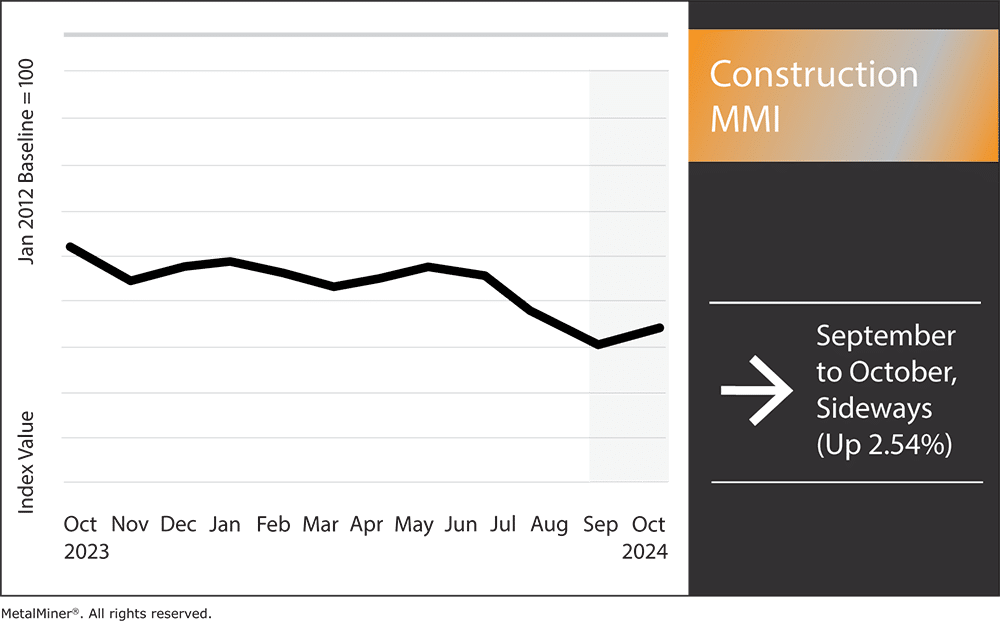

The Construction MMI (Monthly Metals Index) moved sideways, nudging up just 2.54%. Overall, the index continues to move in its more than year-long sideways range, with metal prices remaining stagnant. While the index had a slight response to the September interest rate drop, it will take a lot more than that to generate any type of noticeable momentum up or down. However, it is worth noting that aluminum sheet prices in Europe and steel prices in the U.S. are showing more movement than in the past several months, which could impact the overall U.S. construction industry.

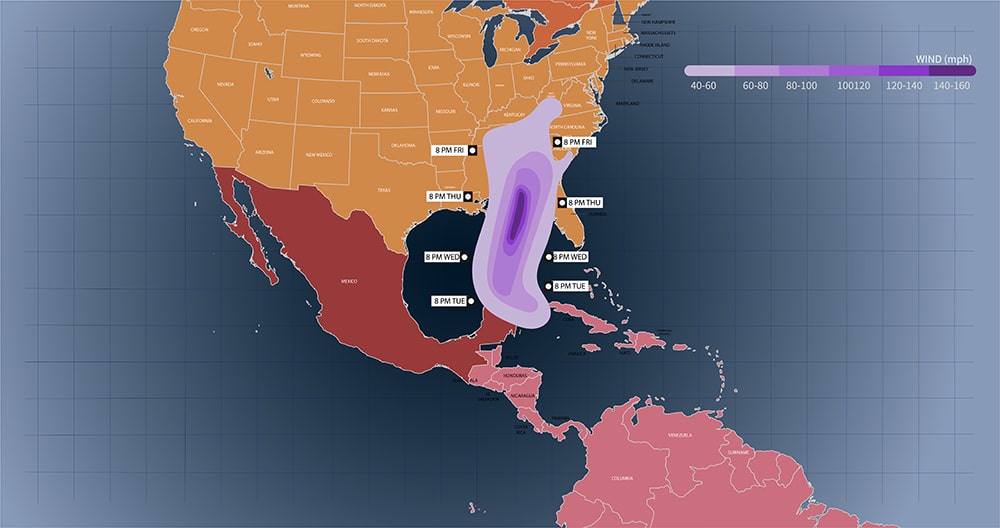

Along with this, another issue could impact the U.S. construction market. In the wake of Hurricane Helene and Hurricane Milton, the Southeast will need to undergo numerous reconstruction projects. This will include homes, industrial and commercial buildings, and infrastructure like bridges and electrical grids. This could cause the index to witness more movement in the short term than it has in over 12 months.

“Hurricane-Force” Reconstruction Efforts After Helene and Milton

In the wake of Hurricanes Helene and Milton, the U.S. construction industry and industrial metals markets face significant potential disruptions. To make matters worse, these back-to-back storms hit at a time when both industries were already grappling with issues like high material costs and elevated interest rates.

Structure Damage and Strain

At least $10.5 to $17.5 billion in insured damages resulted from Hurricane Helene’s devastation of Florida and other southeastern states. This included damaged roads, bridges, water systems and electrical grids. Hurricane Milton followed shortly after, worsening the existing problems. These storms illustrated how pitfalls in infrastructure can make disaster response more difficult.

The damage also placed additional pressure on an already strained construction workforce. Contractors now need to rebuild not only physical structures but also their supply chains in these impacted areas. With ongoing labor shortages, these companies will need to prioritize efficiency. Industry players are encouraged to consult resources like MetalMiner’s Best Practices Library to manage procurement challenges under these volatile conditions.

Supply Chain Disruptions and Potential Volatility in Metal Prices

The storms forced logistics networks at vital ports to delay building supplies like steel and aluminum, driving up metal prices. These interruptions highlight how natural catastrophes can worsen existing supply chain weaknesses, slowing production and pushing back project deadlines.

Managing Uncertainty with Market Intelligence

Beyond the immediate aftermath, the uncertainty caused by these hurricanes will continue to ripple through the economy. With industrial metal prices prone to fluctuations, companies need to remain proactive.

Hurricane Milton and Helene serve as reminders of how unforeseen events can affect long-term business strategies and cash flow. Buyers and contractors alike will need to leverage market intelligence and forecast reports, such as MetalMiner’s Monthly Metals Outlook (MMO), to better anticipate price shifts and adjust their budgets accordingly.

Insights on Resilient Infrastructure and Metal Prices

Due to more frequent and increasingly intense storms, the U.S. will require stronger infrastructure and proactive risk management strategies. As contractors begin the rebuilding process, they should emphasize building techniques that can withstand future disasters. This shift aligns with broader developments in the construction industry, where public and private businesses increasingly prioritize resilience and sustainability.

In this dynamic environment, access to accurate data and expert insights is critical. Companies can gain a competitive edge by subscribing to MetalMiner’s weekly newsletter for the latest developments in metal prices and industry trends. This allowed companies to stay well-prepared to handle both short-term supply chain disruptions and long-term procurement needs.

Forging the Path Ahead

With infrastructure damage and supply chain disruptions, recovery will require coordinated efforts and strategic planning. For industrial metal buyers, the volatility introduced by these storms underscores the importance of proactive procurement strategies and market intelligence. By utilizing resources like forecasting reports, businesses can mitigate risks, capitalize on market opportunities and ensure they remain prepared for whatever challenges lie ahead.

Construction MMI: Noteworthy Shifts in Metal Prices

- Chinese steel rebar moved sideways, only rising by 0.82%. This left prices at $484.43 per metric ton.

- Chinese 200mm h-beam steel dropped by 3.03% to $407.52 per metric ton.

- Iron ore PB fines rose by 7.78% to $114.36 per metric ton.

- Lastly, European commercial 1050 aluminum sheet rose the most out of all components of the index. In total, prices increased by 17.07% to $3,679.70 per metric ton.