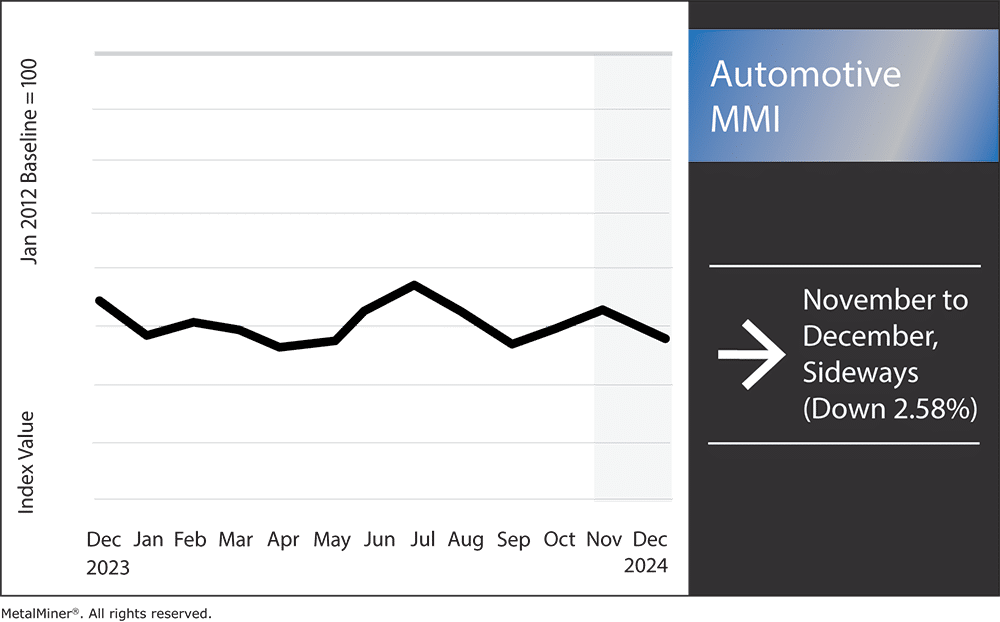

The Automotive MMI (Monthly Metals Index) remained sideways, only moving down 2.58%. There are currently no significant factors within the US automotive market causing much movement in price action, and automotive sector as a whole remains slow. Despite this, concern about incoming tariffs from the new Trump administration remains palpable. While Trump hasn’t threatened tariffs on large automotive manufacturing nations like Japan or Germany, any hot-dipped galvanized steel products coming out of China will be subject to Trump’s proposed tariffs. This could create more market volatility and place pressure on the automotive industry in the long term.

Another noteworthy trend in the US automotive market is a steady increase in imports to the U.S from Vietnam. In recent years, steel imports have been flowing into Vietnam from China, raising suspicions as to whether China is again looking for a country in which to dump steel products. However, this hasn’t caused any major fluctuations in hot-dipped galvanized prices or the US automotive market just yet. Currently, all eyes remain on the new Trump Administration to see what will happen with the proposed tariffs.

With MetalMiner’s Weekly Newsletter, you get crucial updates on metal prices, industry news, and everything affecting the US automotive market – all delivered straight to your inbox.

Stellantis CEO Carlos Tavares Resigns. What Next?

The resignation of Stellantis CEO Carlos Tavares on December 1 sent shockwaves through the automotive industry, particularly impacting the US market and the steel sector. Tavares’ departure, which was attributed to disagreements over operational strategies and stakeholder relations, raises questions about the future direction of Stellantis and its broader impact on the US automotive market.

Tavares’ exit was driven by deep disagreements with Stellantis’ board over the company’s strategic priorities. According to reports, his push for aggressive cost-cutting and ambitious sales targets sparked friction with dealers, suppliers, and unions.

Critics contended that his approach favored short-term profits at the expense of long-term stability, thus undermining product quality and innovation. During his tenure, Stellantis faced a 20% drop in sales and a €12 billion decline in revenue, which raised alarms about the company’s financial outlook.

Arm yourself with the industry’s most robust metal intelligence and get maximum ROI with MetalMiner Insights, view our full metal catalog to see if we cover your metal types.

Impact on the U.S. Automotive Market

As the parent company of Jeep, Ram and Chrysler, Stellantis holds a key position in the US automotive industry. Therefore, Tavares’ resignation brings a wave of uncertainty that could impact market dynamics. His strict cost-cutting policies had created tension with U.S. dealers, causing dissatisfaction. However, his departure represents an opportunity to rebuild dealer relationships and adopt strategies that better align with their interests.

Stellantis experienced a 17% drop in US sales this year alone. The impact of leadership changes will depend on the new CEO’s approach, which could either stabilize or further unsettle sales. Under Tavares, the company prioritized high-end vehicles. However, the firm’s focus could shift to more affordable models, influencing competition and consumer preferences in the US market.

Potential Effects on Hot-Dipped Galvanized Steel Prices

The automotive industry relies heavily on hot-dipped galvanized (HDG) steel for vehicle manufacturing. As a result, changes in leadership at an American automotive manufacturer as large as Stellantis could impact both demand and pricing. Moreover, leadership transitions might alter production levels, with higher vehicle output potentially boosting HDG steel demand and driving up prices.

Stellantis’ procurement strategies also play a key role in shaping the steel supply chain. A new CEO could redefine supplier relationships, affecting demand and pricing for HDG steel. Of course, the overall sense of uncertainty surrounding Stellantis’ direction may also impact market sentiment, causing price fluctuations as stakeholders anticipate potential shifts in demand.

Are you under pressure to generate metal cost savings? Make sure you are following these 5 best practices.

Moving Forward

Carlos Tavares’ resignation marks a pivotal moment for American automotive manufacturing, with significant implications for both the US automotive market and the industrial metals sector.

The company’s strategic direction under its new leadership will be crucial in determining its market position and influence on HDG steel demand. Stakeholders should closely monitor developments within Stellantis to assess potential impacts on market dynamics and pricing structures.

Automotive MMI: Noteworthy Price Trends

Worried about how the US automotive market impacts steel prices? MetalMiner Insights covers price points, correlation charts and price forecasting for a full suite of steel types, copper and more. See our full metals catalog.

- Chinese lead prices moved sideways, rising up a slight 2.78% to $2,356.54 per metric ton

- Korean 5052 aluminum coil premium over 1050 prices moved sideways, rising by 1.57%. This left prices at $4.21 per kilogram

- Hot-dipped galvanized steel prices also moved sideways, only dropping a slight 0.42%. This brought prices to $944 per short ton