Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

2024 is another Fastned year of fast growth

Fastned published its Q4 2024 results recently. The main message, and the main topic with the financial analysts, was the growth strategy based on the results over recent years.

The commercial numbers over the quarter were as expected, no news there. In 2022, the group within Fastned looking for and developing new locations was significantly enlarged. And teams were added for the expansion into new markets: Spain, Italy, Poland, Denmark, Austria, Ireland, and little Luxembourg.

This resulted in the first station open in Denmark in 2023 and the acquisition of locations in Spain and Italy. In the countries where Fastned is active, many small numbers of locations were acquired. In total, that was nearly 60 new locations. In Germany, Fastned won two lots in the Deutschlandnetz tender. There are 92 search areas for urban and rural stations — these are not yet acquired locations. But the federal government will help with cutting red tape and provide financial support in some kind of public private partnership. Think of those 92 as prospects with a high likelihood to become assured locations.

In 2024, Fastned won one of the Autobahn lots in the highway part of the Deutschlandnetz tender, adding 34 locations to the portfolio. In Switzerland, an 11 station tender from ASTRA is a big win for Fastned. Another 11 stations were in the Belgium province of Luxembourg. But the big win this year is the joint venture with Places for London for 25 stations initially in this decade, with a possible extension to 65 stations. All of them are in the London metropolis. 5 station locations are decided and were counted in the 2024 total. These were 61 shows of power to win big tenders.

Overall, countries that Fastned is trying to open for electric driving include a large series of smaller wins for 77 locations. This resulted in the potential growth accelerating to getting 138 new locations. The portfolio of locations being prepared for new stations is now 223. Add to this nearly a hundred stations agreed to be built with Deutschlandnetz and Places for London, but without definitive locations. That is well over 320 locations to be built in the next few years, and add to that the new stations to be built in the countries Fastned is expanding in but doesn’t have secured locations for now.

New locations are nice, but turning them into operational stations requires a lot of work. Only after opening do they start creating electric freedom for drivers and revenue for Fastned. After adding 53 stations in 2023, this year did see growth, with 49 to 346 stations in operation. It’s not as many as customers hoped for, but the mountains of red tape and lack of grid connections made building new stations faster too hard.

In all the countries where Fastned is active, there was growth in the number of electric vehicles on the road. Those vehicles are used more, and for longer journeys, resulting in impressive growth of kWh delivered and CO2 avoided.

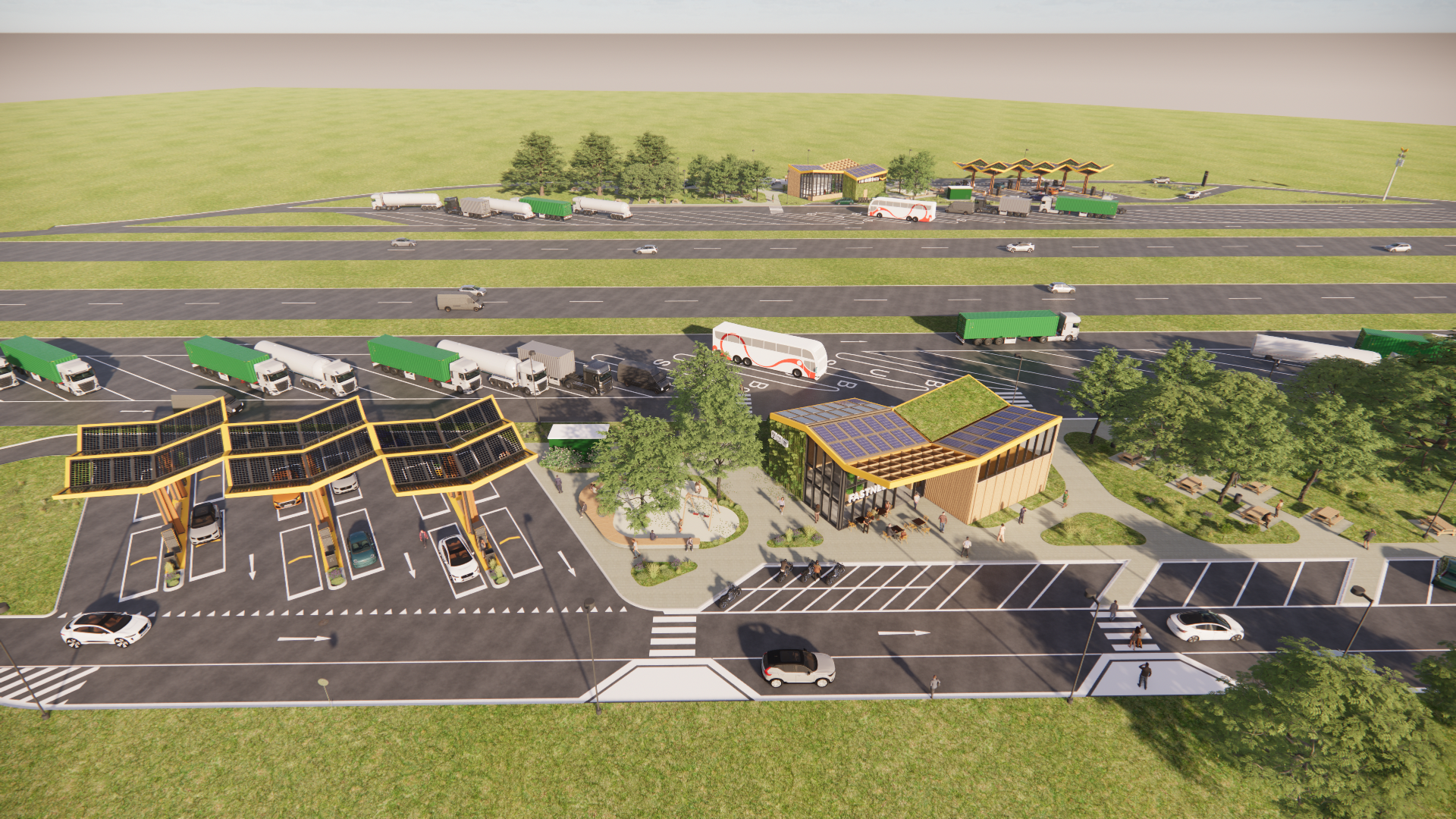

Customers have been asking for amenities from the beginning. It started with wooden benches, followed by trash cans. Recently, Fastned started to add convenience stores, kiosks, vending machines, and toilets to some stations where it is possible and allowed. We are growing from hidden chargers at fast food locations (not by Fastned) to fast food at charging stations. This charging network is leading the industry and becoming more mature every year.

Fastned’s 2025 challenge

2025 is the year the EU is fastening the thumbscrews on the automotive industry. The Corporate Average Fuel Economy (CAFE) regulation mandates significantly lower average CO2/km emissions. To comply, the carmakers must sell more hybrid, plug-in hybrid, and fully electric vehicles. They have a choice of powertrain mix to comply. But even the mix with the most tailpipe vehicles will cause at least 50% more sales of vehicles without a tailpipe. Some scenarios require an increase of even 80% in sales of full EVs.

While there are new incentive schemes in the big markets of Italy and Poland, in most other markets, the incentives have been lowered. Carmakers are not happy with the task of selling far more cleaner vehicles with fewer incentives for their customers.

For most customers, the biggest problem besides the price is charging anxiety. Many of the new BEV drivers will be people without home charging. Those with the possibility of home charging were often among early adopters. Expect a significant increase in demand for public charging, both AC and DC charging. Not as big as the increase in sales, but still a lot. All those new EV drivers have the same question: “Where can I charge?” It helps when charging stations are recognizable, preferably very recognizable.

The challenge for Fastned in 2025 is to learn to slash red tape faster, to build many more stations than last year, to keep being (one of) the best charging networks in Europe, to stay ahead of the new growth spurt initiated by the EU for the second half of this decade.

More people are needed. I did hope the growth of opex (operational expenditures) for the group working on expansion could be in line with the growth of the cash flow from the sales revenue. This hope is likely in vain. Both expansion opex and revenue cash flow are growing fast. But the need to expand station building capacity is winning this race. The growing number of customers charging at the (new) stations do finance most of the expansion operational costs. The capital expenditures are financed with borrowed money.

It would be nice if most new stations can start producing a positive cash flow within a few month after its opening. This is possible in the countries with a higher EV fleet share. The new countries have very different fleet shares. As a rule of thumb, 2% is expected to be the minimum to have a profitable station on a AAA location.

Most of Spain (0.7%), Italy (0.6%), and Poland (0.2%), with tiny BEV fleet sizes, do not have enough electric vehicles on the road to make fast charging stations profitable. But Fastned should start acquiring locations in these large countries. And some routes are important for Fastned customers on holiday from the countries that are further in the transition to electric, clean driving.

Tesla did build a charging network in Spain and Italy years before it started selling vehicles in those countries. Supporting customers from the north is a meager business case for Fastned. But building a large portfolio with prime locations is important for its future in these three big laggards.

I am glad I am not the Fastned manager having to decide what to build when in those countries.

Luckily, there are a number of smaller countries with the required density of BEVs in the fleet. First, we have tiny Luxembourg with a 6% BEV share in the fleet. But this is mostly important for the huge numbers of travelers going to France or further south. That is followed by Denmark (5.7%). Beside being one of the leading BEV countries in Scandinavia, it is also a gateway to popular hinterland. Next is Austria (3.1%), with more prospects passing the future stations than in Germany (2.9%) or the UK (2.8%), besides being the road to Italy for many.

Ireland (2.5%) is between Belgium (2.6%) and France (2.5%). The last potentially (soon to be) profitable country is Portugal (1.7%), with 2.5 times the BEV density in its fleet compared to neighbor Spain.

Well, this year, the expectation is about 75 new stations. And I hope next year over a hundred.

Let us look at some stations of the future.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy