Gold formed a swing high after reaching our $2,800 target, and a pullback is overdue.

Gold formed a swing high after reaching our $2,800 target, and a pullback is overdue.

Given the election outcome and next week’s Fed announcement, prices could go either way in November.

If gold corrects, the initial drop could be sharp, followed by sideways trading. I see a 25% chance prices keep pressing towards $3,000.

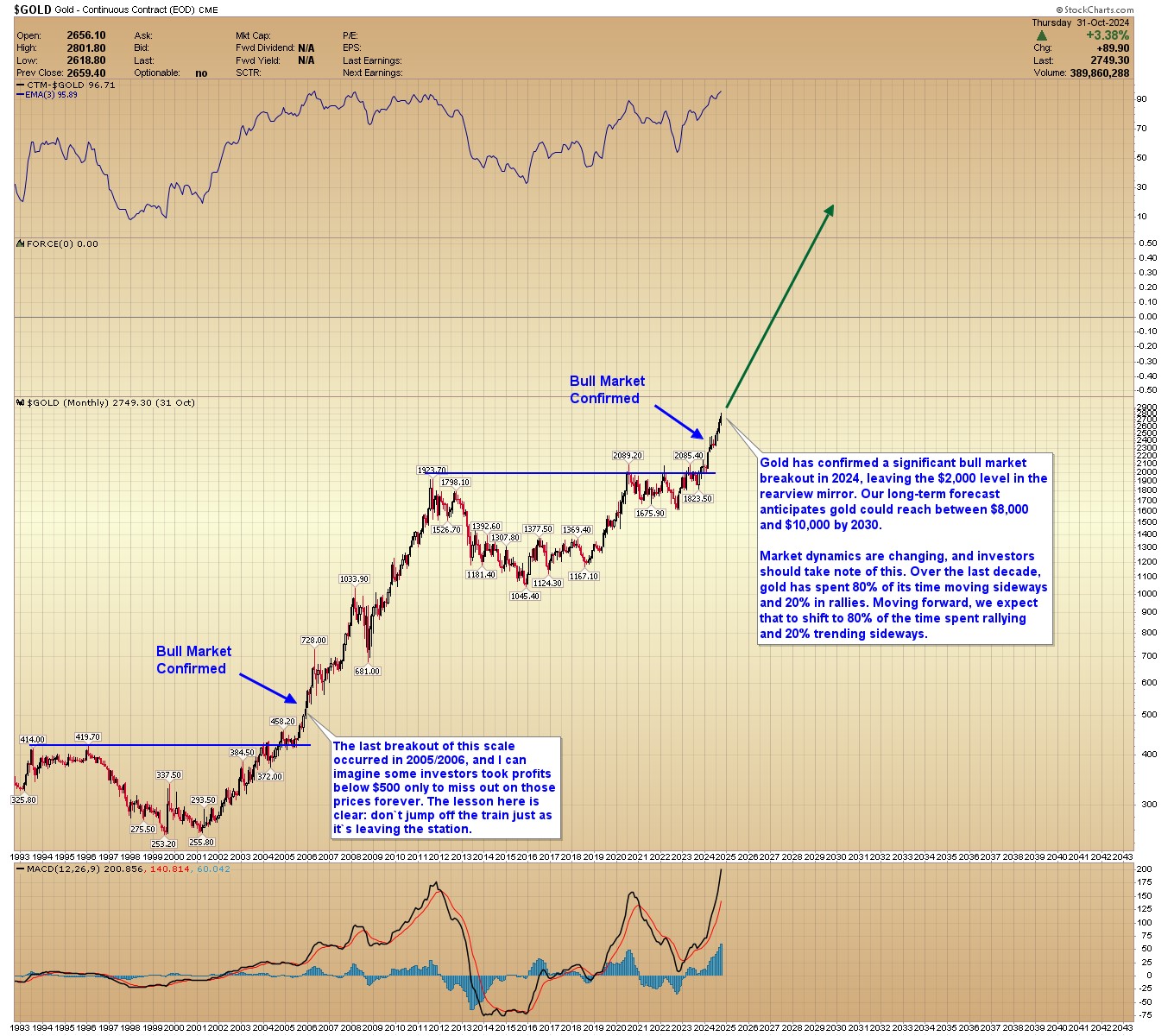

GOLD BIG PICTURE

Gold has confirmed a significant bull market breakout in 2024, leaving the $2,000 level in the rearview mirror. Our long-term forecast anticipates gold could reach between $8,000 and $10,000 by 2030.

Market dynamics are changing, and investors should take note of this. Over the last decade, gold has spent 80% of its time moving sideways and 20% in rallies. Moving forward, we expect that to shift to 80% of the time spent rallying and 20% trending sideways.

The last breakout of this scale occurred in 2005/2006, and I can imagine some investors took profits below $500 only to miss out on those prices forever. The lesson here is clear: don’t jump off the train just as it’s leaving the station.

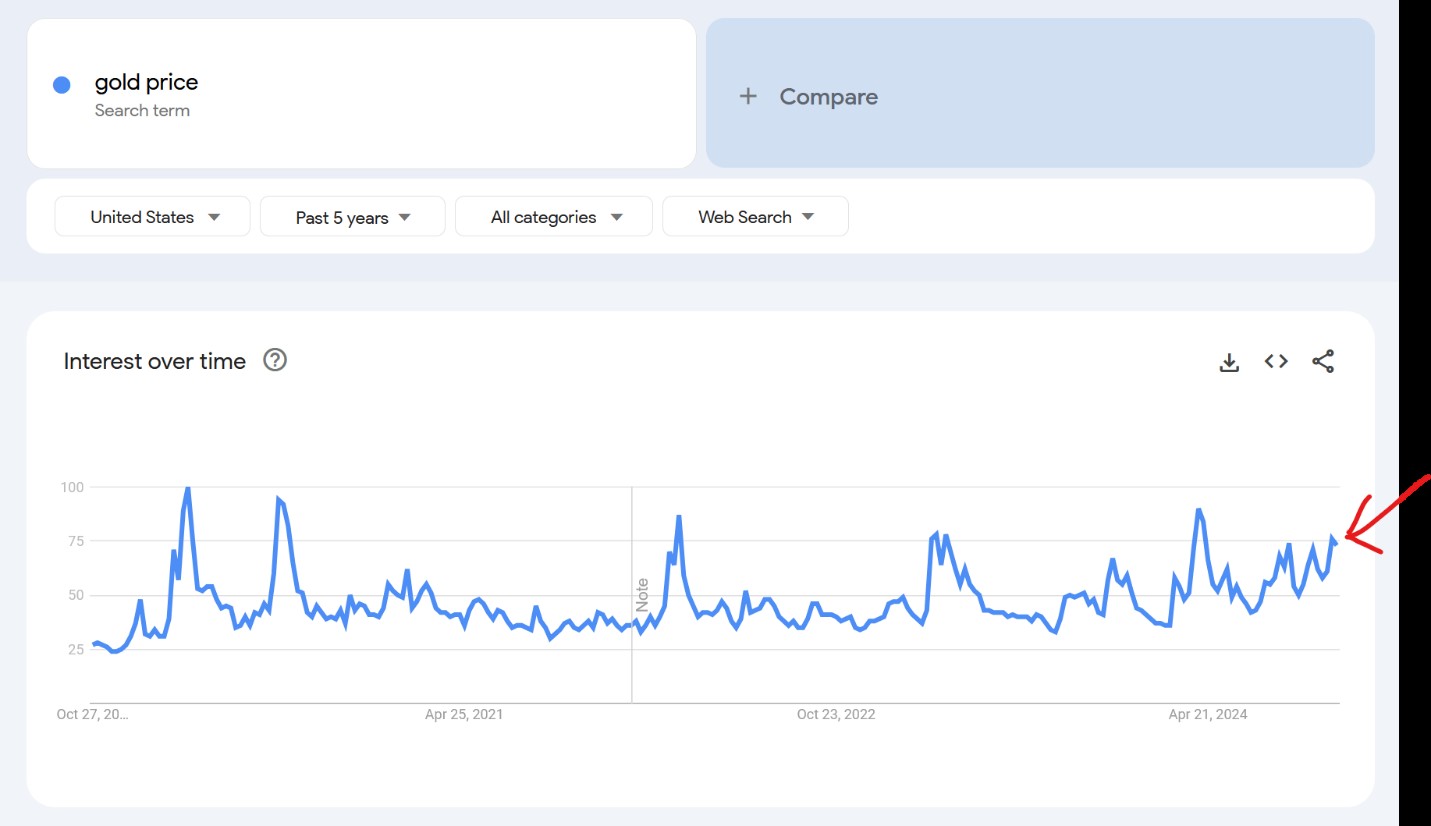

GOLD SENTIMENT

Despite reaching $2,800 and new all-time highs, Google searches for “gold price” are still below the peaks seen over the past five years. This is one reason I think prices may keep rising.

https://trends.google.com/trends/explore?date=today%205-y&geo=US&q=gold%20price&hl=en

GOLD- Gold formed a swing high after yesterday’s close above $2,800, and the odds favor a pullback. How prices will react to next week’s election and Fed announcement is anybody’s guess.

Closing below the 50-day EMA (currently $2,644) in November would confirm an intermediate-degree pullback. Depending on the election, a continued rally towards $3,000 remains a distinct possibility.

SILVER- Silver needs to hold support near $32.50 to maintain the potential for an accelerated rally towards $40.00.

PLATINUM- Platinum is testing support near $1,000. Progressive closes below the 50-day EMA would promote more downside.

GDX- Miners failed to hold the accelerated trendline, which was wishful thinking on my part. Prices must close above the $41.51 price gap to promote a continued uptrend and higher highs.

GDXJ- Juniors need to close above $53.02 to signal an end to this pullback. Progressive closes below the 50-day EMA would confirm an intermediate-degree pullback.

SILJ- Silver juniors need to close above $14.31 to signal an end to this pullback. Progressive closes below the 50-day EMA would confirm an intermediate-degree pullback.

AEM- Agnico Eagle reported EPS 16% higher than estimates, and prices still finished the day lower. Support at the 6-month trendline.

Conclusion

The bull market in precious metals is just starting and is expected to continue into 2030. Gold could reach between $8,000 and $10,000, while I foresee silver exceeding $200. Don’t lose your seat on the train just as it’s leaving the station.

AG Thorson is a registered CMT and an expert in technical analysis. For more price predictions and daily market commentary, consider subscribing at www.GoldPredict.com.

*******