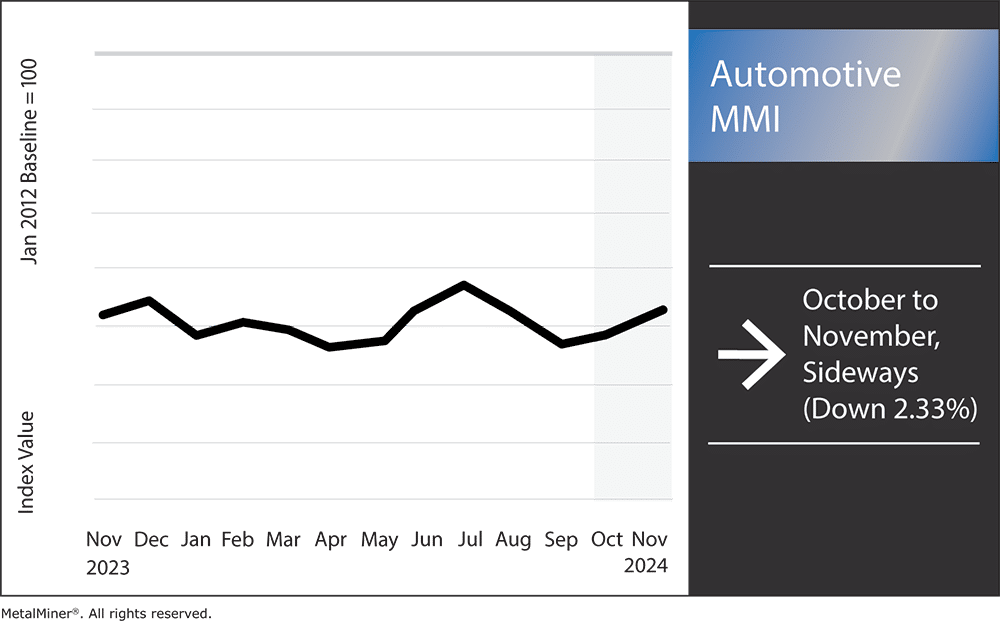

The November Automotive MMI (Monthly Metals Index) found slightly more upward momentum than the prior month. While the index remained sideways, price action rose by 2.33%. That said, the US automotive market could witness headwinds from a combination of factors. First, Donald Trump`s win in the US election could mean incoming tariffs that will impact the overall automotive market.

Secondly, a recent report highlighted a poll concluding that 37% of German businesses said they will cut production or move abroad, a 31% increase compared to 2023. This could have ramifications for vehicles sourced from Germany, such as Volkswagen, BMW, Audi, Mercedes-Benz and other German-based automobile manufacturers.

Receive indispensable updates on metal prices, shifts in the US automotive market and potential incoming tariffs, empowering your company to make informed purchasing decisions. Opt into MetalMiner’s free weekly newsletter.

Trump Victory and Potential Tariffs in 2025

The US automotive industry seems poised for changes following President-elect Donald Trump’s victory. His proposed policies, particularly concerning tariffs, are expected to significantly affect both manufacturers and consumers.

Trump plans to impose tariffs on imported vehicles and auto parts, including a 100% tariff on cars made in Mexico and a 60% tariff on goods from China. By introducing these measures, he intends to push automakers to shift production to the US. However, industry experts caution that these tariffs could immediately drive up production costs, adding an estimated $40 billion in costs for US automakers.

Impact on Electric Vehicles and International Relations

The new administration is likely to also bring changes to the EV sector. Trump plans to eliminate federal tax credits for electric vehicles, a move that could provide an advantage to established manufacturers like Tesla. However, this policy could also create hurdles for foreign EV makers that sell to the US market, like Toyota Motors and BMW.

The proposed tariffs are also likely to strain international trade relations, particularly with countries like China. Automakers have long relied on China for cost-effective manufacturing and parts supply. However, tariffs also encourage less reliance on China, which many have argued is a national security risk.

Consumer Impacts

Consumers may face higher vehicle prices as increased production costs and tariffs on imported goods drive up expenses. Additionally, removing EV tax credits could make electric vehicles less affordable for many buyers.

When automotive imports are in jeopardy, it’s vital to know how to generate the most savings on your metal purchases. Read how here.

Germany Manufacturing Setbacks: What’s in for U.S. Imports?

A recent Reuters article shed light on results from a poll regarding Germany’s manufacturing state. 37% of German businesses said they will cut production in the near future or move abroad.

According to the International Energy Agency, power prices in Europe doubled compared to those in the US in 2023, primarily because Europe shifted from Russian gas to pricier liquefied natural gas.

Regulatory and Bureaucratic Challenges

In addition to high energy costs, German manufacturers continue to struggle with regulatory obstacles that hurt their competitiveness. The chemical industry, for example, has urged regulatory reforms and a clear growth strategy to boost competitiveness while working toward climate neutrality. Industry studies point to significant challenges, including excessive bureaucracy and slow approval procedures.

MetalMiner customizes metal price forecasting to your specific metals, forms and gauges. View our full metals catalog.

Impact on the US Automotive Market

Rising energy costs and competition from China’s growing automobile market have leaders at companies like Volkswagen contemplating shutting down plants. This poses a risk to the industry’s role in supporting Germany’s GDP and employment levels.

The German government has introduced measures to reduce energy costs for industries to address these challenges. These include cutting the electricity tax for all manufacturers to the EU minimum and expanding subsidies to help energy-intensive businesses offset a portion of the CO2 costs associated with electricity under the EU Emissions Trading System.

Automotive MMI: Noteworthy Price Shifts

There is lots in store for the US automotive market post-election. Get alerted about rapid shifts in metal prices and make timely sourcing decisions with MetalMiner Insights’ instant alerts. Ready to learn more?

- Chinese lead prices increased 3.22% to $2,292.00 per metric ton.

- Hot-dipped galvanized steel prices retracted by 3.78% to $943 per short ton.

- Lastly, Korean aluminum 5052 premium over 1050 coil prices traded flat, remaining at $4.15 per kilogram.