Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

I realize that this article is not going to be popular with everyone. Bitcoin is a kind of tech financial fantasy, whereby many tech fans have come to the conclusion that we can live in some kind of financial utopia divorced from inflation and economic woes if we follow this fake mining path. There are probably many CleanTechnica readers who are big bitcoin or who at least have significant bitcoin holdings.

Unfortunately, bitcoin is a really stupid idea that is massively energy intensive and could become the nail in our climate coffin. Naturally, it’s not one thing that is going to destroy a livable climate for humans (unless you want to say “burning fossil fuels,” which is by far the biggest factor). However, bitcoin — or cryptocurrency mining more generally — is a notable problem, and it basically just captures the essence of our broader problem as humans.

The Bitcoin Problem

Four years ago, when Tesla bought some bitcoin holdings, Maximilian Holland explained why bitcoin is not good for the climate. Here’s part of his piece (bold emphasis added):

“The problem is that bitcoin’s proof-of-work blockchain validation architecture is undoubtedly a negative phenomenon for climate protection compared to alternatives. There are both other more energy efficient cryptocurrencies available to choose from and more established currency-hedging strategies to protect Tesla’s cash pile, if that is indeed the prime objective. Almost any of these would have been much more aligned to Tesla’s often-touted mission ‘to accelerate the world’s transition to sustainable energy.’ […]

“But to put it in simple terms, bitcoin’s verification system uses a “proof of work” mechanism — which involves validators demonstrating computational effort to solve cryptographically secured number-crunching puzzles, and notably, expenditure of significant computational energy in the form of electricity. This puzzle-solving, number-crunching “work” that helps keep accurate transaction records is then rewarded by the allocation of a newly minted bitcoin, which is the payoff for participating in the record keeping task. For this reason, the number-crunching validation work is known as “bitcoin mining,” and results in huge server farms of computers more or less continuously crunching numbers (and using electricity). When the value of bitcoin rises, the value of the minted bitcoin that gets rewarded to validators obviously rises too, and more bitcoin mining (and more energy expenditure) results. The system is explicitly designed to expend significant energy on the security of the validation and record keeping processes, in order to be a demonstration of commitment or ‘work.’”

That was four years ago. Indeed, as bitcoin’s value has gone up, more and more energy has been expended to mine more bitcoin. An enormous amount of electricity is used every day to mine it.

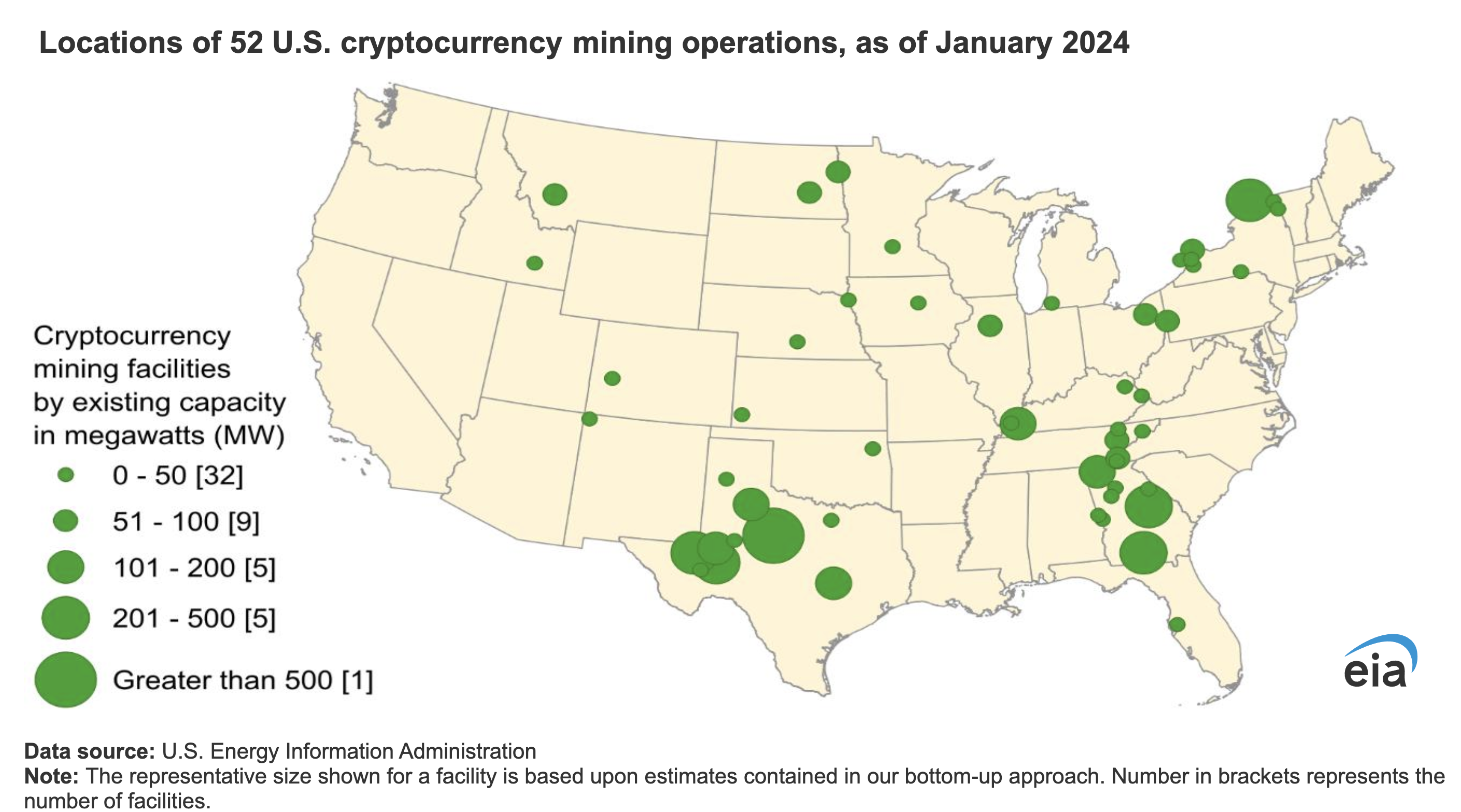

“Electricity demand associated with U.S. cryptocurrency mining operations in the United States has grown very rapidly over the last several years,” the US Energy Information Administration wrote earlier this year. “Although cryptocurrency mining began in the United States about a decade ago, the activity began to expand rapidly in 2019. Recent growth is largely due to cryptocurrency mining operations relocating to the United States from China after that country cracked down on digital currency mining in 2021, though reports indicate that there may still be some mining in China.3 As cryptocurrency mining has increased in the United States, concerns have grown about the energy-intensive nature of the business and its effects on the U.S. electric power industry. Concerns expressed to EIA include strains to the electricity grid during periods of peak demand, the potential for higher electricity prices, as well as effects on energy-related carbon dioxide (CO2) emissions.”

In that article, the EIA went into more detail on growing energy use from cryptocurrency mining, including noting that “the Electric Reliability Council of Texas (ERCOT) has 41 gigawatts (GW) of requests for new cryptocurrency mining capacity, for which 9 GW of planning studies have been approved, according to NERC.” Here are a couple more segments from that article:

“The primary operating cost of a cryptocurrency mining facility is expenditure for electricity. The computational effort needed to support profitable cryptocurrency mining consumes large amounts of electricity to operate the machines as well as to cool equipment to prevent overheating. Consequently, owners are constantly seeking various alternatives to acquire substantial amounts of power at the lowest possible cost. […]

“We collected details for each facility identified, including the maximum power capacity needed to run the mining rigs in MW. Several cryptocurrency mining facilities identified could be tied to power generating plants listed in our EIA-860, Annual Electric Generator Report. Others could not. Of the 137 facilities identified, we have identified maximum electricity use at 101 of those facilities, which we estimate to be 10,275 MW. This amount compares with an average annual power demand of about 450,000 MW in the United States, representing a share of 2.3%.”

2.3% of US electricity demand! More than one out of every 50 electrons. And that’s just today. Imagine the figure in 10 years if this trend continues!

Some have claimed that renewables are now the most cost effective electricity choices, so cryptocurrency mining can just build solar and wind farms. That’s a nice fantasy. In actuality, there are many regions where fossil gas (aka “natural gas”) and old coal power plants are the cheapest options for powering bitcoin mining facilities, and there are tons of megawatt-hours of electricity from such polluting sources in operation today for this purpose.

Tesla initially pulled back from its bitcoin investments and transactions after discovering that they were massively jacking up emissions, but since then, the company has actually removed references to its original mission (“to accelerate the world’s transition to sustainable energy”) and Elon Musk has made super weird comments about fossil fuel use and climate change that make him sound more like the CEO of ExxonMobil than the CEO of Tesla.

In recent years, bitcoin miners and oil & gas execs have gotten very close. They realized they can benefit financially from each other. There was reportedly serious collaboration between them on the side of Donald Trump’s run for president again this year. Supporting the bitcoin and cryptocurrency industry, Trump and Republicans are also supporting oil & gas billionaires who routinely support the Republican Party and did so again this year.

Counterarguments

Again, a counterargument is that bitcoin mining will just use solar and wind and hydropower more and more. Aside from the fact that an enormous amount of fossil fuel is being burned in the meantime, the issue with that is that every serious model for how we can reduce CO2 emissions to a reasonable level includes the need to cut energy use as well as the need to use renewable energy more. If you spike demand for electricity, it only becomes that much harder to shut down fossil fuel power plants while adding new clean energy ones. If demand goes through the roof, prices go higher, and fossil fuels remain more competitive. We can only build so many solar panels and wind turbines each year. The one somewhat reasonable counterargument is the faster electricity demand grows, the faster solar panel and wind turbine production grows, and thus the faster economies of scale bring down their costs allowing them to outcompete fueling existing fossil fuel power plants. But I haven’t seen any serious people make that argument, and it seems extremely tenuous given everything else I wrote above.

Human Failings

When it comes down to it, we’ve seen time and time again that humans are just too greedy. Bitcoin is all about “gaming the system” and becoming richer. It’s not about adding value to society. It’s not about helping others. It’s about trying to financially maximize one’s savings in the easiest and most reliable way. It’s just about the rich getting richer. George Harvey explains that in a bit more depth but also less bluntly in this article.

There are countless examples of human greed destroying what’s good. There are few failings or sins more widely considered horrible traps humans should avoid. Yet our modern society, and American society in particular, is built on greed. Everywhere you look, there’s encouragement to be greedier. Our capitalistic model tells us greed is good. Pursuing growing net worth by putting your money into something that serves no useful purpose for society and burns an enormous amount of fossil fuel is widely seen as a good idea and even a virtue. It’s senseless and harmful. Unfortunately, I don’t see the trend turning around anytime soon. …

The bitcoin bros won the 2024 US election. Bitcoin miners, oil & gas teams, and the incoming Trump–Musk Republican crew seem dead set on propping up bitcoin much further — much further. Bitcoin holders have been ecstatic since Trump won the presidency. Too the moon, and then Mars! It’s all a fantabulous, utopian dream for them. However, in my humble opinion, this is just going to accelerate the destruction of our climate, and is likely to put the nail in our climate coffin. We are screwed, but greed is winning big time right now and doesn’t seem likely to slow down or turn around.

I have thought several times in recent years that the movie It’s a Wonderful Life couldn’t be made today, or wouldn’t be a hit at least. Rather than valuing caring for others, or prioritizing the community or society as a whole over making more money, we are greedier than ever, more selfish than ever, and tearing up our world more than ever. The bottom half of society is struggling more and more, our climate commons is being burnt up more and more, and the richest of the rich are driving our society off a cliff. I’d love to think some George Bailey character could come and save the day, but I just don’t see it happening.

The bitcoin story is either going to be much better in 4 years or much worse in 4 years. I’ll try to do a check-in then and see if I’m right or wrong about this story, but I’m sure afraid that I’m going to be very right about this one….

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy