The Brit’s victory lifted him into second in the Drivers’ Championship. On the other side of the garage, Norman Nato’s good race pace went unrewarded, but the Frenchman will be looking to bounce back at what is expected to be a thrilling weekend of action.

The first race of the double-header will showcase the inclusion of Pit Boost for the first time. Cars will receive a 10% energy increase (3.85kWh) from a quick, 30-second 600kW re-charge in the pitlane, with the rigorously tested feature set to introduce an extra layer of strategy for drivers and teams to contend with. Read More

The UAE has emerged as a leader in renewable energy with 6.3 gigawatts (GW) installed capacity, Dubai-based Dii Desert Energy said in a report.

Egypt and Saudi Arabia follow with 4.6 GW and 4.5 GW installed capacities. The UAE has achieved more installed capacity than Egypt with fewer than half the projects, mainly due to the impact of Mohammed bin Rashid Al Maktoum Solar Park (MBR Solar Park), significantly contributing to the country’s renewable energy capacity. Overall, the current installed solar photovoltaic (PV) capacity stands at 22.3 GW in the Middle East and North Africa (MENA) region. At the end of 2024, the Dii database reported more than 700 projects, greater than 5 megawatts (MW), at various stages of development. Of these 714 projects, 467 are operational, 47 are under construction, 89 projects are in the development phase and an additional 90 have been announced. Read More

(QNA) – Gold prices hit a record high on Tuesday as investors flocked to safe-haven assets after US tariffs on steel and aluminum imports.

Spot gold rose 1.1% at $2,939.80 per ounce, after hitting an all-time high of $2,942.70 in the previous session.

US gold futures also rose 1.1% to $2,966 on Tuesday.

Among other metals, spot silver rose by 0.4% to $32.16 per ounce, platinum fell by 0.4% to $989.50, and palladium gained 0.4% to $986.97. Read More