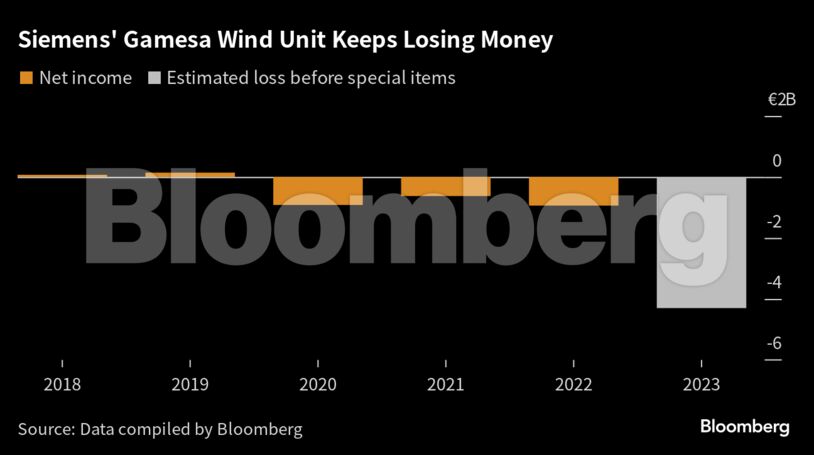

Siemens Energy AG launched a strategic review of its wind power business as problems with its turbines are expected to cause a €4.5 billion ($5 billion) net loss in one of industrial Germany’s biggest debacles.

The worsening outlook, which compares with a previous roughly €1 billion net loss prediction, marks the latest setback for the German manufacturer in getting to grips with quality flaws and unprofitable contracts weighing on its wind unit. Siemens Energy’s other businesses are performing well and the company has strong cash reserves.

The quality issues, which can occur in onshore turbines at some rotor blades and main bearings across two platforms, are unlikely to happen again in the same magnitude, Jochen Eickholt, who heads the Siemens Gamesa Renewable Energy wind unit, said Monday on a call.

The problems center on the discovery that a main piece on the frame of a wind turbine can move or twist over time, potentially damaging other critical components, people familiar with the matter have said.

Shares in the company, where former parent Siemens AG still holds a 32% stake, were volatile Monday, falling 4.5% at 1:30 p.m. in Frankfurt following earlier gains and losses. The moves may indicate some short covering with the company one of the most shorted stocks in Europe.

The manufacturer has been lurching from one crisis to the next in a long line of attempts to get a grip on its Spanish unit that’s been loss-making for years with few comparable missteps in Germany’s industrial sector. Steelmaker Thyssenkrupp AG in 2013 sold steel operations in the US that caused several consecutive annual losses, while Daimler AG dumped Chrysler at a fraction of its original $35 billion price tag.

Siemens Energy Chief Executive Officer Christian Bruch has blamed the rapid introduction of new turbines and ramping up capacity quickly for some of the issues. To better address Gamesa’s problems, the company last year took control of the remaining Gamesa shares it didn’t already own at a cost of €4.4 billion.

Most of the deep-seated technical struggles, some of which the company is pinning on suppliers, are centered in the onshore activities, where business has been particularly tough for all turbine makers due to higher costs and lack of scale.

Record Slump

Monday’s announcement marks the first update from Siemens Energy after it suspended its annual profit guidance in June. At the time, its shares slumped by a record after the company said the technical problems at the Spanish subsidiary could cost more than €1 billion to resolve. The company in January had expressed confidence it had uncovered all of Gamesa’s quality issues.

“It has been a very demanding quarter,” Bruch said in an interview with Bloomberg Television. The company is now reviewing different elements in its wind business, he added, as the problems “delay our path to profitability” for the division.

Siemens Energy on Monday said total costs to fix the flaws in Gamesa’s onshore turbines will cost €1.6 billion. Despite the quality problems in the 4.X and 5.X platforms, the majority of turbines is still performing well and fixes are expected to be made during regular service intervals, Eickholt said. The main part of the repair costs is expected over the next two fiscal years.

In addition, the company detailed issues in its offshore business, where higher product costs and ramp-up challenges incurred charges of €600 million during the fiscal third quarter through June. The higher outlays mean Siemens Energy is making a loss on certain contracts if customers take delivery.

While Siemens Energy’s wind power business is beset by internal problems, the industry has for years suffered steep losses after soaring raw materials prices, increased transportation costs and supply chain disruptions. Vestas Wind Systems A/S, the world’s biggest wind turbine maker, earlier this year outlined a surprise first-quarter profit, leading to predictions of better times for manufacturers laboring through a backlog of unprofitable contracts.

Adding to the expected annual net loss is a €700 million writedown of deferred tax assets during the fiscal year through September. Despite the additional charges, Siemens Energy has cash and cash equivalents of around €4.3 billion.

To contain the fallout from its quality problems at Gamesa, Siemens Energy is trying to delay delivery of new wind turbines from its troubled 5.X platform by as much as seven months, people familiar with the matter have said.

The company will give details on its wind business review in November during an investor day.

While the wind turbine problems at Gamesa weigh on earnings and outlook, revenue and profit in the company’s gas turbine and grid technology segments rose.

During the fiscal third quarter through June, revenue gained 8% to €7.5 billion after orders jumped by more than 50%. Net losses ballooned more than five-fold to €2.93 billion as as the costs of fixing issues at its Gamesa units drag on earnings.

Share This: