Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

What falling sales? Plugins grew by 19% YoY!

Global plugin vehicle registrations were up 19% in August 2024 compared to August 2023. There were 1.5 million registrations. BEVs were up by just 6% YoY (year over year), but plugin hybrids jumped 51% YoY, selling close to half a million units, with BEVs being responsible for the remaining one million units registered.

It is proven that plugin hybrid technology sells, even without the help of subsidies.

In the end, plugins represented 22% share of the overall auto market (14% BEV share alone). This means that the global automotive market remains in the Electric Disruption Zone.

Year to date, plugin electric vehicle market share was up to 19% (12% BEV), or 10 million units (of which 6.3 million are BEVs).

Full electric vehicles (BEVs) represented 63% of plugin registrations in August, in line with the year-to-date tally. A year ago, BEVs owned 70% of the plugin market.

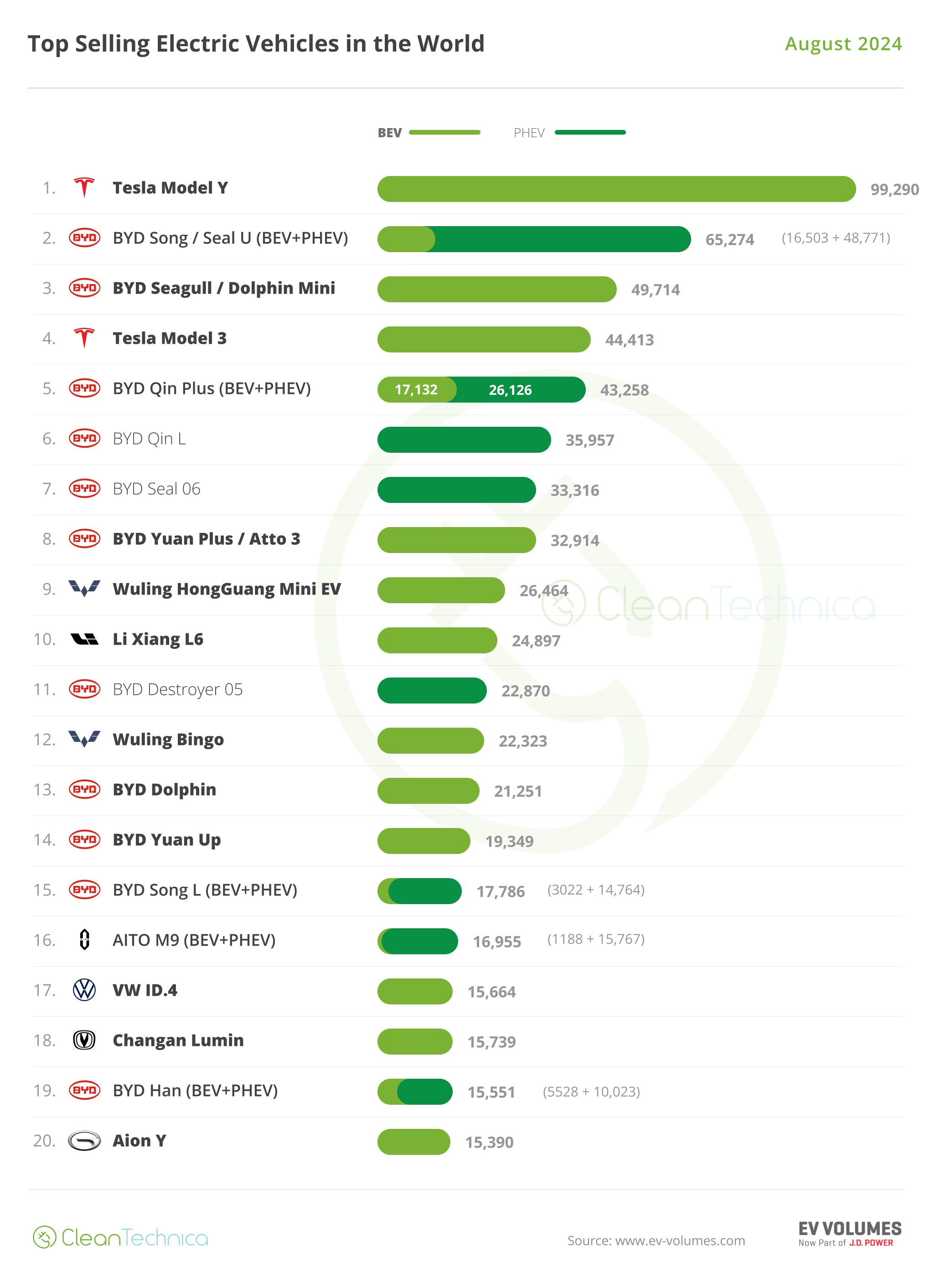

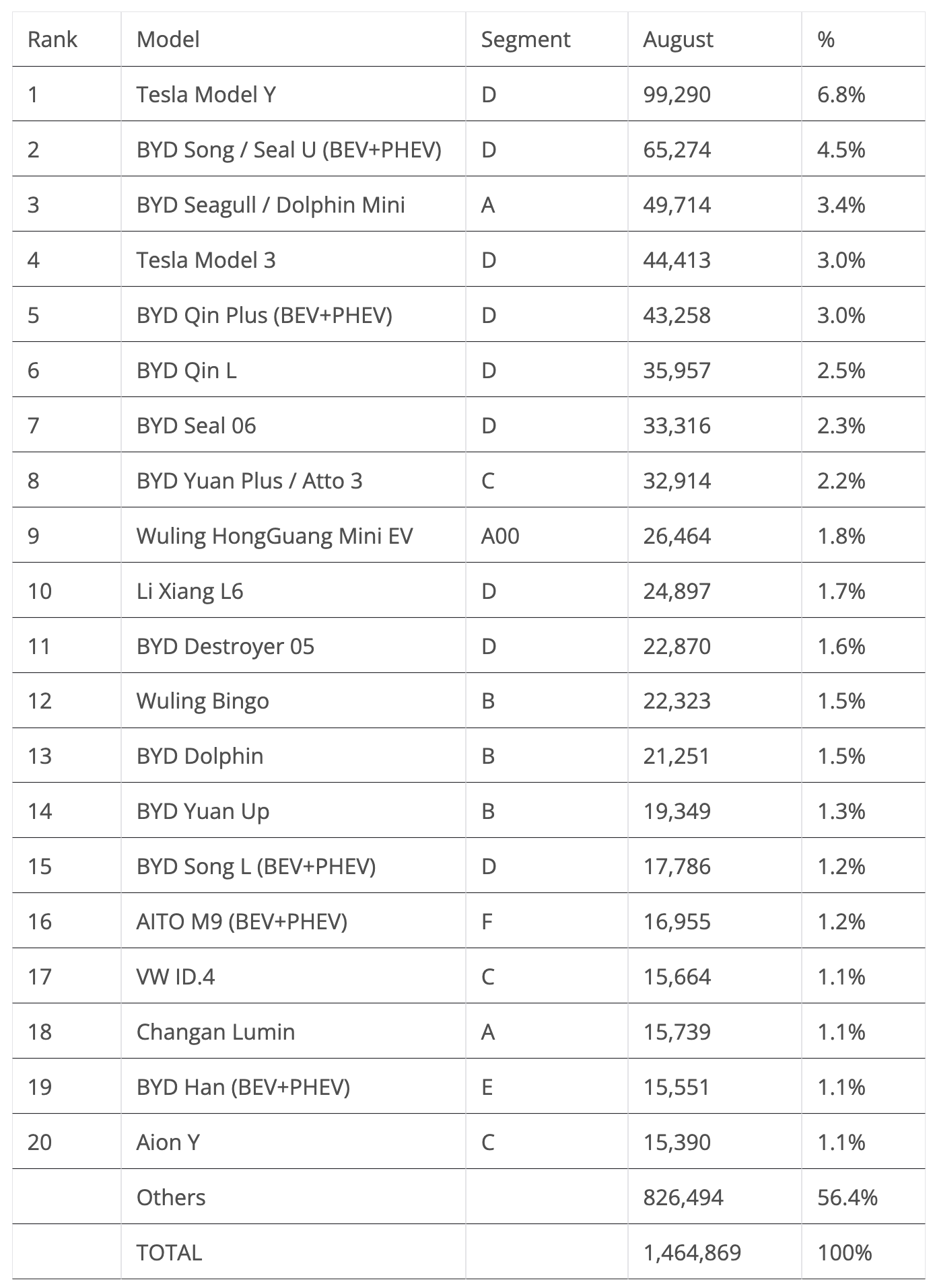

20 Best Selling EV Models in the World in August

Back to August’s best sellers, while the Tesla Model Y was in the lead (as usual) with some 99,000 registrations, down 15% YoY, the Tesla Model 3 ended July only in 4th, with some 44,000 registrations, down 10% YoY. Expect a #1 plus #2 win in September, though, as the Model 3 is expected to have its usual end of quarter peak.

As for BYD, the Shenzhen make placed 11 representatives in the top 20! BYD’s 2024 push is indeed paying dividends.

The best selling non-Tesla and non-BYD this time wasn’t the Li Xiang L6, which ended the month in 10th with 25,000 units, but the tiny Wuling Mini EV, which surged to 9th with 26,000 units. This should be a mere blip, though, as the startup SUV is currently the best candidate for the title of best selling non-Tesla & non-BYD.

In BYD’s extensive lineup, the highlight was the brand new Qin L, which continues to ramp up, scoring 36,000 registrations in only its 3rd month on the market. And it did so without disrupting sales of the regular Qin Plus (5th, with over 43,000 registrations). It also still leaves space for the new Seal 06, its more outgoing twin sibling, to jump to #7, with 32,316 registrations. Add another incredible performance from the BYD Destroyer 05 (#11, 22,870 registrations) and we get four midsize sedans from BYD in the top 11 positions! With a total of 135,000 units! That is peak Model Y performance!

So, after years of talk of Tesla killers, we now have one (or four different nameplates, but that basically are the same car) worthy of the Tesla-killer name. And BYD is yet to really push exports of its sedan quadruplets….

But the highlight of the BYD stable was the 3rd position of the Seagull (aka Dolphin Mini in some export markets), which joined the podium thanks to a record 49,714 units. If the little Lambo continues at this pace, next year’s 3rd position should belong to it, especially considering that its deliveries are in their initial stages in many export markets and it hasn’t yet landed in Europe….

Elsewhere, the #12 Wuling Bingo managed to beat the BYD Dolphin, with the SGMW JV hatchback beating the Shenzhen rival by some 1,000 units, proving that BYD (or Tesla) can be beaten. The same is happening in the full size category, where the #16 AITO M9 continues to impress, beating not only its Li Auto arch-rivals, but also the once all mighty BYD Han, which ended the month in #19.

With a refresh coming soon to the BYD flagship sedan, expect it to rebound in Q4. Although, one wonders if that will be enough to beat Huawei’s full size yacht SUV.

Off the table, the highlight comes from the Geely stable, with the just introduced Galaxy E5 hitting 12,227 registrations in its first full month on the market. This is one of the best entries on the market, which speaks volumes about Geely’s expectations for its compact crossover. With a looong lineup of brands and models, the truth is that the Chinese OEM still has to find one best seller model that manages to stay in the top 20 for more than a few months. Will the Galaxy E5 be it?

With specs directly aimed at beating the BYD Yuan Plus/Atto 3, the 4.6 meter crossover will be available with two different LFP batteries (50 kWh & 60 kWh) and a class-leading drag coefficient of 0.269, leading to an also best in class consumption of 11.9 kWh per 100 km. On top of that, exports are already on the horizon, with a possible landing this year in markets like Norway, Australia, Thailand, Indonesia, and Malaysia (in this last case, as a Proton). This is Geely throwing everything it has in order to finally beat BYD. And all of the sudden, the compact class could become interesting….

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Finally, a reference goes out to the fact that the VW ID.3 failed to win a top 20 position, with the German hatchback scoring just 12,971 units. This meant that the only legacy OEM model in the top 20 was the VW ID.4, in 17th. Will we have a table without any legacy OEM models soon?

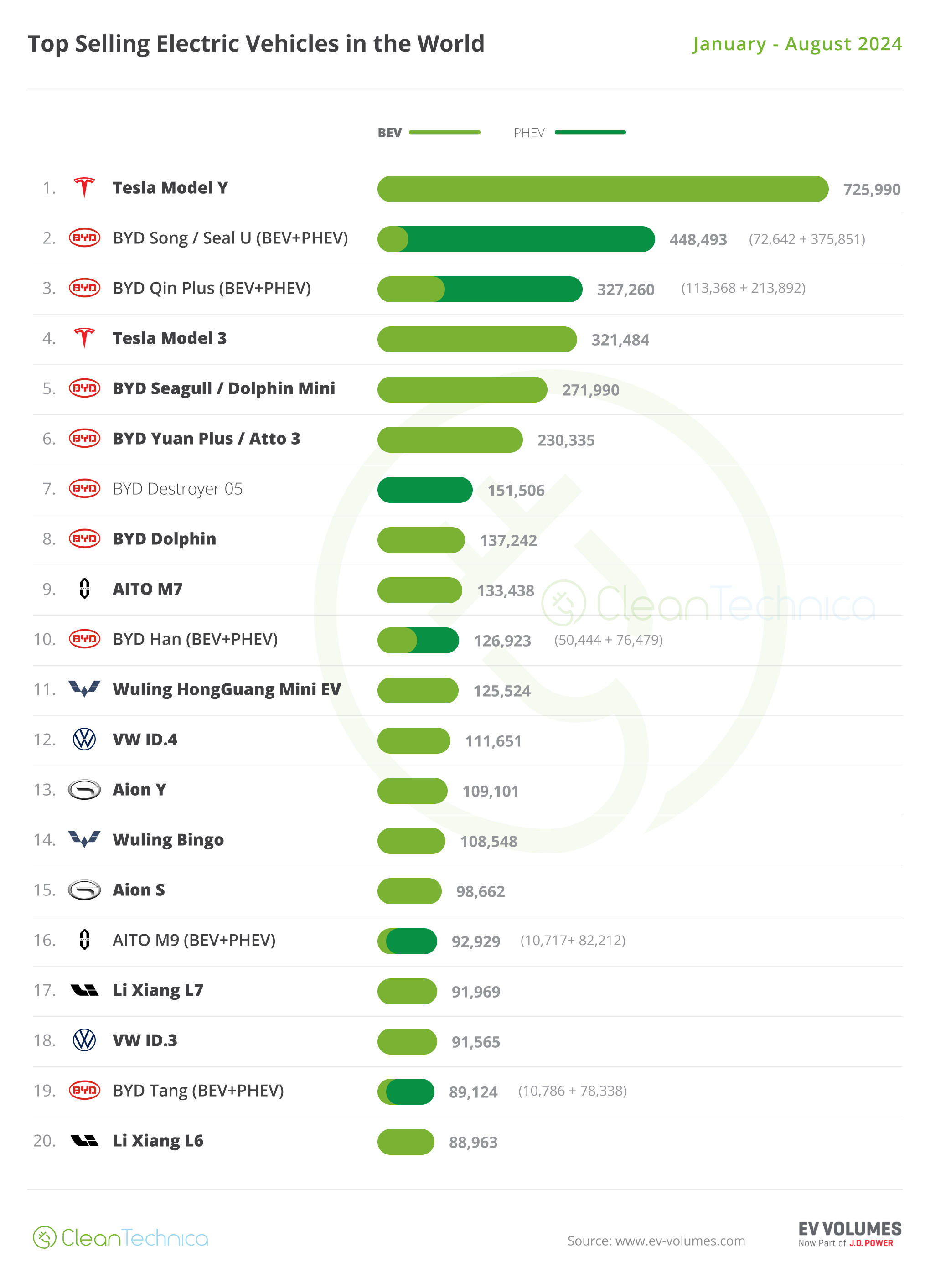

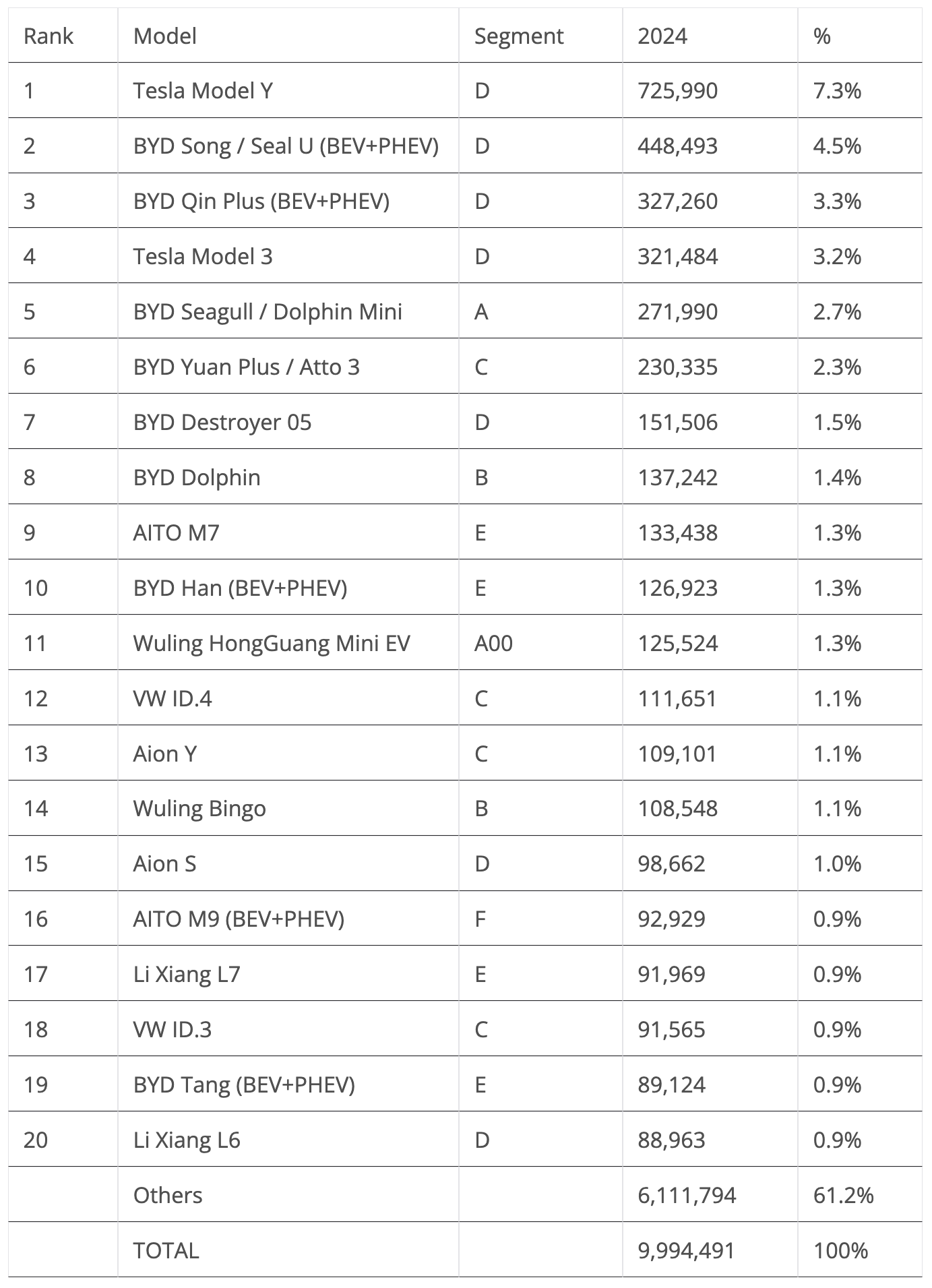

Top 20 EV Models YTD

In the year-to-date (YTD) table, the Tesla Model Y and BYD Song continue firm in the top positions, while the Tesla Model 3 gained some ground to the BYD Qin Plus, now ahead of the US sedan by 7,000 units. Will the Model 3 benefit from enough tail wind in September (aka end of quarter) to regain the 3rd spot?

The following positions seem all secure until the 8th position of the BYD Dolphin, which managed to surpass the AITO M7, with the full size SUV suffering from the direct competition from its larger (and better, I’d say) sibling AITO M9.

GAC’s Aion S reached the 15th spot in August, while right behind it, the AITO M9 continues on the rise, having jumped two positions in August, to 16th. While the category title should be fought between two other models (#9 AITO M7 & #10 BYD Han), expect the flagship AITO to climb a couple more positions by the end of the year.

Finally, the Li Xiang L6 joined the table in #20, and expect it to jump several positions in the remainder of the year.

Right now, there are fewer A/B segment models (four) than there are E/F segment models (five) in the top 20. That speaks volumes to where the EV market is going….

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy