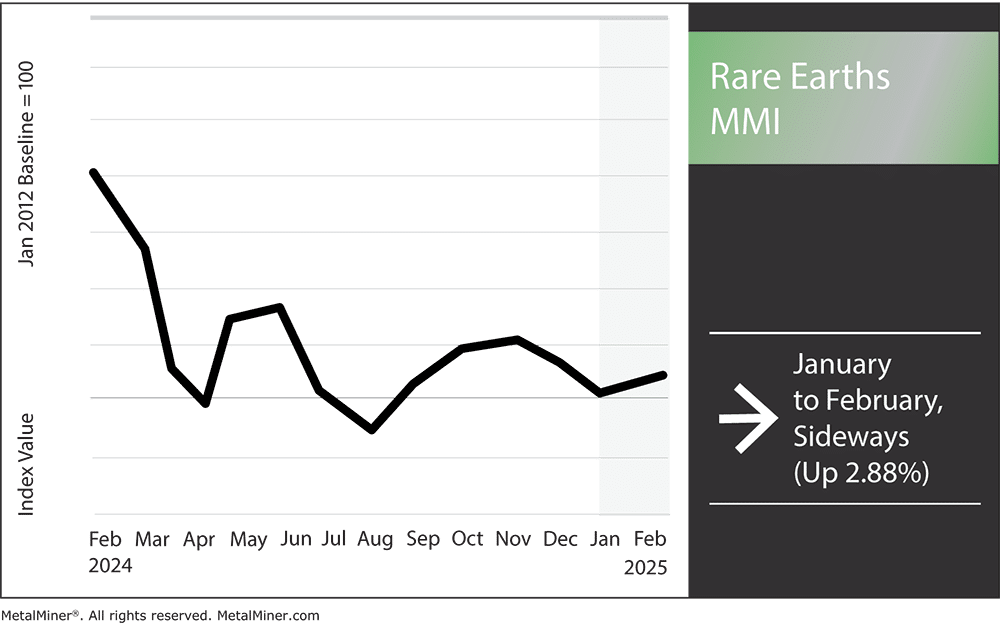

The Rare Earths MMI (Monthly Metals Index) held sideways from January to February, moving up a slight 2.88%. Rare earths prices have proven more volatile in the past year than other metal products like steel. Now, it seems the rare earth market could witness more volatility in 2025.

President Trump recently imposed a 10% tariff on all Chinese goods, which includes rare earths. Meanwhile, the Kachin Independence Army (KIA) remains in extensive control of Myanmar’s valuable rare earth mines, severely limiting the Burmese government’s control over this sector. Get weekly updates about these rare earth shifts in MetalMiner’s Weekly Newsletter.

Trump’s Promised Tariffs – Time to Worry?

In early February, President Trump enacted a 10% tariff on all Chinese imports, intensifying global trade tensions and raising concerns about its potential impact on industries reliant on rare earth elements. China currently supplies between 85% and 95% of the global demand for rare earth elements, granting it significant influence over global supply and pricing.

As reported by Reuters, China announced export controls on critical minerals, including rare earths, in retaliation to the U.S. tariffs. This signals the country’s readiness to leverage its dominant position in the sector.

Potential Impacts on the Global Rare Earths Market

These tariffs have led to concerns about supply chain disruptions and increased costs for industries dependent on rare earth elements. Because of these developments, manufacturers in sectors such as electronics, automotive, and defense could face challenges securing necessary materials. Reuters states that this could lead to production delays and higher prices for consumers.

Pick and pay for only the metal price data that impacts your bottom line. Learn about MetalMiner Select.

Assessing the Panic

Some analysts argue that the level of concern may be disproportionate to the actual threat. They argue that the global market has previously navigated similar challenges.

For instance, during past trade disputes, companies adapted by diversifying their supply chains and investing in alternative sources of rare earths. Additionally, the current export controls by China are targeted and leave room for negotiation, suggesting that a complete cutoff of rare earth supplies is unlikely.

Various Mitigation Strategies

There are several strategies businesses can utilize to mitigate the effects of tariffs and potential supply shortages. One way to reduce dependence on a single supplier and increase resilience to geopolitical disruptions is to diversify the supply of rare earth elements across multiple sources.

Another way of balancing the world’s supply of rare earths is to invest in exploration and development in places like Australia. Nations can also decrease their reliance on primary sources by supporting technologies that concentrate on producing alternative materials or recycling rare earth elements from goods that have reached the end of their useful lives.

Are you on the hook for communicating your company’s stainless steel performance to your executive team? See what should be in that report.

Myanmar Mine Woes Continue into 2025

In the past year, Myanmar’s rare earth mining sector has faced significant upheaval due to escalating conflicts involving armed ethnic groups. This stems from moves by the Kachin Independence Army, an ethnic insurgent group, which has seized control of key mining hubs in Kachin State. Most notable are those located in Panwa and Chipwe, which are critical suppliers of rare earth oxides to China.

Historically, these mining areas were controlled by the New Democratic Army-Kachin, a militia allied with Myanmar’s junta government. However, recent KIA offensives have altered this dynamic. Analysts suggest that while the KIA may intend to resume rare earth operations, negotiations with China could delay any quick restart, potentially tightening global supply and increasing prices.

Looking Ahead

The topic is sure to remain complicated going forward. Due to the KIA’s control over important mining regions, the worldwide supply chain for rare earths will remain unpredictable. Though talks between the KIA and Chinese firms may allow mining operations to resume, there is no clear timetable. Moreover, there is always the chance of more conflict.

Meanwhile, the international community is sure to watch these advances carefully, as they have important ramifications for industries worldwide.

Rare Earths MMI: Noteworthy Price Shifts

MetalMiner’s MMI report includes 10 metal price reports and can be used as an economic indicator for contracting, price forecasting and predictive analytics. Sign up here.

- Europium oxide prices dropped by 4.91% to $23.77 per kilogram.

- Cerium oxide prices rose by 7.39% to $1,122.89 per metric ton.

- Dysprosium oxide prices climbed by 5.11% to $227.46 per kilogram.

- Lastly, neodymium prices rose 4.59% to $69,941.78 per metric ton.