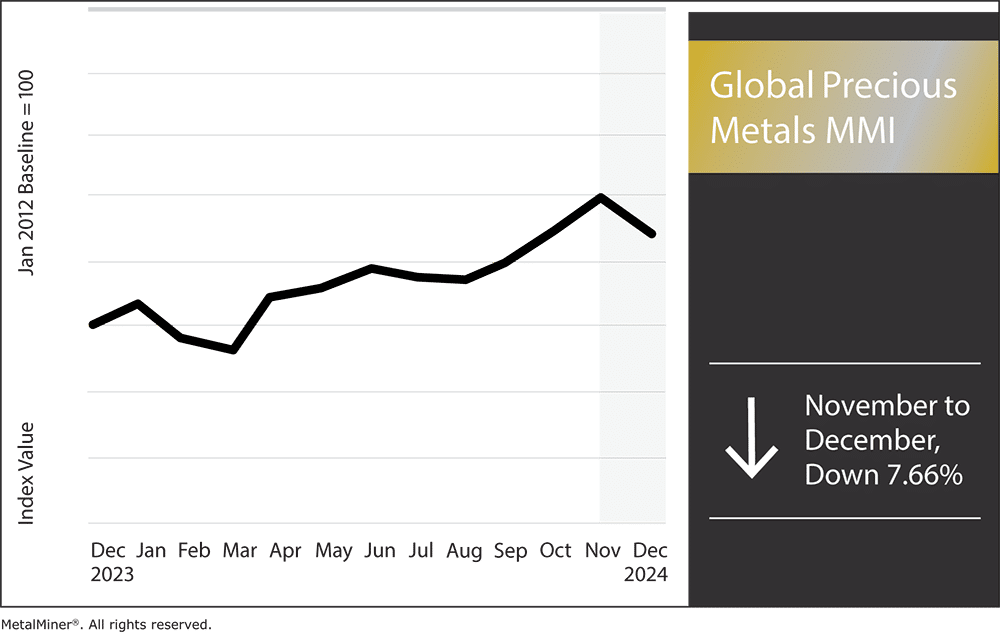

The Global Precious Metals MMI (Monthly Metals Index) dropped month-over-month by 7.66%.

Precious metals prices showed mixed trends over the past month, shaped by central bank decisions, geopolitical uncertainties and shifts in market demand. While gold and silver continued to rise, platinum and palladium encountered declining momentum.

Precious Metals Prices: Palladium

Palladium prices have faced downward pressure as the growing popularity of electric vehicles diminishes the need for palladium-based catalytic converters and mining restrictions. Experts predict this trend could persist, potentially driving prices even lower in the months ahead.

Stay up to date on MetalMiner, precious metals prices, and more valuable commodity news with weekly updates – without the sales pitch. Sign up for MetalMiner’s weekly newsletter.

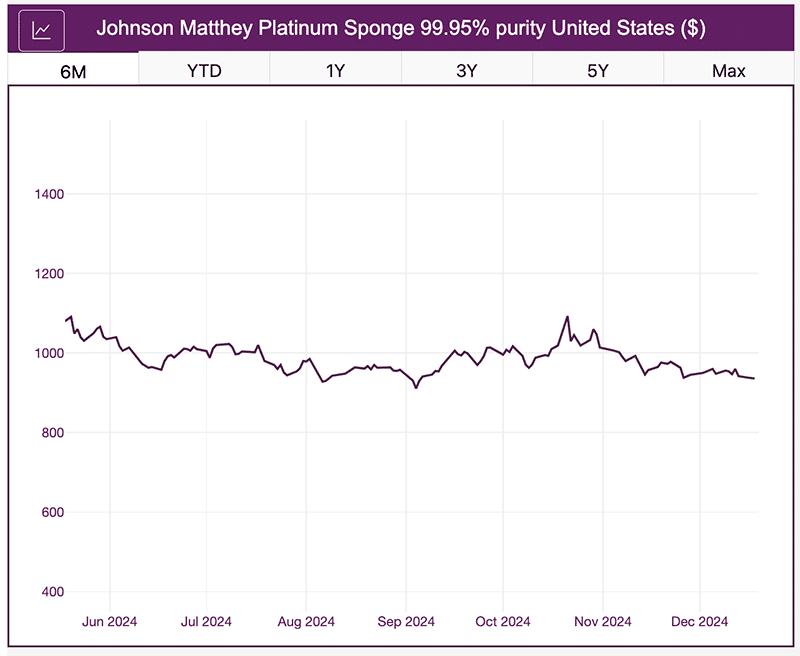

Platinum Price Movements and Outlook

Platinum prices encountered difficulties in Q4 due to changes in the automotive sector and overall market dynamics. The growing adoption of electric vehicles, which do not use platinum-based catalytic converters, has led to some reduced demand.

