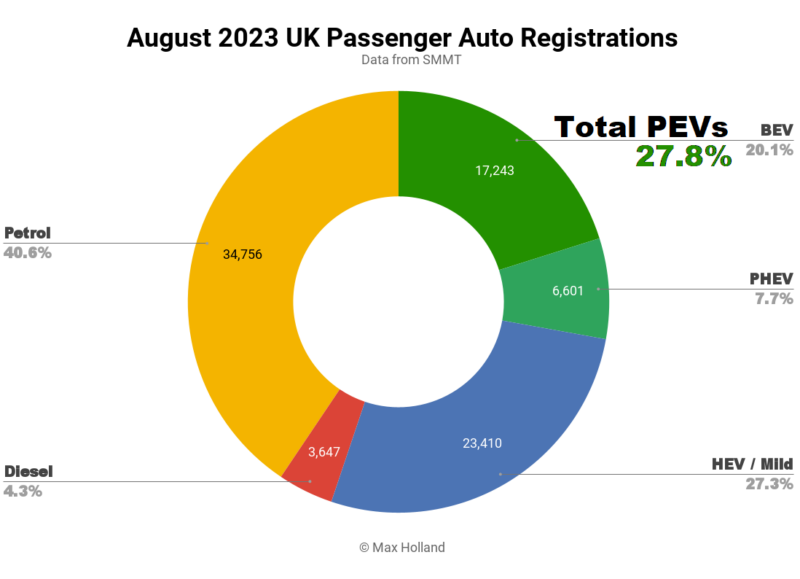

August saw EVs take 27.8% of the UK auto market, up from 20.2% year on year. Full electrics drove most of the EV growth. Overall auto volume was 85,657 units, up 24% YoY, but still slightly down from 2018–2019 seasonal norms. Tesla placed two models in the UK’s overall top 10 best sellers in August.

The combined plugin market share of 27.8% comprised 20.1% full battery electrics (BEVs), and 7.7% plugin hybrids (PHEVs). These follow from August 2022 figures of 20.2% combined, with 14.5% BEV, and 5.6% PHEV.

Looking at volumes, BEVs grew by 72% YoY, to 17,243 units. PHEVs grew by 70%, to 6,601 units. All non-plugin vehicles (combined) grew at a more modest 12.5%, with the diesel segment actually shrinking in volume by 18% to a near-record low of 3,647 units, just 4.3% share.

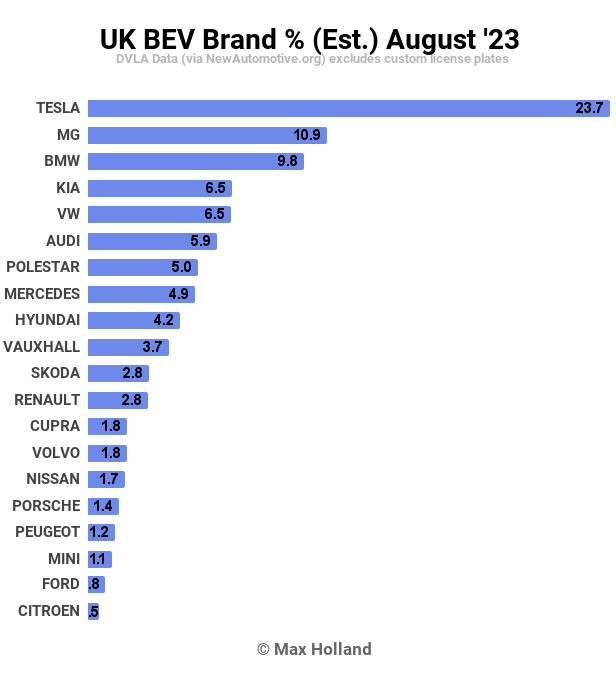

UK Best Selling Brands

Tesla placed two models in the UK’s overall top 10 best selling vehicles in August — the Model Y (2nd), and the Model 3 (6th). Together they grabbed almost 24% of the BEV market.

The next best performing BEV brand was MG Motor, with the MG4 leading, and in third was BMW, with the i4, iX1, and others.

With August habitually being one of the quietest months of the year for UK auto sales, most brands saw BEV volumes drop compared to July, except for Renault which saw a modest 4% increase. There were only some minor shufflings in the top 20 ranks.

With August habitually being one of the quietest months of the year for UK auto sales, most brands saw BEV volumes drop compared to July, except for Renault which saw a modest 4% increase. There were only some minor shufflings in the top 20 ranks.

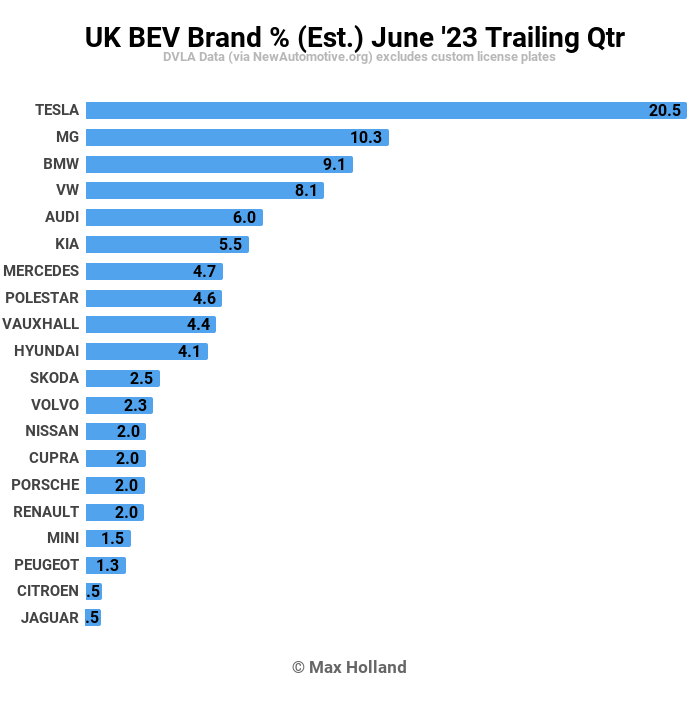

Let’s look at the 3 month view to get a more weighty perspective:

Here we can see that Tesla has an outstanding lead, claiming over a fifth of the UK’s BEV market. They are also at twice the volume of runner up, MG Motor.

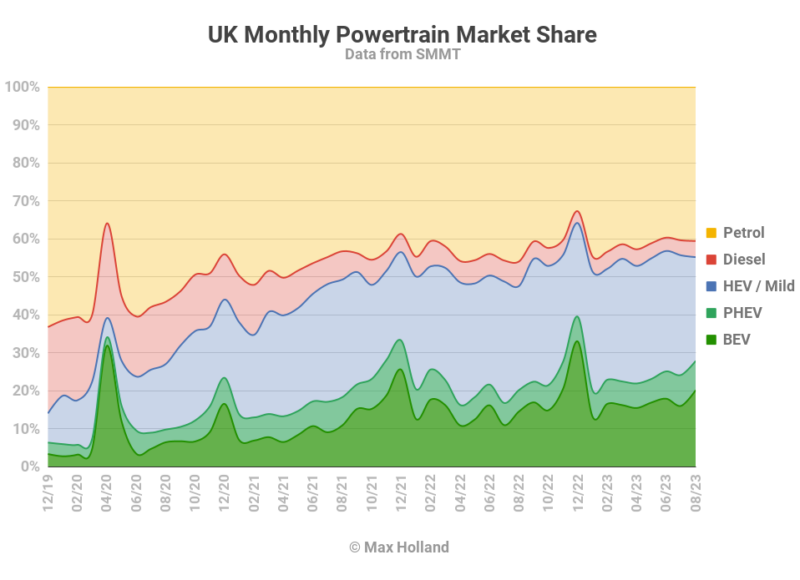

Looking at changes — the previous March-to-May period typically sees the highest auto volumes of each year, because March (along with September) brings shiny new license plates. The most recent June-to-August period doesn’t therefore compete with the previous 3 months on volumes, even in the BEV segment.

Nevertheless, both Tesla and BMW saw modest BEV volume growth over the period. Further down the ranks, Porsche and Renault also grew BEV volume. Other brands’ volumes dipped somewhat. There were small shuffles in top 20 ranking reflecting these relative changes in volume.

It continues to disappoint that a brand as generally popular with UK auto buyers as Ford is so woefully underperforming in BEV model offerings and volume. Ford is this year’s 2nd most sold auto brand in the UK — but only 1.7% of their sales are BEVs.

Bear in mind that — in the overall auto market — 16.4% of sales so far this year are BEVs. Ford is not pulling anything like its weight. It doesn’t even make it on to the 3-month top 20 list!

And yet. two Japanese brands make Ford look good by comparison. In Honda’s case, only some 0.6% of their 17,17o UK sales this year have been BEVs.

Toyota is the most miserable. It is the world’s largest auto maker, and has the 5th largest overall auto sales of any brand in the UK, with almost 68,690 overall units sold YTD. Like Honda, only around 0.6% of Toyota’s UK sales are BEVs.

Come January 1st 2024, less than 4 months from now, the UK will implement the zero emissions vehicle (ZEV) mandate that I discussed in more detail in a previous report. With some wriggle-room, it requires auto brands sales to be 22% “ZEV” in 2024 (and ratcheting up each year thereafter).

Although this doesn’t directly translate in into 22% BEV (or even 22% plugins), Ford, Toyota and Honda (amongst others) will certainly need to change their game to meet the requirement. No surprise then that it is Ford and Toyota that are already lobbying the UK government to water-down the 2024 targets.

Outlook

The 24% YoY growth in auto sales is a relative bright spot in the UK economy, which saw only 0.4% YoY growth in Q2. Inflation remains high at 6.8% in July, though an improvement from the over 10% in Q1. Interest rates have increased consistently since late 2021, and are currently at 5.25%, their highest since early 2009. PMI decreased to 43 in August from 45.3 previously (below 50 indicates a negative trend).

Obviously high inflation rates and high interest rates are not great for stimulating big consumer purchases like autos. Fortunately company and fleet buyers are anyway now increasingly aware of the TCO advantages of plugins, and both domestic and commercial electricity costs have come down a lot recently, from record highs.

These factors, along with the coming ZEV mandate, should ensure that — even if overall auto sales may potentially see weak volume in the coming months and years — the share of plugins will continue to grow.

What are your thoughts on the UK’s EV transition? Please jump in to the comments below and join the discussion.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …