Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Domestic car manufacturing has been under fire this week, with the UAW posing small, sporadic strikes against Detroit automakers. One of the lesser told aspects of their demands is that, if you want to buy the most USA-made cars, trucks or SUVs, the Motor City ain’t where it’s at. In fact, only one brand is at the top of a prominent US domestic car manufacturing index, and it’s Tesla.

It’s a conundrum for the UAW, the Detroit automakers, and the Biden administration, who recently backed the UAW in their negotiations over wage increases.

Ford, GM, and Stellantis fade by comparison. Actually, German and Japanese brands produced more in the US in 2023 than have those US legacy automakers.

A mixture of 5 primary factors makes it to the pinnacle of domestic car manufacturing in the Cars.com American-Made index, which surveyed light passenger vehicles, including trucks, SUVs, and cars:

- location of final assembly;

- percentage of US and Canadian parts;

- country of origin for available engines;

- country of origin for available transmissions; and,

- US manufacturing employees relative to the automaker’s footprint.

The 4 Tesla models — S, E, X, and Y — comprised the Top Four. Following these were Honda Passport, Volkswagen ID.4, Honda Odyssey, Acura MDX, Honda Ridgeline, and Acura RDX.

But that report was released in June, so it’s not, actually, new news. What’s brought it back to the forefront?

Politics: that’s what.

They Said One Thing, So I Had to Say the Other

With the 2024 US Presidential race beginning to heat up, candidates are trying to solidify their standings in polls and the press. The ongoing struggle between labor and capital has been a staple of American politics since the nation came into existence. So, too, has politicians’ capacity for vacillating dependent on their opponents’ position on particular topics.

A 2022 researcher analyzed more than 160 elections in 56 countries. The results showed that ideological considerations are more important for the vote when all party leaders are disliked, incumbent coalitions are large, and polarization is high. That pretty much captures the current state of US politics, doesn’t it? It especially rings true when the two frontrunners — incumbent President Joe Biden and former President Donald Trump — are in a pollster’s dead heat. Biden is upside down in approval ratings, and only half of Republican primary voters plan to vote for Trump.

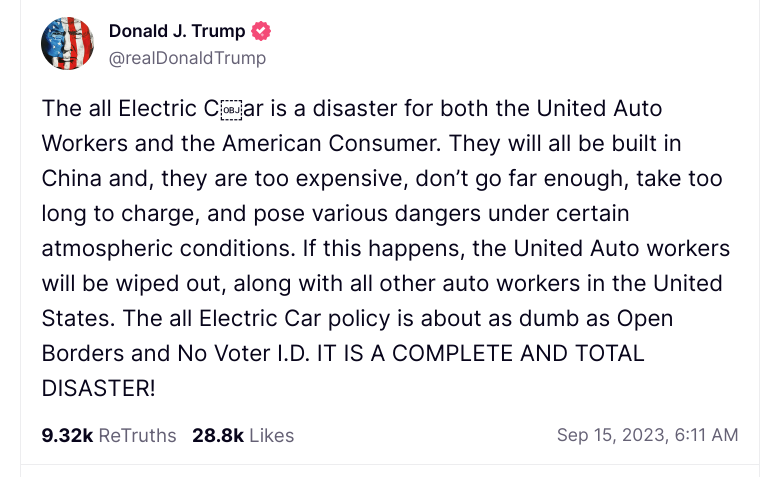

Biden came out in favor of the UAWs, so Trump has taken the opposite tack, supporting the Detroit carmakers. His theme recently has been that EVs are bad for the American car industry.

The Detroit automakers don’t seem quite in sync with Trump’s statement that the “electric car is a disaster.” Yes, it’s correct that General Motors, Ford Motor, and Stellantis are doing a delicate dance to protect profits and their marketplace dominance while confronting the technological feats of Tesla and foreign automakers.

“They will all be built in China,” Trump predicts. The nuance he’s failed to discern is that EVs have emerged as the sole growth area in the automotive market, amid a decline in overall car sales since their peak in 2017, according to China Briefing. With expectations around innovation in a crucial economic sector, China has embraced the EV transformation and provided numerous government incentives, environmental regulations, favorable policies, and technological R&D. Perhaps Detroit’s automakers should’ve heeded Elon’s call several years earlier. Way back in 2010, Musk insisted that the start-up culture would make Tesla agile where Detroit had been plodding — with the bet that a foreseeable future would have cars driven by electricity instead of oil.

Now the Detroit automakers’ whines seem a little bit like crying wolf. Forbes noted on Monday that “Musk and Tesla are the ‘clear winners’ of the Detroit auto strike.”

Trump continued his rant about EVs by spitting out that “they’re too expensive, don’t go far enough, take too long to charge, and pose various dangers under certain atmospheric conditions.” Oh, my.

According to data from Cox Automotive, parent of Kelley Blue Book, the average transaction price for electric cars was $53,469 in July 2023 versus gas-powered vehicles at $48,334. Tesla contributed to a substantial drop in EV prices since late last year as it cut prices.

According to the US Department of Transportation, if you use a Level 1 charger, well, yes, duh, it’s going to take a couple of days to charge. But most people have a Level 2 charger at their home, which can recharge overnight. A Level 3 charger zips right back up to 80% in a mere half hour or so. Does Trump ever read, or do any research, or consult any experts, before he blusters? Okay, I know the answer to that one, sorry.

I really have no idea what he’s talking about when he refers to “various dangers under certain atmospheric conditions.” You?

“We want to become middle class again,” Andrew Hudson, who works at a Ford assembly plant in Wayne, Michigan, told the Washington Post. One of the issues that resonates with UAW members is that the Inflation Reduction Act is pouring billions of dollars into building new factories in Trump’s own stronghold red states where unions struggle to gain traction with workers. With the UAW making transparent the loss of worker wages in comparison to CEO pay raises, the autoworkers may actually gain ground instead of, as Trump put it, “be wiped out.”

Part of that negotiating, of course, is the recognition that the transportation future is electric.

What Trump Didn’t Say about Domestic Car Manufacturing

Forbes was all over Trump’s biggest problem with his argument about EVs: “It avoids any mention of Tesla — the proverbial elephant in the room and the biggest positive for the American car industry today.” Tesla could be on its way to becoming the largest carmaker in the world by output by 2030.

Looking back over a decade, Tesla’s hardware architecture contradicted early legacy automakers’ attempts at vehicle electrification due to the all-electric car company’s flat pack of batteries at the base, 2 electric motors (front and rear), and no transmission. Tesla’s competitors writhed as they saw a lower center of gravity, greater energy density, and more efficient battery management instead of their feeble approach of adapting existing ICE vehicle architecture by putting batteries in the trunk.

And now we return to the Cars.com report. Tesla is a homegrown US car company. It manufactures vehicles with the highest US parts content of any US auto manufacturer. Abandoning brand loyalty was especially noticeable in the luxury segment during the last 2 years, with one exception: Tesla. Maybe the Biden administration’s “electric car policy” isn’t “dumb” after all, with the NACS coming into play and good paying automaker jobs on the horizon.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

EV Obsession Daily!

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

Tesla Sales in 2023, 2024, and 2030

CleanTechnica uses affiliate links. See our policy here.