Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Plugin vehicles in China once again ended the year with a record month, growing by 46% year over year (YoY) in the last month of the year to a record 1,379,000 units. Full electrics (BEVs) were responsible for 55% of the plugin market in December, 8% below the result of December 2023, with the final 2024 number ending at 52% for BEVs.

Sharewise, December saw plugins reach 53% share (29% for BEVs alone), while the final 2024 result was 48% share (and 25% for BEVs).

Looking back, the plugin share progression of the past few years has been heavily based on PHEVs, as BEVs seem to be plateauing at 20-something. At the end of 2020, we had 6.3% (5.1% BEV) market share, followed by 15% (12% BEV) in 2021, and 30% (22% BEV) in 2022. In, 2023 we were at 37% (25% BEV), and 2024 ended at 48% (25% BEV).

So, while BEVs progressed 3% in share since 2022, in the same period, PHEVs jumped from 8%, to … 23%.

With the plugin share already at 48% in 2024, and with full electrics (BEVs) alone accounting for 25%, a slowdown in the plugin growth rate is bound to happen, but even with slower rates, expect the Chinese automotive market, the largest in the world, to cross the 50% mark in 2025 — hopefully with BEVs still being the majority.

If Chinese OEMs wish to continue doubling their sales, as many have been aiming to do, there is one way to do it: exports.

