Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

The Tesla Model Y was #1 again, in a year that saw plugins reach 22% share of the global market.

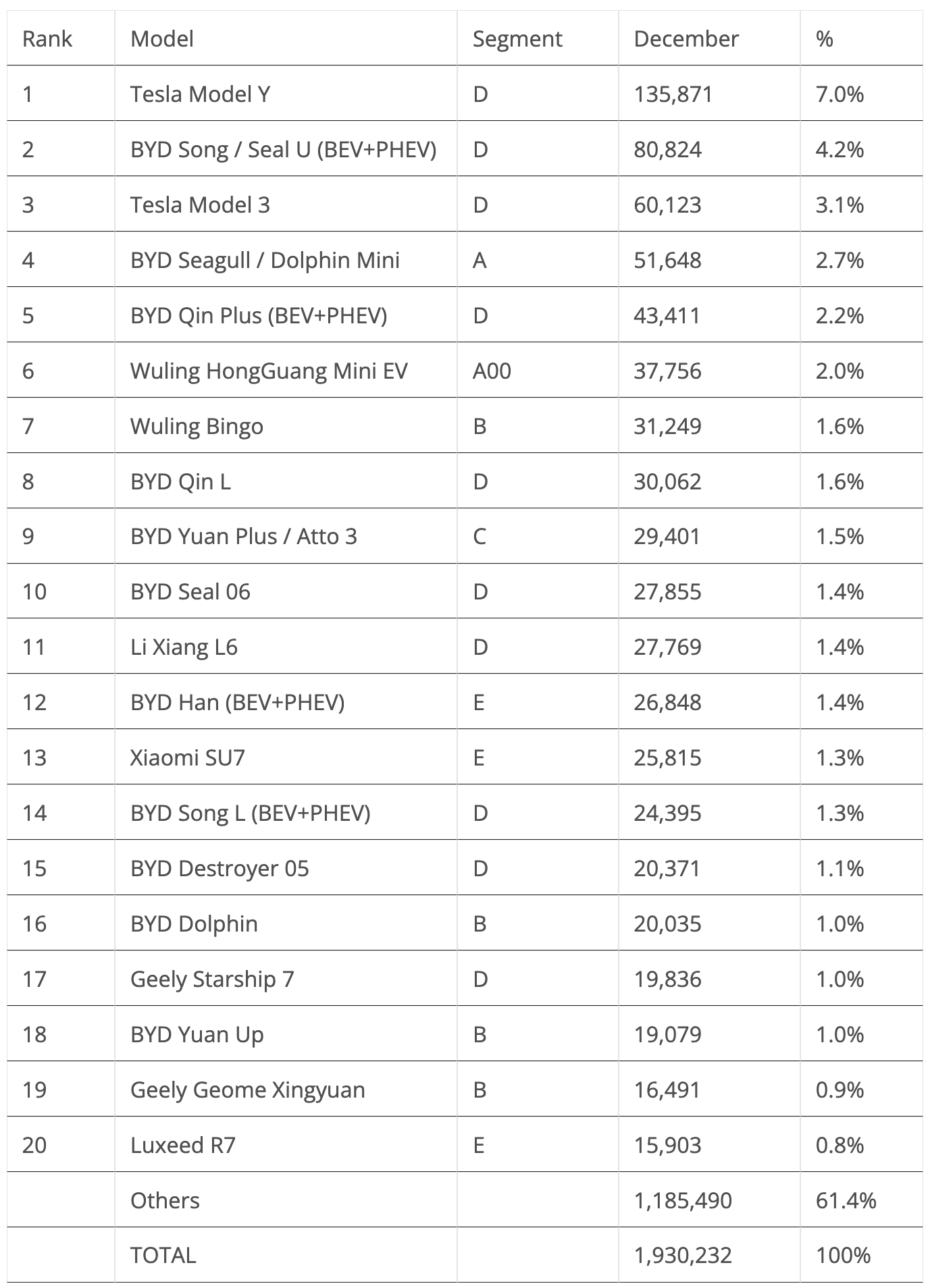

The last months of 2024 brought a record-fest for world plugin vehicle sales, and December was one of them, with over 1.9 million registrations!

With plugin registrations jumping a significant 26% in 2024 compared to 2023, the year ended with the plugin market above the 17 million mark for the first time.

Plugin hybrid electric vehicles (PHEVs) ended the year growing faster than BEVs — +53% year over year (YoY) versus +14% YoY. That allowed them to end the year with 37% of plugin EV sales, up 6 percentage points from the 31% of 2023 and 9% ahead of the 28% result of 2022. Interestingly, the EV sales breakdown between the two powertrains had been balancing between 31% and 26% since 2018, so 2024 saw PHEVs regain importance — to the joy of some and the dismay of others. One thing is certain: plugin hybrids will still be around for a while.

The December plugin vehicle (PEV) share jumped to a record 30% share (19% BEV), pulling the final 2024 plugin share to 22% (14% BEV), a robust rise from the 16% (10% BEV) of 2023 and the 14% (10% BEV) of 2022. Not to mention the 9% (6.1% BEV) of 2021, or the 4% of 2020….

There’s no turning back, folks. The EV Revolution is happening, no matter what.

Sure, in 2025, Trump could try to disrupt EV adoption in the USA, lobbyists in Europe might try to soften the EU’s 2035 ICE ban and the industry’s next steps, and protectionist could grow across the world — but the truth is that those setbacks would only delay the EV Revolution, not derail it. We are already too far ahead in the process.

And to prove this, here’s an interesting statistic — while plugins grew by single digits (+9%) in the USA and stagnated in Europe, if we exclude these two blocs, and also China (which is in its own growth bubble — 48% share in 2024 vs. 37% in 2023), the rest of the world’s EV sales grew by 27% YoY!

So, even if the USA and Europe get stuck in the old ways, the rest of the world will just move on and leave these two behind. This is no longer a question of being eco/green minded or not. We’re also passing the old vs. new technology battle. The economic survival of automotive businesses relies on EV growth. True, protecting their domestic markets would be enough to keep some form of their local makes afloat, but it would be like the Soviet Union’s Ladas — they were only good enough for your citizens, because they didn’t have a choice of something better.

And that is already starting to happen. If it wasn’t for the ban on Chinese EVs in the USA, I could see brands like Li Auto greatly successful there.

But, back to 2024, the Tesla Model Y won another monthly best seller title, and this time with an all-time record — over 135,000 deliveries! Expect the Model Y to continue racking up a series of monthly best seller titles in 2025, as the midsize crossover is sure to benefit from the upcoming refresh.

Just below, the BYD Song was again runner-up, getting a record 80,824 registrations. With exports now helping out not only in Europe, but also in places like Brazil (5,000 units in December), the real plus of this model is value for money. While some of its siblings, like the Sea Lion 07, are going after the more posh end of the market, the regular Song is less showy, and competitively priced.

The last place on the podium went to the Model 3, which had more than 60,000 deliveries, ending well ahead of the #4 BYD Seagull, which profited from expanding sales at home and elsewhere, and also from the BYD Qin Plus slowdown, which is starting to show its age.

Off the podium, major highlights came from Wuling. It placed two models in the top 10, the tiny Mini EV in 6th, and the larger hatchback Bingo in 7th. As such, Wuling managed to place two EVs in the middle of the BYD armada — which placed six models in the top 10 and 11 models in the top 20! BYD sure needs more competition….

The bottom half of the table saw several models ramping up or hitting record results. Starting in the 11th position, the Li Xiang L6 hit a record 27,769 registrations in what can be seen as a peak performance from the startup midsizer. Will 2025 bring export prospects for the smaller of the Li Auto models? (Well, I wouldn’t call a 4.92 meter SUV small, but … here we are.)

Being a record month, record performances didn’t stop here. In fact, the most significant record scores came in the full size category. One key highlight was the Xiaomi SU7, ramping up deliveries to 25,815 units and ending only some 1,000 units behind the category leader BYD Han (perfect timing, then, for the new Han L). Still in the full size category, the Luxeed R7 crossover joined the table in only its second month on the market, thanks to 15,903 registrations, just ahead of the #21 Xpeng Mona M03 (15,877 units), #22 VW ID.4 (15,232), and #23 Geely Galaxy E5 (14,978).

Speaking of Geely, the Starship 7 has also joined the global top 20, in #17, with Geely’s BYD Song fighter joining the table in only its second month on the market as well. If Geely manages just half of the sales of the BYD midsize SUV, it would already be considered a major sales success.

Interestingly, all of the 20 models present here are being made in China — 18 belong to Chinese OEMs, and the remaining two come from Tesla, which can currently be considered half Chinese. These stats speak volumes to the importance of the Chinese market in the broader EV industry.

Outside the top 20, there is a lot to talk about. But instead of talking about all the Chinese models, which I have already discussed in the China EV sales report, let’s look at the ones that belong to brands outside China.

The best seller in December was the aforementioned Volkswagen ID.4, which ended the month at #22 with 15,232 registrations, followed by its smaller sibling, the VW ID.3, with 13,343 registrations. The third best selling model was the Volvo XC60 PHEV, with 10,327 registrations, and in 4th we have the Hyundai Ioniq 5 (9,638 registrations), which is the best selling model that isn’t sold in China.

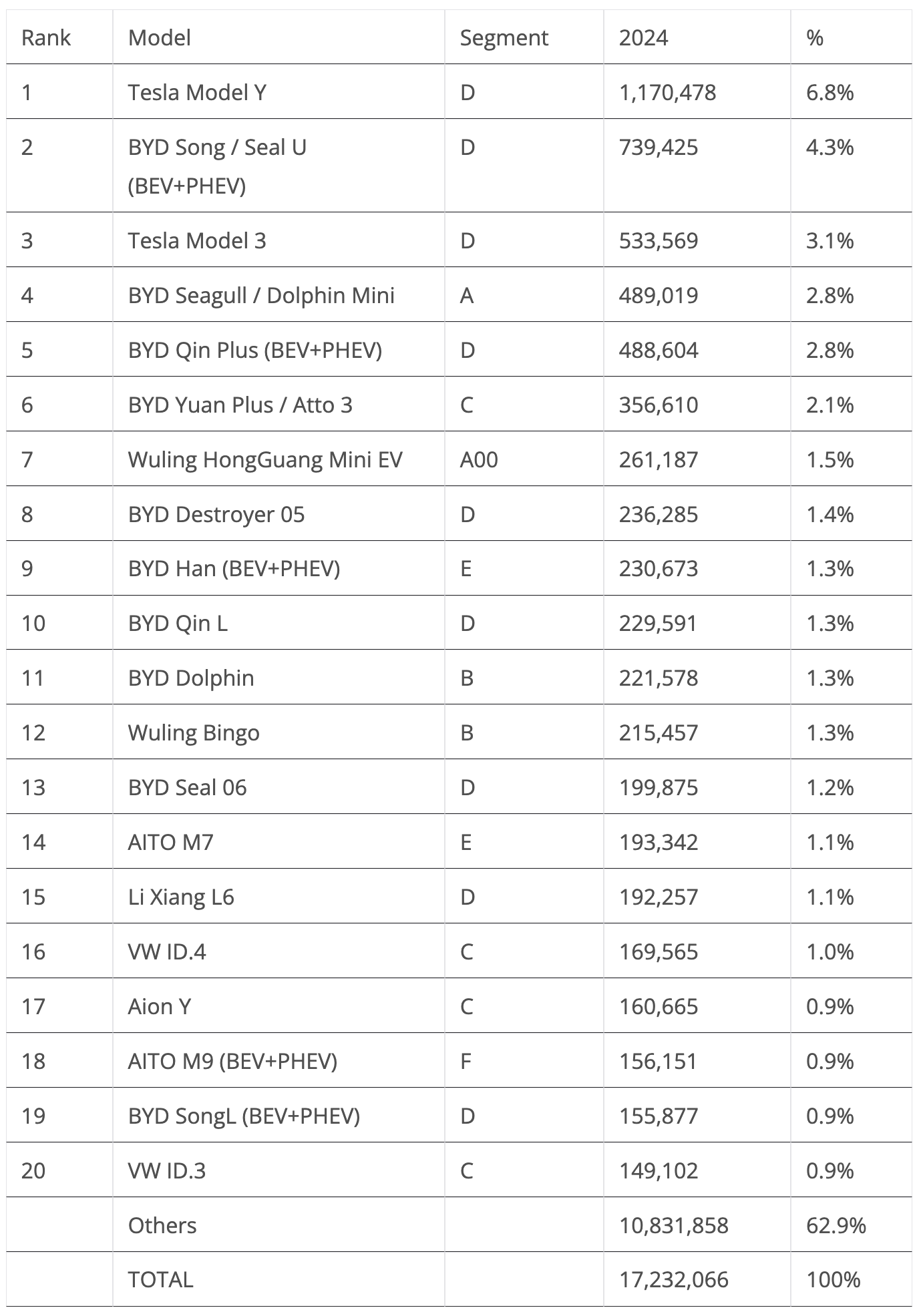

In the final 2024 table, the Tesla Model Y again had the highest place on the podium, close to 1.2 million registrations, meaning that this is its third consecutive Best Selling EV trophy. The crossover is now just one title away from equalling the two EVs with the most Best Seller trophies, the Nissan Leaf (2011, ’13, ’14, and ’16) and the Tesla Model 3 (from 2018 until 2021).

This 1.2 million volume represented a slight (3%) decrease compared to 2023. Expect the crossover to recover in 2025, possibly beating the result of 2023 (1.21 million units).

The podium was the same as in 2022 and 2023. The BYD Song comfortably beat the Tesla Model 3 and took the silver medal. The Chinese SUV ended the year with 739,000 registrations, a 16% increase over 2023. As for the #3 Tesla Model 3, it ended with 533,000 registrations, its best result ever — although, increasing its score by just 4,000 units.

Still, this is a model launched in 2017, meaning it is now 8 years old — at full maturity. Not only has the sedan seen its market share erode (14% in 2019; 12% in 2020; 8% in 2021; 4.7% in 2022; 3.9% in 2023; 3.1% in 2024), its sales have basically stagnated since 2021, the year when the sedan had 501,000 registrations. The 533,000 registrations of 2024 represented a 6% increase over 2021, while in the same period, the plugin market jumped from 6.6 million units to 17.2 million units.

So, yes, there are market limits to how much a given model can grow.

Looking at the Model 3’s 2025 prospects, we have to consider the new #4 BYD Seagull. The Seagull grew 93% in 2024, from 254,000 units in 2023 to its current 489,000 registrations, with the small EV expanding to more overseas markets during the year. Expect it to continue growing, albeit moderately — it wouldn’t be surprising for it to see reach some 540,000 units in 2025. With the Model 3 probably suffering from internal cannibalization from the refreshed Model Y, it will already be a victory if the car stays above 530,000 units in 2025. Which means…

… that for the first time since 2017, Tesla’s midsize sedan won’t be on the podium.

Below the podium, we have a squad of BYD models (#4 Seagull; #5 Qin Plus; #6 Yuan Plus/Atto 3; #8 Destroyer 05; #9 Han; #10 Qin L; #11 Dolphin; #13 Seal 06; #19 Song L). This means that BYD placed 7 models in the top 10, and 10 in the top 20. And out of those ten, three are brand new models (Qin L, Seal 06, Song L), which says a lot about the OEM’s capacity to develop, launch, and ramp up brand new models!

Not everything is good news for the Shenzhen make, though, as the Dolphin has seen its sales drop, and its 2024 standing (#11) is five positions below to where it was in 2023.

Outside the BYD Galaxy, there’s good news for Wuling. Its dynamic duo rose one position compared to 2023, with the Mini EV now in 7th and the Bingo in 12th. AITO placed two models in the top 20, with the M7 at #14 and the M9 flagship at #18. Meanwhile, its rival, Li Auto, placed its L6 SUV in 15th, a new best for the startup.

