Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

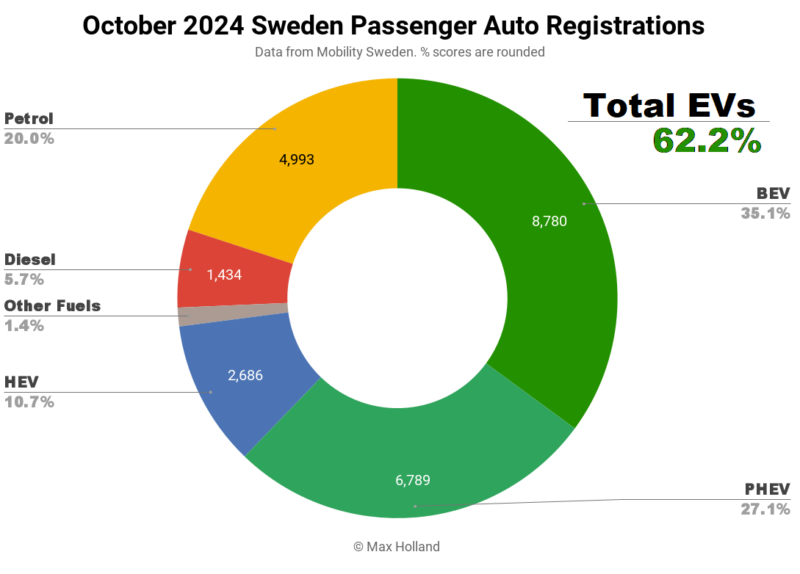

October saw plugin EVs take 62.2% share in Sweden, up slightly YoY from 60.6%. BEV volume fell YoY, though PHEV volume increased. Overall auto volume was 25,026 units, flat YoY. The Tesla Model Y was once again the best selling BEV.

October’s auto sales saw combined plugin EVs take 62.2% share in Sweden, with full battery-electrics (BEVs) at 35.1%, and plugin hybrids (PHEVs) at 27.1%. These shares compare YoY against 60.6% combined, with 37.6% BEV, and 23.0% PHEV.

Sweden’s BEV decline is still present, with October volume of 8,780 units, down from 9,408 units, YoY. Again, PHEVs have somewhat softened the overall plugin picture, growing slightly to compensate for the fall in BEVs. This is not ideal, but is preferable to plugless vehicle sales increasing to fill the gap left over by BEVs.

This is a good example of why puritanical BEV monomania, and hostility towards PHEVs — riding roughshod over local context — is unhelpful. Sweden is still in the mid-point of the EV transition where PHEVs are playing a significant role in displacing what would otherwise be plugless car sales. Put differently, in the Swedish context, PHEVs are at least moving the needle in a positive direction compared to the status quo. This is a basic definition of progress.

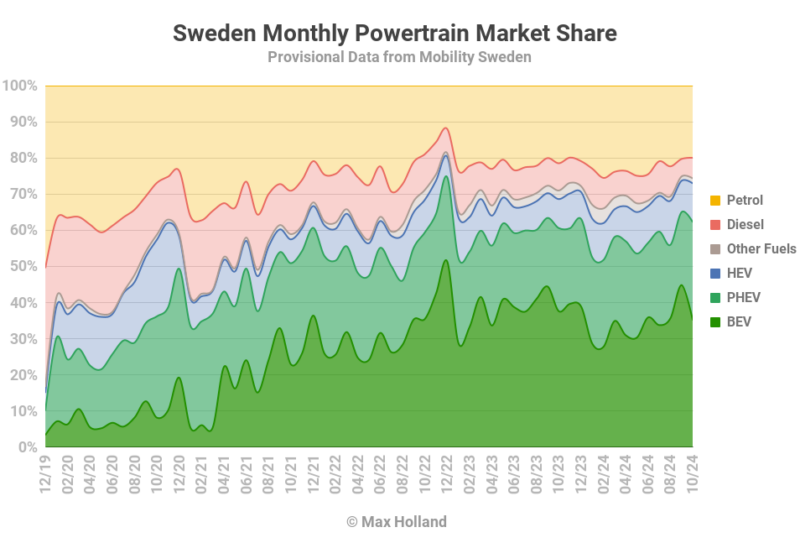

We’ve often rehearsed the reasons behind Sweden’s 2024 BEV decline. In short, continued overpricing of BEVs from legacy auto makers (and profit-protecting hurdles being put in the way of actually affordable BEVs from China) are to blame, compounded by a weak consumer economy.

As a consequence, year-to-date BEV sales now stand at 74,618 units, down from 90,624 units, YoY.

A mild upbeat note is that ICE-only vehicle share continues to decline, with diesels down to 5.7% share, and petrols down to 25.7%.

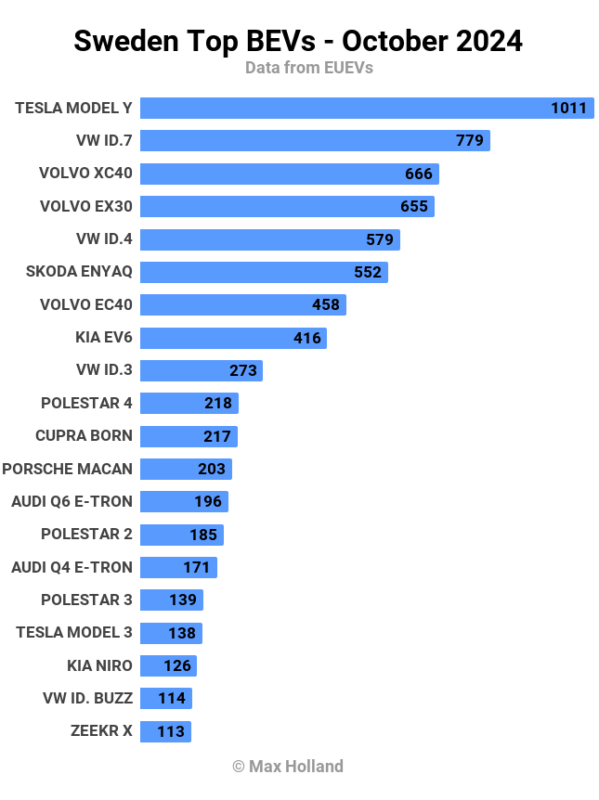

Best Selling BEV Models

Yet again, the Tesla Model Y was by far the best selling BEV in Sweden in October, with 1,011 units registered. The Model Y has led the pack every month since May.

In second place in October was the Volkswagen ID.7, with 779 units. In third was the Volvo XC40, with 666 units.

This is the best ranking (and highest volume) so far for the Volkswagen ID.7, which launched in November 2023. Its previous best was 5th spot, just last month.

Within the broader picture of mostly normal monthly variations, a few models stood out for their relatively strong performances. The new Porsche Macan, and its cousin the Audi Q6 e-tron, both continued to grow volume, now in 12th and 13th spots, respectively.

Just ahead of them, in 10th spot, the new Polestar 4 continues to be popular, with 218 units (a repeat of September’s volume). Further behind, in 20th spot, the Zeekr X is also still climbing, with a personal best of 113 units in October.

The Cupra Tavascan is also slowly climbing, from its 16-unit August debut, with two months of doubling, to 65 units in October.

Looking at October’s debutants, there were two of note – the Kia EV3, and the Citroen e-C3. The Kia EV3, with just one initial unit, has to be a strong favourite to quickly enter the top 10 in Sweden. Why is that? Its closest predecessor, the Kia Niro, was madly popular, always firmly in the top 5 between 2019 and 2022.

With similar value, but even more practical and capable, the EV3 will surely follow in the Niro’s footsteps, despite the far greater spread of BEV models now available. I’d bet on it being in the top 10 six months from now, and remaining there for at least a year or two.

The new Citroen e-C3 broke the ice with 7 units in October, and will continue to climb from here. Although not nearly as affordable as the compact BEV models coming out of China (e.g. the BYD Dolphin Mini, Wuling Bingo), the e-C3 is still about as affordable a competent all-rounder BEV as is currently available in Europe.

What do I mean by all-rounder? Rather than being limited to only urban or regional journeys (as were the early Leaf, and Zoe, and more recently, the Honda-e, and 1st generation Mini BEVs), the Citroen e-C3 is capable of making an occasional longer trip. This is possible thanks to a WLTP range of 326 km, and ~30 minute DC charging (10-80%).

It may not get you there in record time, but with one ~35 minute meal break, plus one ~15 minute fikapaus, the little Citroen can readily cover a trip of 500+ km.

With a little more effort, one could in principle even take breakfast in Malmo, a dinner in Frankfurt, and the next evening, be enjoying a Ragu in Bologna. In short, the Citroen can – without undue haste – tackle any driving task that an equivalent ICE car is capable of.

The e-C3 is priced from 299,990 SEK (€25,780) MSRP. A year from now, we may expect occasional informal deals in the ballpark of €20,000 or under.

Other low-volume BEVs debuting in October were the innovative MG Cyberster, and the Mercedes G-Wagon, both of which are welcome additions, despite no prospect of either being big sellers.

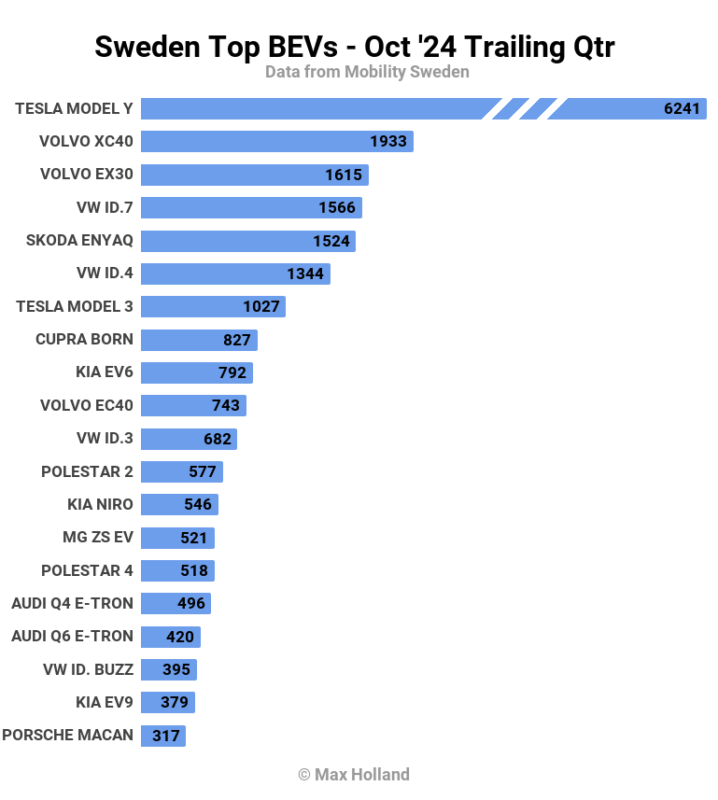

Here’s a look at the 3-month chart:

The Tesla Model Y has an unassailable lead over everything else, almost matching the volume of the next 4 BEV models combined.

Note that – while the Model Y is at marginally better volume year-to-date compared to 2023 – the main YoY change is that the Volkswagen ID.4 is only at about half its 2023 YTD volume. It was previously often in first or second place.

This is disastrous for Volkswagen. At least Volvo has the legitimate excuse that the XC40’s former solo performance is now shared with the new EX30, and combined volume is decently increased YoY. What is Volkswagen’s excuse?

Volkwagen will have to console themselves with the relative success of the ID.7, which is doing well, now up to fourth, from back in 12th in the prior 3 month period.

After three months of decent volume, the new Polestar 4 has now joined the rankings, in 15th spot. Last month I was asking whether its volume was temporarily inflated to catch up with an order backlog, or instead, sustainable. The evidence seems to be pointing to sustainable, and the new model may even climb into the top 12 by the end of this year, which would be a great result for Polestar.

We also said last month that the Audi Q6 e-tron should soon break into the top 20, and indeed it has done, now in 17th spot. Remarkably, the new Porsche Macan has also entered the chart, at 20th, after just 2 months of sales.

As mentioned above, the next ones to watch will be the Citroen e-C3, and especially the new Kia EV3. Expect both to feature in the quarterly top 20 by early next year, and – for the Kia – eventually the top 10.

Outlook

As avid BEV market observers, most of us are tuned in to the pricing trends of BEVs available in Sweden (and Europe as a whole), and obviously affordability is still far behind where it should be by now, hampering the EV transition.

The broader economic environment is also crucial, and that’s not looking great for Swedish consumers either. Latest GDP data from Q3 2024 showed a 0.1% contraction YoY, following 2 preceding quarters that were weakly positive.

Inflation cooled to 1.6%, and interest rates were 3.25%. Manufacturing PMI in October improved to 53.1 points, from 51.6 in September.

Across 2024 year to date, BEV market share has lost ground. It has stepped back from the 38.6% at this point in 2023, down to 34.2%. This means BEV share has literally taken half a step backwards towards the level it saw at this point in 2022. Will this negative trend end in 2025, and get back to growth?

In theory, with new EU regulations requiring emissions tightening in 2025, manufacturers will have to start pricing BEVs more competitively vs. ICE counterparts. The economic outlook is less certain, however, with no easy path back to a buoyant consumer economy.

What are your thoughts on Sweden’s EV transition over the past year? Can you see prospects for improvement on the horizon? Please let us know your thoughts and forecasts in the comments section below.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy