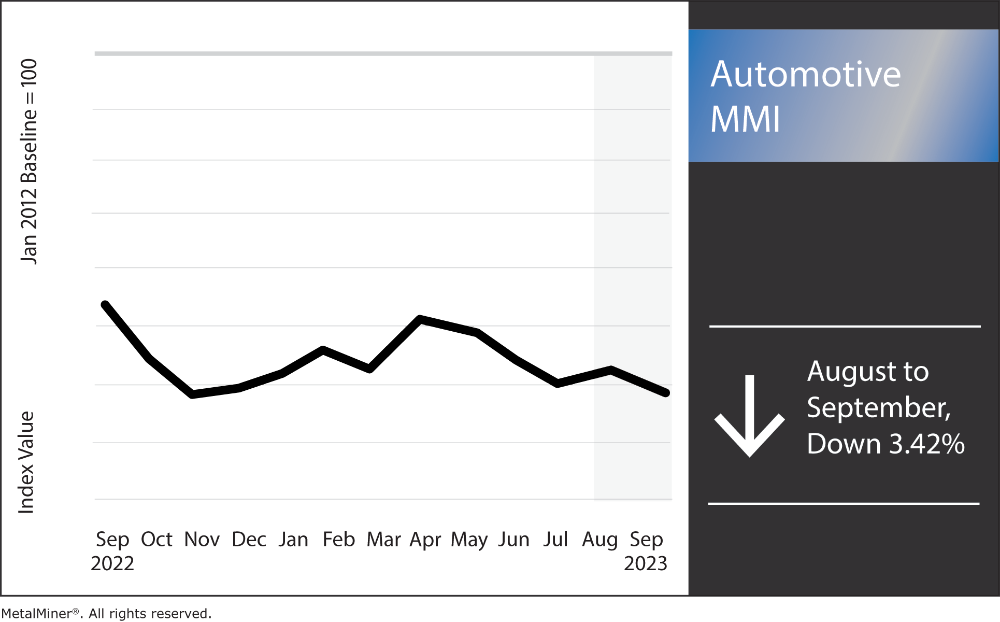

Month-over-month, the Automotive MMI (Monthly Metals Index) slid downward by 3.42%. Steel prices within the index, like hot-dipped galvanized, trended sideways. However, copper and lead fell, introducing bearish pressure. Overall, the U.S. automotive industry witnessed some dynamic changes month-over-month. More robust demand for personal transport continues to emerge as supply chains regain strength. This will continue to add support to the index in the coming months. However, if the United Auto Workers Union decides to follow through with a strike, it will have immediate and serious ramifications on the U.S. automotive industry as well as steel prices.

MetalMiner’s 2024 Annual Outlook is the one-stop shop for everything you need to generate massive steel ROI in 2024, including 2024 price projections, detailed sourcing strategies and in-depth contracting mechanism. Subscribe here.

United Auto Workers Union Members Threaten to Strike, Impacting Industry

The United Auto Workers’ (UAW) contract with the Detroit Big 3 automakers, General Motors (GM), Ford, and Stellantis, expires on September 14. However, as the UAW and corporations remain at odds over several issues, the union members recently threatened to strike. At the moment, walkouts appear certain.

Members of the UAW called for improved pay, benefits, and increased job security. Additionally, they urged businesses to invest more in the U.S. manufacturing sector and to repatriate jobs transferred to other nations.

A strike would halt production at the Detroit Big 3, which are currently in charge of a sizable chunk of U.S. automobile output. The strike will also result in disruptions and delays in the distribution of parts and components to other automakers and suppliers. This could impact 2024 steel contract negotiations if steel prices witness massive impact from a strike, so it’s best to follow these five best practices.

Impact of UAW Strike on Steel Prices and U.S. Steel Industry

Were the UAW to strike, the steel industry – especially hot-dipped galvanized steel and scrap steel – would see a significant impact. Indeed, such a strike would mean fewer cars being produced, translating into less demand for steel. But, because of the sheer volume of scrap steel coming out of automobile manufacturing, a decline in demand could translate into a rise in scrap steel prices.

If any automaker unions were to go on strike, it would also add thousands of tons of steel to the spot market. The price of steel would also drop as a result of this increase in supply, which would negatively affect steel businesses’ profitability. In order to generate the most steel ROI possible in 2024, attend the free workshop “Tackling Falling Demand, Rising Material Prices and Supply Chain Shocks.”

Ways the Automotive Industry Directly Impacts Steel Prices

The automotive industry’s demand for steel significantly impacts U.S. steel prices. For instance, a strong demand for cars in the U.S. prevents steel prices from rising sharply. When automakers reduce their output, they also decrease their steel consumption, which can lower the cost of steel overall. Meanwhile, falling steel demand and concerns about steel prices can also substantially impact the global steel market.

Abrupt swings in steel pricing lead to increased manufacturing costs for automakers, thereby reducing their profit margins. This, in turn, could result in them reducing their production, thus lowering their steel requirements.

It’s impossible to overstate the importance of steel to the automobile sector. High-strength steel vehicles significantly reduce overall life cycle emissions and driving emissions. Steel tariffs could potentially affect the automotive sector as well. For instance, tariffs implemented in March 2018 led to a 10% drop in automobile scrap prices and a 22% decrease in cold-rolled steel prices, followed by subsequent highs.

MetalMiner’s monthly free MMI report gives monthly price trends for 10 different metal areas, including copper, stainless, aluminum and precious metals. Sign up here.

Automotive MMI: Notable Price Shifts

- Lead decreased by 3.25%, bringing prices to $2,199.58 per metric ton.

- Korean 5052 aluminum coil premium over 1050 decreased by 4.73%, leaving prices at $4.03 per kilogram.

- U.S. hot-dipped galvanized steel dropped significantly, declining by 7.31%. As of September 1, prices sat at $1001 per short ton.

- Finally, U.S. shredded scrap steel traded sideways, increasing a mere 0.5% to $400 per short ton.