Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

It’s time for another quarterly US EV sales report. Fully electric vehicles (BEVs/EVs) accounted for 7.0% of US auto sales in Q3, down slightly from Q2 2024, when the share was 7.4%. But let’s look more closely at notable trends year over year and in Q3 2024 compared to Q3 2022.

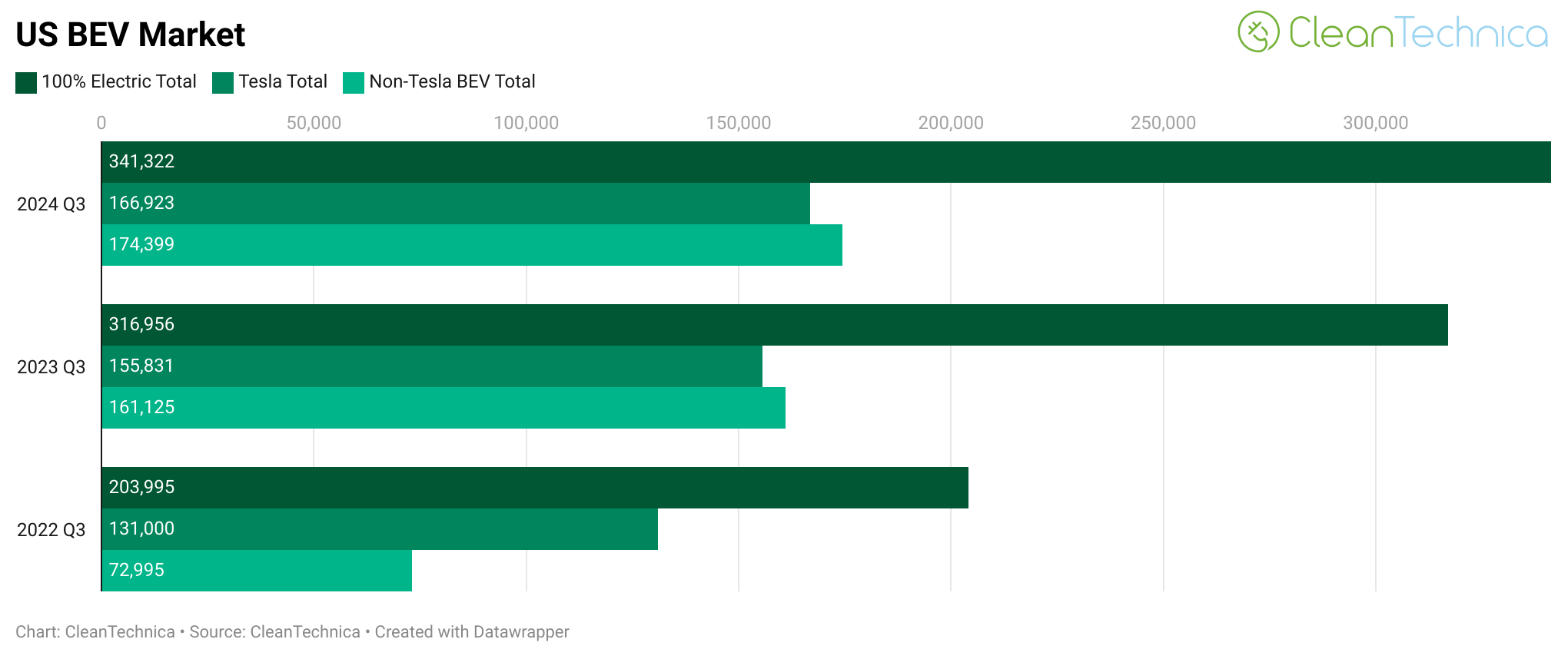

As you can see in the chart above, overall EV sales continue to grow year over year. There’s no confusion looking at that chart — overall EV sales have been up each year in the 3rd quarter, Tesla sales increased (finally) year over year in Q3, and non-Tesla EV sales also increase year over year in Q3.

You can indeed see that growth slowed down in 2024. That’s the narrative that is correct so far — growth slowed down. However, EV sales are still growing. They’re higher this year, and much higher than two years ago.

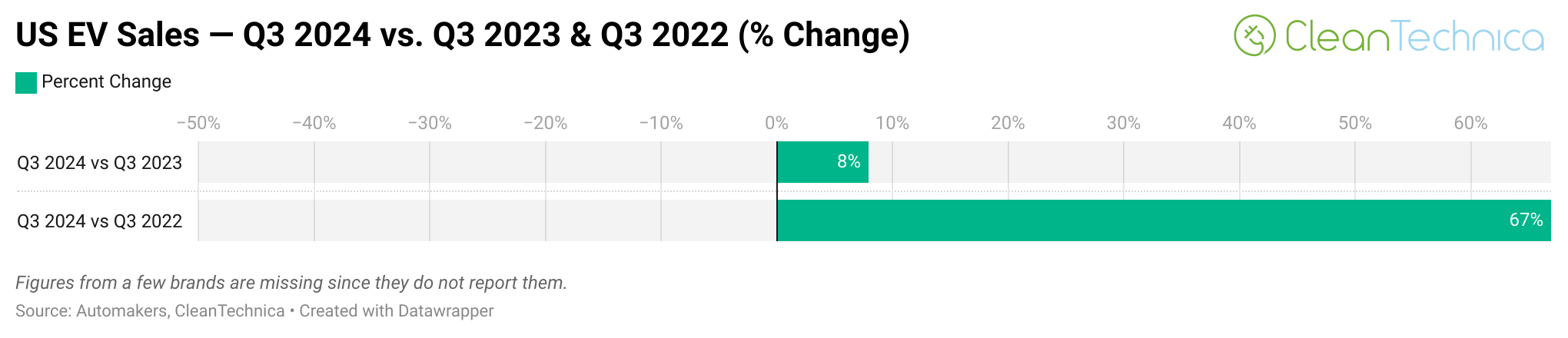

Here are a couple more charts showing the sales trends. On a percentage basis, EV sales were up 8% year over year in the 3rd quarter, and they were up 67% compared to the 3rd quarter of 2022.

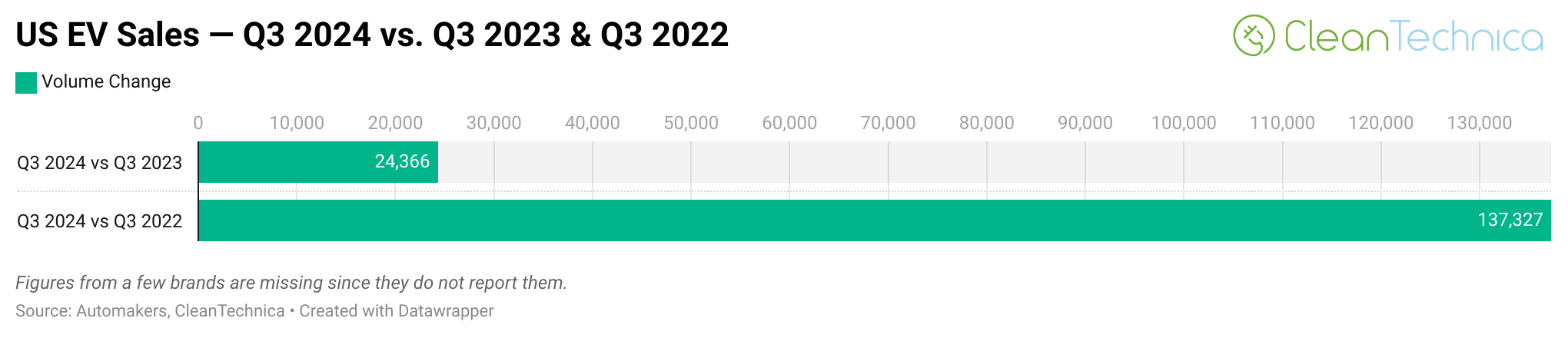

In volume terms, sales were up by more than 24,000 year over year in the 3rd quarter, and they were up by more than 137,000 compared to the 3rd quarter of 2022.

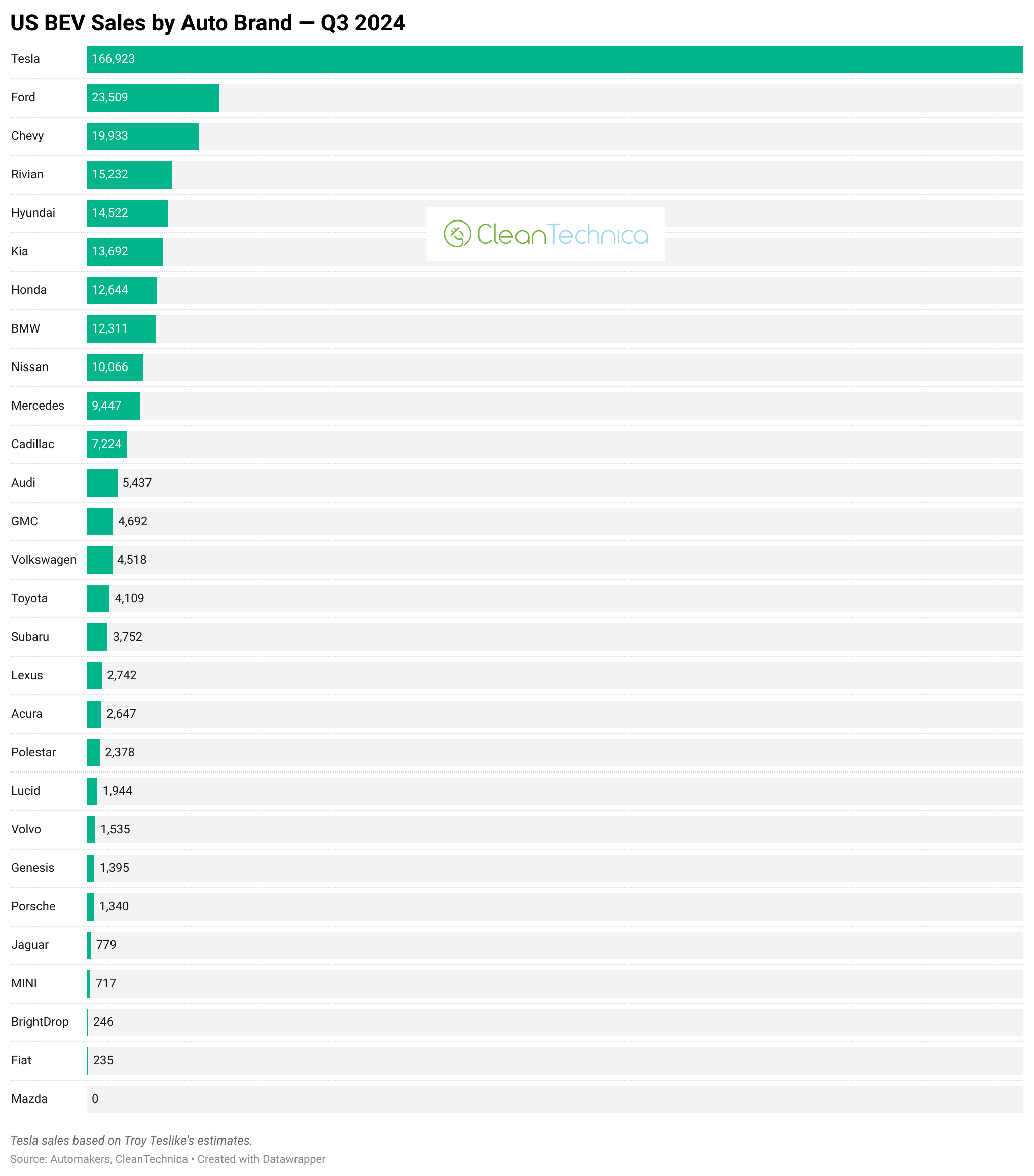

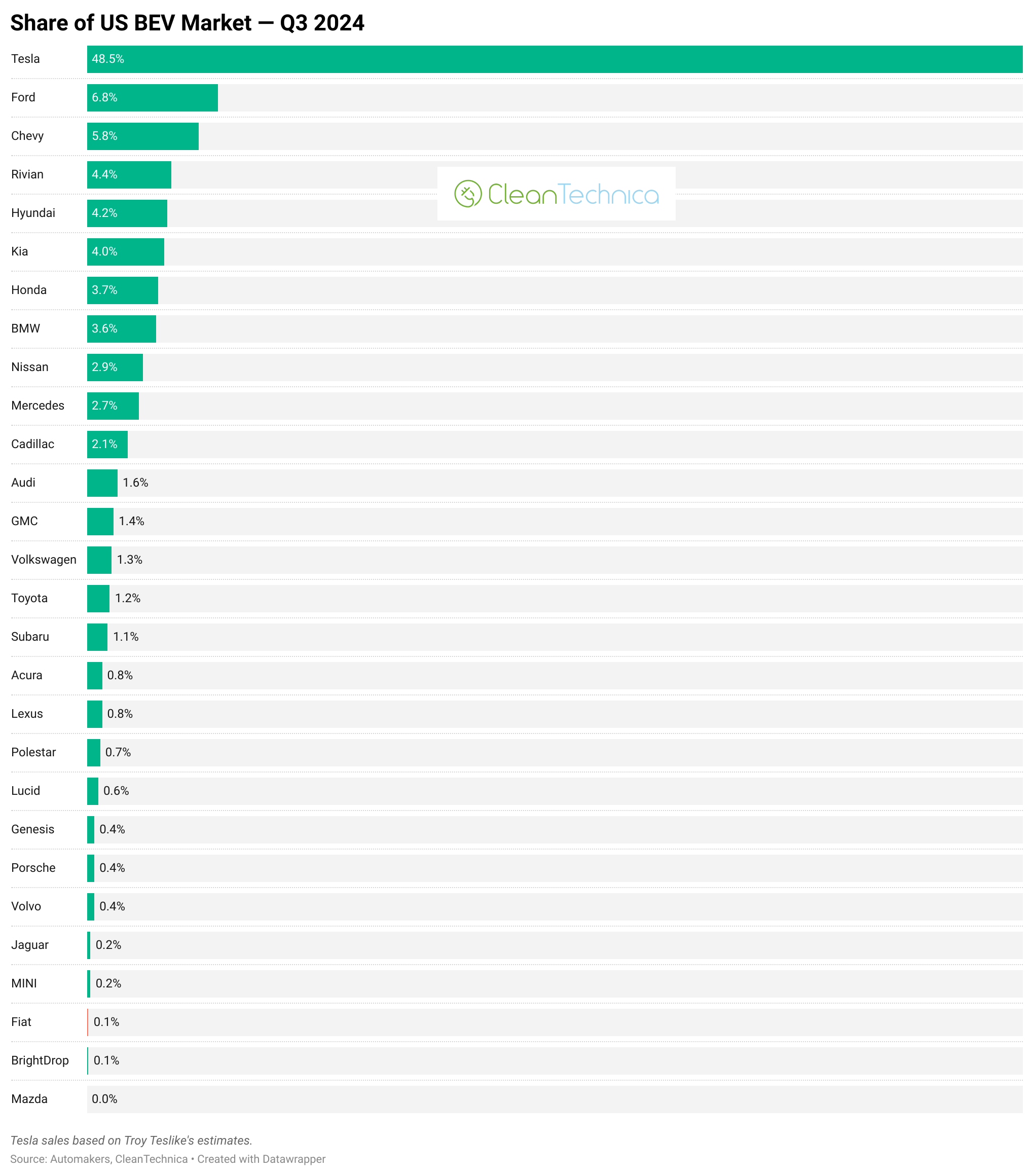

Tesla still dominates US EV sales. It may represent less than 50% of the market finally, but it’s still nearly as much as every other automaker combined, which is stunning and not at all the sign of a mature market. One has to expect its share will continue to decline as other automakers continue to offer new models, offer better specs and value for money, and scale up production more and more. Well, I guess some people expect that Tesla will bounce back, see a surge in sales, and shoot above 50% market share again. I don’t see that happening, at least not for long. The long term trend is down from about 80% of the US market to less than 50% of the US EV market, and I expect that trend will continue for years to come.

As far as the other auto brands, Ford holds onto its silver medal, with one percentage point or about 4,000 sales more than #3 Chevrolet. Then you get another pure EV producer, Rivian, which could rise up the charts strongly in coming years as it releases more affordable models. Hyundai and Kia are right on Rivian’s tail at the moment, though, and keep offering extremely compelling EV offerings. And then you’ve got Honda coming out of nowhere thanks to the Honda Prologue, which I feel like I’m seeing everyday now.

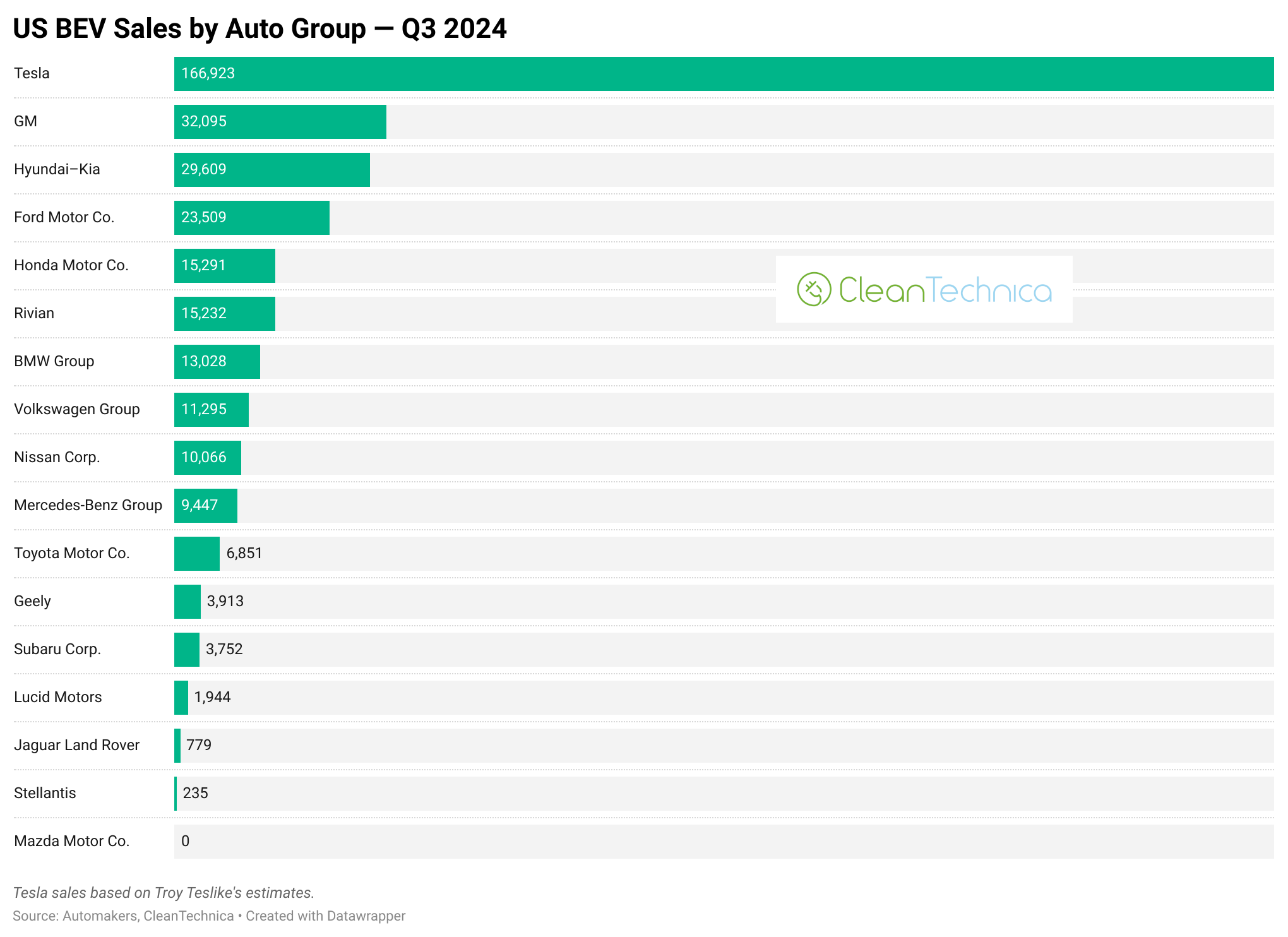

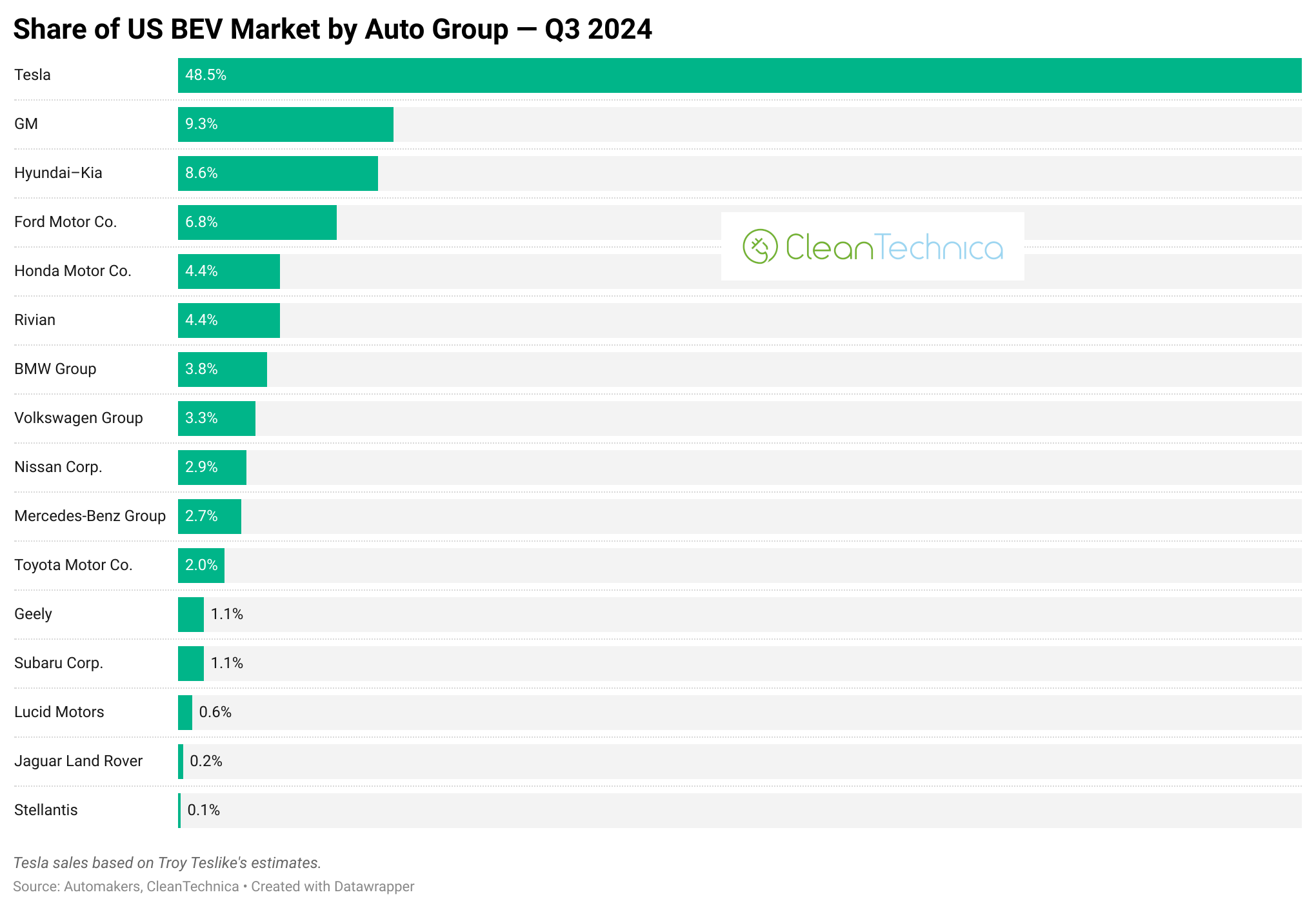

Looking at the numbers by auto group instead of auto brand, of course, Tesla is still in exactly the same spot (since it has no sub-brands). However, GM jumps into second place (Chevrolet, Cadillac, GMC, and Brightdrop all combine here). Hyundai–Kia (which is not a traditional auto group but is a very complicated corporate combination that basically counts as one) takes the silver medal here.

Ford drops down to 4th, as the Ford brand gets no electric vehicle support from other brands. Honda is indeed a surprise shooting up to 5th so fast, but it’s just above 1 EV per state (59 EVs) higher than Rivian. We’ll see what happens in the 4th quarter.

Stay tuned for more US EV sales reports coming later today.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy