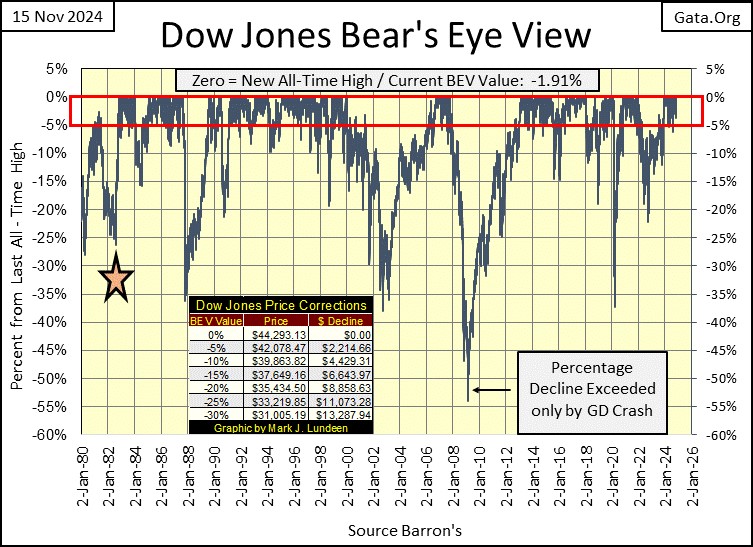

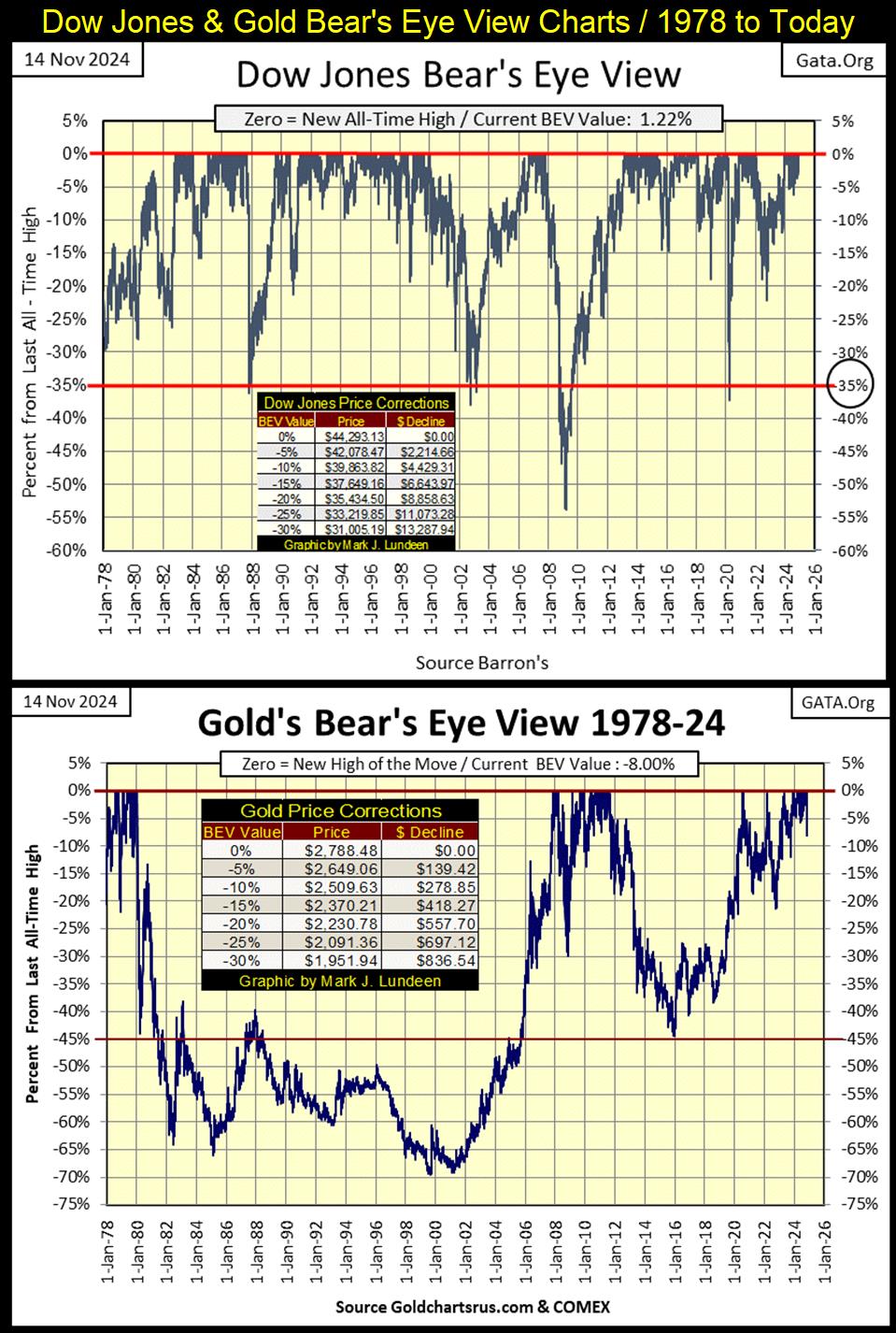

The Dow Jones all this week, closed daily in scoring position in its BEV chart below, between the BEV 0.0% and -5.0% lines, closing on Friday with a BEV of -1.91%. Which leads me to believe the Dow Jones, my proxy for the broad stock market, has more upside before it sees its ultimate, and last all-time high of this advance; its Terminal Zero (TZ).

What is a TZ? There are a few of them to be seen in the BEV chart below; where the Dow Jones forms a cluster of BEV Zeros along its Red 0% line, to then see the BEV plot breaking BIG below its BEV -10% line. The last BEV Zero of the cluster, is the Terminal Zero (TZ) of the advance, its last all-time high.

Looking at the Dow Jones below in daily bars, for the week, except for Monday’s advance into a new all-time high, the Dow Jones lost ground. However, following last week’s huge advance, seeing the Dow Jones correct a bit is completely normal.

As long as the Dow Jones remains above its BEV -5% line, it’s best assuming this advance is a continuing advance. And should it fall below its BEV 10% line below, it’s best to sell most of what you have, if not all of it, and take your profits home with you. Don’t be in a hurry to come back either.

So far in the 21st Century, there is too much debt being carried by someone or something in the economy. Using the US National Debt as an example, in January 2000, it was $5.73 Trillion dollars. At this week’s close, a quarter of a century later, it’s now $35.96 Trillion dollars. I don’t believe I’m being reckless assuming similar increases in debt would be found for corporate debt, student loans, credit-card debt, etc, etc, etc.

The entire purpose of a bear market is, to stress test everyone’s and everything’s balance sheet. And for those items found on the asset side of peoples, and institutions’ balance sheets that fail this stress test, they are written off as losses. Corporations, institutions and individuals will become bankrupted in this process, or did until the Powers-That-Be, allowed the FOMC to invent their Quantitative Easing, in response to Mr Bear’s 2007-2009 stress test of the sub-prime mortgage bubble.

Historically, if not recently, here is what Mr Bear does for everyone in a bear market; he evaluates whether those individuals, and institutions, who during the good times can pay their bills, can also service their debt, make their payroll, and pay their utility bills when the economy turns down, when their income, and revenues go down with the decline in the economy.

This is a painful, but necessary process, to prevent the economy, and banking system from becoming bogged down with past loans, that in the retrospect of a bear market, should never have been made.

These past loans, that in retrospect should have never been made, are something that in 2024, the world holds in great abundance on balance sheets as far as the eye can see. Mr Bear in the next bear market, intends on cleaning up this mess. To do so, will prove to be a very ugly, and painful process for all involved. I’m talking about you, me and all the billionaires in Silicon Valley, as market valuations for stocks, bonds and real estate deflate to levels that cannot be believed today.

That is unless, a gaggle of idiots at the FOMC, decide to once again “stabilize market valuations,” with a massive “injection” of monetary inflation into the financial system, as they did with four QEs so far since 2009. Something Mr Bear may not allow them to do for a fifth time.

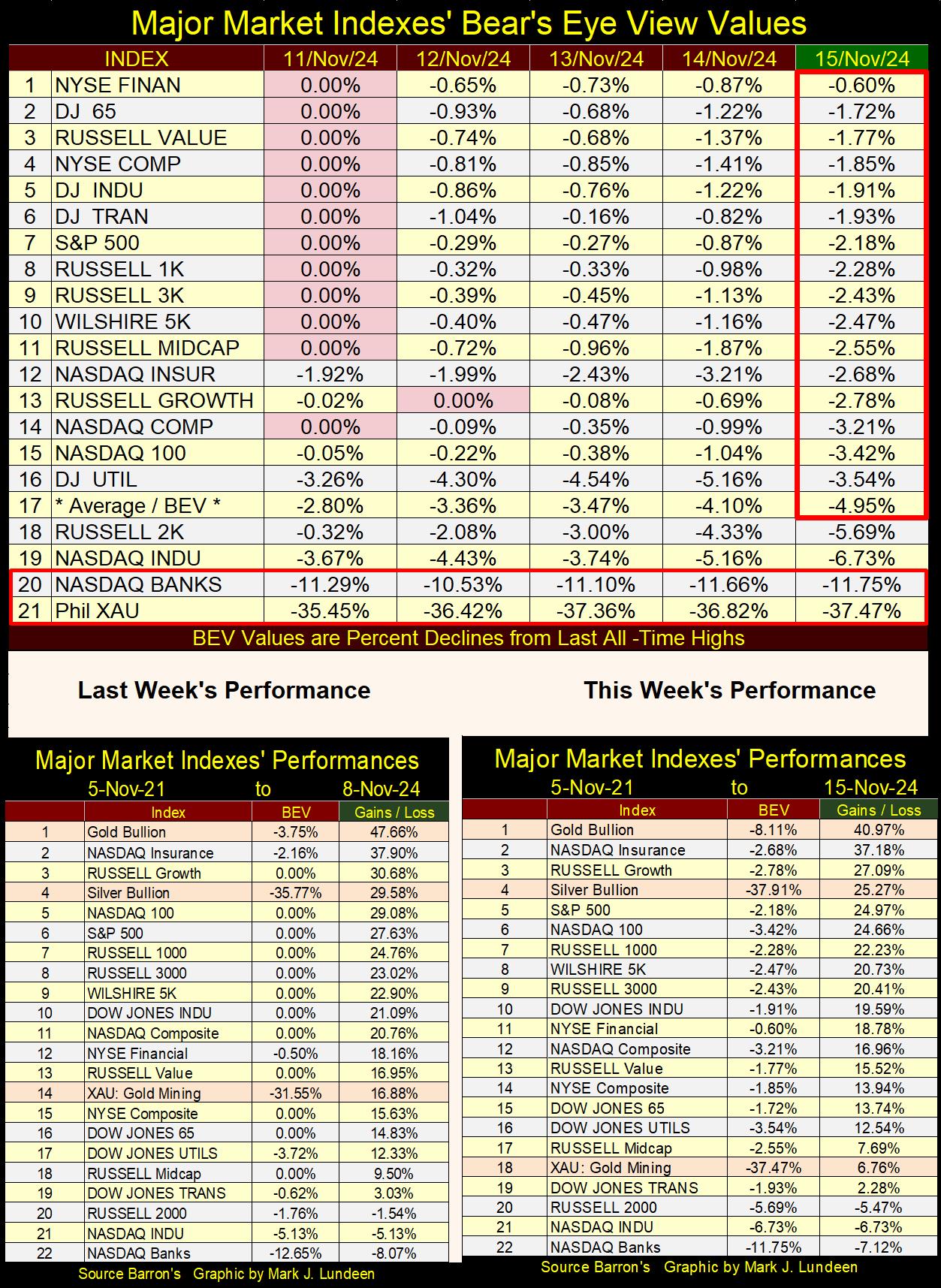

But that is all in the future. This week wasn’t so bad for the stock market, as seen in the table below, listing the BEV values of the major markets I follow. At Friday’s close, these indexes saw no new all-time highs, as they did abundantly on Monday’s close. But sixteen of them close the week in scoring position, which I’m going to assume indicates this advance has more upside to go.

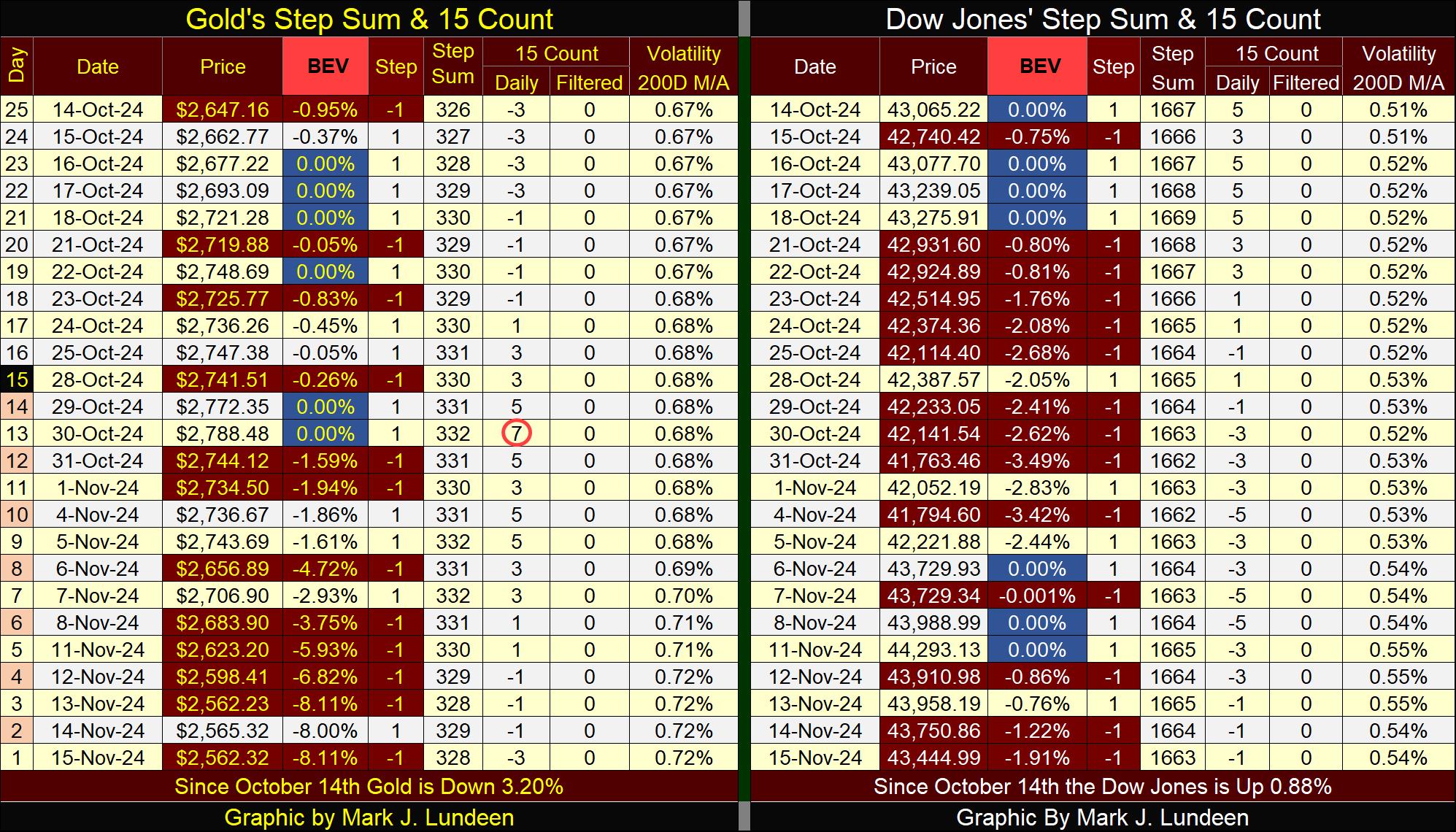

In the performance tables above, everything was down this past week. Some by a little, others by a lot. Still, gold and silver held on to their #1 and #4 positions in the table, while the XAU was down by 10% for the week, or six BEV points, taking it from #14 last week, to #18 this week.

It was only eleven trading days ago since gold hit its last all-time high of $2,877.48, its forty-third BEV Zero (new all-time high) since gold entered scoring position a year ago, traded within the 0.0% & -5.0% lines on its BEV chart. Now this week, gold closed with a BEV value of -8.11%, an 8% decline from its last all-time high of October 30th, a full 3% out of scoring position. What in the heck is going on?

That is a good question, I don’t have a good answer for, as a market enthusiast, such as myself, will never have access to the insider information any major market has, information known to its market makers. But one thing I do know; market prices / valuations seen today are no longer the simple outcome of the basic supply and demand fundamentals within a market; the haggling over prices naturally seen between those who produce, and those who consume the stuff all economies make possible, that college text books on economics would have us believe drives market prices today.

Politicians depend on the market, and its prices to maintain their grip on power.

In October 2008, as the market in sub-prime mortgage crashed, the Dow Jones was down by 40% from an all-time high, for the first time since early 1942, with the secondary market in mortgages, itself in ruins. This was a multi-trillion-dollar market that went bust in less than a year, a market that in October 2008 had plenty of sellers, but absolutely no buyers. In October 2008, our political class, for very good reasons, was very much concerned with its ability to maintain its control over the American people.

So, they gave their creature, the Federal Reserve System, permission to generate monetary inflation on a scale the United States has never seen before, via FOMC’s Idiot Primate, Doctor Benjimin Bernanke’s Quantitative Easings (QE).

Bernanke’s QE was the only way to do, what Washinton wanted to be done; create hundreds-of-billions of dollars in demand for illiquid mortgages, and for shares trading at the NYSE and NASDAQ stock exchanges.

And the FOMC, now funded with as much monetary inflation as needed, was very willing to do, what everyone else refused to do; * BUY * at prices everyone else refused to do, during the greatest selling panic on Wall Street, since the Great Depression Crash of the early 1930s.

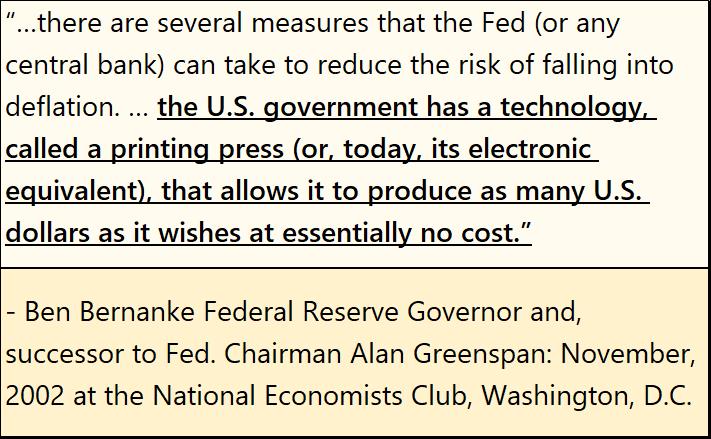

Bernanke had foreseen the probability of a major market decline as early as November 2002, and the necessity of responding to it with as much monetary inflation as needed. When he stated the below at the National Economics Club in Washington DC, I believe he guaranteed, he would be Alan Greenspan’s replacement as Idiot Primate of the FOMC four years later, when Greenspan retired in March 2006.

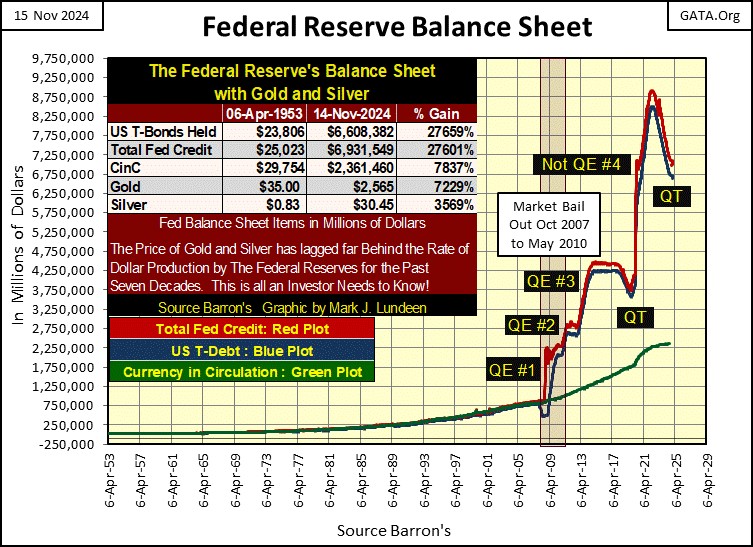

In the chart below of the Federal Reserve’s balance sheet, the QE #1-3 shows Bernanke’s commitment to “produce as many US dollars as he wished,” in service to America’s political and economic establishment. The Not QE #4 is our current FOMC’s Idiot Primate, Powell, “stabilizing market valuations” during the March 2020 Flash Crash. A market decline that had the potential for rivaling the Great Depression’s market crash, had he not “stabilized market valuations” with his massive Not QE #4.

Why do I call this massive infusion of monetary inflation a “Not QE #4?” That is what Powell himself called it; “it’s Not a QE” in October 2019, and that is good enough for me.

By March 2009, the idiots at the FOMC had “stabilized market valuation,” and once again all was right with the world, or so we were told. Sadly, today’s solution to a problem in the financial markets, using monetary inflation flowing from the Federal Reserve, will ultimately prove to be an even larger problem, sometime tomorrow.

And why would that be? Because inflated valuations are problems of their own, problems that are best left to be deflated on their own, free from any government, or FOMC interference;

- Why does the United States today, have a huge problem with people being homeless?

- Why does a college education cost so much?

Housing and funding a college education were not problems before 1971, before the dollar was taken off its $35 gold peg. Things have since changed, but how?

Housing prices, and college-tuition costs have become grotesquely inflated, thanks to Washington’s subsidizing these markets, using the unlimited bank credit flowing from the Federal Reserve System.

I know who I am; I’m only a market enthusiast, whose interest in the market began when I was sailing the Seven Seas with Uncle Sam, almost fifty years ago.

But I too have memories of the market. I remember coming into Pattaya Beach, Thailand in early 1980, on the USS Mobile LKA-115, then deployed with a Marine Corps flotilla, cruising in the Indian Ocean below Iran, after the Islamic Republic captured the American Embassy in Tehran.

After a few months of going around in circles, in the Indian Ocean, the fleet had plenty of paychecks saved up in sailors and marine’s lockers. With our arrival in Pattaya Beach, the fleet now had somewhere to spend it, usually for intoxication and intercourse.

I’m not suggesting that sailors and marines formed long lines around the blocks hosting the gold shops of Pattaya Beach. It wasn’t like that. But oddly, in early 1980, it was noticeable there were sailors and marines, who used a good portion of their unspent cash buying gold in Thailand.

One only had to ask them. These bulls in the gold market from forty-four years ago were excited, as they knew the gold they bought for $800 an ounce in Thailand, could soon be sold for $2000 an ounce, or more, maybe as soon as we once again returned to our home port in San Diego, California.

That was the first, and last time I saw sailors do that in Pattaya Beach, or anywhere else. But it’s remarkable that somehow, the gold fever of the late 1970s, long before the internet was available to ships at sea, infected sailors in the middle of the Indian Ocean at the top of the 1969 to 1980 bull market in gold and silver.

So, what in the heck does all that have to do with gold this week, now closing well out of scoring position? Maybe nothing. And then again, maybe something big, as at market tops, when the potential for financial gain is minimum, and risks to invested funds are maximum, the draw of high prices in any market advance, always attracts the public, in ways lower prices never will.

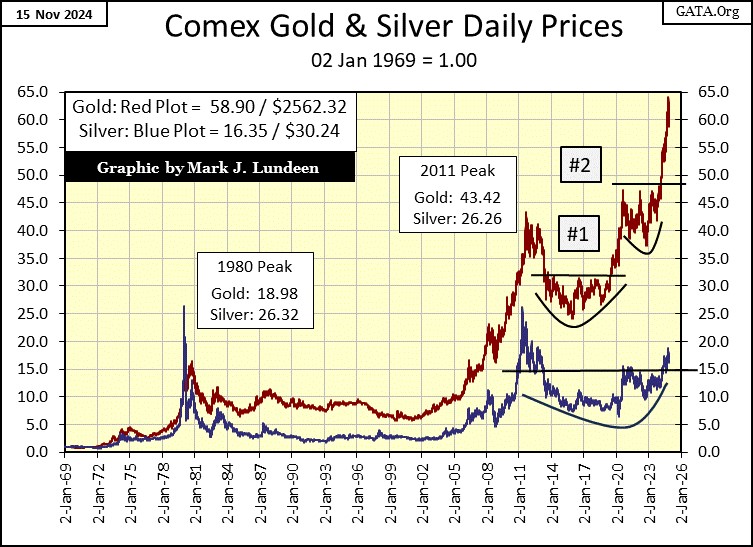

So far, the rising prices for gold and silver since 2001, have failed to generate any broad based public excitement for the old monetary metals. I take this as proof that presently, the bull market in gold and silver are far from their ultimate bull market tops. And yes, looking at gold and silver in the chart below, they are currently in a bull market.

That so few people care, is a solid indication that gold and silver are still in the early phase of their bull markets. Making this an excellent time to be buyers. For those with patience, ultimately the old monetary metals will richly reward their owners.

Compare gold and silver to Bitcoin today, which now is trading for over $87,000 a coin. Everyone is talking about bitcoin, and public interest in cyber currencies is huge. Even national governments, and their central banks who didn’t care for Bitcoins when it could be purchased for less than $5 in 2010, now want Bitcoins.

Bitcoin for $5 in 2010? I don’t follow this market, but I believe this is correct, as is assuming an increase from $5 to over $87,000, in only fourteen years is the result of a historic bubble, that is best to be observed in the safety of the market’s peanut gallery. Though I could be wrong.

I wish I had purchased a few thousand Bitcoins fourteen years ago; I could have. But today’s valuation for Bitcoin is insane, typical of a historic market top. I’m thinking of the Tulip Mania of 17th century Holland. So, with everyone else wanting in, I’m happy being out of this crypto-market, a market no one really understands.

Markets I do follow are the Dow Jones and gold. The question astute investors should be asking themselves is; are these markets over, or undervalued?

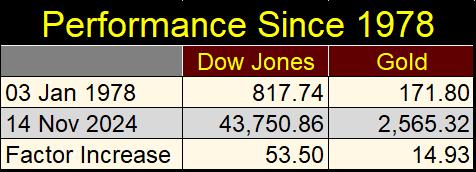

Let’s start off with a comparison of prices for gold and the Dow Jones, from the first trading day of January 1978, to this week’s Thursday’s close, in the table below.

You tell me where monetary inflation flowing from the Federal Reserve, since 1971 has been flowing into. With the Dow Jones up by a factor of 53.50 since January 1978, while gold is up by a factor of only 14.93. I think it’s obvious it’s the stock market, not gold and silver that is overvalued in 2024.

Now, let’s look at the Bear’s Eye View charts for the Dow Jones and gold, from the first day of trading for 1978, to this week’s Thursday’s close.

The Dow Jones since 1982, has generated many new all-time highs, and frequently traded in scoring position for decades. There have been corrections over the years, some lasting a year or two. But without a doubt, the Dow Jones for the past forty-three years, has been advancing in a historic bull market. The question that comes to my mind is; how much longer can this go on?

The Bear’s Eye View chart for gold above is completely different from the Dow Jones’ BEV chart. We see the twenty-year, 70% bear market decline that dominates its BEV chart above.

Following gold’s 2001 bottom, it increased to new all-time highs beginning in November 2008. But that advance was cut short in August 2011, when gold began a brutal, four year mini-bear market, a 45% decline that soured market sentiment for gold, to this day. Since August 2020, gold has advanced to new all-time highs, without attracting much of the public’s attention.

Why would that be? Because that is how things are, as early in a bull market’s advance, investors are still thinking of the past bear market’s decline.

Don’t worry, the day is coming when sailors from the 7th Fleet, will once again be forgoing the Earthly pleasures to be found in Pattaya Beach, Thailand, choosing instead to buy gold. And when that day comes, it will be time to once again sell your gold, as it was in January 1980.

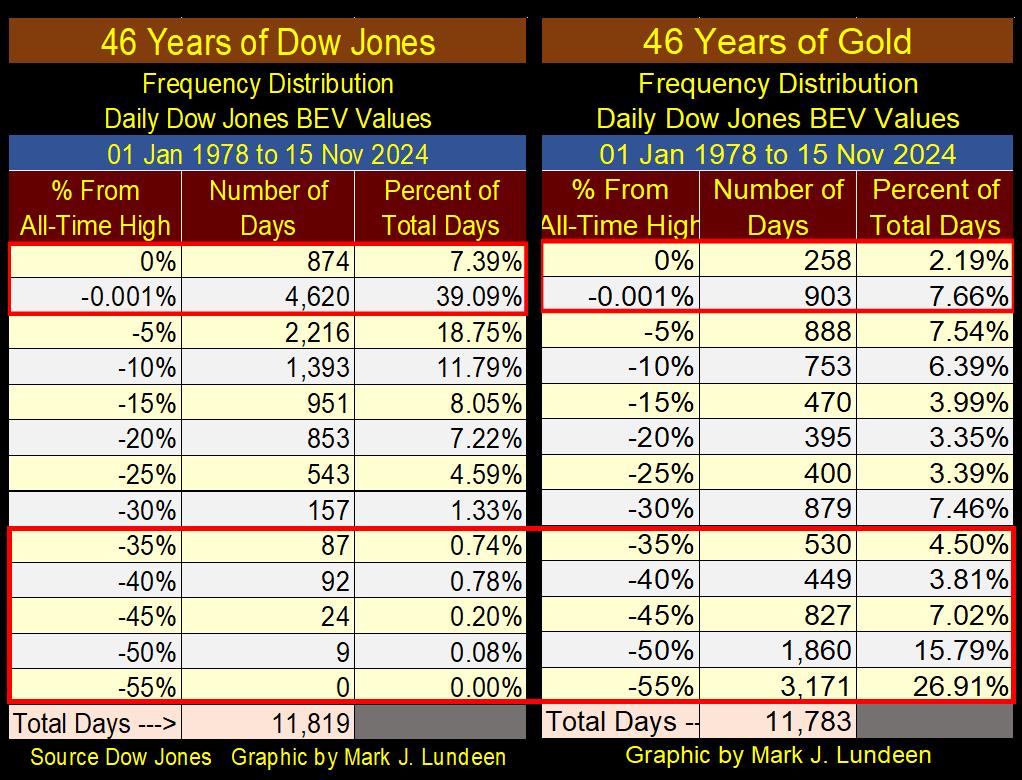

Let’s look at the frequency distribution tables for the Dow Jones and gold below. Note; the data seen in the tables below, is derived from the BEV data seen charted above.

The nice feature of looking at price data in the Bear’s Eye View format, is we can compare one market’s freq table, with another, as I’ve done below. As always, the key thing to note in a BEV freq table; is the frequency of daily closes in the 0% (new all-time highs / BEV Zeros), and the -0.001% (daily closings in scoring position) rows.

Adding the Percent of Total Days for their 0.0%, and -0.001% rows for these two markets, we can ascertain how bullish, or bearish these markets have been since 1977.

The Dow Jones has closed at new all-time highs, or in scoring position, for 46.48% of its 11,819 trading sessions since 1977. While gold has closed at a new all-time high, or in scoring position for only 9.85% of its 11,783 trading sessions since 1977.

This is why investors today like the stock market, more than they like the gold market.

We should also note the frequency these markets have seen daily closes below 35% from an all-time high, the -35% rows and below in the tables above. Since 1977, the Dow Jones has closed 35%, or more from an all-time high for only 1.80%, of its 11,819 trading sessions. For decades, the Dow Jones has been advancing, not declining. So, this is the reason why everyone in 2024 likes the stock market.

Gold has traded down 35%, or more from an all-time high, for 58.03% of its 11,783 trading sessions since 1977. Geeze Louise, this is terrible! No wonder the general public isn’t interested in gold and silver as an investment. Still, and this is important, gold in the past year has made forty-three new all-time highs, the last of them on October 30th, only $212 short of $3000.

So gold, an asset the general public holds in low regard, is advancing into new all-time highs, in spite of the lack of any broad support, which is why I like gold – a lot!

Back in the early 1980s, the old-timers in the market always said that early in a bull market, the bulls advance by “climbing a wall of worry.” The Dow Jones stopped worrying about anything since the idiots at the FOMC began “stabilizing market valuations” their QEs in 2009.

That doesn’t seem good to me, feelings of certainty in our uncertain world of finance. For that reason, I do like gold and silver, despite all the problems they now struggle with, as they are now climbing that same wall of worry, the Dow Jones did decades ago.

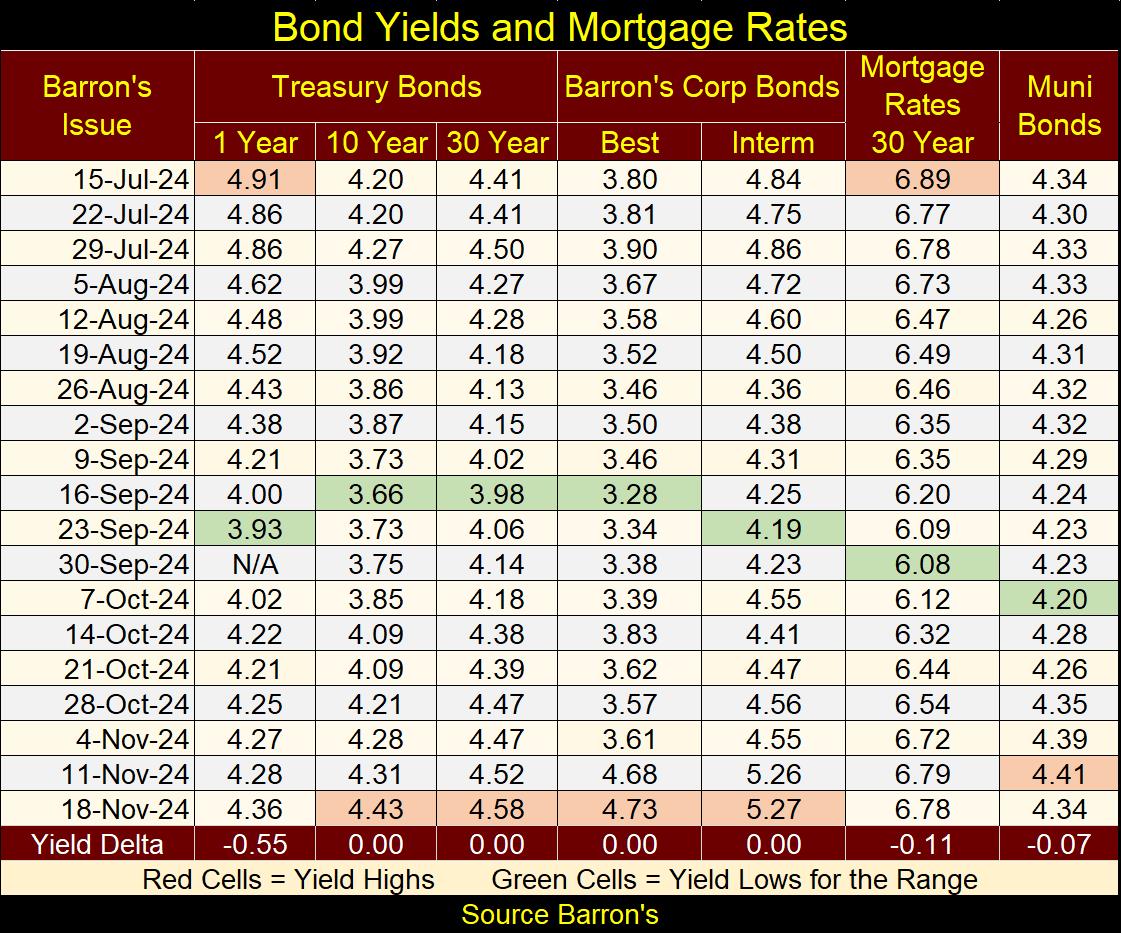

Here is something for the stock market bulls need to be worried about; bond yields continue trending upwards, as are mortgage rates in the table below. Should yields continue rising, it will become a big problem for Wall Street. But not for gold and silver bullion, assets with zero counter-party risk.

Here is an ugly chart; gold’s BEV chart with gold’s BEV value at -8.11%. At weeks close, gold was no longer in scoring position, within the Red Rectangle of its BEV chart. But then, gold still hasn’t fallen below its BEV -10% line either.

When the Dow Jones, a market that has been in a very public bull market since August 1982, does something as we see below, I’d become concerned of the health of its current market advance.

As for gold, now trading below its BEV -5% line, a market only a few people follow, and even fewer buy, I’m not going to lose any sleep over gold now trading outside of scoring position. Let’s see what it does in the weeks to come. But no matter what, in the uncertain world we live in, I still believe gold is a long-term hold.

Looking at gold in its step sum table below, the possibility of it resuming its march to new all-time highs in the weeks and months to come, is a very real. The gold market doesn’t look all that bad, let’s see what gold does when once again, advancing days overwhelm declining days.

Mark J. Lundeen

********