Without digging into what effect Trump’s tariffs, tax cuts, vanquishing of cheap immigrant labor, etc. might have on the economy in 2025, let’s just take a quick overview of the latest economic data and commentary that came in this week that didn’t get covered in my editorial. I believe the events of the past week, including the stock market’s plunge, which we did talk about some, give a clear impression of where the economy sits.

We got another crack at PCE this past week, and it clearly showed inflation is rising (to a degree that no one argued with). Even the Fed noted the rise and made a policy change because of it. While they did the obligatory (because it was so fully expected) cut in interest, they steered markets to expect those cuts to slow way down and even to stop entirely—not if inflation rose more but if it didn’t start going back down.

That was a pretty significant turn, and markets clearly took it as such with the Dow plunging a 1100 points that day because it is one thing to say, “We will stop rate cuts if inflation keeps rising” and another to say, “We will stop rate cuts until we see inflation start to go down again.” Based on the Powell Presser, the latter sounds like the Fed’s new policy stance.

Some of the other news we’re going to look at from this week, says that kind of downturn in inflation is not at all likely. Therefore, more cuts are not likely.

Looking up the producer pipeline

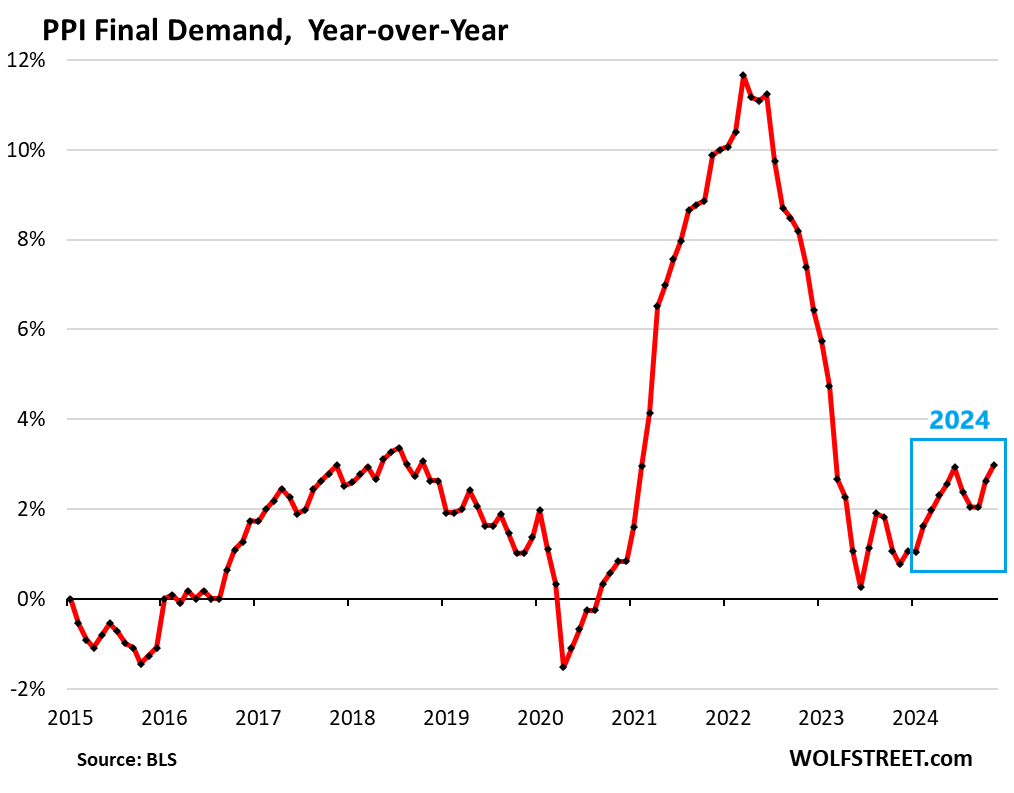

We touched on the Producer Price Index back on Dec. 12, but I’ll mention a little more than just its “red hotness.” I’ve often noted that particular measure of inflation is just a little further up the pipeline than the outflow to consumers so it lets us know what is mostly likely coming down the pipe fairly soon.

Wolf Richter published an article on Dec. 12, which I carried in The Daily Doom this past week, titled “PPI, “Core” PPI, “Core Services” PPI Inflation Much Hotter after Whopper Up-Revisions Going Back Months.” I didn’t wind up talking about it in my editorials because the flurry of stories about UFOs all over the US, particularly around military sites, was far more interesting to me than yet another inflation story; but let’s not miss its main inflation points because they tell us how unreasonable the market is to continue to think ANY Fed rate cuts are coming soon now that the Fed has indicated further cuts will be dependent on seeing inflation go down. The market is clearly anticipating that inflation will start to go back down, and that is unreasonable at best.

PPI presented such a bad outlook that Wolf said in summary …

The problem is in services, which account for 67% of PPI. But goods prices are re-accelerating too. The whole inflation scenario has changed.

This is what I’ve been expecting here at The Daily Doom, but this is the news that said it actually happened. Adding to the impact of that news, previous months were revised upward to show that inflation at the producer end actually turned up more than thought in prior months, too: (Something that would have been no surprise here, except for the degree to which those data points turned up.)

The prior months’ data of the Producer Price Index were revised substantially higher today, powered by whoppers of upward revisions in the PPI for services, something that has been happening month after month, and on top of that came the price increases in November.

The PPI tracks inflation in goods and services that companies buy and whose cost increases they ultimately try to pass on to their customers. And the entire year 2024 through November has been a big acceleration….

So the data went in two months from 1.8% to 3.0%: that’s a big fast acceleration.

These data revisions brought some strong confirmation of what is coming.

You can see in the following graph how producer prices were rising along with consumer inflation, as predicted, throughout the first half of this year. Then they took that short-lived dip through the summer that caused lots of people to think (wrongly) the Fed had beaten inflation back down, so the market started speculating again on lots of Fed rate cuts—as many as six—which has so far turned out to be half that many and may well hold right there:

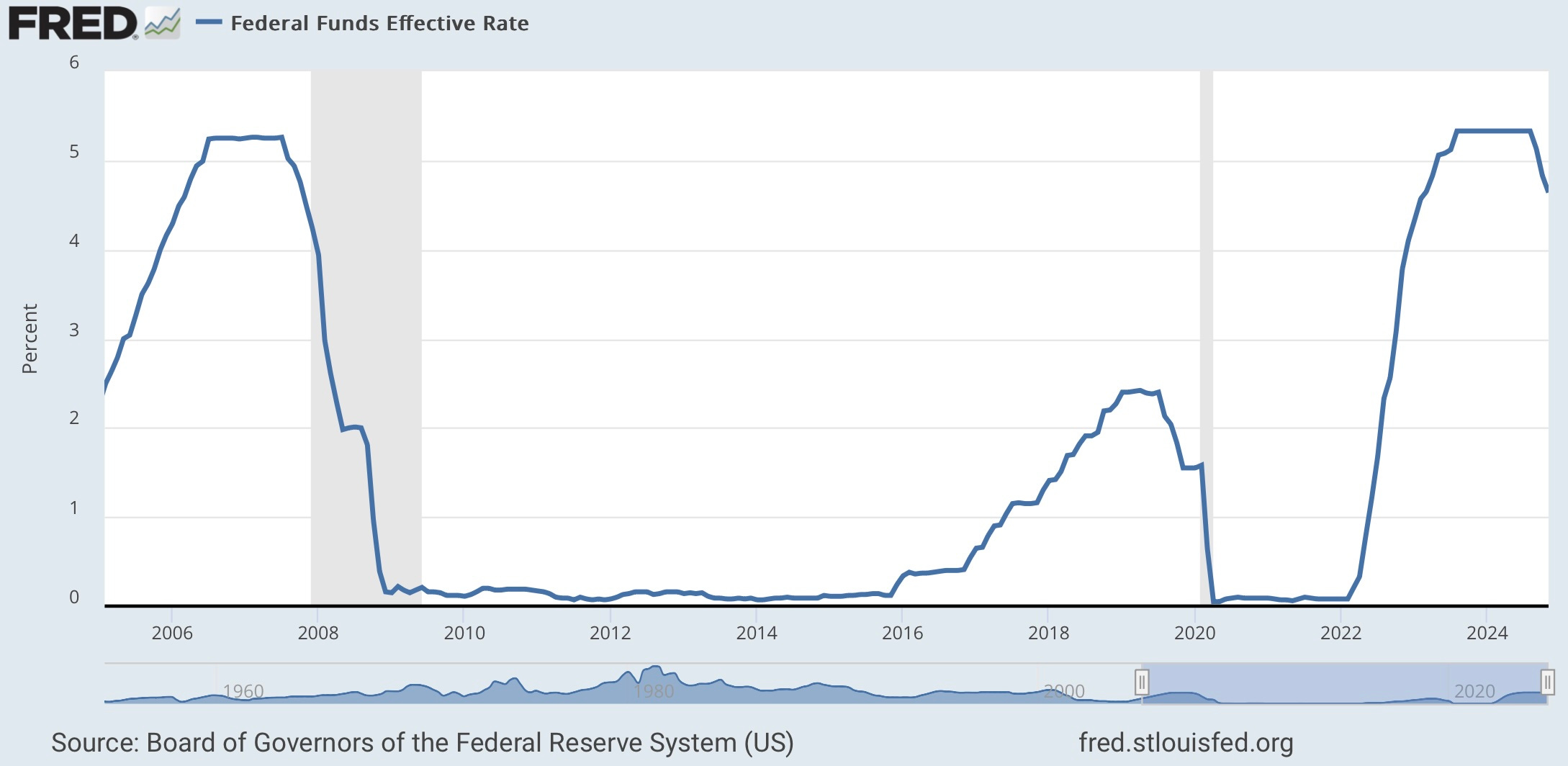

You can see in the following graph how little the Fed accomplished in getting its rates back down before inflation took back off:

It didn’t make it far before inflation started raising its ugly head everywhere, just as I’ve been assuring everyone, since this inflation began a few years ago, inflation would do to the Fed. This is what I’ve meant by saying to paying subscribers for months that inflation will continue to hold the Fed’s feet to the fire when it wants to lower rates in order to score that soft landing that avoids shredding the economy into recession.

They made it only that puny distance, and the heat is already on to such a degree that they’ve said they won’t likely go any further until inflation starts to go back down again. (And these numbers, being further up the pipeline, have barely begun to hit CPI or PCE, which is what the Fed looks at.)

*********