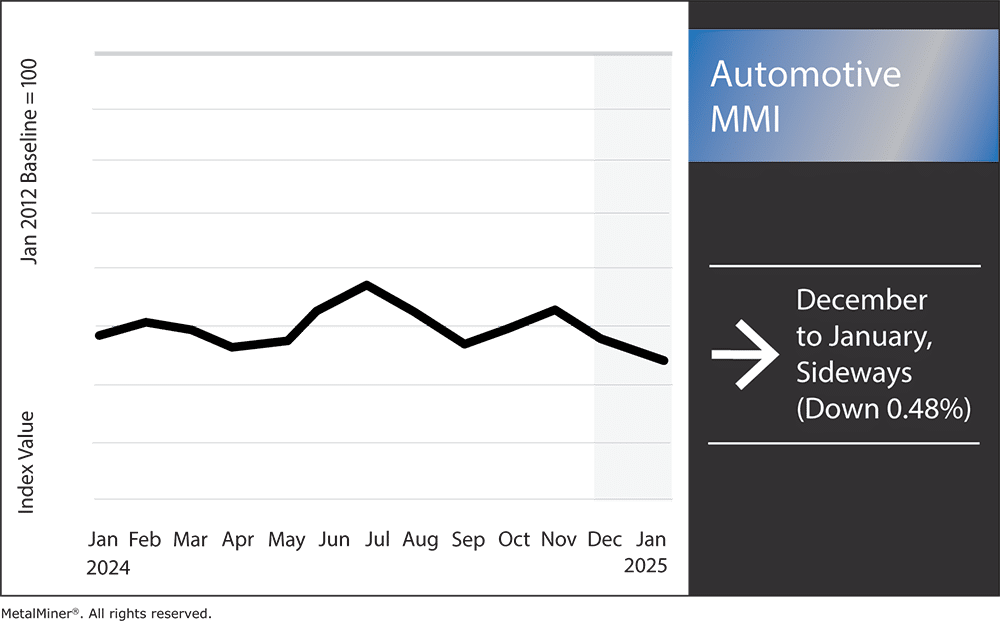

The Automotive MMI (Monthly Metals Index) held sideways from December to January, dropping a mere 0.48%. The index has yet to show a lot of momentum in 2025, with no clear trend up or down. However, the U.S. automotive industry has raised concerns about Trump’s proposed tariffs on automotive imports from Canada, Mexico and China.

Trump’s Tariff Concerns

The U.S. automotive industry continues to express concerns over President-elect Donald Trump’s proposed tariffs on imports from Canada, Mexico and China. The tariffs, which include a 25% charge on goods from Canada and Mexico, aim to address issues like illegal immigration and drug trafficking.

However, automotive industry stakeholders fear these measures could disrupt supply chains, increase production costs and lead to higher prices for consumers. Many also argue that introducing these tariffs will drive up the costs of imported vehicles and parts, resulting in higher overall expenses. As a result, experts foresee a potential rise in car prices, which may ultimately lower consumer demand.

Get valuable market trends, price alerts and commodity news to help your business mitigate the impact of fluctuating metal prices. Register for MetalMiner’s free weekly newsletter.

Industry Response and Strategic Shifts

To prepare for possible tariffs, global auto suppliers are exploring shifting production closer to or within the United States to lessen the impact. Previously, companies such as Bosch, Continental and Honda had looked into strategies to adapt their manufacturing and supply chains.

Semiconductor Headache Continues into 2025

The global semiconductor industry continues to face significant challenges, with supply chain disruptions and geopolitical tensions heavily influencing its path. As 2025 progresses, whether the microchip shortage will improve or worsen will remain a key concern.

In late 2024, China implemented strict export controls on “dual-use” technologies, a move primarily aimed at the United States. These restrictions include bans on exporting antimony, gallium and germanium, all of which are critical minerals for semiconductor production.

Subscribe to MetalMiner’s free Monthly Metals Index report and leverage it as a valuable resource for tracking and predicting automotive industry trends. Opt in here.

Another Wave of Semiconductor Shortages?

Industry experts caution that the global semiconductor shortage witnessed in 2020 could reemerge in 2025. Limited chip fabrication capacity continues to pose a significant challenge. Although reduced demand in 2022 and 2023 offered a brief reprieve, the likelihood of renewed constraints in automotive chip supply remains high.

Meanwhile, businesses and governments are working to strengthen supply chain resilience so they can better address these challenges. For example, Korea Zinc has begun initial talks with U.S. organizations to provide antimony in light of China’s export restrictions. According to Reuters, the company is considering long-term agreements, as many anticipate antimony prices to reach record highs.

Automotive MMI: Noteworthy Price Shifts

- Chinese lead prices dropped by 3.06% to $2,284.47 per metric ton.

- Hot-dipped galvanized steel prices moved sideways, dropping a slight 0.95% to $935 per short ton.

- Lastly, Korean 5052 premium over 1050 aluminum coil prices traded flat, remaining at $4.21 per kilogram.