Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Key Takeaways:

- Those benefiting from charging microgrids must spearhead their build

- Stakeholders must collaborate to share growth and revenues

- Use federal and state-level incentives to enhance bankability

Edward Freeman, an American philosopher and scholar, is best known for his work in the field of business ethics and strategic management. In 1984, he published a book, Strategic Management: A Stakeholder Approach, and its foundational “Stakeholder Theory.” The theory emphasizes that businesses should create value for all stakeholders, and has significantly influenced how companies approach corporate social responsibility and ethical decision-making — all while focusing on the profits.

In the United States, electrification of freight transportation is an opportunity that creates economic, environmental, and equitable value across stakeholders and communities. While the freight transportation sector is responsible for about 10% of the total greenhouse gas emissions in the U.S. the medium- and heavy-duty trucks are the largest contributors. This underscores the importance of stakeholder efforts to deploy microgrid-centric charging to foster electric truck adoption. To simplify the requisite processes, the article focuses on action for a core set of initiators who, as a team, create value across all the other stakeholders.

As the authors — Rish Ghatikar and Michael Barnard, experts in sustainability, transportation, and strategy — explored in their diagnosis of the challenges of truck charging, there are overlapping concerns which can heavily slow down deployment of megawatt scale charging solutions to accelerate truck electrification, and getting derailed into non-charging value propositions is one of them. So far the actions have included incrementally adding charging capacity in standardized increments, leveraging the pricing flexibility that microgrids with solar and batteries provide for competitive advantage, finding your lego for modular microgrid components, sticking to the knitting of charging, establishing a central and tightly controlled program to deploy charging microgrids and defining the geographical clusters and corridors where you will start, all explored in previous articles. But that won’t help if you don’t bring the key stakeholders along on the journey with you.

