For decades, I’ve been urging the CME to convert the 100ounce futures contract to a no-margin physical market contract. I’ve also been urging them to launch a one-ounce gold futures contract.

Dumping the 100oz contract would reduce nonsensical margin-oriented volatility in the market. Most gold volatility is created by over-leveraged gamblers getting hit with endless margin calls… calls over market news that should really move the market no more than $2-$5/oz.

The one-ounce contract would also allow more modest net worth citizens to participate in the gold market… at greatly reduced fees.

The bad news is that the CME didn’t kill the 100oz contract, but the good news is that yesterday they finally launched a one ounce “pocket rocket”.

Small investors could buy the one-ounce contract incrementally on dips in the price and then sell them at a loss for tax purposes while buying an equivalent amount from a physical dealer.

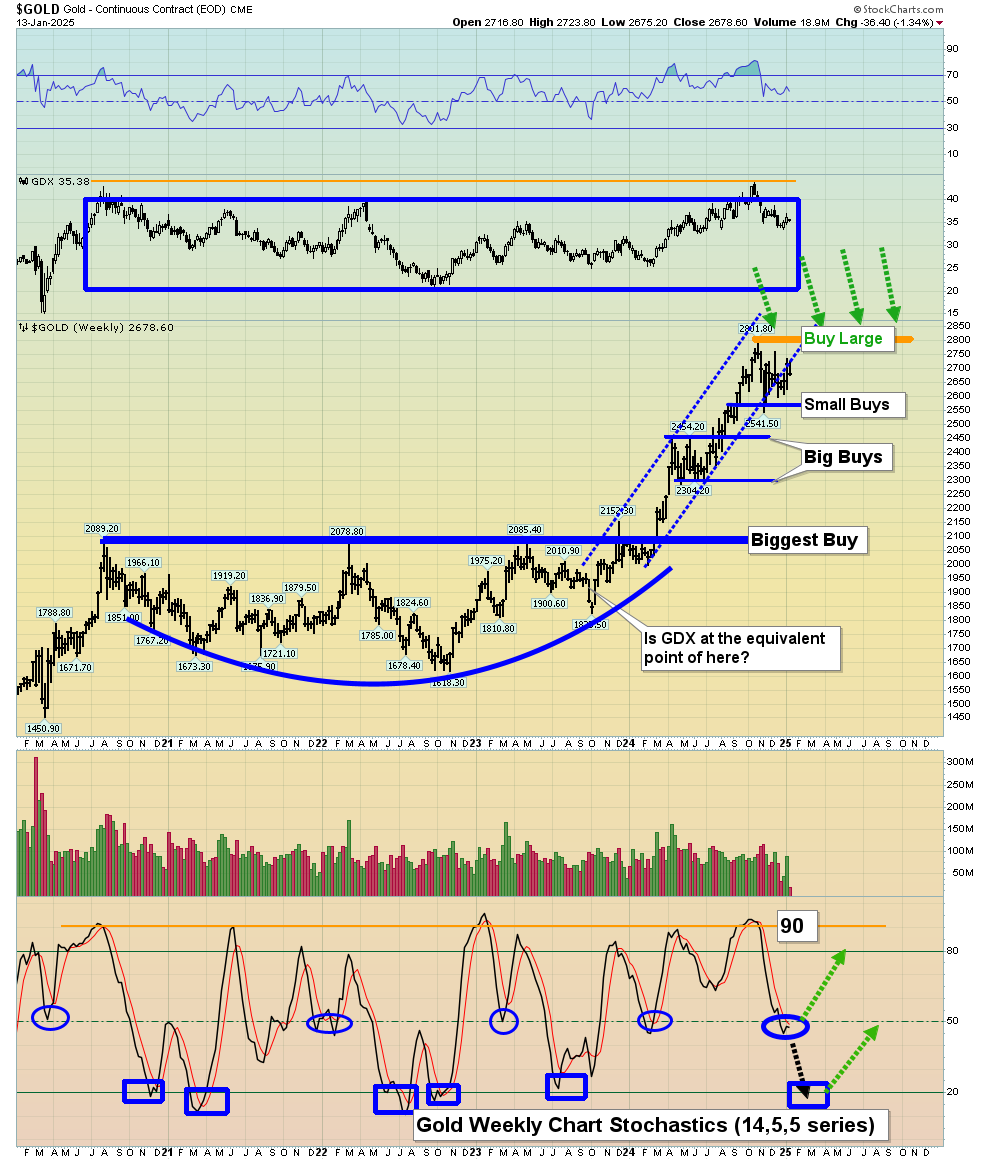

This is the daily gold chart. Some gold bugs may feel like there was a bit of rain on the one-ounce parade, as gold fell about $30 on yesterday’s launch day. Technically, I have no concern and here’s why:

Gold is simply recoiling from the supply line of the triangle pattern… and from previous highs resistance at $2720.

This recoil is 100% normal.

For a look at the weekly chart:

The only question is whether the daily chart triangle breakout occurs with gold near the demand line of the triangle and weekly chart Stochastics fully oversold…

Or whether the price turns up much sooner… perhaps by the end of this week. Overall, the technical situation for gold on both the daily and weekly charts is superb.

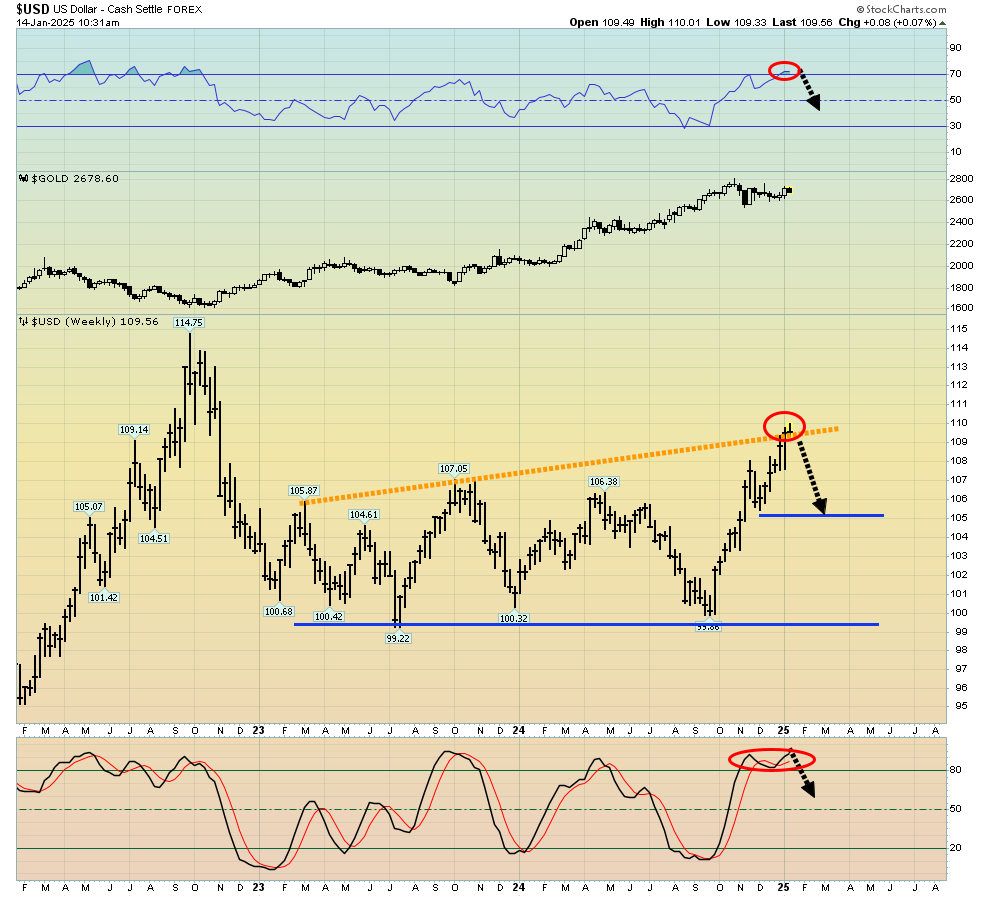

The weekly dollar index chart is in “inverse sync” with the gold charts. It’s likely making a high.

Even if it isn’t, if inflation returns, gold can surge against the dollar while the dollar surges against other fiats. That’s because global government debt is so gargantuan and the will to reduce that debt significantly is essentially non-existent.

This is what happens when the Fed acts as a soup kitchen that hands out candy to debt worshippers instead of a gold-themed Rock of Gibralter; the situation gets ugly.

It could soon get a lot uglier than most interest rate top callers think and “Tarifftaxflation” is just one of many items that could usher in a massive rise in rates.

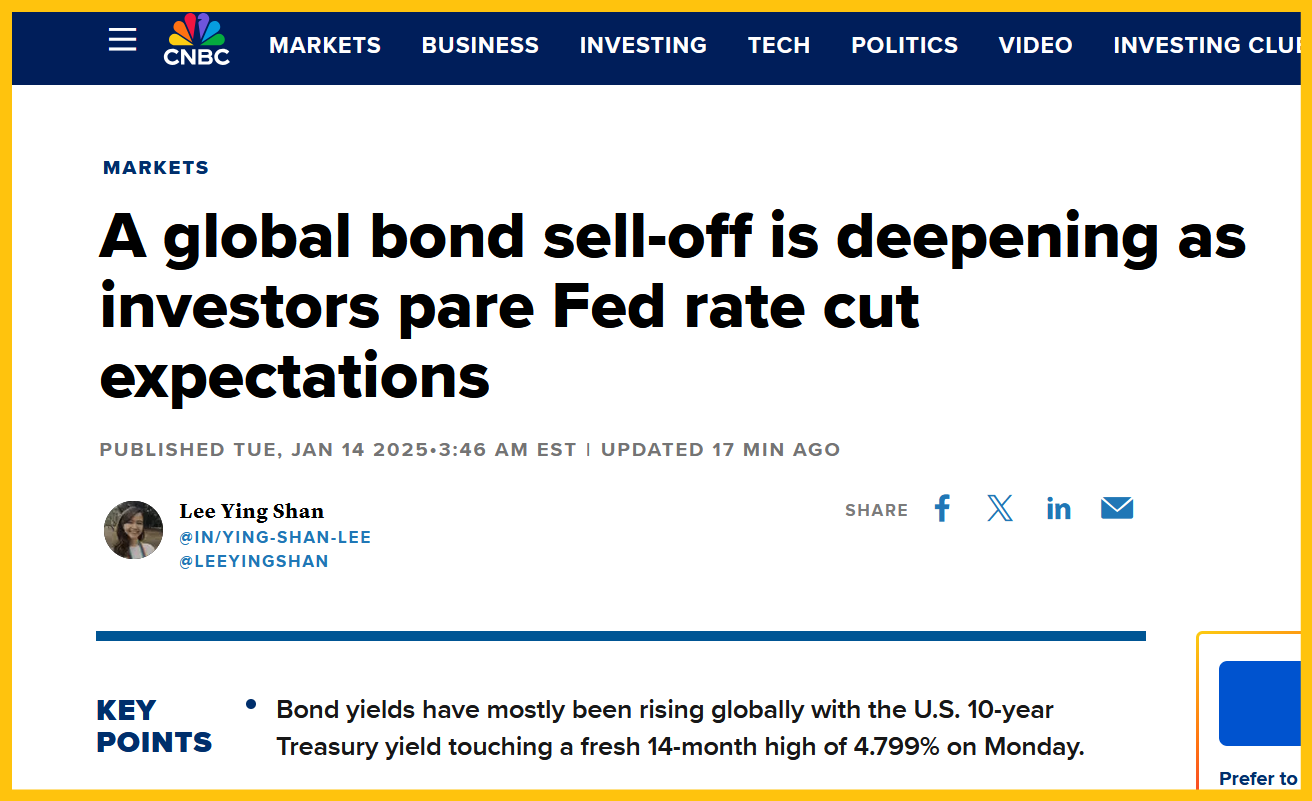

For a look at the US rates daily chart:

Most bond market gurus are stunned by the rise in rates, a rise that is occurring after Fed Chair Jay chopped rates twice!

They are surprised because they don’t understand the long-term 40year cycle for US rates. It bottomed in 1940, peaked in 1980, and bottomed in 2020.

Having said that, investors can expect a substantial dip in rates from the strong resistance formed by the previous highs at 5%… before rates shock the world and begin a long-term rise that is unlikely to peak until the year 2060.

The US government and its relatively tiny population (with the exception of some very savvy gold bugs!) is looking mostly irrelevant on the world’s gold-oriented stage.

Clearly, a daily focus on the big picture is critical for investors as inflation, recession, the 2021-2025 war cycle, a wildly overvalued stock market, debt ceiling horror, and empire transition dominate the investing landscape. I cover this big picture 5-6 times a week in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, but I’m offering a $179/15mths “special offer” that investors can use to get in on the winning action and meticulous analysis. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

What about the gold stocks?

This is the “dividends-stripped” GDX chart. A very positive bull wedge is in play, and the current action is likely a final recoil from the supply line of that wedge.

For a solid look at the ratio chart of GDX versus gold:

There’s loose inverse H&S pattern action. All technical lights on the above charts are green!

Here is obviously one of the most bullish charts in all markets, the GDX weekly chart.

RSI and Stochastics are ideally postured for a momentum-oriented blast over the C&H pattern handle neckline, with RSI at about 50 and Stochastics in the sub20 zone!

Tactics: I like to see investors buy incrementally/systematically like the banks do, rather than with one single “hero” buy. For GDX, a 3price point entry should yield spectacular results, as the breakout occurs. There’s only one thing left to say, which of course is: Have a golden day!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********