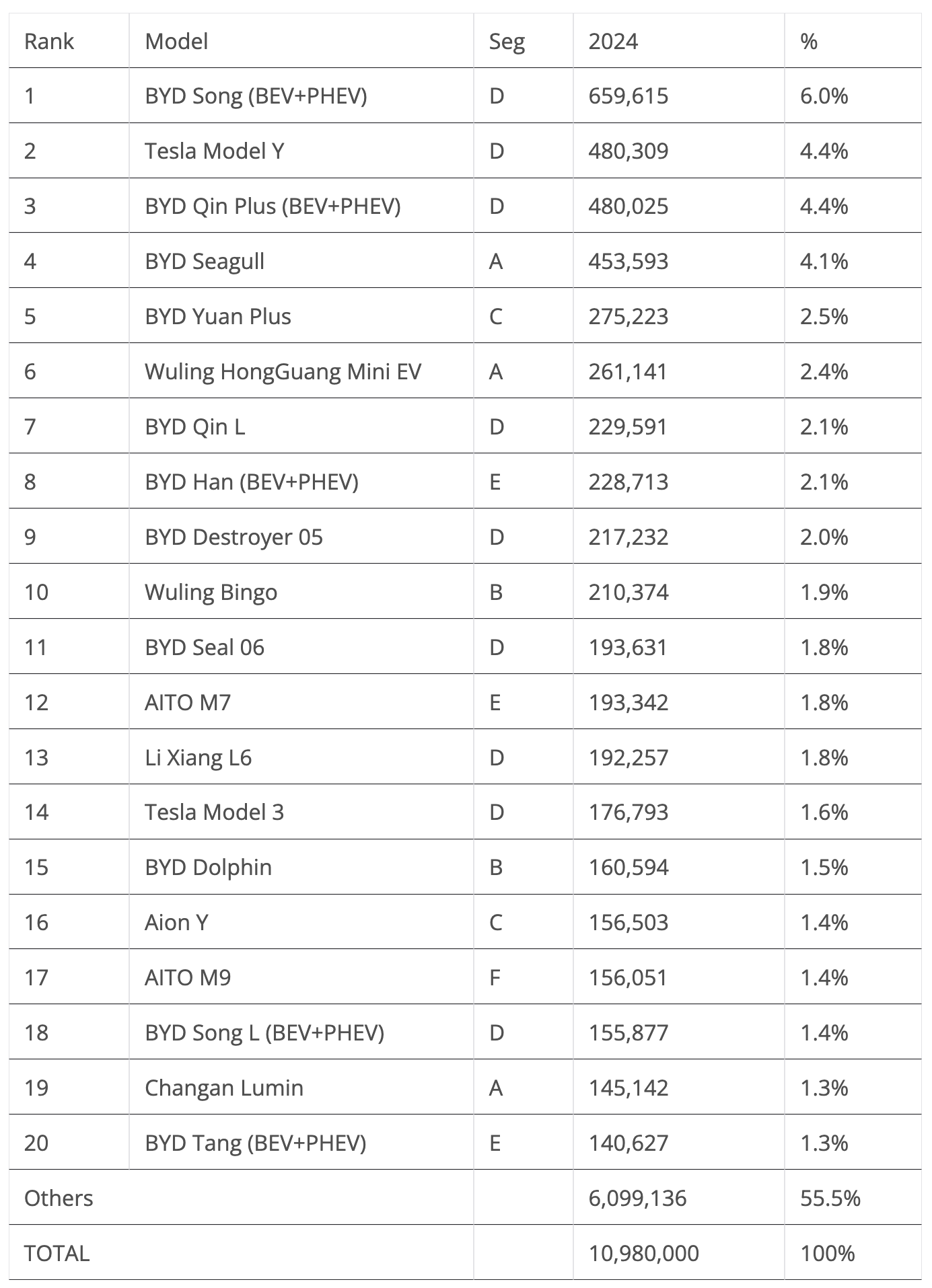

In the overall ranking, the top four was 100% plugin. The Tesla Model Y was the best selling non-BYD model, in 2nd. The model that most progressed was the BYD Seagull, which jumped from 10th in 2023 to 4th in 2024. The best selling ICE (internal combustion engine) model was the Nissan Sylphy, in 5th.

In 2024, we had four fossil fuel models present in the top 10, with all of them being sedans and three of the four being compact sedans. That class is turning out to be the last bastion of resistance for ICE vehicles in China.

Speaking of ICE sedans, looking at the final results in several categories, all but the C segment (compact cars) have plugins dominating the podium. In the C segment, the top two positions are ICE models.

Still, I believe this is temporary. BYD’s Yuan Plus continues going strong, the promising Geely Galaxy E5 is still ramping up, as is the BYD Seal 06 GT, while the upcoming BYD Sealion 05 EV (aka anti-Geely Galaxy E5) is surely going to make a splash. And don’t forget the recently introduced Xpeng Mona M03….

Regarding December 2024, the main news was the BYD Seagull ending the month in 3rd, surpassing the Qin Plus. The BYD Song (BEV+PHEV) won another best seller title, followed by its arch rival, the Tesla Model Y. Here’s more on December’s top 5 best selling models:

#1 — BYD Song (PHEV+BEV)

The performances of BYD’s midsize SUV are remarkable, including the 65,637 sold in December. The current generation is seemingly unaffected by its younger siblings (Song L, Sealion…). Will the Song continue to rule in the Chinese automotive market? Well, it depends on the competition, including the internal competition. Despite an increasing number of competitors, the Song continues clocking over 50,000–60,000 sales/month, a necessary threshold to continue leading the cutthroat Chinese auto market. Thanks to its competitive pricing (and an upcoming refresh?), the Song is set to continue its success story.

#2 — Tesla Model Y

The bread and butter model of the Tesla family had 61,881 registrations last month, a 5% increase over the same month last year. This is an especially impressive result considering the context — not only is the external competition said to be increasing, but the upcoming Model Y refresh could have stolen some clients from it in December. It seems that wasn’t the case, though, so expect the crossover to continue posting strong results in China, especially after the refresh. With the standard BYD Song possibly being cannibalized by its siblings, expect Tesla’s crossover to feature regularly at #1 in 2025, even if its sales won’t grow significantly.

#3 — BYD Seagull

BYD’s smallest star had 48,754 registrations in December, and that was NOT a record month, which seems to imply that the delivery ramp-up is slowing down, at least for now. The biggest impact of this baby Lambo in 2025 is going to be in export numbers, where many markets are hungry for small and affordable EVs. One of the most competitive small EVs on the market, the little BYD hatchback is set to become a regular on the podium in China and globally. Competitive pricing and specs go a long way.

