Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

As I wrote a week ago, unfortunately, following some surprise obstacles getting financial support in Germany, Lilium had to file for insolvency. The electric vertical takeoff and landing (eVTOL) aircraft startup has been getting hype and praise for years, and even logged hundreds of orders this year and planning to build a high-volume production facility. But everything fell through recently when a loan from KfW failed in the Budget Committee of the German parliament. All is not lost, though.

Lilium published an update today indicating that it still aims to achieve commercial flight and certification. It just has to pursue other avenues now. “The Lilium business remains fully focused on re-emerging following restructuring; setting sights on fresh investment to support the all-electric Lilium Jet’s path to certification and entry into service,” the company writes. KPMG has been selected to conduct “an open, transparent and fair M&A process.”

Going on: “Preliminary insolvency proceedings under self-administration are court-ordered restructuring proceedings aimed at preserving the business. The management remains in charge and leads the business through the proceedings, supported by restructuring experts.

“The court has appointed to the German subsidiaries’ Boards of Management with immediate effect two restructuring-experienced lawyers, Prof. Dr. Gerrit Hölzle and Dr. Thorsten Bieg as Chief Insolvency Officers (CIOs). Both have already successfully advised a large number of companies in crisis situations. Most recently, they worked for Senvion and The Social Chain AG, among others. They will now oversee the reorganization of Lilium’s German subsidiaries.

“The Local Court of Weilheim has also appointed attorney Mr. Ivo-Meinert Willrodt, Managing Partner at PLUTA Rechtsanwalts GmbH, as the provisional custodian. The restructuring expert is an attorney and specialist lawyer for insolvency and restructuring law and has already acted as trustee for the solar car start-up Sono Motors and the drone manufacturer EMT, among others. His role is to protect the interests of the creditors in the proceedings. […]

“Work at Lilium’s subsidiaries continues, with the more than 1,000 employees engaged in progressing towards the next significant program milestone, first manned flight, having been informed on the details of continued employee payment. The business has also informed affected suppliers, outlining expectations and procedural steps.

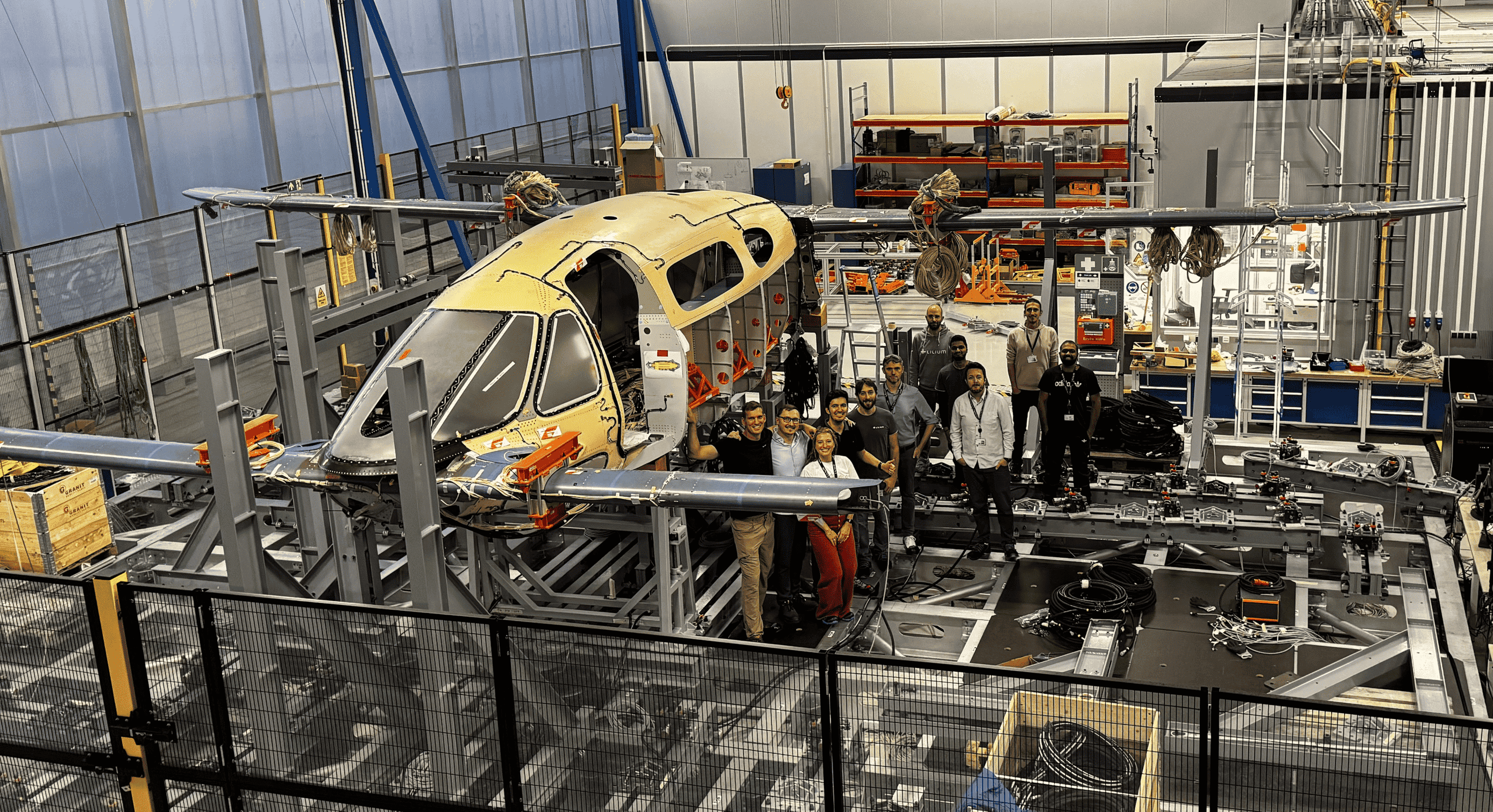

“The first two Lilium Jets are currently on the final assembly line, with the first aircraft having recently completed the initial low-voltage power-on milestone and due to advance shortly into the ground testing phase. The fuselage and wings of the third aircraft are currently in assembly at aerostructures suppliers Aciturri and Aernnova. End of October, Lilium engineers moved a fully assembled, conforming Lilium Jet airframe into the static test rig for structural testing, in a significant advance for the program. The structural strength test is an essential part of the testing plan for first manned flight and type certification.”

So, yeah, despite running out of money, Lilium is plowing forward and hoping to keep its work going as it is bought up by another company (or merged into one).

Across Europe, the US, South America, Asia, and the Middle East, Lilium has a combined 780+ orders of various sorts — a mixture of “firm orders, reservations, options, and memoranda of understanding.” Clearly, there is massive interest in this company’s electric jets. Will these eVTOL jets eventually be built and delivered? One can hope!

In the meantime, here’s the remaining legal guidance on insolvency and the company’s position on the stock market:

“Lilium has been notified by NASDAQ that trading of the company’s shares and warrants will be suspended at the opening of business on November 6. Following trading suspension, the Company’s ordinary shares may commence trading over-the-counter, which may result in significantly lower trading volumes and could further depress the share price.

“Lilium N.V.’s Board of Directors authorized Lilium’s listed entity, the Netherlands-registered public limited liability company (naamloze vennootschap) to file for insolvency on Sunday, 4th of November 2024.“

Stay tuned. More is sure to be on the way. Lilium won’t go quietly into the night.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy