London, October 30, 2024, (Oilandgaspress) ––– Ford reported third-quarter 2024 results that indicate the long-term value creation made possible by a winning lineup of internal combustion, hybrid and electric vehicles for retail and commercial customers combined with an advantaged strategy and global footprint.

“We are in a strong position with Ford+ as our industry undergoes a sweeping transformation,” said Ford President and CEO Jim Farley. “We have made strategic decisions and taken the tough actions to create advantages for Ford versus the competition in key areas like Ford Pro, international operations, software and next-generation electric vehicles. Importantly, over time, we have significant financial upside as we bend the curve on cost and quality, a key focus of our team.”

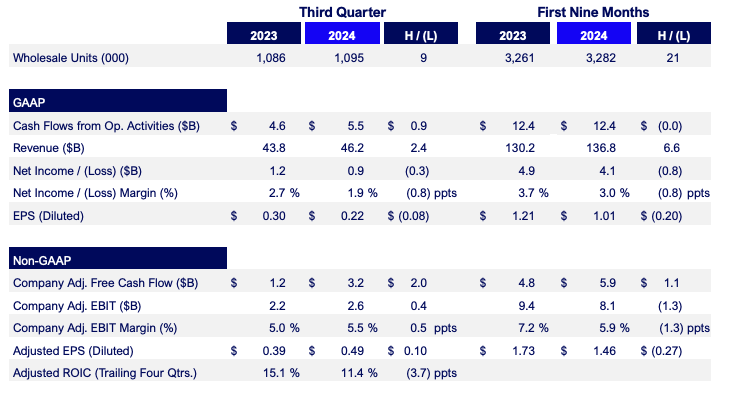

Ford’s third-quarter revenue was $46 billion, up 5% from the same period a year ago. This marks the company’s 10th consecutive quarter of year-over-year revenue growth, benefits of a fresh and compelling product lineup that offers freedom of choice to both retail and commercial customers.

Company net income was $0.9 billion, down $0.3 billion from third-quarter 2023, due largely to a previously announced $1 billion electric vehicle-related charge that was part of actions taken to deliver a profitable, capital-efficient and growing electric vehicle business.

Adjusted earnings before interest and taxes, or EBIT, was $2.6 billion, a $352 million improvement year-over-year. The improvement was driven by higher volume and favorable mix, offset partially by electric vehicle pricing pressure and adverse exchange; overall costs were lower in the quarter.

“We are remaking the company with Ford+ into a higher-growth, higher-margin, more capital-efficient and more durable business,” said Ford Vice Chair and CFO John Lawler. “The work we have done over the past few years to restructure our global business — and tailor our product lineup to segments where we know our customers best — is driving continued growth and generating stronger and more consistent cash flow.”

Cash flow from operations in the third quarter was $5.5 billion, and adjusted free cash flow was $3.2 billion. At quarter-end, Ford had nearly $28 billion in cash and $46 billion in liquidity, providing considerable flexibility in a dynamic environment.

The company also declared a fourth-quarter regular dividend of 15 cents per share, payable on December 2 to shareholders of record at the close of business on November 7.

Company Key Metrics Summary

Information Source: Read More

Oil and gas press covers, Energy Monitor, Climate, Gas,Renewable, Oil and Gas, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,