#4 — BYD Qin Plus (BEV+PHEV)

A lasting player in the BYD lineup, the Qin Plus scored 40,709 registrations last month. Expect the midsize model to continue competing for top 5 positions throughout 2025. Thanks to unbeatable value for money, the Shenzhen model is leading its vehicle class (midsize sedans) and solidly ahead of its siblings (Qin L, Destroyer 05, Seal 06…) and the Tesla Model 3. This is one of the secrets of the Chinese EV industry, and of BYD in particular.

#5 — Wuling Mini EV

The tiny car with a long name (Wuling Hongguang Mini EV is its full name) is back to its former glory. Thanks to a refresh, it returned to the top 5. In December, it had 37,747 sales, its best result in over two years. And with a 5-door version landing soon, expect its sales to continue climbing. Will it be able to go after the City Car Master BYD Seagull? Hmm … hard to believe, as it has a more limited appeal. But it will be interesting to see nevertheless….

Looking at the rest of the December best seller table, in a record month, it would be natural that several models hit best ever scores — and they did. We should highlight the #6 Wuling Bingo small hatchback. The Wuling EV has managed to beat the BYD competition in its category, and we might even see it join the top 5 soon. The #8 Li Xiang L6 (27,769 registrations) also deserves a callout, with the midsizer continuing to ramp up production.

In the second half of the table, the big highlight is the #11 Xiaomi SU7, which continues to ramp up. A record 25,815 units were delivered, beating the Tesla Model 3 (#14, with 21,046 units) in a peak Tesla month, all while ending just 612 units below the full size king, the BYD Han. Xiaomi’s sports sedan will be a strong contender to displace the BYD’s flagship sedan from the category’s throne in 2025.

Elsewhere, the last three positions on the table went to models that undoubtedly will feature in 2025’s top sellers. The #18 Geely Galaxy Starship 7 landed with a bang, with 19,836 units delivered in its starting month! That means the crossover had one of the most impressive landings in this market’s history. The #19 Luxeed R7 joined the top 20 in only its second month on the market, thanks to 15,903 sales of the big crossover, and the much hyped Xpeng Mona M03 debuted on the table thanks to 15,877 sales, providing much needed volume for the EV startup.

Outside the top 20, there were a few surprises last month, like the new Deepal S05 — a compact crossover which scored a record 11,922 sales. It looks like Changan’s premium-class arm might have a contender for the best sellers table here.

On the startup side, there is plenty to talk about, like the surprisingly strong result of the Xpeng P7+. In only its second month on the market, 10,034 units of the vehicle were delivered, proving that the Chinese startup has gotten into its stride after the success of the smaller M03. The bigger P7+ uses the same recipe (strong value for money, liftback design) in a higher segment. Are these good omens for the upcoming G7?

Leapmotor posted strong results from its star crossovers, the C11 (11,338 units, a year best) and C10 (10,034 units, a new record), all while NIO’s new offspring brand, Onvo, is starting to show up on the map — with its L60 crossover delivering its first five-digit monthly performance, 10,528 registrations.

While Leapmotor is on its way to profitability in 2025, both Xpeng and NIO face a decisive year, as 2025 could be the year when either they prove their viability or fall prey to the appetite of bigger fish.

Top Selling EVs in China — January–December 2024

Looking at the 2023 ranking, the BYD Song is the 2024 best seller, repeating its success of the past two years (it was #1 in 2022 and 2023). The Song ended with more than 200,000 units above the runner-up, the Tesla Model Y. The Tesla Model Y surpassed the BYD Qin Plus in the last stage of the 2024 race, allowing the Tesla crossover to win its third silver medal, after the ones it won in 2021 and 2023. (It won bronze in 2022.)

Still, with seven models in the top nine positions, BYD had a lot of reasons to open the champagne. Besides, it won three size categories in the overall market, with the Seagull winning the city car category, the Song winning the D-segment/midsize category, and the Han winning the higher level full-size category.

Expect BYD’s domination to be more contested in 2025, as there will be more competition. Not only will the Xiaomi Su7 likely remove the BYD Han from the full size leadership spot, but the Tesla Model Y could have a good chance of beating the BYD midsize armada due to their internal cannibalization.

Elsewhere, there wasn’t much to talk about, with only one non-BYD model rising on the table, the Wuling Bingo, which climbed one position to #10. Meanwhile, BYD saw four models (#7 Qin L, #11 Seal 06, #18 Song L, #20 Tang) climb one spot in December.

Changes in the Overall Brand Ranking

In 2024, the podium remained the same. The rise and rise of leader BYD continued, growing 37% compared to 2023. #2 Volkswagen and #3 Toyota (both down 7%) were hanging on, while Geely (+24%) was up from #5 in 2023 to #4 in 2024. And maybe 3rd in 2025? Geely is rising….

With the opposite dynamic, #5 Honda (down 27% YoY) lost a position in 2024 and could lose more in 2025, as #7 Wuling, #8 Chery, and even #9 Tesla could surpass it in 2025.

In not so different news, another legacy OEM suffering is BMW. It was 10th in 2024 (compared to 7th in 2023) after a 13% drop in sales. Still, it is better than #20 Buick (-30%), #41 Cadillac (-38%), and #54 Chevrolet (-67%)….

For some brands to come down, others are on the way up, like #17 AITO (+280%), #22 Leapmotor (+97%), and #24 Zeekr (+87%).

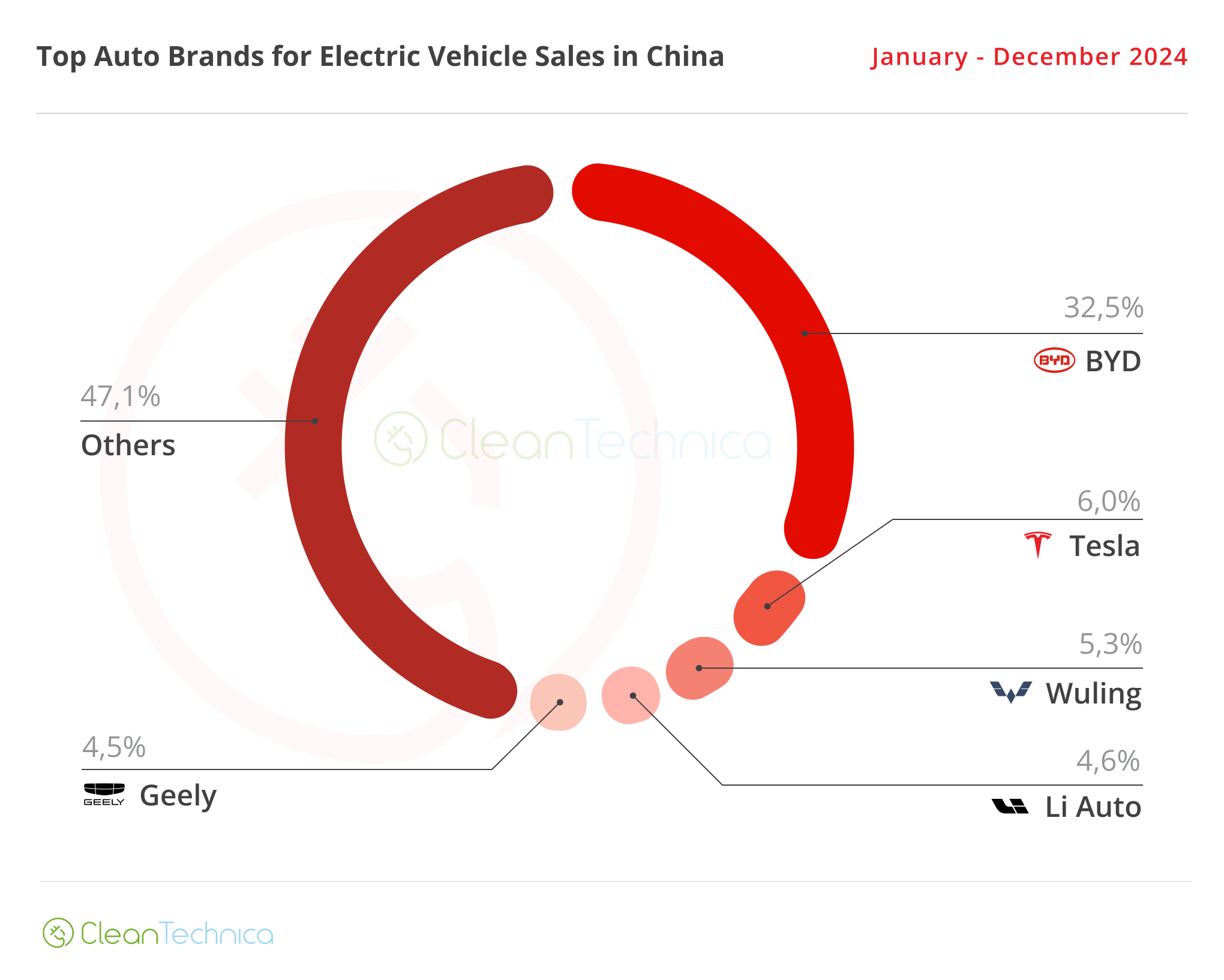

Looking at the brand EV ranking, BYD won its 4th title in a row (and 11th overall), but it did lose some share compared to 2023 (33.8% in 2023 vs. 32.5% in 2024). Are we witnessing peak BYD? Interestingly, ever since it started making plugins, waaay back in 2008, the Shenzhen make always ended among the top two positions in the top manufacturers table in China, and since 2012 it only lost the best sellers title two times, once in 2013 (to Chery) and a second time in 2020 to the SGMW joint venture. This says a lot about BYD’s importance regarding the EV Revolution in China.

Meanwhile, Tesla won its second silver medal in 2023, with 6% share. Still, this was a significant 1.5% drop in market share, as a year ago it had ended the year with 7.5%. Was 2023 also peak Tesla in China?

Still on the podium, Wuling won bronze, ending in 3rd with 5.3% share. This success is much thanks to the success of its dynamic duo, the Mini EV and Bingo.

Li Auto profited from the success of its L6 midsize SUV and ended the year in 4th, with 4.6% share, just ahead of #5 Geely, that ended the year with 4.5% share. This is a significant improvement over the 7th spot of 2023, when it ended the year with 4.1% share. And that result was already an improvement over the 3.7% of 2022. As such, 2025 could be the breakout year for the make, and a podium position might not be such a distant possibility.

By automotive EV group, the big winner was BYD, but with a slight drop in share compared to the previous year (34.1% now vs. 35.5% then), repeating last year’s #1 title. Expect the following years to be the same story — such is BYD’s domination here.

Having also been #1 in the overall market, for the second year in a row, the demand ceiling should be coming close, leaving little room for significant growth in China. The Shenzhen automaker is now more worried about going upmarket domestically and conquering overseas markets.

As for Geely’s runner-up spot, with 7.9% share, it can be said that the Chinese OEM is continuing its unstoppable rise. From 4th with 7.1% share to 2nd with 7.9%, Geely is set to be winning silver in the upcoming years.

With silver and gold already taken for the foreseeable future, the question mark now is the last position on the podium. Tesla won it, with 6% share, this time, but SAIC (runner-up in 2023) ended the year just 0.1% behind Tesla, at 5.9%. And with #5 Changan ending 2024 with 5.7% share, Tesla will have a hard time to keep these two off of the podium in 2025.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy