Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

As we’ve seen now, electric vehicles had healthy sales growth in 2024. Many companies actually had spectacular EV sales growth. Without a doubt, policies in certain countries help with this — because they force companies to actually try, and to be willing to produce and sell higher volumes of electric vehicles than in the past. But consumers are not going to buy electric cars if they aren’t worth buying. So, clearly, higher EV sales are not forced on consumers. They are buying electric vehicles more and more because they are good purchases.

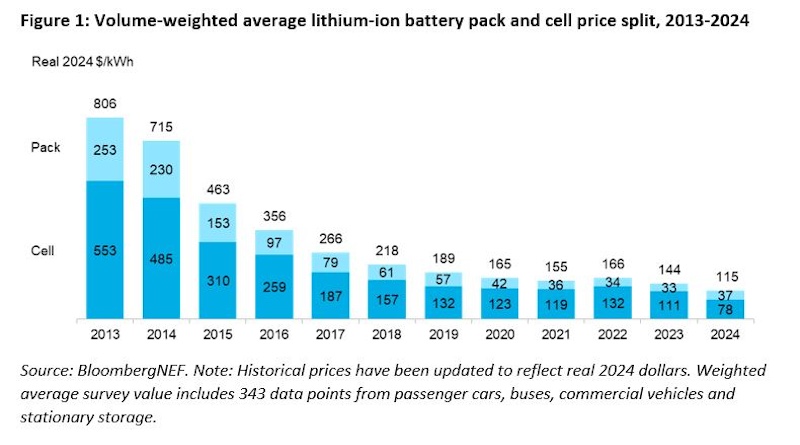

One critical thing has been driving consumer sales at the same time that some governments have been requiring that automakers try harder: battery costs have been falling year after year.

I have to give credit to CleanTechnica reader “earwig” for this point, though. Yesterday, he shared a recent BloombergNEF chart focused on this topic, the chart above and below.

A decade ago, you could get an electric car with about 100 miles of range at a mid-market price. Now you can get one with about 300 miles of range at a mid-market (or even below mid-market) price. When you consider that in 2024 an EV battery pack cost about a quarter of what it cost in 2015, that makes a lot of sense.

Without this strong, rapid drop in EV battery costs, China wouldn’t be at more than 50% of new cars being plugin cars, and Europe wouldn’t be at 25% in that regard. It’s long range at an affordable price that has made electric cars acceptable to many more buyers, and when you throw in their superior traits, with adequate range, they’re now better purchase decisions for millions of consumers.

Though, regarding China, another reader pointed out something else: “Hi earwig. Nice graph. Thanks for that. It seems like Bloomberg is weighted towards the West. In China, over 50% of EV sales, its lower. Undoubtedly, the pack price reflects the higher amounts of NMC used in the West. In China, where LFP is used, pack prices are much lower than that,” reader “eveee” wrote, and then threw in this link and this video:

So, yes, it’s not just stronger government policies in China that’s driving stronger sales than in Europe or the USA. It’s also lower battery prices — which, naturally, also come from scaling up production and economies of scale.

Back to the BloombergNEF data, though, last month the company wrote: “Battery prices saw their biggest annual drop since 2017. Lithium-ion battery pack prices dropped 20% from 2023 to a record low of $115 per kilowatt-hour, according to analysis by research provider BloombergNEF (BNEF). Factors driving the decline include cell manufacturing overcapacity, economies of scale, low metal and component prices, adoption of lower-cost lithium-iron-phosphate (LFP) batteries, and a slowdown in electric vehicle sales growth. This figure represents a global average, with prices varying widely across different countries and application areas.

“Prices for battery electric vehicles (BEVs) came in at $97/kWh, crossing below the $100/kWh threshold for the first time. While EVs have reached price parity in China, they are still more expensive than comparable combustion cars in many markets. BNEF expects more segments to reach price parity in the years ahead as lower-cost batteries become more widely available outside of China.”

So, as we can see, BloombergNEF is actually saying basically the same thing as eveee, and adding more context as well. There’s always a push and pull as a new popular technology ramps up. It’s initially expensive but highly desirable, which leads to some sales. Then, those sales result in lowering of costs, which attracts more buyers. However, given that industry forecasts are never perfect and supply doesn’t perfectly ramp up with demand, when demand is a little higher than supply, costs rise a bit (or drop more slowly); whereas when supply chains ramp up a bit faster than demand, prices must be dropped, which leads to the overall price of the product eventually dropping as well.

The cheaper battery prices are leading to cheaper electric cars, which will again cause a spike in EV demand. We’ve seen this story time and time again. It happened with solar cells and modules, and it will continue happening with EV batteries and EVs.

“On a regional basis, average battery pack prices were lowest in China, at $94/kWh. Packs in the US and Europe were 31% and 48% higher, reflecting the relative immaturity of these markets, as well as higher production costs and lower volumes. The price differences for North America and Europe compared to China were higher than in other years, implying the drop in prices was more accentuated in China. Companies in China faced fierce competition this year. These conditions resulted in falling battery prices and lower battery margins, forcing many battery manufacturers to enter new markets, including energy storage, while also eyeing overseas markets willing to pay more for batteries,” BloombergNEF adds.

“BNEF expects pack prices to decrease by $3/kWh in 2025, based on its near-term outlook. Looking ahead, continued investment in R&D, manufacturing process improvements, and capacity expansion across the supply chain will help improve battery technology and further reduce prices over the next decade. In addition, next-generation technologies, such as silicon and lithium metal anodes, solid-state electrolytes, new cathode material, and new cell-manufacturing processes will play an important role in enabling further price reductions in the coming decade.”

There are many factors at play that influence changes in cost, though. There’s R&D, there’s changing chemistries, there’s international policy, and there are incremental improvements in manufacturing.

“One thing we’re watching is how new tariffs on finished battery products may lead to distortionary pricing dynamics and slow end-product demand. Regardless, higher adoption of LFP chemistries, continued market competition, improvements in technology, material processing and manufacturing will exert downward pressure on battery prices,” said Yayoi Sekine, head of energy storage at BNEF.

There are many unknowns in the EV industry, but one thing we can bet on: EV battery costs will be much lower in 5 years than they are today, which means EVs will again be much more competitive than they were 5 years ago. Stay tuned. It’s about to get exciting!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy