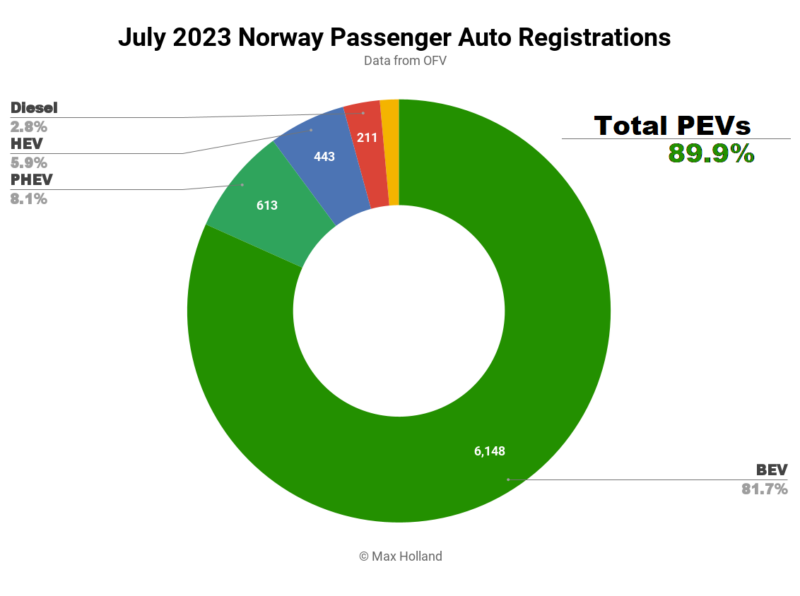

July saw plugin EVs at 90% share of Norway’s auto market, up from 83% year on year. Full electrics continued to advance, taking almost 82% of the market and leaving all other powertrains in decline. July’s overall auto volume was 7,525 units, up some 4% YoY. The Volkswagen ID.4 was Norway’s best selling vehicle in July.

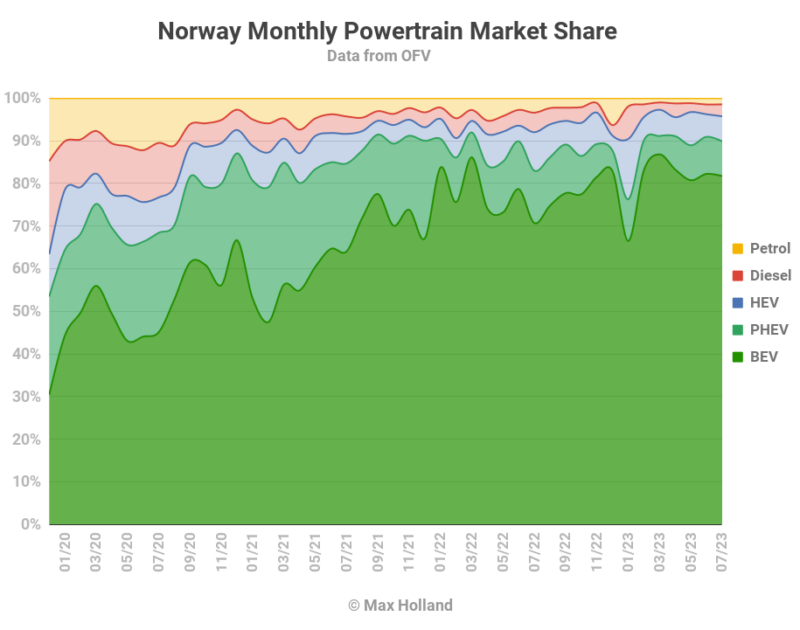

With combined EVs at 90% share (strictly, 89.9%) in July, full battery electrics (BEVs) contributed 81.7%, and plugin hybrids (PHEVs), 8.1%. These compare with equivalent shares of 83.0%, 70.7%, and 12.3%, a year ago.

Looking at volumes, BEVs increased 20% YoY, to 6,148 units, whilst PHEVs shrank by 31%, to 613 units. All of the 4% overall auto market growth came from BEVs.

All other powertrains had even bigger volume drops, with combustion-only powertrains losing some 45% of their volume YoY, with an especially weak performance from petrol vehicles (just 109 units registered). Recall that higher CO2 taxes have been in place since January 2023, which petrol vehicles especially fall foul of.

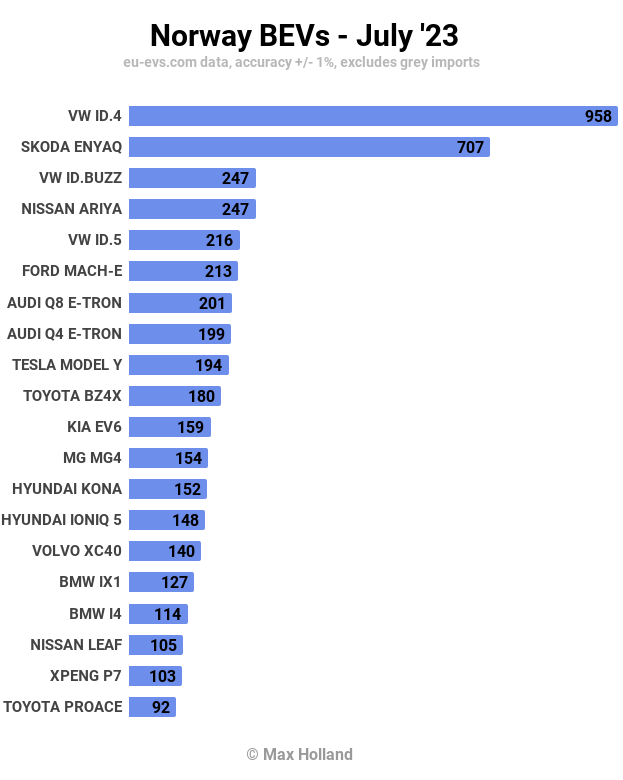

July’s Bestsellers

The Volkswagen ID.4 was Norway’s best selling vehicle in July, with 958 units, its first return to the lead since October 2022 (from its typical 2nd place). The usual suspect, the Tesla Model Y, was at a low delivery ebb in July (just 194 units) after its huge push in June.

In second and third spots were the Skoda Enyaq, and the Volkswagen ID. Buzz, making July a 1-2-3 for Volkswagen Group.

VW Group didn’t stop there either, having another 3 models in the top 8, altogether a very impressive sweep.

This comes with a pinch of salt, though, since almost all of the top 20 models were at a low volume of deliveries compared to June.

Another noticeable performance came from the Xpeng P7, which made its first volume deliveries (103 units) since December, having been almost absent in the intervening months.

There were no new faces in the top 20, and only one in the whole field — the new Jeep Avenger making its first countable deliveries to Norway, though at a modest 28 units for now. It will be interesting to see if this diminutive SUV (barely over 4 meters in length) catches on in Norway.

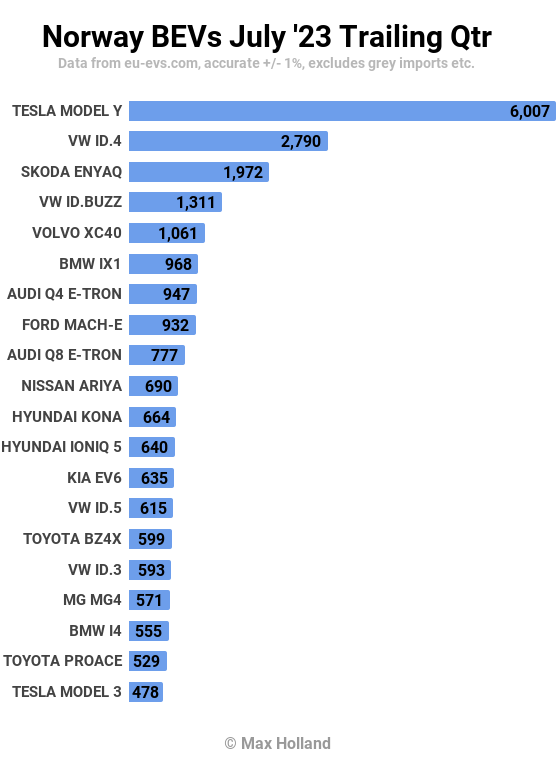

Let’s check the 3-month picture:

In the trailing 3 month charts, the Tesla Model Y remains head and shoulders above the rest, with a massive 6,007 units.

Yet Volkswagen Group made more BEV deliveries than Tesla overall, with 9,178 units, compared to Tesla’s 6,613 units.

There were few moves by newer and potentially disruptive BEVs in the charts. The MG4 continued to climb undramatically, from 30th in the prior period, to 17th in the most recent 3 months. This is a good performance, given that Norwegian buyers strongly prefer SUV form factors. Let’s also keep an eye on the Jeep Avenger now that it has launched in Norway.

Outlook

Norway’s macro economic position remains stable, with 3% GDP growth currently, although at the consumer pocket-book level, inflation and interest rates both remain high. Industrial confidence has also taken a hi in Q2 2023, and is now at the lowest level since Q2 2020, with orders falling.

Nevertheless, the continued growth of the BEV market is a bright spot, and has every potential to continue to play out at a fair clip in the coming years.

As I have often said, for the remaining 10% of sales to switch over to plugins (and eventually to mostly BEVs) will require a further broadening of the spectrum of BEV model offerings. Especially needed are offerings in underserved niches, and some examples of more affordable — yet fully competent — BEVs. This part of the equation is mostly out of Norway’s hands, neither itself being a vehicle producer, nor being a large enough market for manufacturers to tailor their offerings to.

What are your thoughts on Norway’s final stages of the EV transitions. Please jump in and join the discussion below.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …