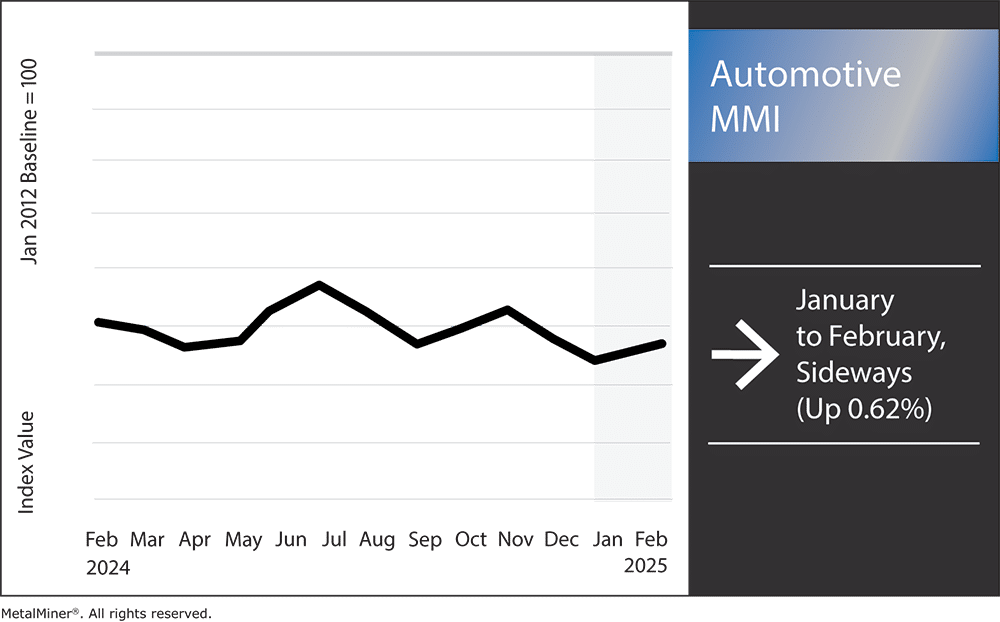

The Automotive MMI (Monthly Metals Index) held sideways for the third month in a row, moving up a mere 0.62%. In January, the U.S. automotive industry faced significant developments affecting metals prices and manufacturing processes. Key factors included proposed tariffs, strategic investments in steel production and notable market reactions among automotive stocks.

Tariff Panic and Industry Response

President Trump’s proposal of a 25% tariff on imports from Canada and Mexico introduced considerable uncertainty into the automotive sector. Given the industry’s reliance on cross-border supply chains, the tariffs threaten to increase production costs and disrupt operations. However, with these tariffs now halted, it’s uncertain if this will have a long-lasting impact on the market.

Despite the stay on the tariffs, many automakers and suppliers are exploring strategies to mitigate the potential impacts, including seeking alternative suppliers and considering price adjustments. All in all, the industry remains braced for disruptions, with concerns that average vehicle prices could rise by approximately $3,000.

Subscribe to MetalMiner’s weekly newsletter and conquer market volatility with valuable weekly market insights and macroeconomics.

Metals Prices: Strategic Investments in Steel Production

In response to the evolving market landscape, ArcelorMittal announced plans to construct an advanced steel manufacturing plant in Calvert, Alabama. With a planned annual capacity of 150,000 metric tons, this facility aims to produce premium non-grain-oriented electrical steel (NOES), which is essential for larger pickups and SUVs.

The $0.9 billion investment seeks to address the rising demand for sophisticated NOES in the U.S., where domestic supply is currently limited. According to Reuters, production is slated to commence in late 2027.

Semiconductor Shortages and Supply Chain Challenges

Meanwhile, the global semiconductor industry continues to face challenges, with supply chain disruptions and geopolitical tensions heavily influencing its path.

With limited chip fabrication capacity posing a significant challenge, industry experts caution that the global semiconductor shortage witnessed in 2020 could reemerge in 2025. Although reduced demand in 2022 and 2023 offered a brief reprieve, the likelihood of renewed constraints in automotive chip supply remained high.

Ditch expensive all-or-nothing subscriptions and pay only for the price forecasts you use. Learn more about MetalMiner Select.

Automotive Stocks and Market Reactions

Automotive stocks experienced notable fluctuations in response to these developments. Ford Motor Company reported a solid fourth quarter with an operating profit of $2.1 billion on sales of $48.2 billion, exceeding Wall Street expectations.

However, Ford’s outlook for 2025 was less optimistic. The latest reports show that the company is projecting an operating profit between $7 billion and $8.5 billion, significantly lower than the expected $9.3 billion.

The proposed tariffs introduced further volatility, forcing investors to weigh the potential impact on production costs and vehicle pricing. The market’s response underscored the sensitivity of automotive stocks to policy changes and global trade dynamics.

Automotive MMI: Shifts in Metals Prices

Looking for forecasting for metals prices in one easy-to-use platform? Inquire about MetalMiner Insights.

- Chinese lead prices moved sideways, dropping a slight 0.8% to $2,282.60 per metric ton.

- Hot-dipped galvanized steel prices also moved sideways. In total, prices edged up by 0.21% to $937 per short ton.

- Lastly, Korean 5052 aluminum coil premium over 1050 prices traded flat, remaining at $4.21 per kilogram.