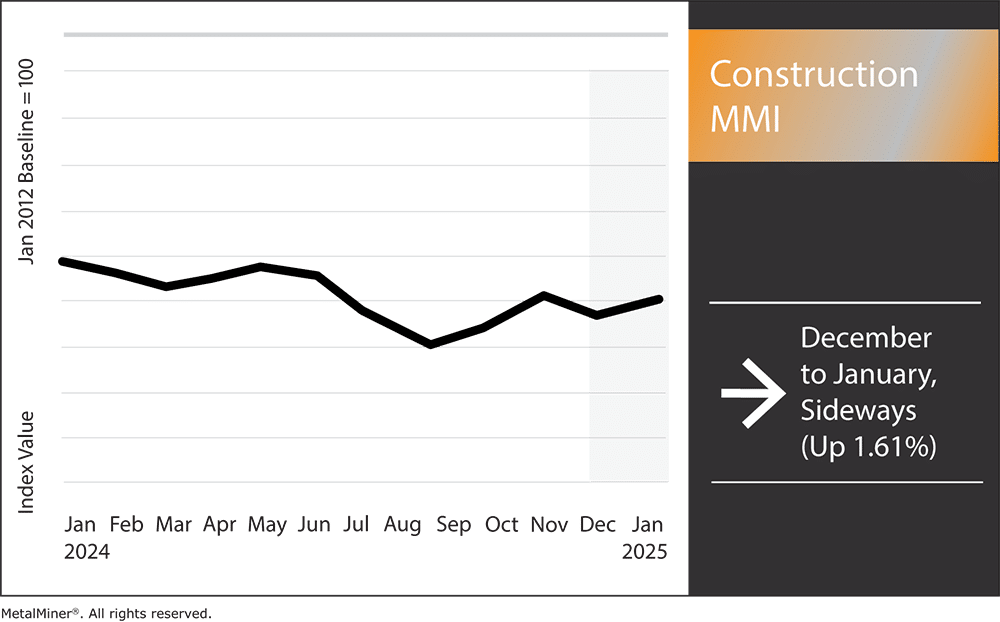

The Construction MMI (Monthly Metals Index) moved sideways, budging up by a slight 1.61%. Overall, 2024 ended with mild volatility. The construction industry didn’t have much reaction to the Fed’s Q4 round of interest rate drops, and the Fed has been hesitant to drop interest rates more significantly. Still, newfound volatility could come in 2025 if Trump pushes through his planned tariffs on Chinese steel, copper and other construction materials.

Along with this, the recent set of wildfires that erupted in the Los Angeles area are likely to impact construction initiatives across southern California.

MetalMiner just release it’s 2025 Annual Outlook quarterly update! This 12-month long-term and short-term forecasts for 10 key metals, along with sourcing strategies, and insights into all primary market price drivers for seamless 2025 budget planning. Get a free sample.

Trump’s Proposed Tariffs on Chinese Construction Materials

President-elect Donald Trump’s proposed tariffs on Chinese imports could significantly impact the U.S. construction industry. Trump’s current trade strategy involves a 60% tariff on Chinese imports, with potential increases to as much as 100% for specific items.

This policy would impacts a wide range of goods, including key construction materials like steel rebar and H-beam steel.

Want to know more about potential construction industry impacts? MetalMiner’s MMI report includes 10 metal price reports and can be used as an economic indicator for contracting, price forecasting and predictive analytics. Sign up here.

Potential Impact of Tariffs on the Construction Industry

Rising tariffs on Chinese steel products would likely increase the cost of these materials in the domestic market. This could result in higher expenses for contractors and developers, driving up overall project costs. According to Construction Dive, the situation is reminiscent of the 2018 tariffs, which caused domestic price hikes and supply chain challenges.

The construction industry’s dependence on imported materials also means that the tariffs could lead to delays and shortages, disrupting project schedules and budgets. Even if companies find alternative suppliers, it might not resolve these issues quickly enough. Overall, it will take time for global supply chains to adapt to the new trade rules.

Rising material costs typically add uncertainty to the construction market, prompting developers to delay or rethink projects due to budget pressures. This could end up hindering industry growth. Furthermore, fluctuating metal prices may complicate contract negotiations and long-term planning.

Impact of Los Angeles Wildfires on Construction Projects

The recent wildfires in the Los Angeles region have caused massive devastation after only 78 hours of burning. According to Reuters, the fires have destroyed countless residential and commercial structures, driving a significant increase in demand for reconstruction.

Post-wildfire rebuilding efforts will likely boost demand for construction materials, in southern California, particularly steel products. This increased demand, combined with the proposed tariffs, could drive up prices while putting additional pressure on supply chains.

Receive indispensable updates on metal prices and market shifts, empowering your company to make informed purchasing decisions. Opt into MetalMiner’s free weekly newsletter

Will Labor Shortages Derail Reconstruction Efforts?

The combined demand for new construction and rebuilding efforts could result in labor shortages across southern California. Skilled workers will be highly sought after, which could potentially lead to project delays and rising labor costs. Contractors may need to plan resource allocation carefully to handle multiple projects efficiently.

Following the wildfires, the state will likely impose stricter regulations on building codes and fire-resistant construction materials. These changes could affect material choices, influencing demand and prices for certain metal products.

Construction MMI: Noteworthy Price Shifts

You can avoid making tactical metal procurement choices thanks to MetalMiner Insights’ price forecasting and should-cost models. Click here.

- European commercial 1050 aluminum sheet prices went up by 4.7% to $3,818.41 per metric ton.

- Chinese h-beam steel prices moved sideways, dropping 0.12% to $442.45 per metric ton.

- Finally, Chinese steel rebar prices moved sideways, dropping by 2.98% to $495.01.