Time flies. The first half of 2023 has already been over for a while, and the EV transition is accelerating, so we’re bringing news from a region often forgotten when speaking about electric vehicles: Latin America.

We will divide this series of articles into three parts: the laggards, the middle of the pack, and the leaders. For each, we will present three countries with some detail, plus one honorable (or dis-honorable) mention, depending on the circumstances. The information will be presented at the detail allowed by the source (normally, a government institution or EV-promoter association), so some countries will have more detailed information than others: in some cases, we will be able to present light and heavy-duty vehicles and include PHEVs; in others, we will have to present only light vehicles (or all vehicles) and only BEVs. We will focus on 4-wheelers, so three-wheelers and motorcycles/scooters will not be part of this analysis.

That being said, let’s start!

Dishonorable mention: Argentina (0.06% BEV market share)

We start this article with the dishonorable mention. Argentina is a relatively big, relatively wealthy country, and yet the presence of EVs there is so marginal that it’s not even present in official statistics (which mostly refer to “electrified vehicles,” including HEVs and even MHEVs).

407,532 vehicles were sold in Argentina in 2022. Of these, 261 were BEVs, presenting an impressive market share of … 0.06%.

That’s right, folks, Argentina is the only country in our entire list yet to surpass not 1%, but 0.1% BEV. Electric vehicles in the country are basically a margin error, a statistical anomaly, and even though PHEVs may be able to bring plug-in market share to 0.1%, we can’t know, because they aren’t classified separately from HEVs.

In the first half of 2023, things have somewhat improved, with 170 BEVs being sold in a market totaling 235,100 units. That brings market share up to … 0.07%! I wouldn’t be holding my breath here. Argentina seems likely to remain a laggard in the foreseeable future, though imports from Brazil may still change the direction of the market. Not many details about BEV sales can be found online, but it seems that the locally produced Tito Corradir remains the most sold BEV in the country.

#9. Perú (0.2% plug-in market share)

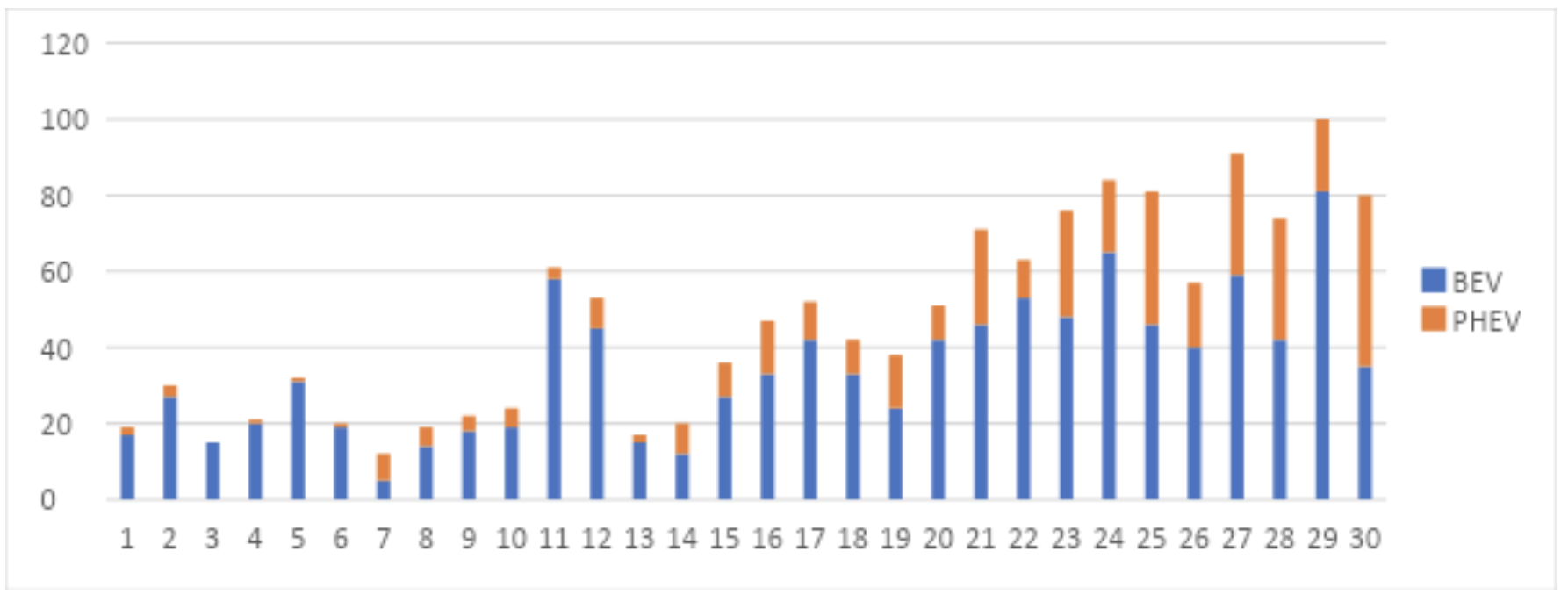

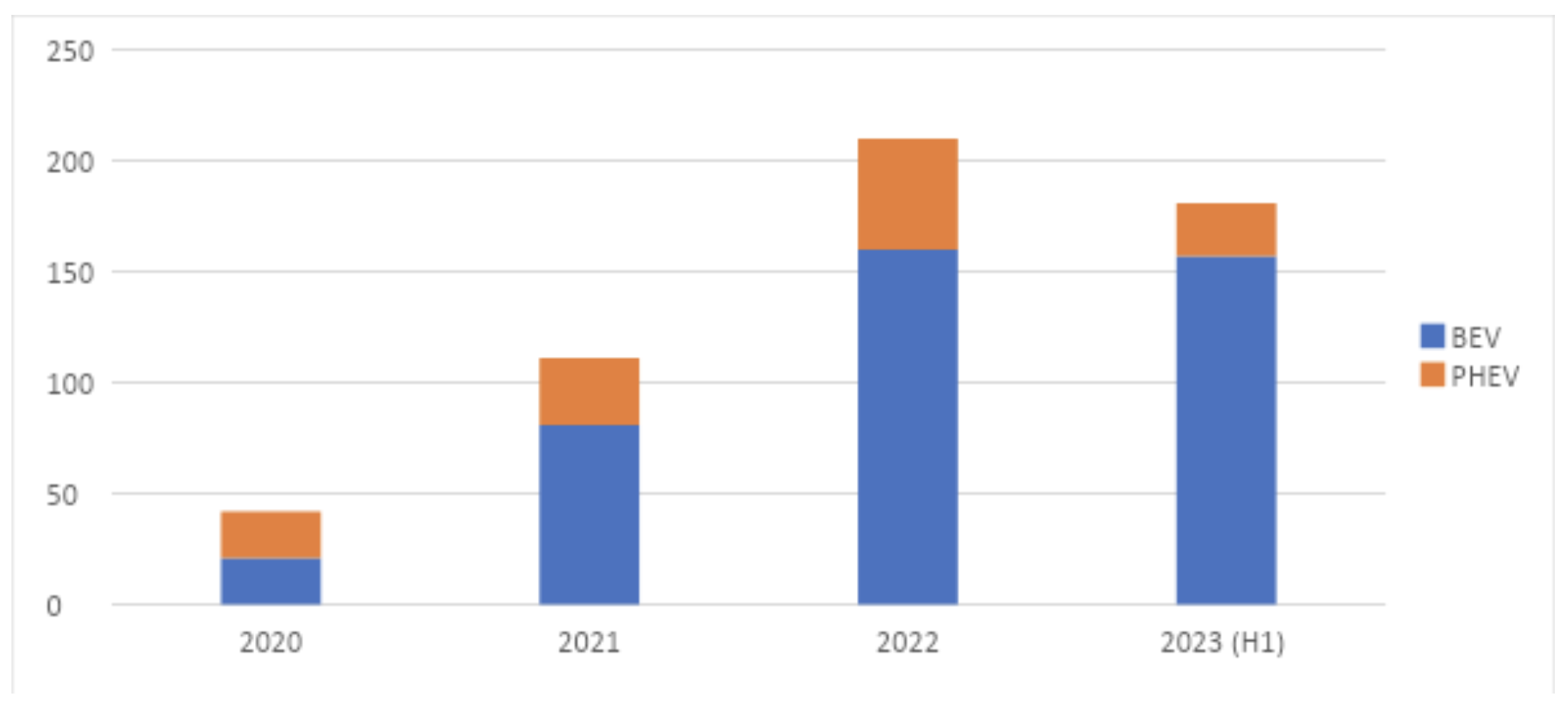

Unlike Argentina, Peru at least has already surpassed 0.1% market share, presenting 110 BEVs and 96 PHEVs in H1 2023 in a market totaling 94,983 units. All in all, BEVs and PHEVs correspond to 0.1% of the market each. That more than doubles Argentina’s market share!

Jokes aside, it’s clear that Peru has a marginal EV market share, and though things seemed to be speeding up in 2022 (when sales tripled, as compared to 2021), 2023 has so far shown disappointing results, with only a 50% increase. Normally, that would be good news, but when we’re starting from a position so low, far more is needed to keep the optimism.

There’s a general trend that, whenever a country has marginal EV market share (such as Peru and Argentina), all news outlets present “electrified” sales instead of BEVs or PHEVs, so it’s hard to find plug-in sales leaders. In Peru’s case, we were able to find out that the Toyota RAV4, the Volvo CX40 and CX90 (all PHEVs) comprise the podium for H1 2023.

#8. Ecuador (0.7% plug-in market share)

Next in our list is Ecuador, and even though numbers remain low, we’re almost reaching the symbolic 1% milestone here.

