Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

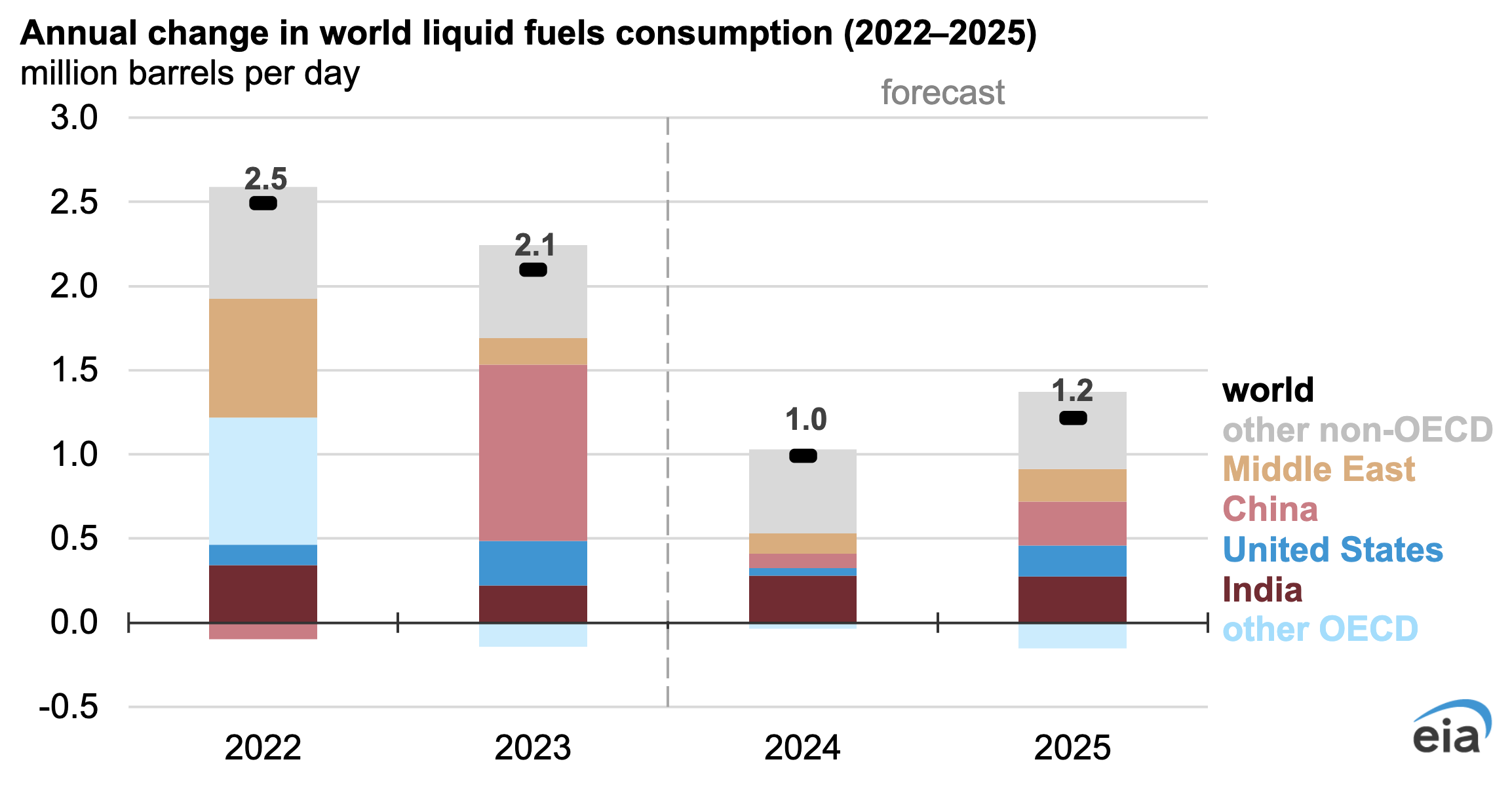

The US Energy Information Administration put out an interesting article today. The headline focused on growth of oil consumption in India compared to China — “India to surpass China as the top source of global oil consumption growth in 2024 and 2025.” I sat looking at the chart for several minutes thinking about what’s going on in different major markets. Here’s the chart:

As you can see, this is about growth, not total oil consumption. China’s oil consumption boomed in 2023, mostly due to much greater use of oil for manufacturing petrochemicals, but then it is forecasted here to grow minimally in 2024. Others have said oil consumption will actually decline in the country this year and the CNPC Economics & Technology Research Institute thinks oil consumption peaked in the country last year.

The Middle East is growing demand for its own major product, and the US is expected to have a small year of growth this year after a big economic rebound last year. But the standout country for growth of oil consumption is India. As I wrote two days ago, India just hasn’t lived up to its own hype and targets with vehicle electrification, and that is showing more and more as the country continues to grow.

“Over 2024 and 2025, India accounts for 25% of total oil consumption growth globally. We expect an increase of 0.9 million barrels per day (b/d) in global consumption of liquid fuels in 2024. We expect even more growth next year, with global oil consumption increasing by 1.3 million b/d,” the EIA writes. “Driven by rising demand for transportation fuels and fuels for home cooking, consumption of liquid fuels in India is forecast to increase by 220,000 b/d in 2024 and by 330,000 b/d in 2025. That growth is the most of any country in our forecast in each of the years.”

Unfortunately, with India so far behind in vehicle electrification and also using liquid fuels so much for cooking, and even growing that use significantly, it’s hard to see the country turning these trends around anytime soon. Massive change is needed in India.

China is the more uplifting, and probably more interesting story. As already noted, after a boom in 2023, growth has collapsed, but I’m not so sure the forecast for 2025 is a solid one from the EIA. Referencing electric vehicles, economy growth slowing, and population decline, growth of oil use in the country is not expected to be high according to the agency, but the chart indicates a pretty big chunk of growth compared to this year and compared to the US. I’m thinking it’s more likely vehicle electrification continues to hit oil use harder than most forecasters expect (new EVs are going to be driven more than old gas cars, and EV sales could grow faster in 2025 than they’re expected), and more economic troubles could be on the horizon if China and the USA under Trump get into a bigger and bigger tariff war. Likely? Who knows, but it’s a definite possibility. It is certainly likely if you believe what Trump has repeatedly said about tariffs.

Of course, despite standout progress cutting oil consumption growth, and perhaps even cutting oil consumption overall now, China still burns a lot of oil. The EIA points out that India is still far, far behind China in that regard despite now seeing faster growth in oil use. “Although India’s growth in percentage and volume terms exceeds China’s growth in our forecast, China still consumes significantly more oil. Total consumption of liquid fuels in India was 5.3 million b/d in 2023, while China consumed more than triple that amount at 16.4 million b/d in 2023, based on estimates in our December STEO.”

As for the US market, well, that’s going to depend on whether our economy continues to rebound/grow or whether there’s some kind of “shocker” and the US economy hits a tough period (as is often the case under Republican administrations at some point).

We’ll see what happens, but something tells me that we’re going to see a much different chart in 2025 than this forecast shows.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy