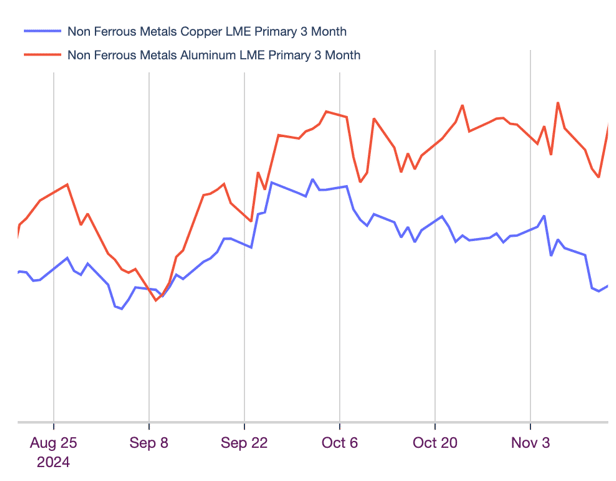

The Aluminum Monthly Metals Index (MMI) steadied, with a 1.38% rise from October to November.

Aluminum prices moved sideways during October. While they only managed a 0.99% rise, aluminum still managed to outperform other base metals during the month. However, prices started to slip by mid-November as they echoed the increasingly bearish trend emerging in markets like copper, nickel, zinc and tin.

Gain access to expert-driven aluminum market insight, ensuring your company is well-informed and prepared to tackle wavering demand. Opt into MetalMiner’s free weekly newsletter.

China to End Export Rebates for Aluminum and Copper

Effective December 1, China will end export rebates for aluminum and copper products. The mid-November announcement came as a surprise to markets, which saw copper and aluminum prices jump as a result. Chinese aluminum prices typically sit at the bottom of the market. However, the end of export rebates could reduce the share of Chinese aluminum that ends up on the global market, which would offer support to global prices.

Although China offered no reason for the changes, markets have started to speculate the move came as a response to the reelection of former President Trump. As many expect Trump to ramp up trade barriers against China in the coming years, the end of rebates could benefit China in negotiations amid longstanding accusations of unfair industrial subsidies and trade practices. This, in some ways, validates the use of tariffs to increase leverage over foreign governments.

Cut aluminum expenses without compromising quality using the Monthly Metals Outlook report. Start with a free sample report and subscribe for ongoing savings.

China, Tariffs and a Tale of Two Administrations

Historically, China has used subsidies and state control over industries to undercut global prices. According to the Organisation for Economic Cooperation and Development (OECD) recent report, “The growing weight of [state enterprises] is especially visible in heavy industries such as steel and aluminum, where firms having 25% or more government ownership generated nearly half of all revenue among sampled firms in 2022.”

According to a number of foreign material brokers, tariffs have increasingly priced Chinese material out of the U.S. market. The most recent U.S. tariffs announced under the Biden administration went into effect on September 27, 2024, increasing Section 301 duties on Chinese steel and aluminum to 25%.

That said, import data has yet to show a meaningful and sustained decline in the share of Chinese aluminum relative to the total imports into the U.S. However, this could change due to moves by both the U.S. and China.

Alumina Prices Remain Elevated Amid Supply Uncertainty

China’s recent export ban comes alongside another bullish driver for the aluminum market as skyrocketing alumina prices, a raw material for aluminum, continued to offer support to the aluminum market last month. An export stoppage in Guinea, which followed supply constraints elsewhere, sparked supply fears. While alumina prices have retreated from their peak in recent days, they nonetheless remain elevated, pushing up producer costs.

Prior to the export halt, Guinea served as a leading supplier to China, accounting for an estimated 70% of Chinese bauxite imports in 2023. However, Guinea provided no information regarding why they are halting exports or how long the halt will last. Some speculate this could be part of a larger strategy to attract foreign investments to the African nation, akin to the strategy employed by Indonesia over recent years. If that’s the case, then the halt may become permanent.

On September 5, 2021, Guinea sparked fears of similar supply constraints when the military junta took power following a coup. Markets worried it would translate to a supply disruption, although the new regime assured the mining industry that there would be no impact on trade. Aluminum prices showed only a short-lived spike in the days that followed the coup before market concerns abated.

Some Analysts See More Behind the Scenes in Guinea

Regarding Guinea, it appears the U.S played a controversial role in the regime changes. According to reports, witnesses saw U.S. forces training the soldiers who went on to foment the coup. Guinea also supplies bauxite to the U.S., although not to the extent it does to China.

This is because Chinese primary aluminum capacity far outpaces that of other countries by orders of magnitude. Following the profitability-related January 2024 curtailment of Missouri’s New Madrid smelter, the U.S. had only four primary aluminum smelters in operation.

A protracted export stoppage could force China to curb production, which producers outside of China, including in the U.S., would likely see as beneficial due to continuing complaints about the impact of Chinese overcapacity. As of September 2024, data from the International Aluminum Institute showed Chinese production remained up year-over-year, although that could change in the coming months. China accounted for nearly 60% of global primary production compared to the 5.39% produced in North America.

Are you under pressure to generate aluminum cost savings? Make sure you are following these 5 best practices.

What’s Next for Aluminum Prices?

Both the end of Chinese export rebates and alumina supply constraints appear to be bullish market signals. However, the extent to which they will influence global prices remains to be seen. They may likely see aluminum prices continue to outperform other base metals, although that may not necessarily mean rising prices, particularly as the base metal category appeared increasingly bearish as of mid-November.

Biggest Aluminum Price Moves

- Chinese aluminum billet prices moved sideways, with a 1.5% rise to $3,108 per metric ton as of November 1.

- Indian primary cash aluminum prices witnessed a 0.9% increase to $2.87 per kilogram.

- Chinese primary cash aluminum prices rose 0.88% to $2,924 per metric ton.

- European commercial 1050 aluminum sheet prices fell 0.88% to $3,647 per metric ton.

- European 5083 aluminum plate prices slid 1.35% to $4,646 per metric ton.

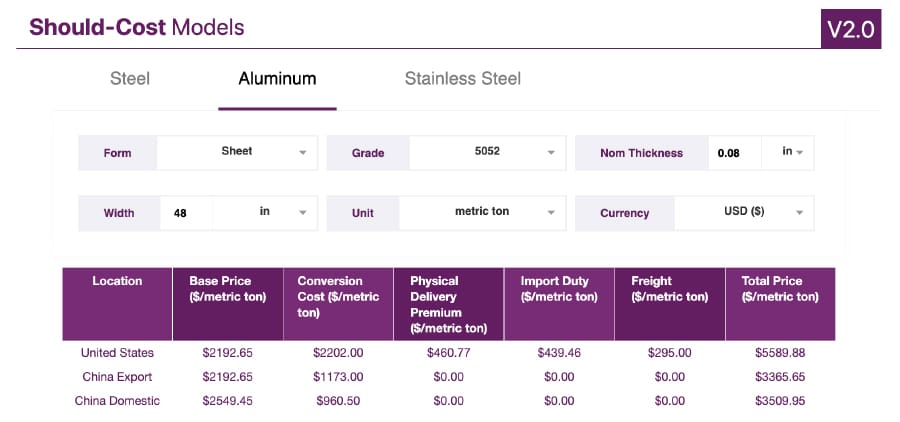

MetalMiner should-cost models: Give your organization levers to pull for more aluminum price transparency, from service centers, producers and part suppliers. Explore the models now.