Australia-headquartered multinational mining company Rio Tinto is all set to add a world-class lithium mining business to its portfolio. A few days ago, the firm announced a definitive agreement that would see the company acquire Arcadium Lithium PLC in an all-cash transaction. The reported cost is US $5.85 per share, which would put the deal in the region of about US $6.7 billion.

According to a press statement, the deal represents a 90% premium over Arcadium’s October 4 closing price of $3.08 per share. The figure is a 39% premium over Arcadium’s volume-weighted average price (VWAP) since the company’s inception on January 4, 2024.

Why Now? Why Arcadium?

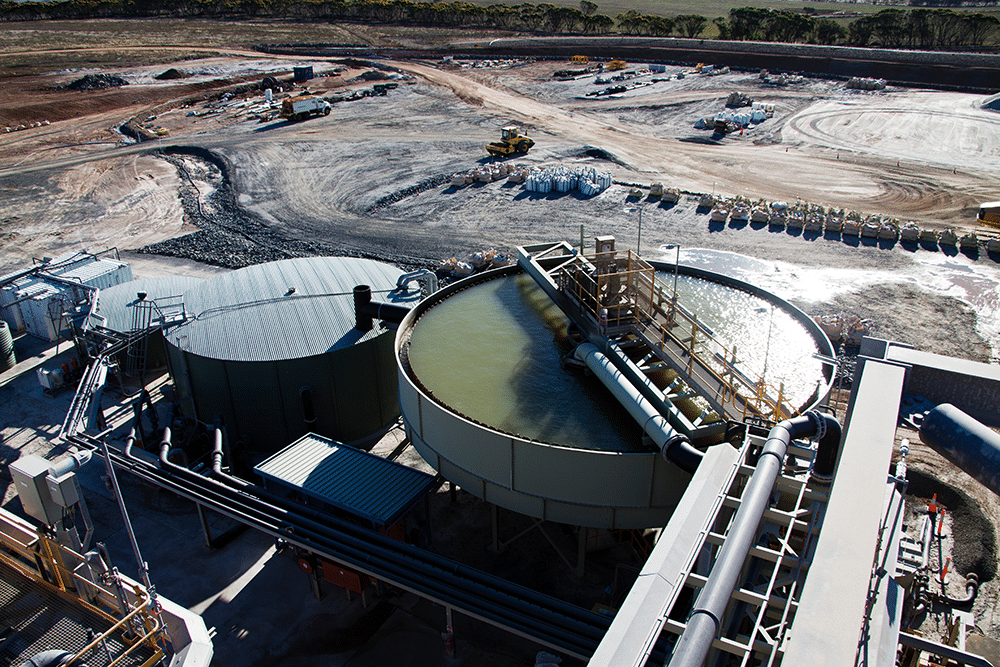

Arcadium is a rapidly expanding global company that produces lithium chemicals with a focus on efficient, low-cost operations and long-lasting resources. The company is a leader in lithium mining and manufacturing, utilizing methods such as hard-rock mining, brine recovery and direct lithium extraction.

Currently, Arcadium produces 75,000 tonnes of lithium carbonate equivalent per year, which includes products like lithium hydroxide. However, the firm has plans to more than double its production capacity by the end of 2028. Arcadium reports having about 2400 employees operating in several countries, including Argentina, Australia, Canada, China, Japan, the United Kingdom and the United States.

With global demand for car batteries at an all-time high, some analysts see the acquisition as a win-win situation for Rio Tinto. They say the move is part of a growing trend of mining company mergers this year, as the industry looks to strengthen its position amid the accelerating energy transition. Lithium plays a key role in this shift, as it remains widely used in electric vehicles, laptops, smartphones, digital cameras and as a coolant.

MetalMiner’s MMI report includes monthly price and market trends for 10 different metal markets and can be used as an economic indicator for contracting, price forecasting and predictive analytics. Sign up here.

Rio Tinto to Gain Leverage Over More Than Just Lithium Mining

It seems Rio Tinto has placed a long-term bet on the lithium market despite current price drops caused by Chinese oversupply and a slowdown in electric vehicle sales. A recent report in The Guardian pointed out that global auto manufacturers had been complaining of stagnating EV demand for months.

Just a few days ago, Toyota revealed it would delay the start of EV production in the U.S. until 2026, reworking its earlier timeline of starting by the end of 2025. The report added that Ford and Volvo were also thinking about delaying their transition to EVs.

Nevertheless, the downturn has made lithium mining companies appealing takeover targets. Part of what makes Rio’s acquisition so appealing is that it not only provides access to lithium mines, processing facilities and deposits in Argentina, Australia, Canada and the U.S., but it comes with a customer list that includes carmakers Tesla, BMW and General Motors.

In the statement of intent to acquire, Rio Tinto Chief Executive Officer Jakob Stausholm explained that acquiring Arcadium Lithium was a “significant step” forward in his company’s long-term strategy. Stausholm sees Rio’s ultimate goal as having a leading lithium business operating alongside its global aluminum and copper operations to supply materials needed for the energy transition.

Subscribe to MetalMiner’s weekly newsletter and conquer market volatility with valuable weekly market insights and macroeconomics.

Tackling China’s Near-Monopoly

Rio Tinto’s acquisition occurs during a downturn in lithium prices, driven primarily by an oversupply from China. With control of about two-thirds of the global lithium supply, China has been flooding the market, leading to a significant drop in prices.

U.S. officials have accused Beijing of using predatory pricing strategies to undercut competitors and force rival lithium producers out of the market. Though the price of lithium tripled between 2021 and 2022, it has since plummeted, dropping by more than 80% over the past year.

Rio Backs Startups Amid Quest of Cleaner Mining

In all this reportage on Rio’s acquisition, let’s not forget another development involving the mining conglomerate. Rio Tinto recently signed a partnership deal with British VC fund Founders Factory to start a Mining Tech Accelerator program focused on promoting cleaner, more efficient mining techniques. More specifically, Rio has assured 14.4 million Australian dollars to the accelerator to support pre-seed and seed-stage startups.

Six such startups have been short-listed in the first leg, including Denver-based Endolith, which utilizes microbes as part of a greener method to recover copper from low-grade ores. Rio Tinto’s recent investments underscore a clear message: the future of mining will hinge on technology. As environmental regulations become more strict, companies that develop cleaner solutions will be in the best position to lead the industry.

Start saving on COGS. Explore MetalMiner’s full metal catalog and start getting metal price forecasts customized to your specific metal types and forms.