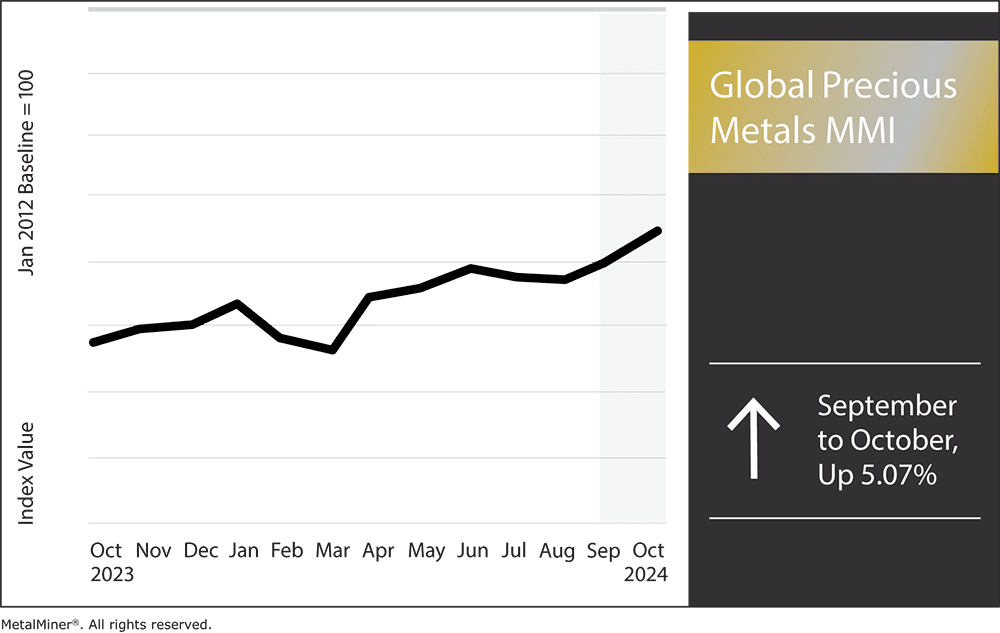

The Global Precious Metals MMI (Monthly Metals Index) continued to make gains this past month, rising by 5.07%. Gold once again reached unprecedented highs, hitting $2,697 per ounce in October due to safe-haven demand spurred by economic concerns and U.S. election uncertainty. Other precious metals prices, like silver, also saw gains. Meanwhile, platinum began to experience more price stability, with moderate growth attributed to supply constraints.

Overall, prices rose due to both safe-haven investment behavior and broader macroeconomic factors.

Precious Metals Prices: Palladium

Palladium prices have continued their downward this past month, largely influenced by declining demand in the automotive sector. However, prices saw a modest increase as of mid-October, trading at approximately $1,079 per troy ounce.

Looking ahead, analysts expect palladium prices to fluctuate between $850 and $1,100. Changes in demand from the automobile industry and other economic factors, such as the impending election, are sure to impact this. Additionally, most anticipate that mining output for palladium and platinum will be weaker than the previous year, which could further induce volatility.

To keep up with the latest trends in precious metals prices, ones that you can use as a hedging tool, make sure to subscribe to MetalMiner’s Weekly Newsletter.

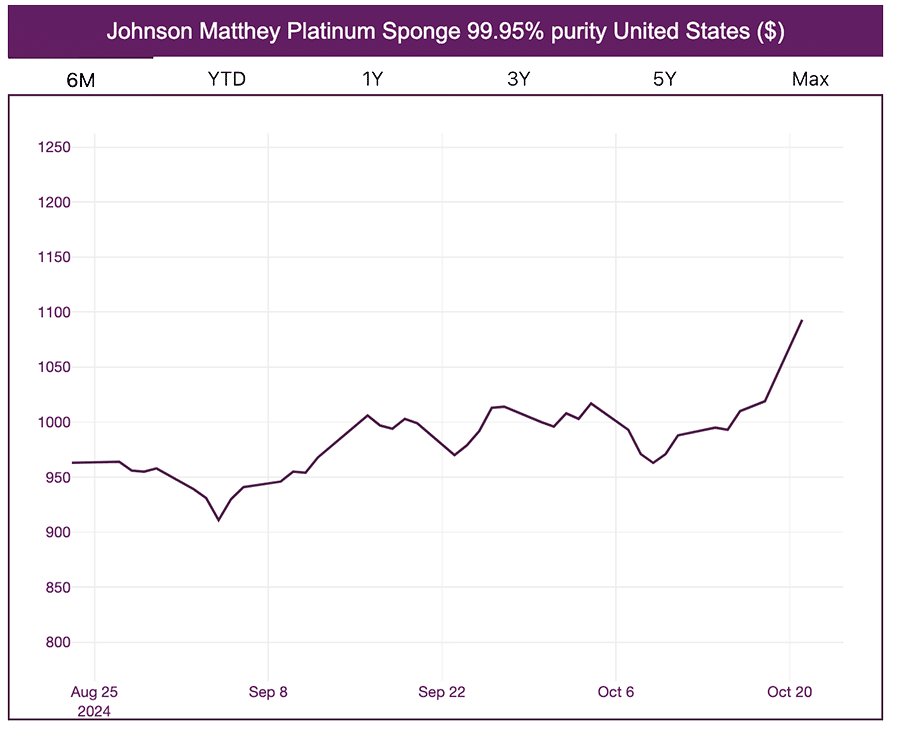

Platinum Prices Remain Steady

Platinum has remained relatively stable, with only slight upward price action. Lingering volatility from supply chain disruptions earlier in the year continues to place bullish pressure on prices, along with the Sibanye-Stillwater mining production cuts.

Though South African mining initiatives continue to recover from recent labor unrest, the resolution of strikes has alleviated immediate supply concerns. These factors will likely keep prices firm and place bullish pressure on platinum prices.

Precious Metals Prices: Silver

Silver prices experienced a steady climb, largely driven by economic uncertainty due to the oncoming election. In addition, supply limitations imposed by key producers such as Mexico and Peru aided overall price support. Looking ahead, silver prices will likely remain somewhat volatile, with potential upward pressure, if industrial demand for silver continues to grow.

For monthly market insights and primary price drivers of precious metals and nine other metals industries, be sure to subscribe to MetalMiner’s Monthly Metals Index (MMI) Report.

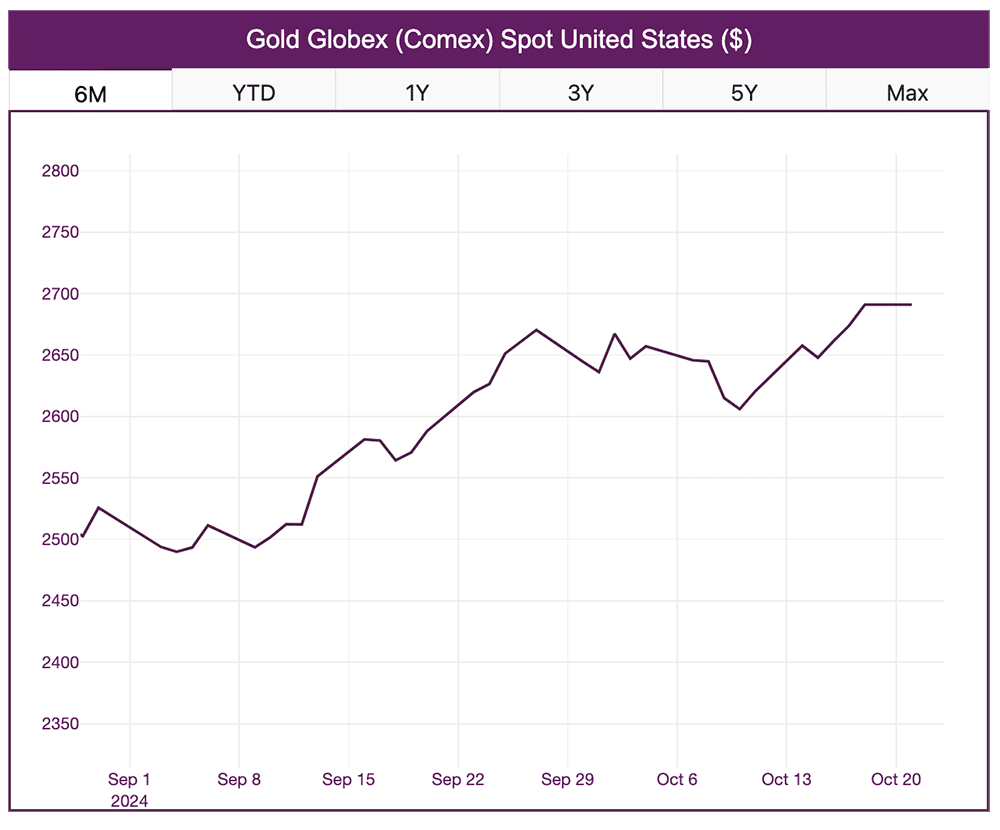

Gold Once Again Hits Record Highs

Gold prices saw yet another significant month-over-month increase. As with other precious metals, continued escalating geopolitical tensions in the Middle East and mounting uncertainty surrounding the U.S. elections fueled demand for the safe-haven asset.

The increasing trend was further supported by central banks signaling extended periods of market instability. Looking forward, analysts predict that gold will continue to perform strongly in the coming months

Precious Metals Prices: Monthly Price Shifts

Navigate precious metal price volatility with confidence. MetalMiner equips you with the critical insights you need to develop a winning hedging strategy. View our full metal catalog.

- Palladium bar prices moved sideways, rising by 1.34% to $984 per ounce.

- Platinum bars moved up by 3.92%. This brought prices to $981 per ounce.

- Silver ingot prices increased by 6.39%, bringing prices to $31.29 per ounce.

- Lastly, gold bullions rose by 4.84%, which brought prices to $2,638.10 per ounce.