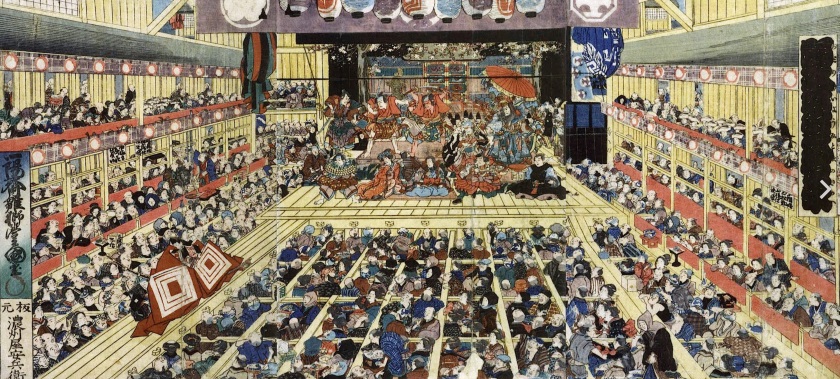

As Trump prepares to take office, the tired old “Debt Ceiling” Kabuki Dance, err debate, plays on…

Yes ladies and gentlemen, it’s that time again. Time for the Kabuki dance that government puts on every so often when an inconvenient limit to the debt the government can push into a bag that is already stuffed with $35T in legacy debt needs to be addressed.

Yes ladies and gentlemen, it’s that time again. Time for the Kabuki dance that government puts on every so often when an inconvenient limit to the debt the government can push into a bag that is already stuffed with $35T in legacy debt needs to be addressed.

Once again, we present the Debt Ceiling Kabuki Dance, where we citizens can sit back, be entertained, and be expected to believe this is sound business as usual. The US economy has a right to grow unabated, you know. And this right is supported by both sides of the political aisle.

Here is a look at GDP vs. debt beginning at the dawn of the age of Inflation onDemand (2000, courtesy of the great Maestro, Alan Greenspan). Back then, the debt was half of GDP. Over the years, our dependence on debt leverage has steadily increased to the point where today it is significantly higher than GDP. Government wants to increase the debt limit yet again. And they will.

St. Louis Fed

St. Louis Fed

The theme (rationale, pipe dream, fantasy) is probably along the lines of… through sweeping tax cuts a productive economy will naturally address the debt, allowing pay-down after more debt funds said “productive” economy. Okay, a lotta moving parts there, guys. But have at it, I guess.

RINO feeding at the trough

RINO feeding at the trough

Since when have Republicans become the primary instigator for such action? The Republican party I thought I used to know was pro-business, pro-economy, sure. But it was also pro-fiscal responsibility, at least on its public face.

Now, it is far from that, not even pretending it wants to do the right thing, fiscally. Where are daddy and junior Paul, by the way? At least they are conservatives, in action as opposed to words.

Trump is a businessman. This Businessman has used debt in myriad ways to both grow his businesses, and in astutely managing bankruptcy laws, sustain his businesses. America is gonna be great again. But that greatness will only go as far as the debt market – the bond market – allows. The bond market has thus far allowed. But currently it is doing this to long-term interest rates.

Let’s remember that fiscal and monetary inflators of yore had a continuum of declining yields at their back until 2022. Today’s bunch have no such beneficial macro backing.

Sit back and enjoy the Kabuki theater. It’s going to be entertaining.

Kabuki Theater, aka both aisles of government

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. You can easily subscribe by Credit Card or PayPal (see all info and options). Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar, or take it to another (intermediate) level with our free eLetter. Follow via Twitter@NFTRHgt.

*********