Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Great month for Volkswagen Group

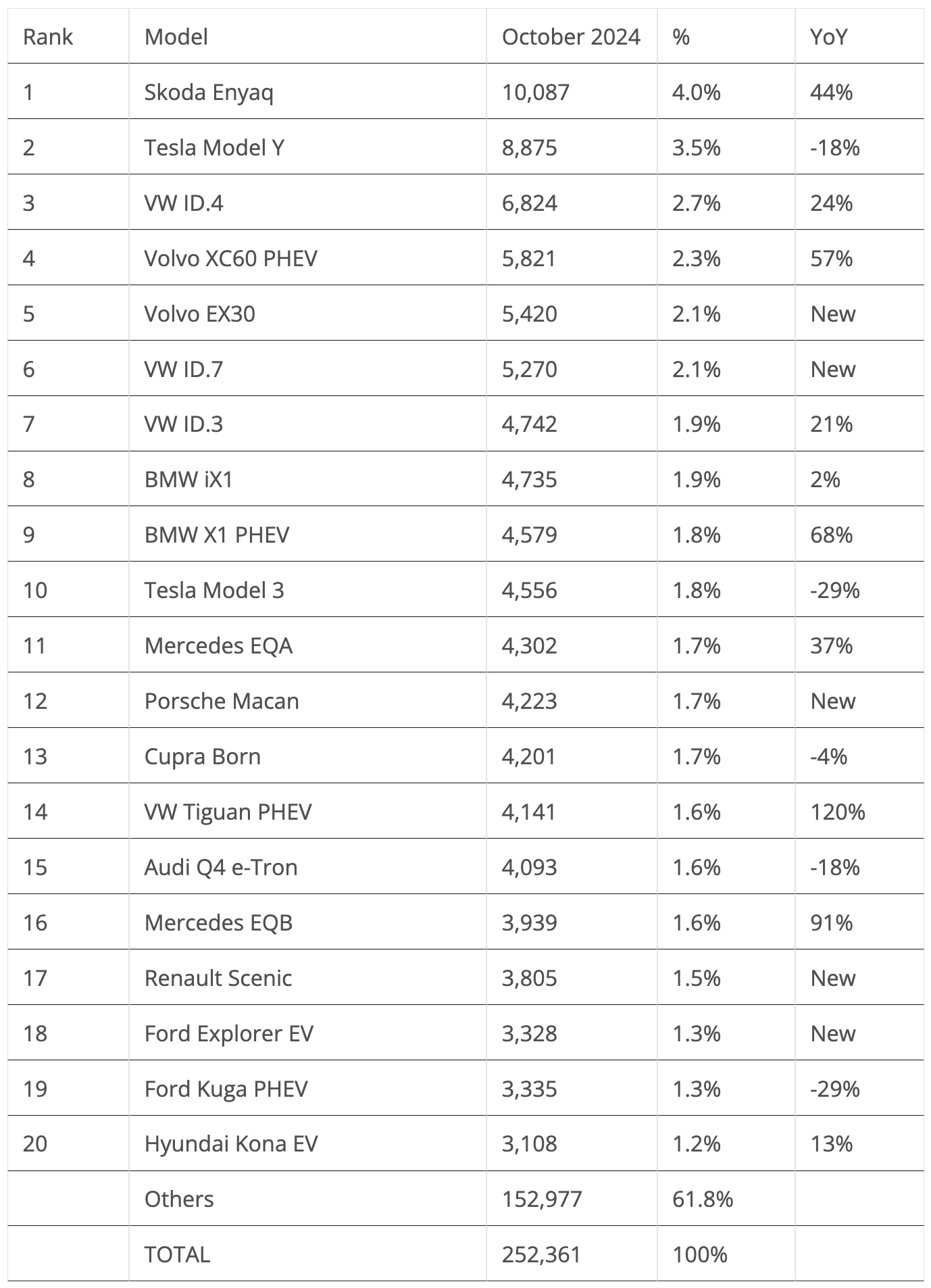

Some 252,000 plugin vehicles were registered in Europe in October, rising 2% year over year (YoY), which represents the EV market’s second month of growth since April.

Interestingly, BEVs are the ones pushing the market upwards, growing 7% YoY to 170,000 units. PHEVs remain stuck in red, falling 7% in September to 83,000 units.

As such, October saw the plugin vehicle share of the overall European auto market reach 24% (16% full electrics/BEVs).