On the other hand … this year, losers were GAC’s Aion Y, which fell eight positions to #17; and Volkswagen’s top models, which dropped down the table significantly — the ID.4 going from #12 in 2023 to #16 and the ID.3 dropping from #15 in 2023 to #20. Will these still be around by the end of 2025?

Finally, while there were four legacy OEM models in the table in 2022 (VW ID.4, Hyundai Ioniq 5, Ford Mustang Mach-E, and Kia EV6), in 2023 and 2024 there were only two, both from Volkswagen Group (#16 VW ID.4 and #20 VW ID.3). And maybe there will be none in 2025. This says a lot about how far ahead the Chinese brands are from the competition….

Category Leaders

Here’s a look at the 2024 segment winners:

A-segment/City Cars — This is all about Chinese EVs. The #4 BYD Seagull won the category title again, ending ahead of the #7 Wuling Mini EV. The Changan Lumin was 3rd this year, retaining its bronze medal from last year, but it ended far from the top two, with only 145,000 registrations. It seems clear that the 2025 winner is already chosen — the BYD Seagull should take the title without a sweat.

B-segment/Subcompacts — Another example of the Chinese takeover: In 2021, there was a French model (Renault Zoe) on top, followed by a Korean (Hyundai Kona EV). Since then, the Chinese models have taken over. This year, the leader was again the #11 BYD Dolphin, but this time it had to sweat to keep the Wuling Bingo at bay. The 12th spot of the rounded hatchback is a welcome surprise, so 2025 should bring an interesting race between these two. Or … the 3rd placed BYD Yuan Up (137,000 units) could continue to ramp up during 2025, and with the help of export markets, the crossover could steal the show and win the title over the two hatchbacks.

C-segment/Compacts — This category was Volkswagen’s turf in 2021, with the ID.4 on top followed by the smaller ID.3. But since 2022, the title is going to the BYD Yuan Plus/Atto 3, and 2024 was no different, with the crossover ending with some 356,000 registrations. The BYD EV was followed by the VW ID.4 in 16th, and the MPV-disguised-as-a-crossover Aion Y, which ended in 17th. Interestingly, all podium bearers lost sales in 2024, so this is a category where there could be surprises and new players in 2025. (Geely Galaxy E5? Xpeng Mona M03?)

D-segment/Midsize — This is still Tesla’s turf. The #1 Model Y was on top, down 3% compared to 2023, and the Model 3 was in third. Between these two, we had the #2 BYD Song bringing hope to the competition. Still, the category winner for 2025 has already been found: the Tesla Model Y.

E/F-segments/Full Size — Three Chinese models were on top here, with the #9 BYD Han (230,000 registrations), #14 AITO M7 (193,000 registrations), and #18 AITO M9 (156,000 registrations) taking the top spots. And then there are the dark horses everyone fears — the Xiaomi SU7 sedan is set to win the category in 2025, with a 250,000+ unit result, while the upcoming Xiaomi YU7 crossover is looking likely to take the trophy in 2026.

Pickup Trucks — This was the third year that this category had relevant numbers, with around 120,000 registrations in 2023, a significant rise from the 52,000 of 2023. So far, it is a quite open category. In 2022, the Rivian R1T (16,074 registrations) won narrowly over the Ford F-150 Lightning. In 2023, Ford won by a sizable margin — the Ford model had 25,000 deliveries, while the Rivian was stuck at 15,000. In 2024, Tesla’s Cybertruck took the title, but with a much smaller than expected advantage over the Ford pickup, with Tesla’s angular pickup delivering 38,500 — versus the 38,000 of the more traditional Ford workhorse. (Funny enough, I remember predicting 55,000 units for the Cybertruck in 2024 and reading comments that I was too pessimistic. Turns out, I wasn’t pessimistic enough!) In 3rd, we had the Rivian R1T, with around 15,000 registrations. What about 2025? Expect this category to continue to grow fast with the production ramp-up of a number of models (GM trucks, BYD Shark…) and the introduction of others (Ram Ramcharger, etc.).

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy