What’s next for gold?

The (potentially massive) rally from the $1885 area low has hit its first sticking point at $1935-$1945.

The low of the left shoulder of a double-headed inverse H&S bottom is providing the resistance, and two other factors are also weighing on gold at the same time.

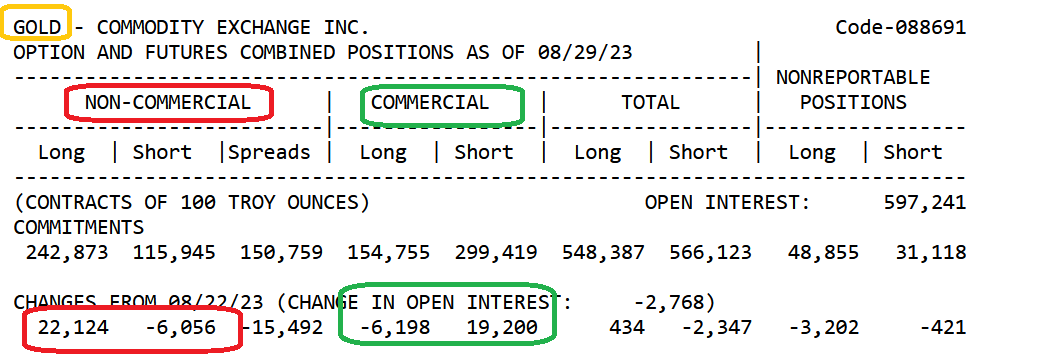

The COT report shows heavy commercial selling through August 29, which is the end of the latest reporting period.

Double-click to enlarge this important ten-year yields chart.

I urged gold bugs to prepare for Friday’s surge in the yield from the key 4.10% support zone, and the jobs report ensured it was a violent one.

The surge has done some damage to the large H&S top that has been forming. The bottom line:

For gold to continue its journey towards my $1980 target zone, yields almost certainly need to re-test and break below that 4.10% barrier.

The first yield chart shows the importance of the 4.10% high in early July. This one shows the additional importance of the March high.

Clearly, 4.10% commands respect. The good news is that when it finally broke decisively to the downside, gold could rally $100/oz very quickly.

Also, Tuesday is often a soft day for gold. Given the strength in yields, the commercial selling in the COT report, and technical resistance at $1935-$1945, price softness is likely today and it could persist for the rest of the week.

The big picture?

The American empire is fading and China is rising, but India is likely to overtake China within just a few decades.

The citizens’ obsession with gold in both nations is likely to create what I call a “gold bull era”.

In the medium term, China is struggling.

In America, mainstream media promises that all is well because a small number of stock market investors are happy.

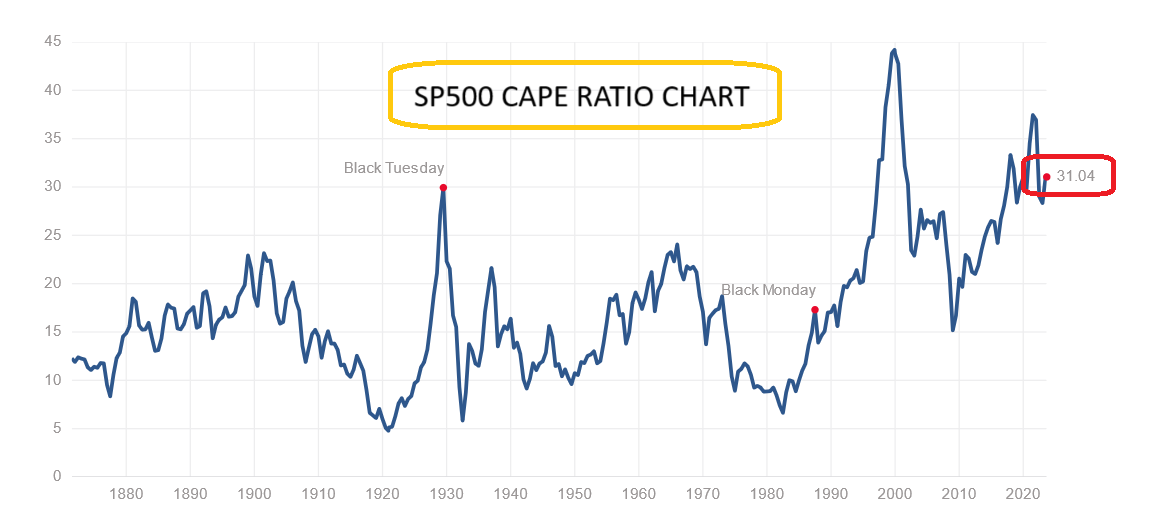

Based on the CAPE (inflation-adjusted PE) ratio, the US stock market is ridiculously overvalued, yet the Fed’s rate hikes have hurt Main Street citizens more than they’ve hurt the debt and war obsessed government.

Institutional stock market investors seem to enjoy watching the average citizen get ruined by both inflation and rate hikes.

The handouts the citizens got during the Corona crisis are gone. The US government’s horrifying scheme to achieve regime change by driving the citizens of Russia into poverty has backfired; the “stagflated” citizens of Europe are praying for a mild winter and US citizens are getting edgy as pump gas begins to move higher again.

A consistent focus on rates and other key big picture items is critical for investors. I cover the big picture 5-6 times a week in updates just like this one, in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, and I’m doing a $179/15mths special offer that investors can use to get in on the winning action. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

When oil last surged as Russian troops stormed into Ukraine, interest rates were low.

Of great concern is the fact that the average Western citizen isn’t a saver. They are debtors. That means a surge in the price of oil now would be devastating.

A huge base pattern is in play with mindboggling upside implications for the price. If a surge happens, the Fed would watch pump gas inflation spill into the rest of the economy, and then begin a new round of hikes.

At that point, the entire Western world could begin to resemble a super-sized version of America in the 1970s, when rates soared but inflation soared more… and the citizens raced to buy both metal and mines!

Double-click to enlarge this GDX chart. There’s a nice inverse H&S bottom pattern in play, and it could become the head of a bigger pattern.

If the price goes under $28.40 the pattern would be ruined, but it would open the door to the formation of an emotionally painful but highly bullish double bottom pattern. Right now, the ten-year yield support zone of 4.10% is the big fly in the mining stock ointment.

My suggested tactic to handle that fly is to lock in short-term government T-bills (and time deposits at the bank) now, and prepare for the next mining stocks surge, as Jay issues a “more dovish than expected” statement at the upcoming meet of the FOMC!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********