These results kept the 2024 plugin vehicle share at 22% (15% for BEVs alone) through the end of October.

Finally, looking at the sales breakdown between BEVs and PHEVs, pure electrics represented 67% of plugin sales in October, in line with the 2024 tally. With new or refreshed models landing soon for both powertrains — namely, cheaper BEVs and longer range PHEVs — and new CO2 ceilings in Europe, it will be interesting to see how the two technologies behave next year.

For more information on the current behavior of BEVs in the European Union, and how incentives influence sales, please check out this EAFO article. Spoiler alert: I can say that it is a tale of two EV markets: Germany on one side, and the rest of the European Union on the other.

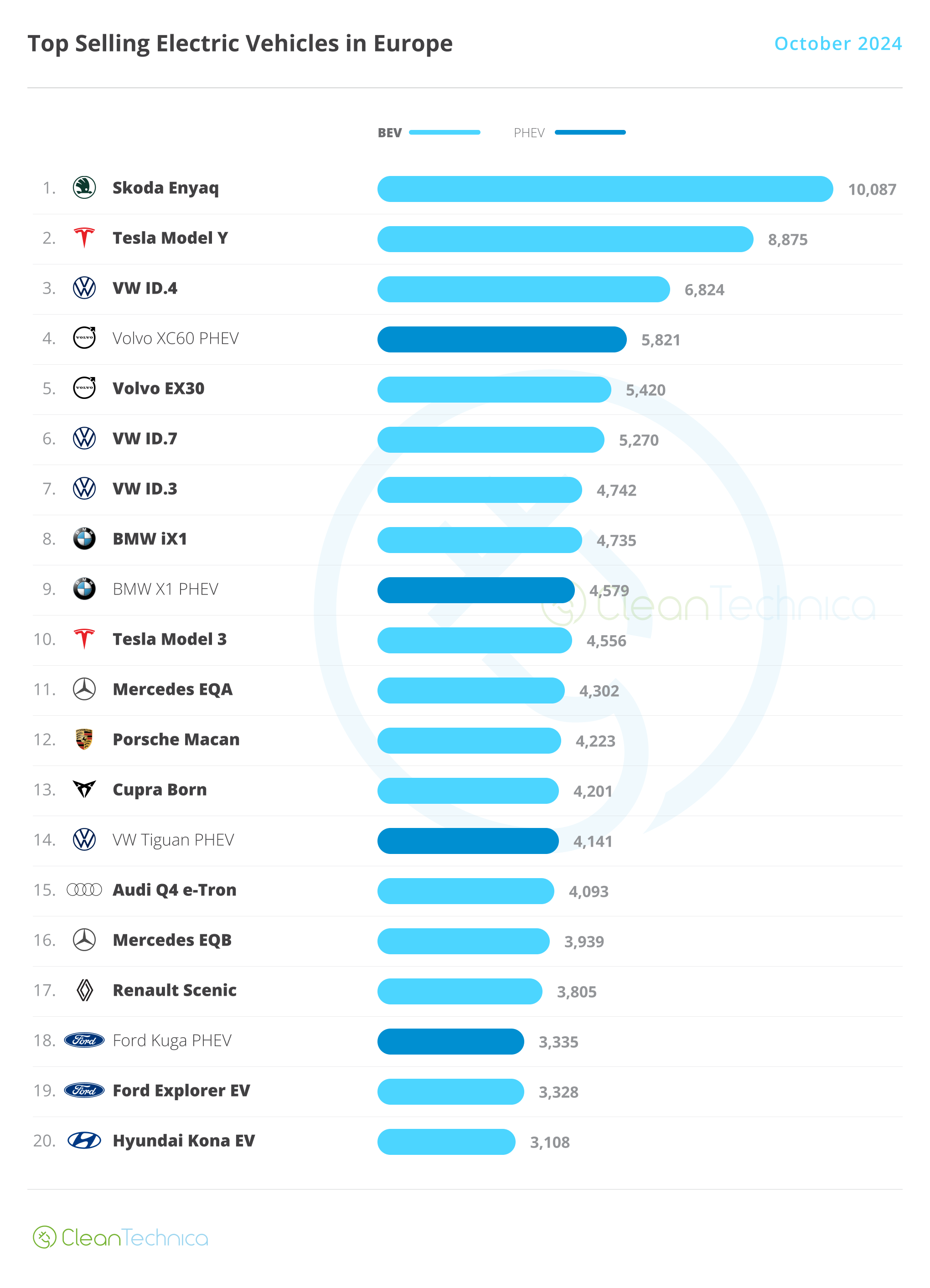

The big highlight of the month was the Skoda Enyaq, nabbing a win and ending a two-year(!) winning streak of the Tesla Model Y in Europe:

#1 Skoda Enyaq — Skoda’s crossover has returned to form, scoring a record 10,087 registrations in October, which represents 44% growth YoY. This is only the second time the Czech model has hit a five-digit result in a single month, after the 10,085 unit score of September. What is even more impressive in the value for money king’s performance is that its younger, slightly smaller, and cheaper Elroq sibling is landing soon. Even if Enyaq sales drop from now on, the potential for Skoda to become a serious contender in the European EV market has been demonstrated. A top 5 position for the Enyaq is not only possible, but likely, for 2024, and it can even make an attempt at stealing the bronze medal from the Volvo EX30 in the last two months. … That will depend a lot on how the landing of the Elroq affects it.

#2 Tesla Model Y — It had to end someday, and that day month was October. After over 20 consecutive wins as the best selling EV in Europe, Tesla’s crossover lost the monthly prize to the Skoda Enyaq last month. The midsizer had 8,875 registrations, which was down 18% YoY. Remember when I mentioned that 2023/24 would be considered the “peak Model Y” period in Europe? Tesla’s midsizer has hit the market’s natural limits. Sure, the refreshed Model Y version, said to land early next year, will bring a second youth to it, but do not expect the Model Y’s performance to go much above what it once was. From now on, expect the leader of the European EV market to stay on top in the foreseeable future, but with smaller winning margins as the increasing competition erodes the Model Y’s sales.

#3 VW ID.4 — The compact crossover won a podium presence in October, with the MEB platform model scoring 6,824 deliveries, 24% growth YoY. This allowed Volkswagen Group to place two models on the podium, with the Skoda Enyaq winning gold and the ID.4 bronze. With improved specs and lower prices, the German EV is once again competitive, even if its Czech cousin is outselling it. … Hey, you can’t win them all, right?

#4 Volvo XC60 PHEV — Volvo’s midsize PHEV delivered 5,821 units, a new record for the Swedish model and a 57% increase YoY, which is a small feat for an SUV that has been on the market since 2017…. And it’s a good omen for the Volvo EX60, said to land in 2026. The XC60 PHEV doesn’t have a class-leading EV range. At 77 km, it is far from the 100+ km range of the most recent Volkswagen Group and Mercedes plugin-hybrids. After all, one cannot expect miracles with a 19 kWh battery. It is nevertheless an improvement over the previous PHEV leader in Europe, the Ford Kuga PHEV, which has 48 km of electric range. Although, something tells me that the 2025 category win will fall to one of the Volkswagen Group models.

#5 Volvo EX30 — The China-made (but with a Swedish passport) crossover is slowing down, scoring 5,420 registrations in October. It seems that the China tariffs have somewhat hurt the crossover’s performance. Before the start of the tariffs, the EX30 was on a roll, with three consecutive scores above 8,000 units/month. After the start of the tariffs, the Volvo EV hasn’t managed to reach that same level of registrations.

Looking at the rest of the October table, a few models deserve a mention, like the continued good results of Volkswagen’s new ID.7, which had a near-record performance, 5,270 registrations, allowing it to end in 6th. With the GTX versions now being delivered, and AWD being standard in these versions, expect its sales to grow significantly in Scandinavia, which might allow it a top 5 presence sometime in the future.

Still on the Volkswagen brand, the make placed four representatives in the top 20, with the ID.4 in 3rd, the ID.7 in 6th, the ID.3 in 7th, and the Tiguan PHEV in 14th — and with a record to boot, thanks to 4,141 units. Add the win of the Skoda Enyaq, the 12th place of the Porsche Macan (Wait, what?!? Yep, Porsche delivered 4,223 units of its SUV in its second full month…), the 13th spot of the Cupra Born, and the 14th position of the Audi Q4 e-tron, and we have eight models from the Volksagen Group galaxy in the top 20, two of them on the podium. This is quite possibly the OEM’s best performance in years.

Elsewhere, Mercedes also had a positive month. The EQA ended at #11, with 4,302 registrations, while its 7-seat sibling, the EQB, ended the month in #16, with a record 3,939 units. The EQB is quite possibly the most interesting electric Mercedes in the lineup, not because it offers class-leading specs, but when you look at value-for-money, it is the best of them — one of the reasons on why it is leading the 7-seater class.

Renault also had something to celebrate, While the 5 hatchback is still in early stages of production, the Scenic MPV crossover joined the table at #17 thanks to a record 3,805 units, ending right above the also new Ford Explorer EV.

An interesting fact about this top 20 is that there are five models that weren’t present 12 months ago (Volvo EX30, VW ID.7, Porsche Macan, Renault Scenic, and Ford Explorer EV). So, although the European market is not as feverish with new vehicles as China’s EV market, it is unfair to say that nothing happens.

And 2025 should bring even more novelties, especially in the lower segments.

Below the top 20, this time there isn’t much to say, with the exception being the ramp-up of the new Audi Q6 e-tron, which had 2,893 deliveries in October. In isolation, that’s not a bad number, until you realise that its Porsche cousin, the Macan, started the ramp-up later and is now delivering higher volumes than its Audi relative.

Is this a case of Porsche being more agile in ramping up production, or is demand for the Leipzig-made Porsche just that much higher than for the Audi?… With the fossil-powered Macan’s peak sales year being 2017, with 27,000 units in Europe, expect the midsize SUV to stabilize sales around 2,000 units/month. This 12th spot in October should have more to do with pent-up demand for the new BEV model than a long-term indication of sales.

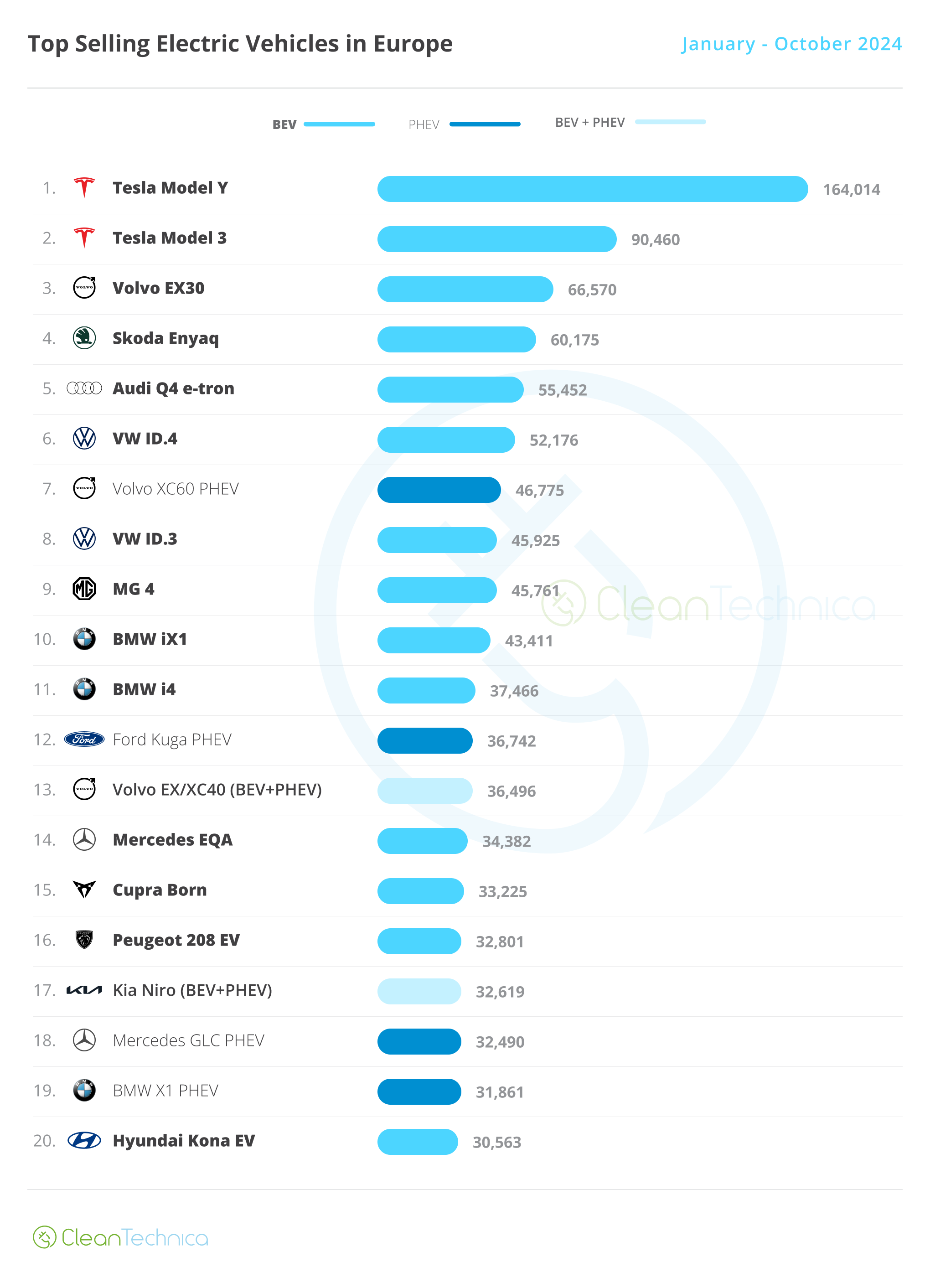

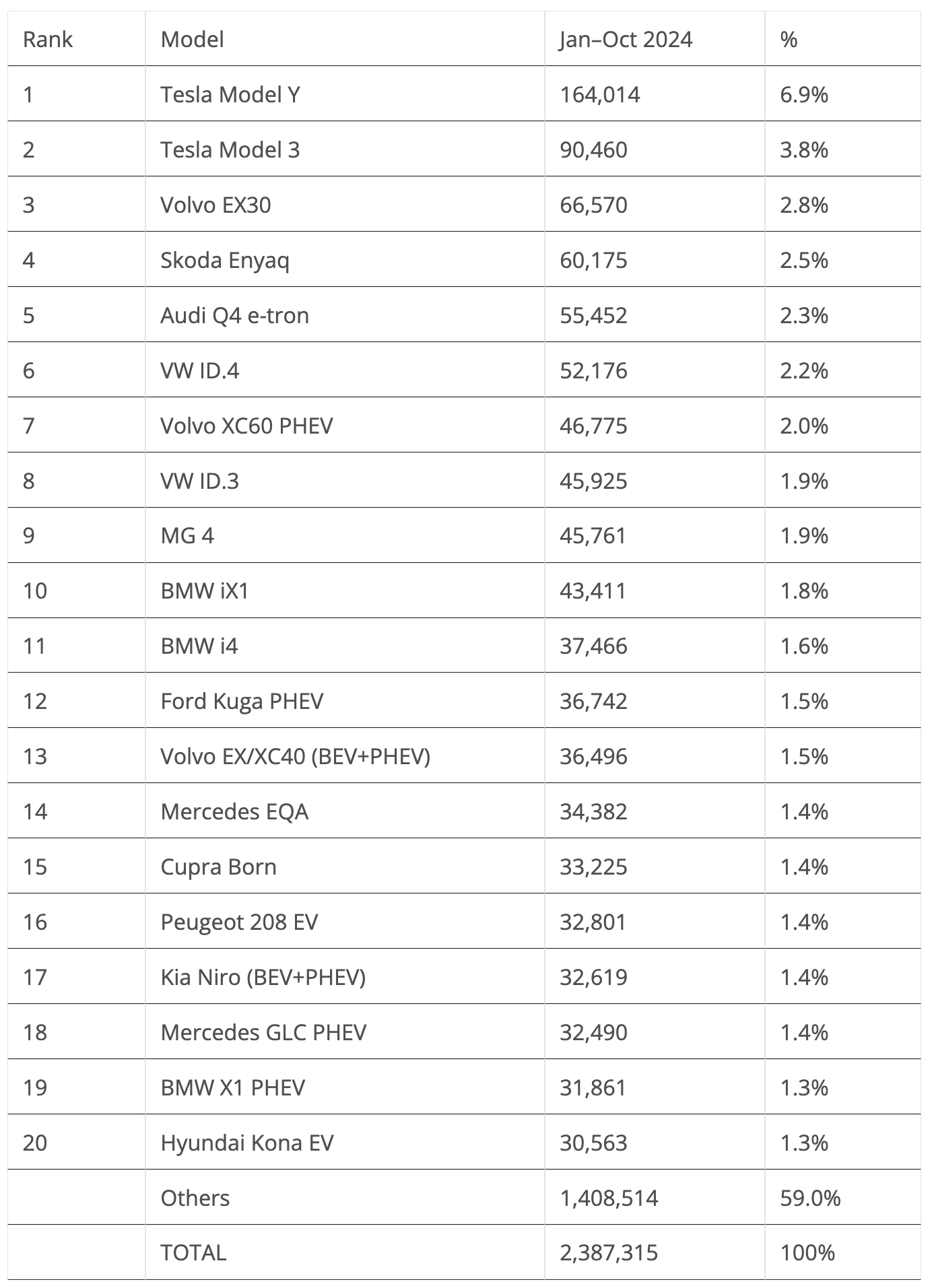

Looking at the 2024 ranking, with the leader, the Tesla Model Y, having a 70,000-unit lead over the runner-up Tesla Model 3, the US crossover is set to win its 3rd best seller title in a row.

Below it, the Tesla Model 3 has also secured the runner-up position, having kept an advantage of some 23,000 units over the #3 Volvo EX30. Tesla will have a gold plus silver finish in Europe this year, repeating the feat of 2022 and 2023.

2025, though? That will be harder. Not because of the Model Y, which should remain on top, but next year, the Model 3 will be met with increased competition, starting from the refreshed Model Y. Also, a number of new, lower priced EVs, are expected to be sold in large volumes. So, if gold won’t be a topic of discussion next year, the remaining two podium positions will be.

The first position change happened in the 4th spot, with the Skoda Enyaq climbing another position at the cost of the Audi Q4 e-tron, which had a slow month in October — 4,093 units, down 18% YoY. With the Czech model some 6,000 units behind the #3 Volvo EX30, the Skoda has a shot at joining the podium, especially since the Swedish EV seems to be suffering from the China tariffs. It will be an interesting race to follow until the end of the year.

Still on the topic of the top 10, the Volvo XC60 PHEV jumped to 7th. With some 10,000 units of advantage over the Ford Kuga PHEV, the Swedish SUV is ready to succeed the Ford model as the best selling PHEV in Europe.

In the second half of the table, benefitting from the end of the road Kia Niro and the slow sales of the Peugeot 208 EV, the Mercedes EQA and Cupra Born jumped a few positions in the table, with the German EV jumping to #14 while the German-born Spaniard was up to #15.

Finally, in the bottom positions of the table, the Hyundai Kona EV was surpassed by the BMW X1 PHEV, which was up to #19.

Comparing the European plugin top 20 with the overall top 20, there is a disconnect. In the overall market, half of the top 20 models are coming from the B-segment (subcompacts). On the plugin table, only one model comes from that category.

On the flipside, in the plugin top 20, there are five midsize (D-segment) models, while on the overall best sellers table, there are no D-segment representatives….

Plugins are still skewed towards the most expensive models, so the EV market needs more affordable models to reach higher volumes, if we want to see Europe follow on China’s steps.

Still on the overall market, looking at the October ranking of OEMs, the best selling make with highest growth rate was #9 Volvo, with a 23% growth rate, to 30,000 units. On the opposite side, the #15 Jaguar Land Rover Group was down by 22% YoY, to 10,000 units (Jaguar alone is down 27%…), #2 Stellantis was down 17% to 150,000 units (in it, Fiat was down a worrying 45%…), and #8 Ford was down by 14% YoY, to 35,000 units, endangering the US brand operations in Europe (well, who told them to kill the Ford Fiesta?…). In the latter case, that added to Ford’s current sales blues in China (#34, with sales down 23% YoY). This is all making its future prospects in export markets rather negative.

The same can be said about the future of smaller Japanese makes in Europe. #13 Suzuki (-11% YoY, down to 15,000 units) and #14 Mazda (-13%, down to 12,000 units) were both down by double digits. In the latter case, its Chinese operations are in the toilet (#48, sales down 45% YoY). So, in a couple of years, we might see Mazda closing shop in both China and Europe.

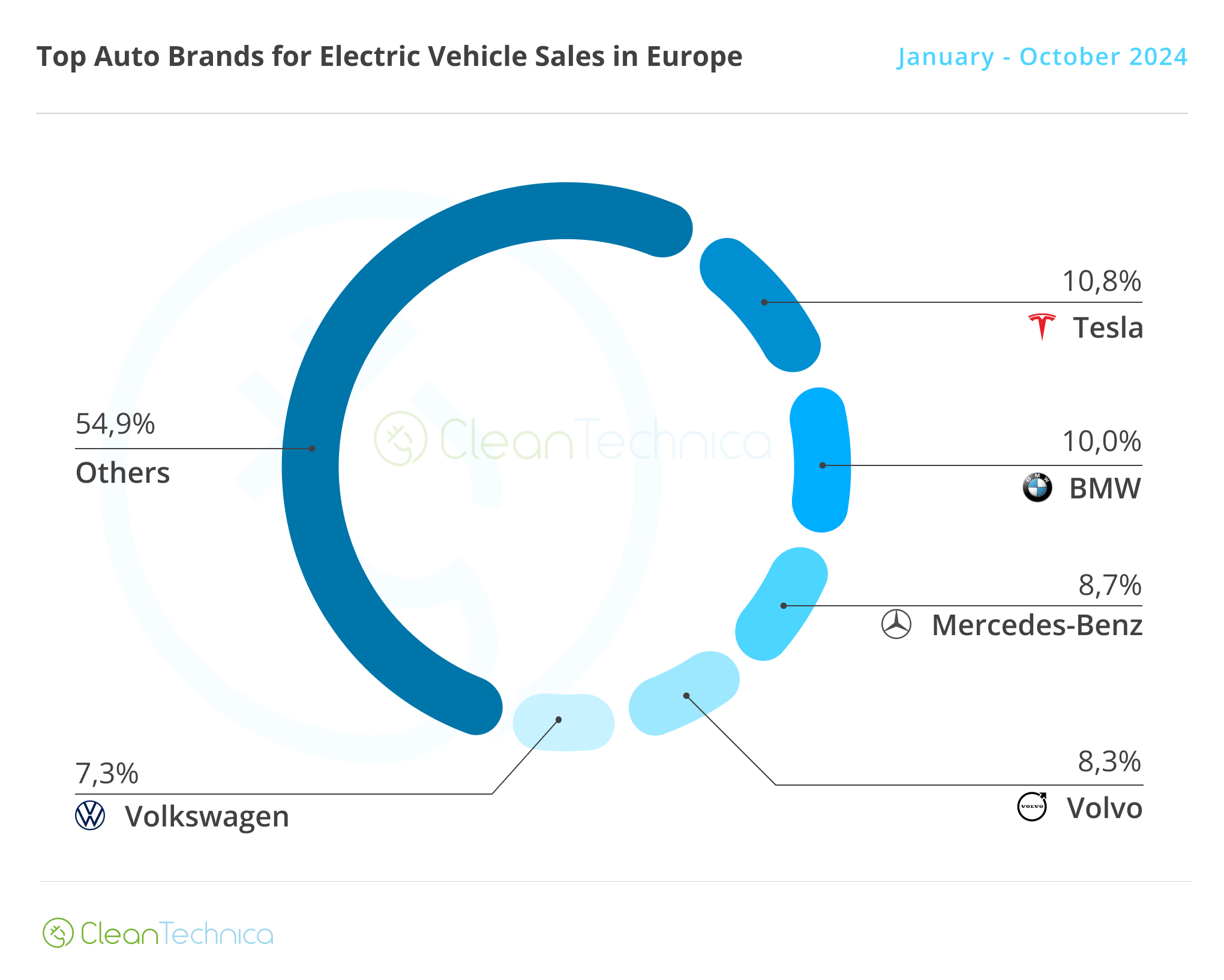

As for the plugin auto brand ranking, Tesla had its usual beggining-of-quarter slump (10.8% in October vs. 11.4% in September), but it secured enough distance to win yet another title this year, its third in a row. Still, compared to the previous year, its share eroded significantly (it had 12.1% share twelve months ago). So, looking at 2025, the US make should have a harder time renewing the title.

Behind the US make, only Volkswagen gained share, going from 7% in September to its current 7.3%. The Wolfsburg make is recovering, but it is still 0.9% share behind its score a year ago (7.3% now vs. 8.2% then).

With Volkswagen having been on the European podium almost every year since 2015 (with the exception being 2019), the German brand is expected to end this year in 5th.

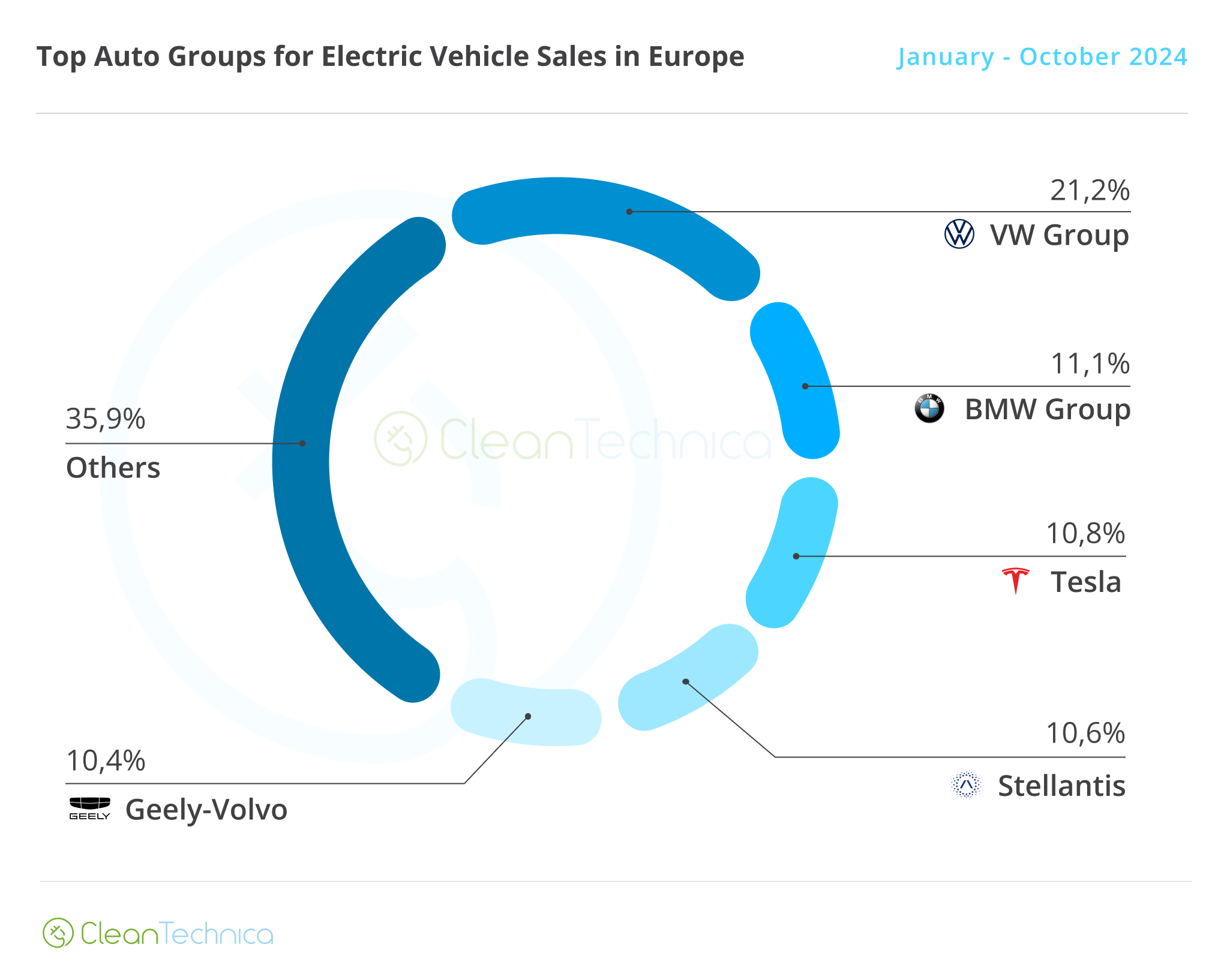

Arranging things by automotive group, Volkswagen Group is in the lead, with 21.2% share (up from 20.8% in September).

Tesla (10.8%) lost one position in October, to 3rd, to the benefit of BMW Group (11.1%). So, there should be an interesting race happening here, especially considering that #4 Stellantis (10.6%) might rebound in December if the ramp-ups of its new, cheap EVs happen.

#5 Geely–Volvo (10.4%, down 0.1%) is stable in 5th, and it is betting on troubles continuing at Stellantis to catch it by year end.

As such, Stellantis can either finish the year in 2nd or 5th, all depending on the production ramp up of its new EVs.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy