Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Recently I published a perspective on the Canadian city of Mississauga’s plan to pilot hydrogen buses for their transit system. It included global data on the high cost and low reliability of hydrogen electrolysis and refueling systems and the high cost and low reliability of hydrogen fuel cell buses. Someone asked the next obvious question: how much money are we talking about, and who would be getting it?

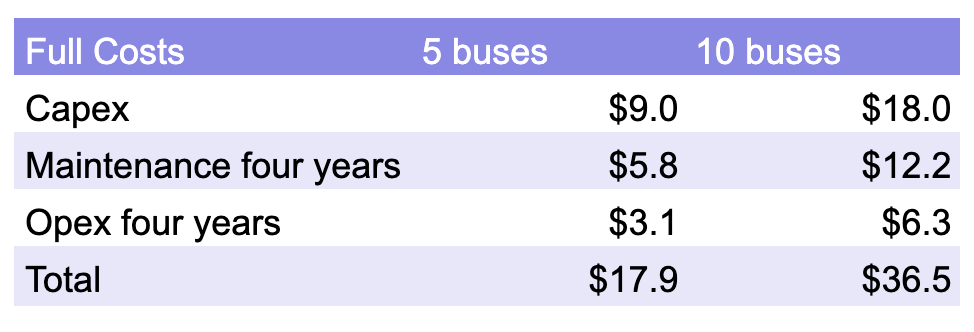

Follow the money, and in this case it’s up to $36 million, far more than the costs of purchasing and operating electric buses for equivalent service. (All dollar values in this article are in Canadian currency unless stated otherwise.)

Let’s start with methodology. I’m a strong proponent of Professor Bent Flyvbjerg’s reference class forecasting approach to estimating the costs of projects. This is outlined in his best selling book with Dan Gardner from 2023, How Big Things Get Done. The methodology is simple:

- Get as much data on costs and duration on historical projects similar to the one proposed as possible

- Take the averages of costs and duration

- Start with that for the likely costs and duration of your project

- Adjust up or down only if it’s absolutely clear that there’s a variance, for example, half the distance of tunneling

As a note, Flyvbjerg and co-authors recently published a paper on uniqueness bias, the assumption that your project is somehow magically different than other, similar projects, and how to avoid it. The abstract:

“The paper explores “uniqueness bias,” a behavioral bias defined as the tendency of planners and managers to see their decisions as singular. For the first time, uniqueness bias is correlated with forecasting accuracy and performance in real-world project investment decisions. We problematize the conventional framing of projects as unique and hypothesize that it leads to poor project performance. We test the thesis for a sample of 219 projects and find that perceived uniqueness is indeed highly statistically significantly associated with underperformance. Finally, we identify how decision makers can mitigate uniqueness bias in their projects through what Daniel Kahneman aptly called “decision hygiene,” specifically reference class forecasting, premortems, similarity-based forecasting, and noise audits.”

I encourage Mississauga’s transit planners to read both the material on reference class forecasting and uniqueness and apply the learnings to the proposed hydrogen bus trial.

For full disclosure, some of my material appears in one of the chapters of Flyvbjerg’s book, I communicate with him moderately regularly and have worked professionally with his firm Oxford Global Projects. For further context, I was a major, complex projects estimation subject matter expert for one of the world’s largest technology firms as part of my professional life for several years, and developed and applied estimation to projects of up to a billion USD in value.

For the proposed Mississauga hydrogen bus pilot, we have at least some data from dozens of pilots and efforts around the world, including Quebec’s failed hydrogen car fleet and refueling, Whistler’s failed hydrogen buses, London’s failing hydrogen buses, and California’s failing hydrogen stations and bus fleets. The data is far from perfect. Unlike Flyvbjerg and team, I’m not attempting a rigorous data collection, cleansing, and statistical analysis, but a more rough and ready indicative estimate. I encourage Mississauga’s transit operators, CUTRIC, and international organizations, including researchers associated with the Oxford Centre for Sustainable Road Freight or RMI to perform a more rigorous study.

For people interested in the details of the global hydrogen fleets, I encourage you to read the article outlining more realistic cost and reliability data in the earlier article.

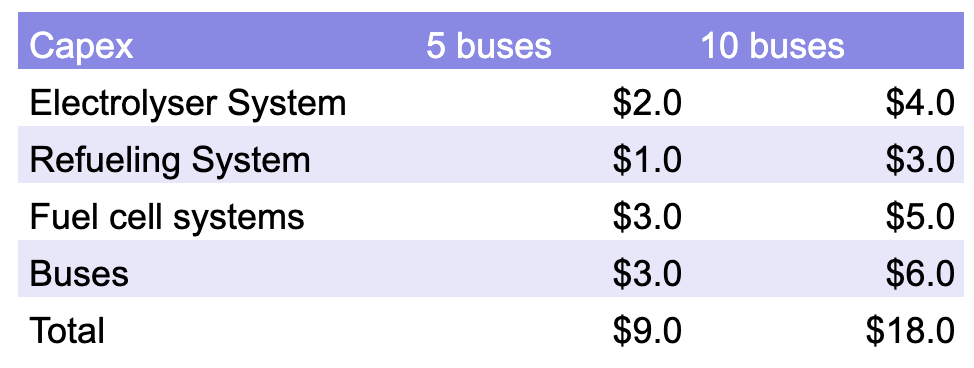

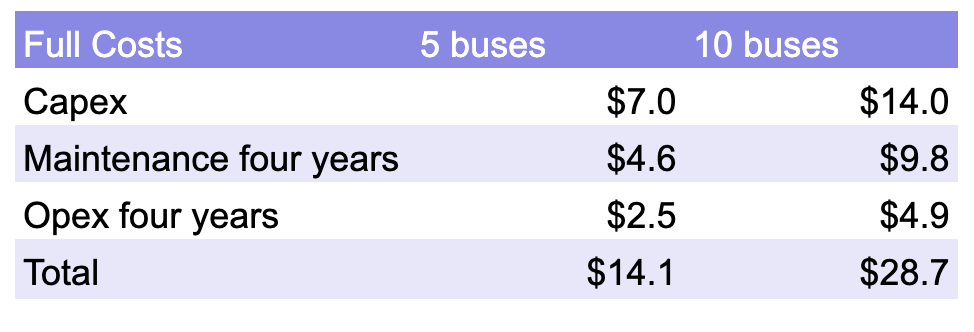

For this exercise, I’ll estimate capital costs for all components and maintenance and operational costs over four years for both 5-bus and 10-bus pilots. I’ll include a scenario for hydrogen electrolysis and a scenario for gray hydrogen. I’ll also include a scenario for electric buses instead. All values in millions of Canadian dollars in tables.

The electrolyzer and refueling system are not directly aligned with the number of buses, but the range of costs for them is in line with global averages. As a reminder, the Quebec single refueling point for a single car at a time plus the associated electrolyzer cost $5.2 million, within this range.

Fuel cell systems, including humidity control, surgical-suite grade air filtration, 300 to 750 atmosphere hydrogen tanks, temperature management for hydrogen as it changes pressure radically, and temperature management systems for water emissions so they don’t freeze, are expensive, and represent 35% to 50% of the cost of a fuel cell bus. At present, I am allocating all of those costs to the fuel cell system and hence to the fuel cell vendor, not the bus vendor. Adding the fuel cell system and bus lines is the total cost of the buses. Global data is aligned with these costs.

The Canadian government would fund up to 50% of this capital expenditure through its $2.75 billion zero emissions transit fund and program. The following vendors would most likely be the recipients of the total value.

HTEC is a Canadian hydrogen refueling station firm which provides the electrolyzers in BC and the single one in Quebec City. It would most likely get the $1 to $3 million for the refueling system and might also get the electrolyzer system.

Air Products manufactures gray hydrogen from natural gas in Sarnia for industrial consumers and also provides electrolyzer systems, and so might get the electrolyzer system money.

Ballad Power Systems is a Canadian fuel cell company and would receive most or all of the fuel cell systems money. However, Ballard loses $55 million annually on average, and $1.3 billion in total since 2000, without ever turning an annual profit. As with all of the other short-lived pilots Ballard has participated in globally over 25 years, this will not lead to it being a going concern. As another note, Ballard’s stock price peaked in March 2000, and is currently trading at 1.25% of that peak. The company cannot be considered a reliable source of information on anything except the firm price of buying its fuel cells in a signed contract.

Mississauga, like most transit organizations in North America, gets its buses from New Flyer, so the Ballard costs and rest of the bus costs will likely flow through them. Bus manufacturers love hydrogen because the buses cost so much more so that revenue and profits can be higher, even as customers end up hating them because of their costs and lack of reliability.

Global experience with electrolyzers makes it clear that they prefer to run in industrial settings full time. Running them part time has led to maintenance issues. Small-scale systems without dedicated support staff, such as Quebec’s system, have more outages for longer than industrial scale systems with dedicated operations staff. Quebec’s hydrogen refueling system was out of service for a full third of the total hours of the four years of the pilot, and 50% of those outages were attributed to the electrolyzer.

California’s refueling station experience, where mostly gray hydrogen was delivered by truck, found that compressors were the high failure point, comprising about 50% of all of the issues for those systems. In the six months with the best data — mature refueling stations, mature maintenance and operations, highest demand without being remotely near capacity — the stations were out of service for repairs and maintenance 2,000 more hours than the total time spent pumping hydrogen into vehicles.

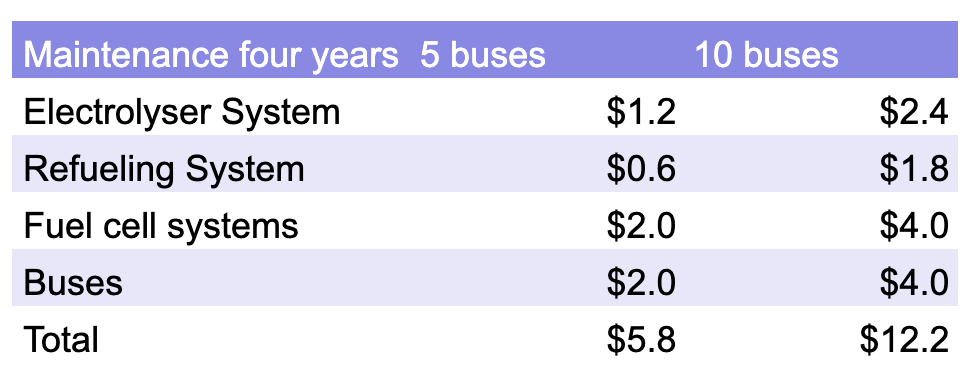

In hydrogen buses, California’s data for its bus fleets makes it clear that maintenance costs were 50% higher than for its diesel buses, and costs in this table are based on that experience.

Note that European experience per their annual hydrogen status report makes it clear that they have been unable to get over 20 months of warranty and maintenance included in costs of the hydrogen buses, while they were able to get 5 years of full parts and service and 8-year drivetrain warranties for electric buses. The numbers above could be adjusted based on achieving a useful warranty and service agreement in the cost of the buses, but the bus capital cost would go up.

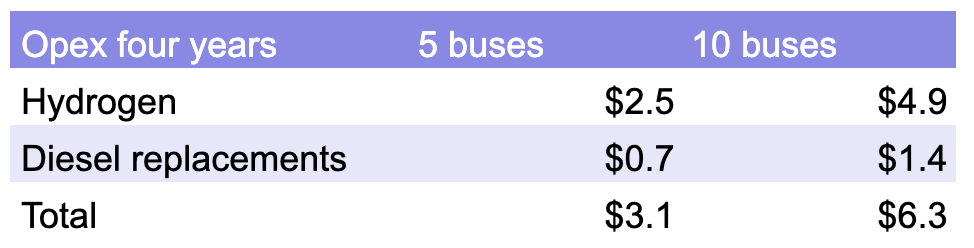

This scenario has an electrolyzer positioned on Mississauga transit facilities with the hydrogen buses. Based on the experiences of California, London, Whistler, Barcelona, and Madrid, I’m assuming 80% bus reliability, and hence 56,000 kilometers instead of 70,000 as the annual driving distance per bus. The electrolyzers are assumed to be running at night under Ontario’s very low night time rates, for a blended cost per kWh of $0.04.

As a reminder, each kilogram of hydrogen requires 55 kWh of electricity. Hydrogen fuel cell buses consume roughly 10 kilograms of hydrogen per 100 kilometers of driving per metrics I have at hand, so 56,000 kilometers requires about 5,600 kilograms of hydrogen. Each bus would have a requirement for roughly 300 MWh of electricity delivered to electrolyzers at the facility over the year. This is roughly three times the electricity requirements for an equivalent electric bus, for contrast.

As hydrogen bus fleets are not reliable based on global experiences since the early 2000s, with no appreciable improvements experienced, diesel buses would need to operate in their stead when they were out of service. Operational costs exclude driver labor, as it’s assumed to be required even if no pilot were run.

As a note on this, while operational changes due to electric bus charging are modeled and expounded on constantly, the lack of reliability of hydrogen buses and refueling stations is never modeled in estimates in my experience, just discovered — again — during operation.

For these scenarios, CA$18 to $36.5 million are the range of costs over the five years.

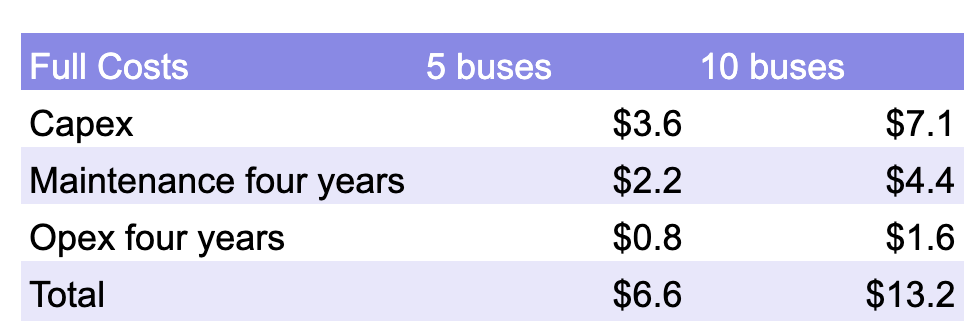

The next scenario to consider is one in which the electrolyzer and electricity costs are eliminated. In this case, it is likely that Air Products would be contracted to provide gray hydrogen delivered from its Sarnia facility by tanker truck. US Department of Energy and other data points make it clear that delivered cost of hydrogen for smaller scales, 450 kilograms a day or less, are higher. For the 5-bus scenario, the hydrogen requirements per day are roughly 60 kilograms, and for the 10-bus scenario roughly 120 kilograms, well under the lower clip level.

“For tube-trailer gaseous stations, delivery costs are projected to be $9.50/kg and $8/kg at 450 kg/day and 1,000 kg/day stations, respectively (2016$)”

Note that’s only delivery cost, and those are US dollars. For this scenario, Mississauga should budget the higher end of those scales for delivery and add costs for manufacturing the hydrogen. Assuming CA$14 for delivery and $2 for manufacturing, the cost per kilogram would be roughly $16.

Note that Canadian heavyweight Enbridge would prefer this solution too. All of that hydrogen would be manufactured from natural gas Enbridge delivered to the Air Product Sarnia facility. The volumes aren’t great for this, but Enbridge’s strategy is the same as all other fossil fuel manufacturers and distributors, to replace natural gas and oil with hydrogen manufactured from their product with significant governmental subsidies in one case and simply delay electrification and shifting off of fossil fuels in the alternative. They win either way, but no one else does.

It wouldn’t surprise if Enbridge was lobbying for the Mississauga hydrogen bus pilot. After all, it was part of the group of hydrogen-heavy firms which deeply skewed Ontario’s hydrogen strategy into one that will be a failure studied in B-schools and policy classes for years.

Given the strong strategic advantages for both Enbridge and Air Products, Mississauga should be wary about any proposed delivered costs of hydrogen being artificially lowered to create dependency, and insist on being quoted full costs for the hydrogen.

Further, as noted in the previous article, global data on the actual cost of manufacturing green hydrogen makes it clear that projections of very inexpensive green hydrogen are baseless. Do not base cost cases on presumed low future costs of hydrogen. It’s not getting cheaper.

Note that while the total cost of the trial goes down, so do the benefits. Gray hydrogen would result in double the greenhouse gas emissions of green hydrogen with Ontario’s grid electricity carbon intensity, and six times the emissions of battery-electric vehicles. (As a note, fuel cell buses manufacturing carbon debt is much more similar to battery electric and the constant usage amortizes manufacturing debt over more kilometers, so the difference is not great.)

The final scenario is, of course, battery-electric buses. While this is changing quite rapidly, there is still the assumption of 10% more electric buses required to provide the same service as diesel buses, and the scenario respects that.

Capital expenditures are vastly lower. Hydrogen electrolyzers and refueling stations are much more expensive than high-speed charging systems for electric buses, even with substantial battery buffering to reduce grid upgrade costs. Hydrogen electrolyzers would require three times the energy and power overnight to manufacture hydrogen at the facility, so the cost of electrical systems upgrades would not be in green hydrogen’s favor, although it would be in delivered gray hydrogen’s favor.

Electric buses are much more reliable than fuel cell buses and more reliable than diesel buses, as once again California’s bus fleet data shows. Maintenance costs are lower than diesel and downtime does not have to be accounted for, especially for small fleets with overnight depot charging.

Electricity is a third the cost of manufacturing green hydrogen on site.

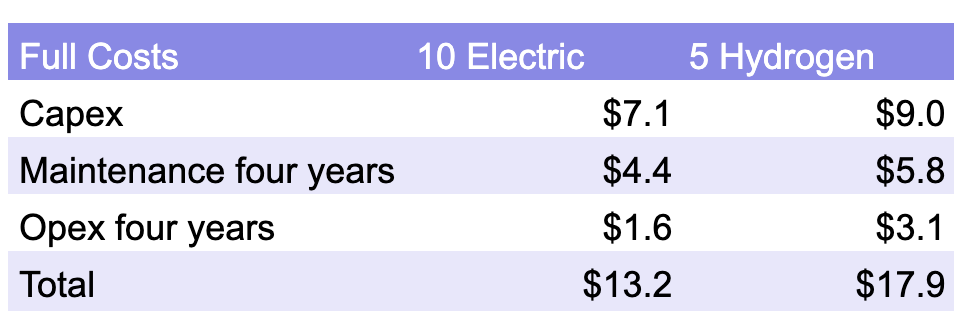

The costs for the hydrogen bus scenario vs the battery-electric bus scenario, per global data on actual experiences, not fantasmagorical illusions of dirt cheap hydrogen, make it clear that Mississauga could get twelve or thirteen electric buses, including full systems components, maintenance, and operational costs, for less than the total system cost of five hydrogen buses.

I provided some recommendations for the government of Canada, the city of Mississauga, and CUTRIC in the previous article. Clearly I’m adding reference class forecasting to the recommendations. If CUTRIC’s Rout∑.i™ 2.0 model doesn’t result in costs that align with empirical reality from hydrogen bus pilots around the world, then it’s simply wrong. As CUTRIC has been enabling Mississauga with its hydrogen bus pilot program, it clearly can’t be showing these significant budgetary variances, otherwise Mississauga wouldn’t be considering hydrogen buses.

After all, why would a city spend vastly more for a less reliable solution if it actually was getting good advice and data from CUTRIC?

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy