Grid Metals Corp. (TSXV:GRDM) (OTCQB:MSMGF) (“Grid” or the “Company”) is pleased to announce it has executed a definitive option and joint venture agreement (the “Agreement”) with Teck Resources Limited (“Teck”), a leading Canadian resource company, to explore and develop the Mawka nickel project (“Makwa” or the “Project”) in southeastern Manitoba, Canada. The Makwa nickel project sits on the southern arm of the Bird River Greenstone Belt approximately 145 km from Winnipeg, the provincial capital. The focus of the Agreement will be the discovery of a Tier 1 magmatic nickel-copper-PGM-cobalt deposit at Makwa. Grid will maintain its 100% interest and exploration program at Mayville Cu-Ni Property located 30km to the north of Makwa.

The Agreement grants Teck a two-stage option to acquire up to a 70% interest in Makwa by funding cumulative expenditures of CAD$15,700,000 and making staged cash payments of CAD$1,600,000 to Grid (of which CAD$1,000,000 can be completed through a subscription of shares at Teck’s election). Teck’s minimum commitment under the agreement is the initial CAD$400,000 cash payment. Following completion of additional geophysical surveying, Teck would be committed to funding CAD$450,000 of minimum expenditures. The Agreement is subject to TSX-V approval.

Robin Dunbar, P. Geo., Grid’s CEO & President, stated, “We are pleased to announce a definitive agreement with Teck, a leading Canadian resource company focused on responsibly providing the metals essential to economic development and the energy transition. Teck’s significant technical and operational know-how will be of immediate benefit to the Makwa nickel project. Having Teck involved in the Project will provide financial support and added technical expertise to give our shareholders the maximum opportunity to participate in a Tier 1 nickel discovery.”

Stuart McCracken, Vice President, Exploration, Teck stated, “We are excited to announce this agreement with Grid, providing a framework to explore for magmatic Ni-Cu-PGE systems in a prospective and readily accessible area. Bringing together resources and expertise from both Grid and Teck will support an agile, efficient, and focused discovery program.”

Key Project Milestones at the Makwa Project include:

- The recent consolidation of the known nickel copper sulfide occurrences and deposits at Makwa

- The delineation of a pit-constrained nickel sulfide resource at the former Makwa mine site announced in 2024 (see The Makwa Nickel Project below)

- A recent exploration agreement and ongoing collaboration with the Sagkeeng First Nation on whose ancestral lands the Makwa Project is situated

- Grid assembling of a base metals technical team led by Dave Peck, P. Geo., who was instrumental in positioning the project to attract a partner like Teck.

Transaction Terms

Pursuant to the Agreement, Teck has the options (“Options”) to acquire up to an 70% interest in the Makwa nickel property.

Teck may exercise the first option (the “First Option”) by making an aggregate of CAD$600,000 in cash payments, including a firm commitment of CAD$400,000 (the “Minimum Cash Payment”), and incurring an aggregate of CAD$5,700,000 in exploration expenditures over four years, according to the following schedules (which may be accelerated at Teck’s option):

| On or Before | Cumulative Aggregate Expenditures |

Cash Payments | Interest Earned (not including required Cash Payments; see below) |

| First Option | |||

| January 31, 2025 | $400,000 | ||

| May 31, 2025 | $450,000 | ||

| January 31, 2026 | $100,000 | ||

| May 31, 2026 | $1,950,000 | ||

| January 31, 2027 | $100,000 | ||

| May 31, 2027 | $3,700,000 | ||

| May 31, 2028 | $5,700,000 | 51% | |

| Second Option | |||

| January 31, 2031 | $1,000,000* | ||

| May 31, 2031 | $15,700,000 | 70% | |

*May be in the form of an Equity Placement at a 25% premium

Upon completion of the First Option requirements above and delivery of notice thereof to Grid (the “First Option Exercise Notice”), Teck would have exercised the First Option, and the Property would be owned by Teck as to 51% and Grid as to 49%.

If Teck exercises the First Option, Teck will have a further sole and exclusive option to acquire an additional 19% interest in the Property (the “Second Option”). Teck may exercise the Second Option by incurring a further CAD$10,000,000 in exploration expenditures over a period of three years commencing on the date of the First Option Exercise Notice and making a payment of CAD$1,000,000 in cash or, at Teck’s election and subject to TSX-V approval, through a subscription for Grid shares priced at a 25% premium per share to the preceding 20-day volume weighted average price per share.

Provided that Teck exercises the First Option, a contractual joint venture (the “Joint Venture”) will be formed between Grid and Teck. Thereafter, each Party would fund its pro-rata share of future expenditures on the Property or incur dilution. For a period of six months following the formation of the Joint Venture (the “Initial Period”), Grid may elect to defer the contributions required to fund its pro-rata share of expenditures, for which Teck would agree to temporarily contribute in lieu (the “Grid Deferrals”). Should Grid elect to defer contributions during the Initial Period, Grid would have until twelve months after the formation of the Joint Venture to reimburse Teck for the Grid Deferrals, otherwise Grid would incur proportionate dilution. The party with the majority interest shall be the “Operator” of the Joint Venture, and each party would control their pro-rata share of offtake from the Property.

If a party’s interest in the Property is diluted below 10%, its interest would be converted to a 1.5% NSR royalty on the Property, of which 0.75% could be bought back by the royalty payor at any time for a cash payment of CAD$2,000,000. Of the remaining 0.75% NSR royalty on those claims held by Gossan, 0.5% could be bought back by the royalty payor at any time for a cash payment of CAD$2,000,000.

The Makwa Nickel Project

The Makwa project is one of two copper-nickel-PGM properties owned by Grid and located in the Archean-age Bird River greenstone belt of southeastern Manitoba. The project has excellent infrastructure, e.g., all season roads, local hydro-electric power, proximity to major trans-continental rail and trucking arteries. The Bird River belt is a direct analogue of the Ring of Fire district in northwestern Ontario in terms of the variety of mineral deposit types and geology, scale and structure. The primary target rocks at Makwa are ultramafic cumulates of the >30 km long Bird River Sill, which represents a dynamic intrusive complex featuring a wide range of intrusion shapes, sizes and structural associations. Despite its excellent pedigree as a past nickel producer, it was not until 2023 – when Grid completed its consolidation of the nickel-copper sulfide properties in the belt, that a comprehensive district-scale magmatic sulfide exploration program could be enacted. In particular, a historical property boundary severely hampered exploration for high-grade massive sulfide deposits within an interpreted >5 km long feeder system (the ‘ore fault corridor’). Prior exploration efforts were also impaired by the limited depth of penetration of historical geophysical surveys.

The Makwa project features two past producing nickel sulfide mines, three pit-constrained nickel sulfide resources and numerous high-grade nickel- and/or copper-rich magmatic sulfide surface showings. The Company recently published an updated pit-constrained mineral resource estimate for the Makwa deposit comprising 14.2 MMt of 0.75% Ni Eq grade including a higher-grade core of 4.8 MMt with 1.26% Ni Eq grade (see Micon International Technical Report, September 2024, available on SEDAR). A key aspect of the Makwa mineralization are its high nickel and palladium tenors – making it very amenable to the production of a high-value nickel sulfide concentrate.

Several depositional models will help guide future exploration at the Makwa project including conventional basal-accumulation disseminated and local massive sulfide deposits; feeder-structure related high-grade massive sulfide deposits; and hydrothermal massive sulfide vein systems produced from interaction of magmatic Cu-Ni and volcanogenic Cu-Zn-Ag-Au sulfide mineralization. The critical new discoveries needed to support a robust future mining operation will be based on a new bank of drill targets. These targets will be defined by integrating historical and new geophysical and geochemical surveys with the use of leading-edge 3D analytics methods. Teck and Grid jointly anticipate the launch of an initial drilling campaign that will focus on the discovery of structurally-controlled high-grade massive sulfide deposits.

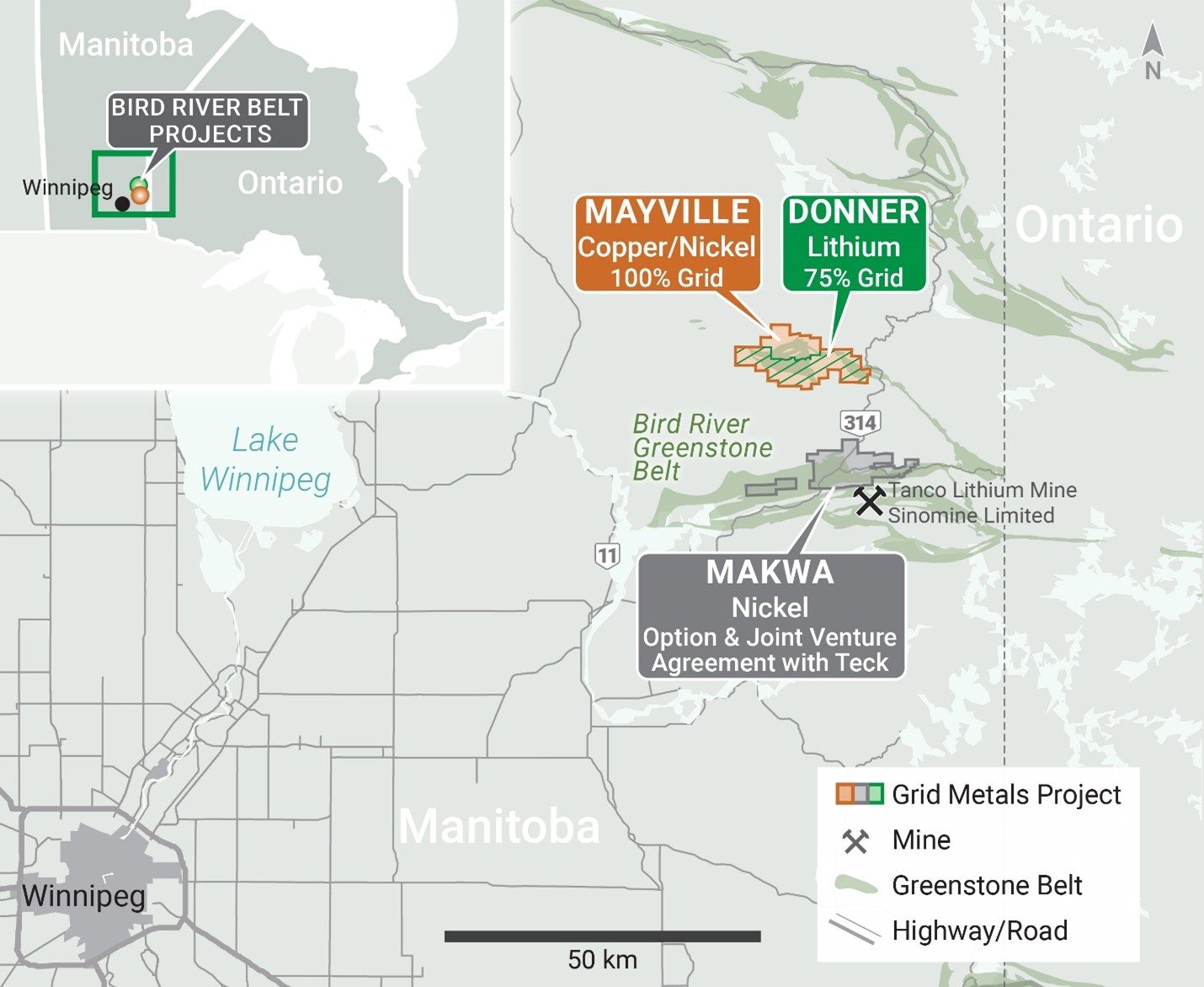

Figure 1: Map of Grid Metals Corp. Bird River Greenstone Belt Property holdings (Mayville Cu-Ni Project and Makwa Ni Project, previously called the MM Cu-Ni Project) in SE Manitoba located 150 northeast of Winnipeg. The north arm hosts the Mayville Cu-Ni Deposit3 (32 Mt with 0.40% Cu and 0.16% Ni) and the New Manitoba Deposit. The Makwa Property (south arm) hosts the Makwa Ni-Cu Deposit(14.2 Mt with 0.48% Ni and 0.11% Cu), and the Page and Ore Fault Deposits (optioned by Grid in 2023).

Qualified Persons Statements

Dr. Dave Peck, P.Geo., is the Qualified Person for purposes of National Instrument 43-101 and has reviewed and approved the technical content of this release.

About Grid Metals Corp.

Grid Metals is focused on exploration and development in southeastern Manitoba with three key projects in the Bird River area.

- The Makwa Property (Ni-Cu-PGM-Co), which is subject to an Option and Joint Venture Agreement with Teck Resources Limited (“Teck”). Teck can earn up to a 70% interest in Makwa by incurring a total of $17.3 million, comprising project expenditures ($15.7 million) and cash payments or equity participation ($1.6 million) with Grid. Makwa is located on the south arm of the Bird River Greenstone Belt.

- The Mayville Property (Cu-Ni) is located on the north arm of the Bird River Greenstone Belt. Grid owns 100% of the Mayville Property subject to a minority interest. The Company is currently drilling at Mayville.

- The Donner Lithium Project is adjacent to the Mayville Property, and Grid owns 75% of the project.

All of the Company’s southeastern Manitoba projects are located on the ancestral lands of the Sagkeeng First Nation with whom the Company maintains an Exploration Agreement.

On Behalf of the Board of Grid Metals Corp.

For more information about the Company, please see the Company website at www.gridmetalscorp.com or contact:

Robin Dunbar – President, CEO & Director Telephone: 416-955-4773 Email: rd@gridmetalscorp.com

Brandon Smith – Chief Development Officer – bsmith@gridmetalscorp.com

David Black – Investor Relations Email: info@gridmetalscorp.com

We seek safe harbour. This news release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of the Securities Act (Ontario) (together, “forward-looking statements”). Such forward-looking statements include the Company’s closing of the proposed financial transactions, sale of royalty and property interests. the overall economic potential of its properties, the availability of adequate financing and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements expressed or implied by such forward- looking statements to be materially different. Such factors include, among others, risks and uncertainties relating to potential political risk, uncertainty of production and capital costs estimates and the potential for unexpected costs and expenses, physical risks inherent in mining operations, metallurgical risk, currency fluctuations, fluctuations in the price of nickel, cobalt, copper and other metals, completion of economic evaluations, changes in project parameters as plans continue to be refined, the inability or failure to obtain adequate financing on a timely basis, and other risks and uncertainties, including those described in the Company’s Management Discussion and Analysis for the most recent financial period and Material Change Reports filed with the Canadian Securities Administrators and available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.