Mining restrictions and supply chain disruptions also continue to plague the platinum market. For that reason, many experts anticipate that platinum could continue to experience a supply deficit.

Precious Metals Prices: Silver

Silver prices faced downward pressure over the past month, hitting an intraday low of $30.51 by mid-November. This marked the first drop to $30 since September 2024, though prices have remained above this threshold since then. That said, many analysts believe silver has a slight chance of outperforming gold in the coming year.

MetalMiner can unlock customizable price forecasting for the precious metals you buy. View our full metals catalog.

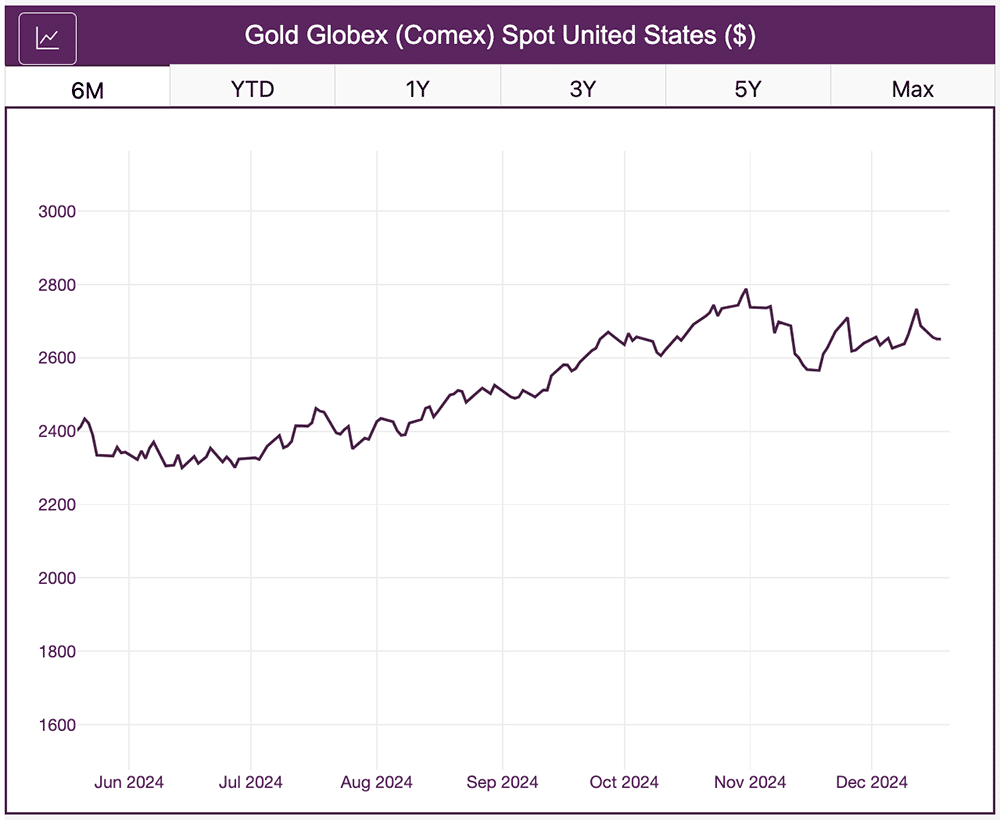

Gold Price Shifts and Outlook

Compared to silver, palladium and platinum, gold prices have been far more stable. As of December 18, Comex spot gold price stood at $2,651.40 per ounce.

Investors are monitoring the Federal Reserve’s monetary policy for hedging signals, as potential interest rate cuts could enhance gold’s attractiveness. Experts predict that gold might climb beyond $2,900 per troy ounce, driven by geopolitical uncertainties and economic stimulus efforts.

Global Precious Metals Prices: Monthly Price Shifts

Subscribe to MetalMiner’s free Monthly Metals Index report and leverage it as a valuable resource for tracking and predicting precious metal price trends.

- Palladium bar prices dropped by 13.55%, to $963 per ounce.

- Platinum bar prices fell by 6.89% month-over-month, closing at $932 per ounce.

- Silver ingot prices dropped by 10.16%, to $1,044.31 per ounce.

- Finally, gold bullion prices fell by 4.7%, to $2,647.40 per ounce.