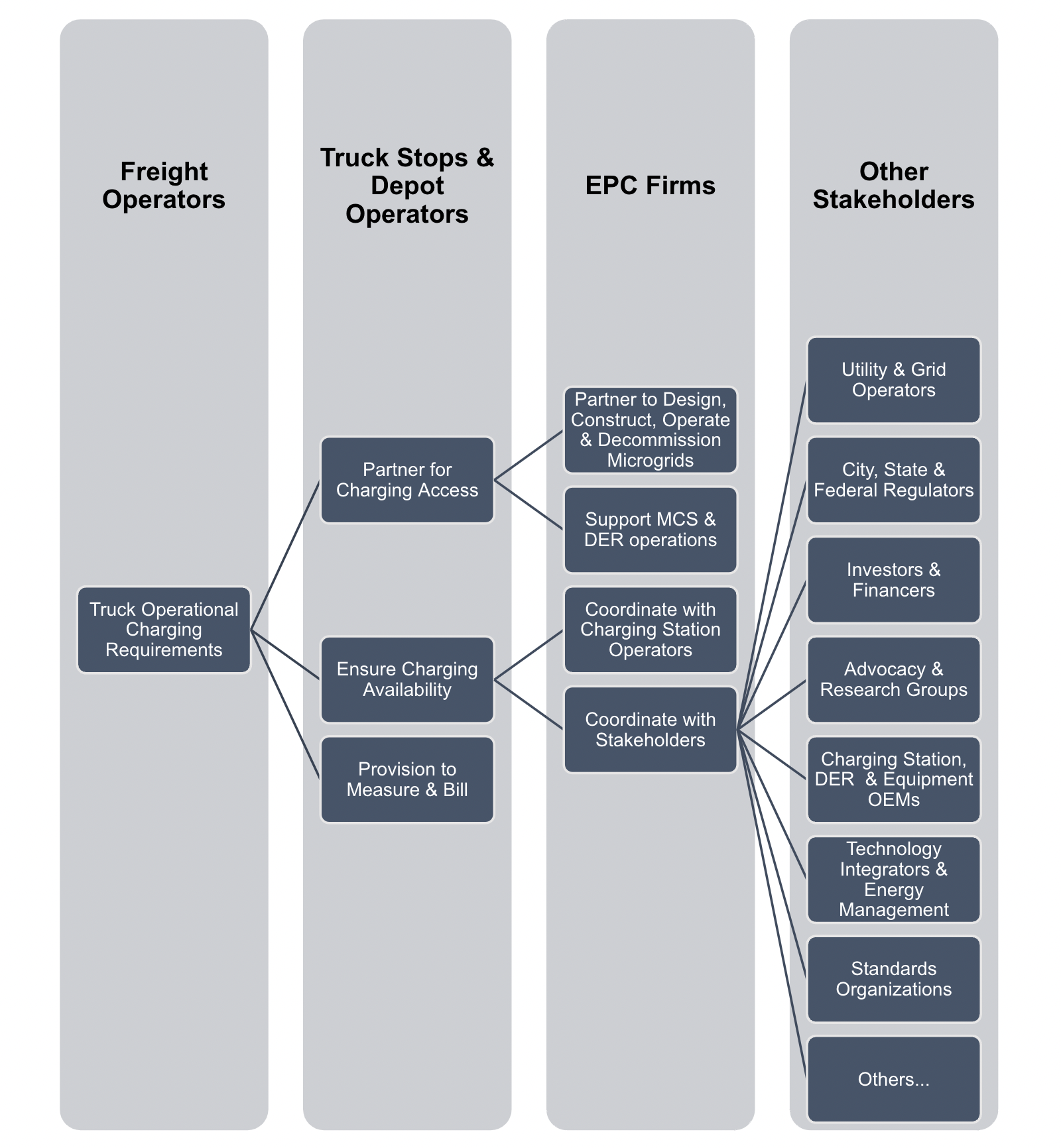

Focusing on the three major audiences or initiators – freight operators; owners and operators of truck stops or depots; and turn-key engineering procurement, and construction (EPC) firms – the article highlights how the initiators can create value across the stakeholders, coordinate charging and microgrid build outs at truck stops and depots, and navigate state and federal policies for incentives. The suggested actions originate from one of the challenges identified in the diagnosis of microgrid charging, the high potential number and complexity of stakeholders for microgrids extant in the literature and due the many purported value propositions.

As shown in the illustration below, an owner and operator of the truck stop or depots such as Pilot Flying J, TravelCenters of America, etc., should engage with the freight operators such as FedEx, UPS, etc., to identify truck charging requirements and partner with a turnkey engineering, procurement and construction (EPC) focused on depots or truck stops such as TLM Development Company, Trinium Inc., Snyder Construction Group, etc. to develop charging infrastructure. An EPC firm designs and builds modular and standardized microgrids and scales it across truck stops or depots. The firm further coordinates with all the necessary stakeholders (e.g,. utility, microgrid operator) to build a microgrid and its increments.

In this teamwork, each of the initiators mutually benefit from the partnerships. The truck or depot operator meets the charging needs of the freight operator, who in return creates new revenue to the operator. Similarly, the operator of truck or depot stops bring new business to the EPC firm. The coordination is simplified and the benefit is enhanced when a freight operator is also the owner and operator of a truck stop or depot. The ownership of truck depots is closely tied to the largest truck operators, as they operate extensive networks of distribution and service hubs for efficient freight operations, critical to their transportation services.

Actions such as, standardizing microgrid components, software and processes must be targeted to modularize and scale microgrids, which reduces cost. Incremental expansion of charging and DER must be iteratively planned and modeled to assess economic and environmental benefits from buildouts. Even with the EPC firms’ turn-key solutions, and modularized and standardized equipment, any microgrid expansion must conduct a review for any further coordination with other stakeholders. Examples include land expansion needs with other land owners, and review of energy service revenue options with utilities. Planning for truck charging and supporting DERs and power systems equipment require coordination with stakeholders that the EPC firms can address with the knowledge of the location of truck stop owner and operator. For location-specific regulations, the EPC firms should proactively plan and coordinate with all regulatory agencies, utilities and grid operators, research and advocacy groups, and standards organizations to ensure that all requirements are identified and can be complied with.

Key stakeholders worth highlighting are electric utility or grid operators, and microgrid operators. The utilities or grid operators play a crucial role to facilitate a successful deployment, integration, and operation of microgrids with electric supply and energy services that can also benefit the overall energy system and community resilience. The energy service offerings from the utilities or grid operators creates new revenue opportunities that are shared between the truck stop or depot operator, and freight operator. In coordination with utilities and grid operators, a turn-key service EPC firm can further engage with advocacy and research groups and standards organizations to better understand regulatory requirements and leverage tools and expertise available for their compliance at all the stages of microgrid charging lifecycle, as highlighted in earlier actions.

Another stakeholder, specifically when the operator of the truck stops or depots cannot engage in the day-to-day microgrid operations, is an operator and maintainer of microgrid and charging infrastructure. Truck stop and depot operators should monitor basic microgrid operations with software tools (e.g., dashboards with key metrics and basic controls). Complex monitoring and maintenance (e.g., power quality, battery safety) require subject-matter expertise. One can anticipate that over time, the owner and operator of truck stops and depots, depending on the value, also operates and maintains a microgrid. In the interim, a microgrid operator must ensure safe and reliable operations of microgrids and charging infrastructure. In such instances, the truck stop and depot operators must coordinate with EPC firms to identify the stakeholder and include the procurement terms in the EPC service contract.

When considering a new microgrid buildout or an expansion, the owners and operators of truck stops and depots face a key challenge, i.e., lack of awareness of economic and environmental value a microgrid-centric charging provides. The operator of truck stops and depots and EPC firm must conduct techno-economic and benefit-cost evaluations to identify value streams, and also the terms for microgrid charging lifecycle, as highlighted in earlier actions.

Additionally, the EPC firms should identify all state and federal government incentives that reduce the overall costs for the owner. In 2024, U.S. federal and state agencies provide incentives for truck charging owners, aiming to foster the adoption of charging infrastructure for MD and HD freight vehicles. These incentives include grants, tax credits, and programs focused on infrastructure development. Examples of federal incentives include the National Electric Vehicle Infrastructure (NEVI) Program that provides $5 billion over five years to states for the development of a high-speed charging network along designated alternative fuel or electric truck freight corridors. The Investment Tax Credit (ITC) from the Inflation Reduction Act (IRA) allows certain charging station owners for tax credits up to 30% of installation costs, with higher credits for projects located in disadvantaged communities. States such as California, Texas, New York, etc., offer grants, fundings, and rebates to reduce costs for charging station owners and expand the infrastructure needed to support truck electrification. California has awarded $100 million in funding so far to truck and bus charging. The U.S. Department of Energy’s Alternative Fuels Data Center is a helpful resource and hosts up-to-date information that the EPC firms review.

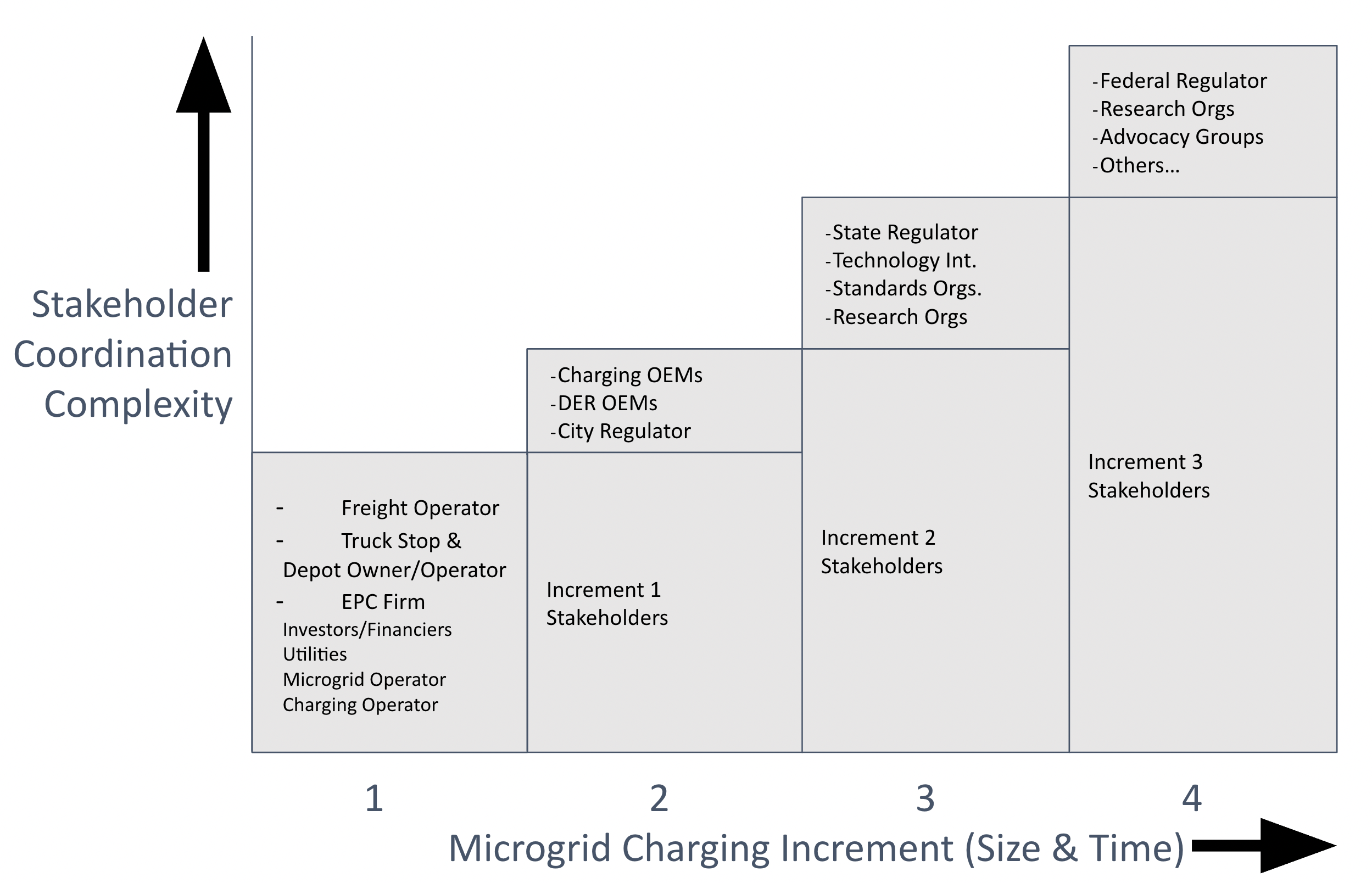

Even when an EPC firm manages complex coordination, the complexities that arise from engagement beyond the core group must be incrementally staged. Prepare for an incremental sizing of microgrids 3 or 4 and resulting stakeholders coordination complexity. Similar to system increments approach for a medium- and large-size microgrid charging from earlier action, closer stakeholder coordination with logistics firms, charging and DER OEMs, grid interconnections, regulators, standards and research organizations, etc., must also be coordinated in increments, as shown in the illustration below.

Microgrid charging must be well-coordinated, modularized and standardized to lower capital and operational costs, increase speed, charging availability and reliability, and create new revenue opportunities. Environmentally, such microgrids reduce GHG emissions by trucks, support sustainability by integrating renewable energy sources, and equity with improved air quality and local job opportunities. Make microgrid-centric charging a compelling choice for locations like truck stops, depots, and community charging hubs, contributing to the broader goals of sustainable economic development and clean energy transition. Addressing limited expertise in charging and microgrid construction requires a multi-faceted approach to determine capacity, share knowledge, and foster skilled professionals. By addressing the awareness and expertise gaps, build the knowledge and skills necessary to support the widespread adoption and successful construction of microgrid-centric charging and its increments.

The incremental coordination action helps address the challenges of complex regulatory and policy barriers, delays in interconnection and utility coordination and limited awareness and technical expertise, identified in the diagnosis of charging microgrids early in the series.

Collectively, the article highlights the action for stakeholder coordination with focus on the initiators, and the value they collectively bring for and gain from microgrid-centric charging. The coordination yields dual value propositions – economic and environmental. Economically, it lowers costs, increases charging availability and reliability, and creates new revenue streams or business opportunities to all the stakeholders. Environmentally, it reduces GHG emissions and supports sustainable renewable sources. Microgrid-centric charging is a compelling choice for locations like truck stops and depots, contributing to the broader goals of businesses with new revenues that create value for all stakeholders, aligning with the Stakeholder Theory.

About the authors:

Rish Ghatikar has an extensive background in decarbonization, specializing in electric vehicles (EVs), grid integration, and demand response (DR) technologies. At General Motors (GM), he advanced transportation electrification energy services, as part of a broader climate strategy. Previously, at Electric Power Research Institute (EPRI), he focused on digitalizing the electric sector, while at Greenlots, he commercialized EV-grid and energy storage solutions. His work at the DOE’s Lawrence Berkeley National Laboratory spearheaded DR automation to support dynamic utility pricing policies. An active climate advocate, Ghatikar advises on policies and technologies that align the grid with transportation and energy use for sustainable growth.

Michael Barnard, a climate futurist and chief strategist at The Future Is Electric (TFIE), advises executives, boards, and investors on long-term decarbonization strategies, projecting scenarios 40 to 80 years into the future. His work spans industries from transportation and agriculture to heavy industry, advocating for total electrification and renewable energy expansion. Barnard, also a co-founder of Trace Intercept and an Advisory Board member for electric aviation startup FLIMAX, contributes regularly to climate discourse as a writer and host of the Redefining Energy – Tech podcast. His perspectives emphasize practical solutions rooted in physics, economics, and human behavior, aiming to accelerate the transition to a sustainable future.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy

.jpg)