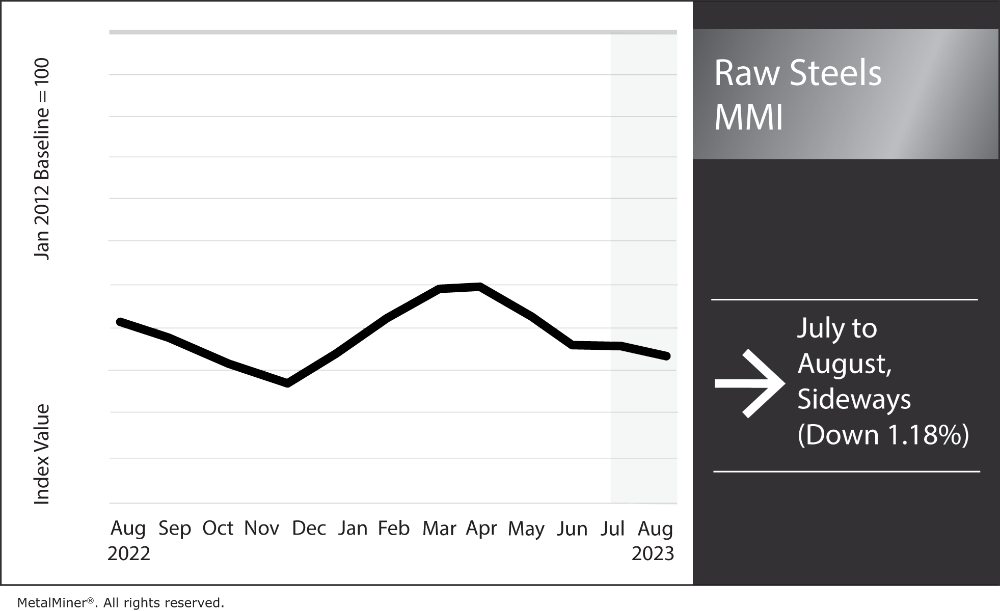

The Raw Steels Monthly Metals Index (MMI) moved sideways, with steel prices experiencing a modest 1.17% decline from July to August.

Flat-rolled steel prices seemingly found a bottom at the end of June before experiencing a modest increase. By mid-July, prices returned bearish, edging downward during the remainder of the month. HRC prices ultimately traded down, with an over 3% month-over-month decline. However, CRC and HDG prices moved sideways, with more modest overall price movement. Meanwhile, plate prices remained flat, falling roughly 1% back to where they stood at the end of Q1. If you regularly purchase plate, HRC, HDG or CRC, make sure to time your purchases correctly with expert sourcing advice using the Monthly Metals Outlook report. View a free sample and subscribe.

U.S. Steel Receives Multiple Buyout Offers, Cliffs Gets Exclusive USW Support

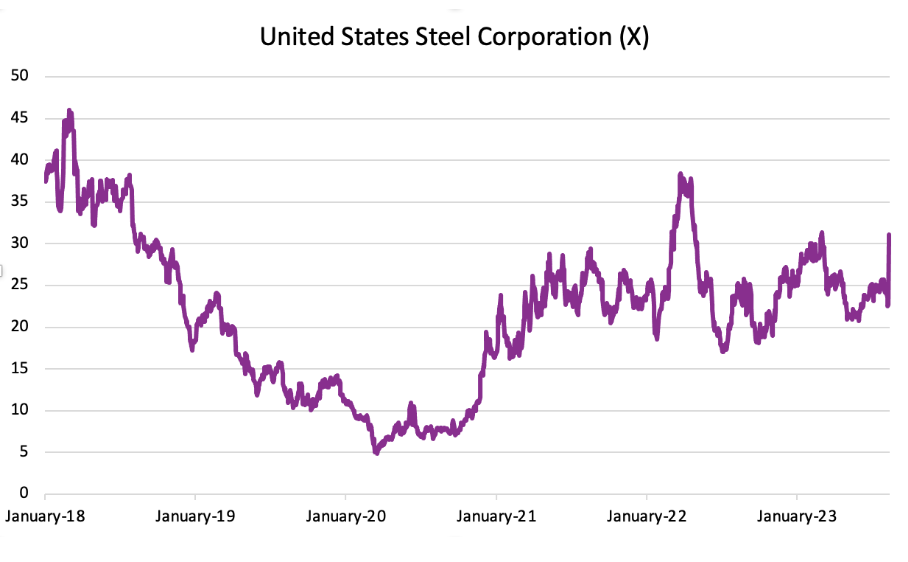

In what is arguably the biggest industrial metal news story of 2023, U.S. Steel received two offers to buy in mid-August. The first came from Cleveland-Cliffs, but was soon followed by a second offer from Esmark Steel Group. Although subsequently rejected, Cliffs offered $7.3 billion for the century-old company on July 28. After Cliffs’ made their offer public, Esmark made an all-cash, $7.8 billion bid on August 14. Esmark’s offer will reportedly expire on November 30.

U.S. Steel has faced a number of challenges in recent years, which have impacted steel prices. Prior to the buyout offers, shares of the company fell over 24% over the last five years. Indeed, Q2 2023 marked the fifth consecutive quarterly decline in profits. Meanwhile, the announcement of the two offers saw company shares jump to their highest level since March.

What a Cliffs Acquisition of U.S. Steel Would Mean

An acquisition of U.S. Steel by Cliffs, in particular, would have substantial implications on the overall market. Indeed, such a merger would make Cliffs the largest steelmaker in the U.S., overtaking Nucor. It would also make the company the 10th largest steel company in the world. Absent any capacity cuts, Cliffs would gain an estimated 30% of the overall domestic market share. The buyout would also position Cliffs as the leading supplier for multiple industries and give the company near total control over U.S. iron ore production. Make sure to stay posted on the Cliffs/U.S. Steel acquisition negotiations through MetalMiner’s weekly newsletter.

Although its initial bid was deemed “unreasonable” by U.S. Steel CEO David Burritt, Cliffs enjoys the exclusive support of the United Steelworkers (USW) union. In an interview, USW International President Thomas Conway stated, “I was adamant that the Cliffs bid is the only one the union will consider due to its synergies and the fact that it best preserves blast furnace and steelmaking capacity and the jobs of USW members.” Conway added that the union “is committed to that proposal, and the USS board should move quickly to conclude this transaction.”

How Fewer Producers Would Impact Steel Prices

Consolidation is certainly not new to the industry. Back in 2020, Cliffs acquired the U.S. operations of both AK Steel and Arcelor Mittal. U.S. Steel, meanwhile, purchased Big River Steel around the same time. These buyouts came shortly after steel prices began the historic uptrend that saw them reach all-time highs. In order to gauge where steel prices are heading to negotiate your 2024 contracts with power, learn about MetalMiner Insights.

Experts attribute most of that uptrend to the “bullwhip effect,” which stemmed from demand starting to turn around following early-pandemic lows. However, the supply chain began to regulate over recent years, with steel prices retracing from their respective peaks. Therefore, the current trading range for flat rolled steel prices remains significantly elevated from before the 2020 acquisitions. Moreover, since August 2022, the average hot rolled coil price has remained almost 40% above the levels recorded between 2012 and December 2020.

Could a Cliffs Buyout See the Correlation Between Plate and HRC Return?

While it certainly has its own nuances, the plate market also poses an interesting comparison. Both HRC and plate prices experienced a similar outsized upside following the pandemic. Indeed, up until mid-2021, the two price points boasted a correlation of more than 86%. Meanwhile, the plate market, which is smaller and has fewer major players, peaked later than HRC prices. This was because fewer producers means each has more control over both capacity and prices. When prices started to invert, the plate market saw considerable friction, partly due to market discipline among producers. The result was very slow downside movement over the last few years, pushing the spread between the two prices to a staggering $750/st as of mid-August. Understand how long-term trends like these impact the steel industry by reading about how procurement professionals use AI to gain invaluable market insight.

HRC Steel Prices in Decline

Sticker plate prices have since translated into the complete erosion of the correlation with HRC prices. In fact, from mid-2021 to now, the correlation plummeted to a negligible 27%. Of course, plate prices have and will continue to see the lion’s share of benefits from infrastructure spending. Indeed, this is partially to blame for the current bifurcation of markets. However, considerable spending related to the IRA remains tied up, which offers no benefit to plate demand.

Curiously, the correlation between HRC and plate mill lead times did not experience the same level of erosion. Instead, the correlation between plate prices and their respective mill lead times began to break down (Understand how correlations like these impact the steel industry as a whole by reading about metal price indexes). This suggests the supply-demand balance has less of an influence on the plate market, especially amid a falling (albeit slowly) and seemingly oversupplied market. Should Cliffs find a way to acquire U.S. steel, it would likely raise the floor for steel prices and give steelmakers much more control over the overall momentum and direction of price action.

Biggest Movements in Steel Prices and Raw Materials

- Chinese coking coal prices saw the largest increase of the index, rising 10.67% to $319 per metric ton as of August 1.

- Chinese HRC prices rose 5.59% to $580 per short ton.

- Chinese steel slab prices saw a 3.39% increase to $616 per metric ton.

- Oppositely, standard Korean steel prices fell 3.59% to $276 per metric ton.

- After Midwest HRC future prices saw the largest increase of the index last month, prices inverted to the downside. Overall, they dropped 12% to $779 per short ton.