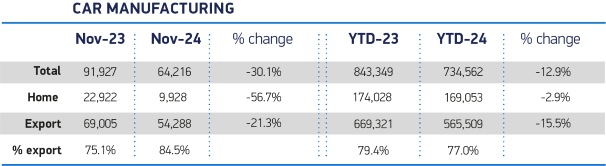

London, December 20, 2024, (Oilandgaspress) ––– UK car production fell -30.1% in November, the ninth consecutive month of decline, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). 64,216 cars rolled off factory lines, 27,711 fewer than in November last year, due to a combination of factors, including strategic product decisions, weakness in key global markets, calendarisation and the fact that production grew significantly in November 2023 as Covid-related supply chain challenges faded.

With UK car makers retooling factories to make electric vehicles, all major manufacturers experienced declines, representing the worst performance for the month since 1980.1 Output for both domestic and export markets fell sharply, down -56.7% and -21.3% respectively, with more than eight-in-10 cars shipped overseas and more than half of these (52.3%) heading into the EU.

19,165 battery electric, plug-in hybrid and hybrid electric cars were made in the month, representing almost a third (29.8%) of output, despite volumes declining by -45.5%. From January to November, UK car makers have produced more than a quarter of a million electrified vehicles, down -19.7% on the same period in 2023 due primarily to model switchovers taking place at major plants.

In the year to date, UK car output has fallen by -12.9% to 734,562 units – 108,787 fewer than the same period in 2023 and almost half a million short of 2019 volumes.2 Given the restructuring that is taking place across the global automotive industry which has seen plant closures, including the UK over this period, and the changes underway as companies transition from ICE to EV production, a decline was expected.

The news comes as all major markets seek to transition to a decarbonised future, with the UK among the leaders. UK automotive manufacturing is well placed to take advantage of this shift as recent investment announcements in EV and battery production testify. However, with consumer confidence depressed across both the UK and key overseas markets and new car registrations lacklustre in the UK and Europe (up just 0.4% in the first 11 months of the year), output invariably suffers.3 Governments can help by boosting consumer confidence and easing the financial pressure on the industry.

With the domestic EV market not growing as fast as expected, the UK government must act quickly by introducing incentives for private consumers, boosting infrastructure rollout and fast tracking an industrial and trade strategy that delivers competitive conditions including cheaper low carbon energy, new skills and measures to attract further investment. Most urgently, however, it must publish its consultation on the changes to the ‘ZEV mandate’ regulation, as the link between a vibrant local market and healthy local production is a critical one.

Information Source: Read More

Oil and gas press covers, Energy Monitor, Climate, Gas,Renewable, Oil and Gas, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,