When the story of global nickel prices is written for 2024, Indonesia and China will undoubtedly be the main characters. This is not only due to the former country’s high production output but also alleged violations of environmental rules and poor labor practices, which Indonesia has consistently denied.

Indonesia is numero uno in global nickel production, accounting for 51% of the world’s total mine production. The country also sits on 42% of total global reserves. Because of this, it’s been a major investment hub for Chinese firms. According to SandP Global Commodity Insights, Indonesia’s nickel production is projected to hit 2.1 million metric tons in 2024—over 50% of the expected global output and more than double its 2020 levels.

Concerned about how shifting nickel prices might impact your bottom line? Plan your nickel and stainless purchases accordingly with the latest macroeconomic news and metal industry trends in MetalMiner’s Weekly Newsletter.

Low Nickel Prices Gutting Non-Indonesian Enterprises

In the rest of the world, the nickel story has turned sour of late. Everywhere you look, mines and smelters are either closed or about to be. Adding to the woes is the fact that benchmark nickel prices remained down in 2024 from the highs of 2022.

The Economist says most sector experts blame these problems on Indonesia because of its high nickel deposits, poor environment and labor laws and cheap coal power, a hot mix for those who want to undercut the competition.

According to media reports, mining giant Vale is implementing job cuts across its global operations due to the continued decline in nickel prices. While the company has not revealed how many of its Sudbury, Ontario employees will be affected, it stated that the layoffs will mainly focus on “non-operating roles.”

Elevate your market intelligence, Subscribe to MetalMiner’s free Monthly Metals Index report to gain a deep understanding of the dynamics affecting nickel prices and 9 other metal industries

Why All This Fuss Over Nickel?

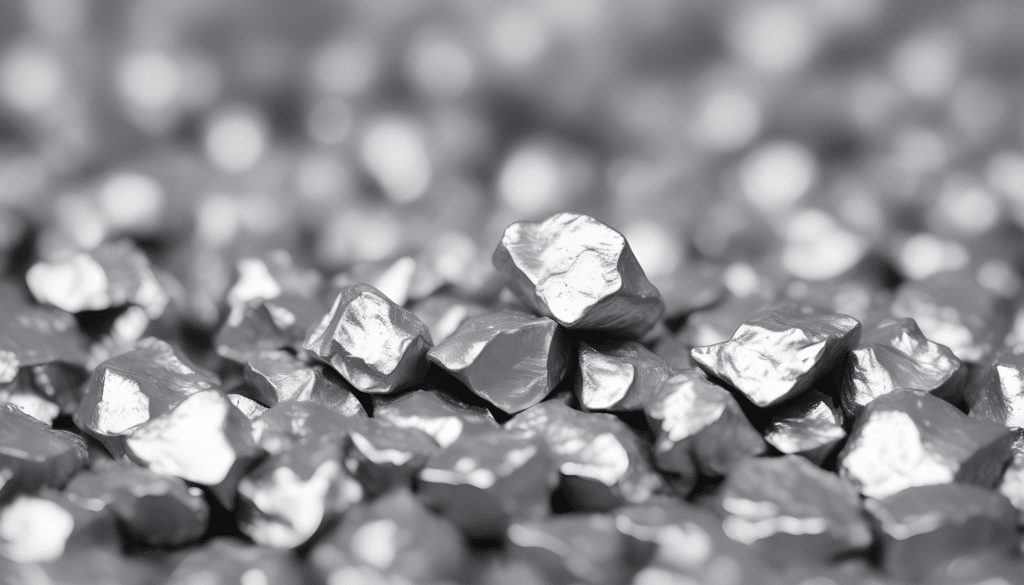

Nickel is vital to various industries and applications. Despite its relatively low profile, nickel is highly versatile, which makes it an essential component in many modern technologies and products. For example, nickel is a key alloying element in stainless steel, which is used in construction, transportation and consumer goods. It can also be used to create high-temperature alloys for aerospace, power generation and chemical processing.

However, the most immediate reason for nickel’s prima donna status is its use in rechargeable batteries, such as nickel-cadmium (Ni-Cd) and nickel-metal hydride (NiMH) batteries, as well as in electronic components like switches, contacts and connectors.

Nickel and Indonesia

As electric vehicles become more popular in the West and other nations, nickel production and use continue to spike. Indonesia is planning to step on the gas pedal next year as far as production is concerned, as reports claim that its four major publicly listed nickel companies, PT Aneka Tambang (Antam), Merdeka Battery Materials (MBMA), Trimegah Bangun Persada (TBP Harita) and PT Vale Indonesia (Vale), are all in expansion mode.

According to a report by the Institute for Energy Economics and Financial Analysis, these firms want to double production within the next 5 years. Last year, these four companies produced 353,000 tons of nickel.

At the same time, they generated 5 million tonnes of greenhouse gas emissions. Indonesia managed to jockey itself into the number one position by implementing a ban on unprocessed nickel ore exports in 2020. Still, processing nickel for EV batteries carries a considerable environmental and carbon footprint.

_Logo_Color.jpg)