Steel news outlets recently discovered that longs and semis producer British Steel recently acquired natural resources to sustain production at its Scunthorpe plant through 2025. “At the same time, we remain in active discussions with the government, working together to ensure British Steel continues to play a vital role in meeting the UK’s infrastructure needs,” the company stated in a November 12 press release.

The announcement follows reports that parent company Jingye Steel was considering exiting the plant. Discussions 4 between the UK government and the Beijing-headquartered Jingye Steel took place during the week of November to ensure British Steel remains operational. According to a November 9 report from the business daily Financial Times, the main point of concern is financial assistance from the government to convert the plant to green steelmaking.

Ditch inaccurate steel price forecasts for targeted precision and save on you 2025 COGS with MetalMiner Insights. View our full catalog of metals.

Scunthorpe’s EAF Switchover Could See More UK Government Support

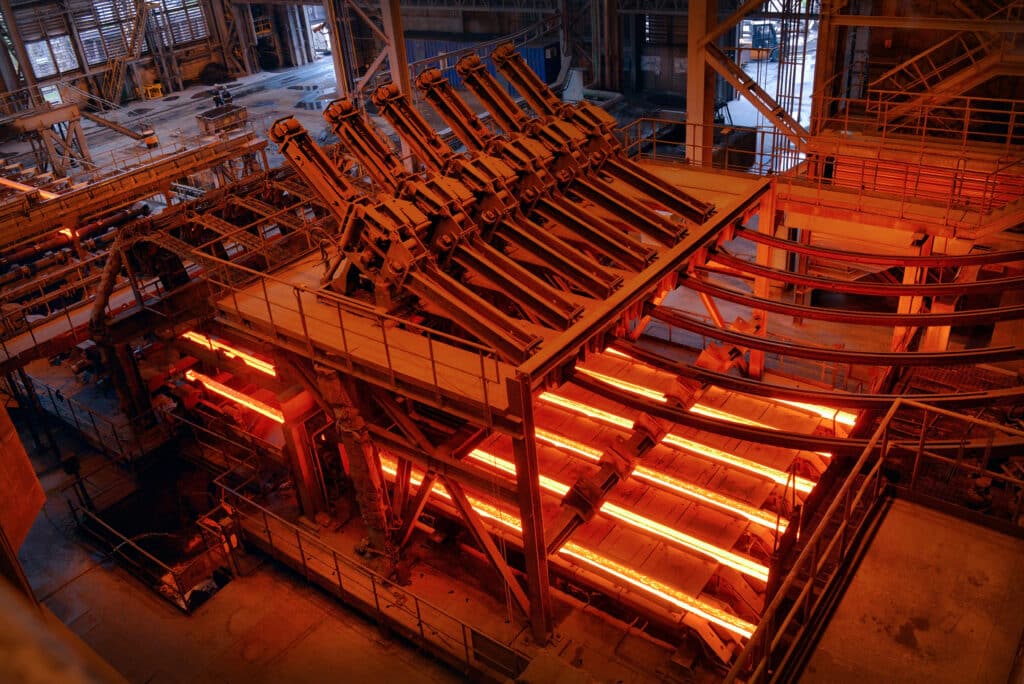

In November 2023, Jingye announced its proposal to replace the two operating blast furnaces at the British Steel plant with electric arc furnace (EAF) technology as part of a £1.3 billion ($1.67 billion) project. This followed Jingye’s acquisition of the plant from London-headquartered Greybull Capital in 2020.

Steel news reports indicate that UK government’s projected state assistance for the project was approximately £300 million ($385 million). This is 40% less than the £500 million ($643 million) Tata Steel received for the installation of two new electric furnaces at its Port Talbot plant in southern Wales.

The government is now considering increasing aid to Scunthorpe to as much as £2 billion ($2.5 billion), which would amount to 80% of the UK’s “war chest” for greening the steel sector, the Financial Times report noted.

Get all of the latest steel market price trends from MetalMiner’s free Monthly Index report. This monthly report contains monthly price-indexes for 10 different metal industries, including aluminum, copper, steel and nickel.

Steel News Reveals Heavy Losses for British Steel

British Steel had initially planned to keep the two operating blast furnaces running while installing EAF technology. However, financial losses from the site prompted Jingye to announce in September that it was considering abandoning the EAF project and shutting down the blast furnaces before the year’s end.

In a September 18 report, the Financial Times stated that British Steel suffered a loss of £408 million ($520 million) for 2022, more than seven times higher than the £49.5 million ($63 million) loss recorded in 2021. The report stated that revenues for the steel industry leader were £1.7 billion ($2.23 billion) and £1.5 billion ($1.95 billion) for 2022 and 2021, respectively.

Meanwhile, European mills’ offer prices for hot rolled coil in late October were about €600 ($635) per metric ton ex-works, down 25% from early 2024. This was mainly due to higher interest rates, elevated energy prices and economic slowdown in Germany.

Crush your competition by getting access to weekly exclusive steel market intel and the latest steel news. Opt into MetalMiner’s free weekly newsletter.

British Steel Hopes to Remain a Steel Industry Leader After Green Transition

British Steel’s main site at Scunthorpe is located approximately 300 kilometers (184 miles) north of London, in Lincolnshire. The plant has four blast furnaces, named after four of the UK’s queens—Mary, Bess, Anne, and Victoria—with a combined annual capacity of 4.7 million metric tons, though only two are currently operational.

Three 330-metric-ton basic oxygen furnaces at the site can produce about 4.3 million metric tons of crude steel, which is cast into slabs and billets. According to information from the company’s website, Scunthorpe rolls sections, rails, merchant bar, and wire rod for the construction, automotive, and engineering sectors in various global markets further downstream.