In H1 2023, 69.947 vehicles were sold in total in the small equatorial country (pun intended), with 303 of these being BEVs and 180 PHEVs. Furthermore, plug-in sales more than doubled from H1 2022, with BEVs growing 87% and PHEVs growing 246%. Now, these are the rates that make one keep the optimism on!

The growing trend for EVs in Ecuador has sparked the interest of Terpel Voltex, Colombia’s largest fast-charging network, which entered the country with a 94kW fast-charging station in Guayaquil last month. However, the company seems to have foregone the lessons learned in the Colombian market, and still opted for the CHAdeMO plug over the far more needed GB/T.

Ecuador still belongs to the aforementioned group where “electrified” cars are all listed together, but we still found out that the Audi E-Tron (43 units) and the Mercedes GLE line (33 units) were the plug-in leaders.

#7. Panama (0.8% plug-in market share)

And we finish our first part with a sad note, for even the leader of the laggards remains under the symbolic 1% milestone. Things will get better in our next chapter, so there’s that.

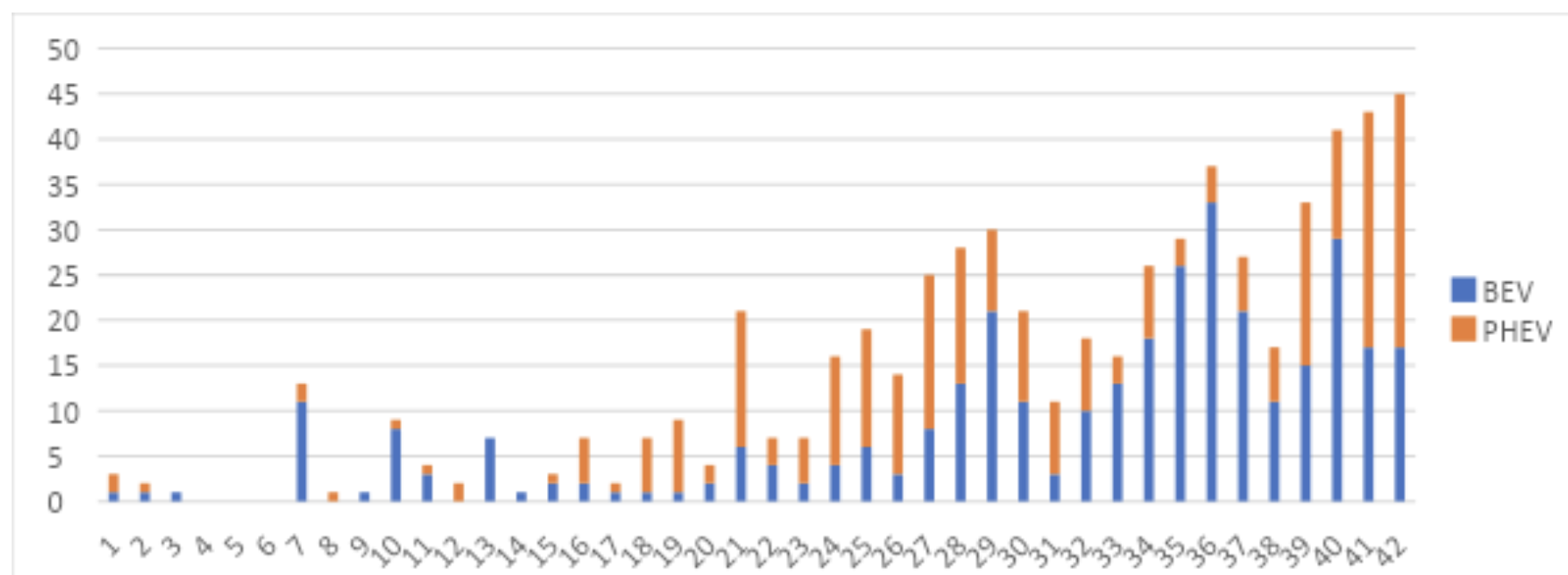

Unlike Peru and Ecuador, Panama does not seem to have any official institution publishing numbers for monthly sales. H1 total sales could not be found, but based on previous years’ trends, and the numbers for Q1, we calculated them to be around 23.000 vehicles (give or take a few), 157 of which were BEV and 24 PHEV. Sales in H1 2023 nearly reach the total numbers for 2022, meaning a fast-growing market here as well:

Panama is also interested in promoting Electric Buses and taxis and has received -alongside Paraguay and Uruguay- 122 million USD to keep advancing in its electric strategy.

Despite Panama being the most EV-friendly country in the first part of our list, I must admit my disappointment. By far, this is the wealthiest country in the entire ranking (and in Latin America), yet it remains so far behind many others, even though it has the resources and the geography to be able to rapidly electrify, if so it wished. But hey, at least it’s not Argentina!

Pretty soon, we’ll publish the second part of the series, so stay tuned!

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …