Sources say sluggish growth in Germany and declines in input prices have seen European hot rolled coil steel prices continue to fall, extinguishing hopes of a rebound after the summer. Cold rolled coil, a downstream product of hot rolled coil, carries an average premium of €100 ($110) per metric ton over the latter.

“Demand is very low,” one market watcher told MetalMiner. The source also noted that high stocks against lower consumption have also put downward pressure on prices.

A September 24 Reuters report stated that Germany’s economy, the largest in Europe, is likely to contract a further 0.1% in 2024, following a 0.3% decline in the previous year. Meanwhile, the growth outlook for 2025 is down to 0.8% from 1.4%.

Another source tole MetalMiner that reliance on cheaper raw materials from Russia, some of which have come under EU sanctions following the February 2022 invasion of Ukraine, plus increased technical competition from China, have played significant roles in Germany’s current economic situation.

Get all of the latest metal price trends from MetalMiner’s free Monthly Index report. This must-have document contains monthly price-indexes for 10 different metal industries, covering aluminum, copper and steel prices.

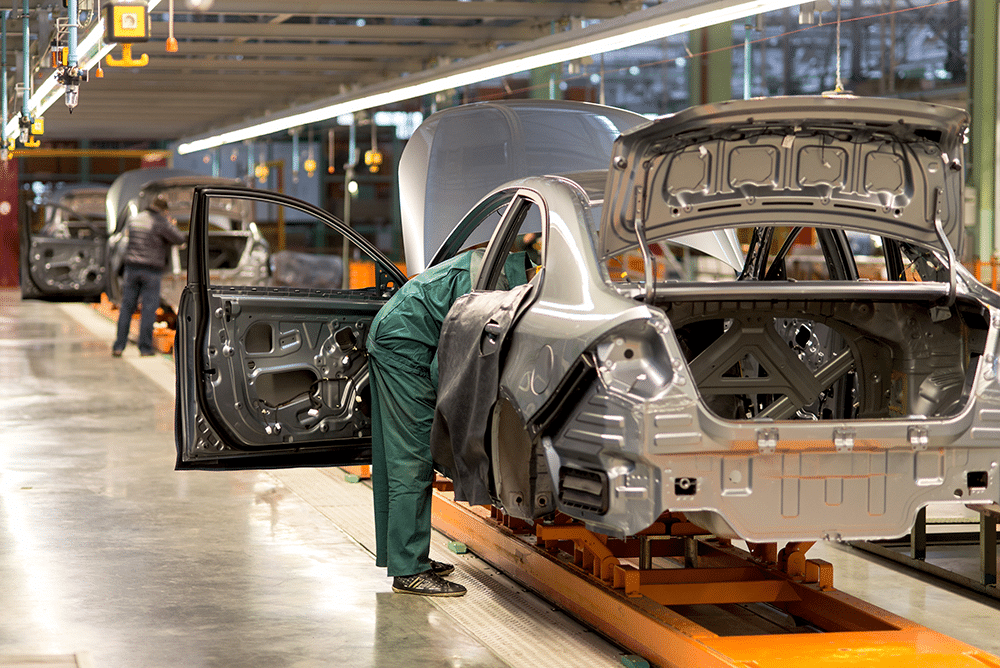

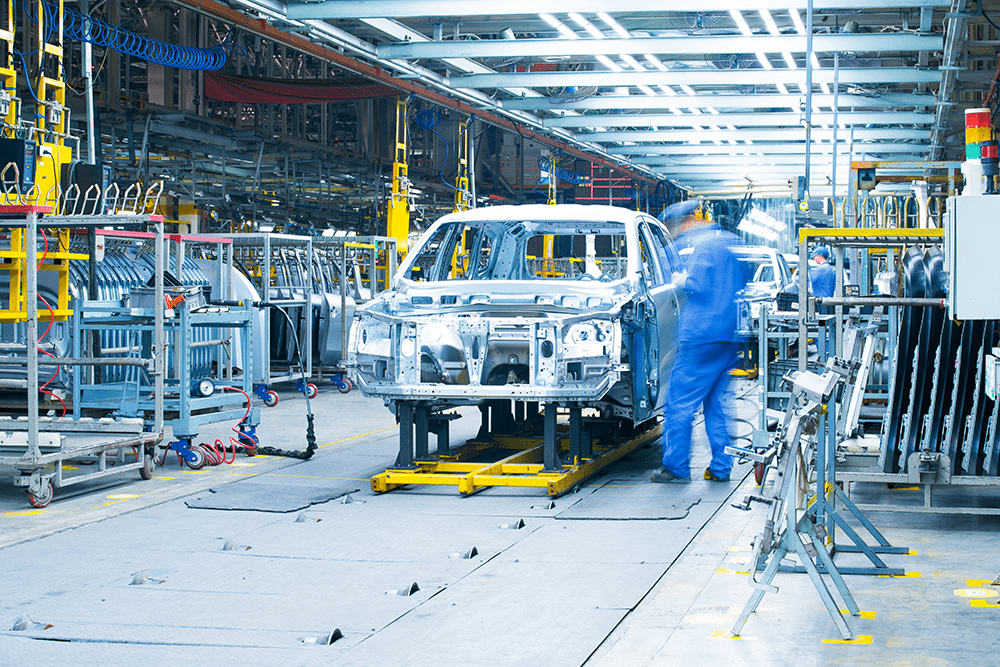

ACEA Report Indicates Declining Auto Registrations

On September 19, the European Automobile Manufacturers Association (ACEA) released a report stat that automobile registrations within Europe also saw a double-digit loss in August. The ACEA data showed that new vehicle registrations came to 643,637 units, down 18.3% year on year from 787,812 units.

“Double-digit losses were witnessed in Germany (-27.8%), France (-24.3%), and Italy (-13.4%), with the Spanish market declining by 6.5%,” the ACEA noted.

The latest figures showed that August numbers are down about one-quarter from the 851,690 units registered in January and over 40% from June’s 1.09 million registrations. Of that number, battery electric vehicle registrations totaled 92,627 units, reflecting a 43.9% drop from 165,204 metric tons in August 2023.

Do you know which steel contracting mechanisms are best for each different type of market conditions? Check out our best practices on this topic.

China’s Economic Weakness Affecting Iron, Steel Prices

Weak economic sentiment in China, the world’s largest steelmaker, continues to put downward pressure on iron ore, one of the main components in producing crude steel.

Data from Trading Economics showed that Benchmark 62% Fe iron ore was $92.50 per metric ton CFR Chinese ports on September 25, down over 6% from the $98.45 on August 27. The data also showed that the price for the feedstock saw a 7.5% day-on-day decline to $92.93 from $100.55 between September 3 and September 4.

“The latest data from China underwhelmed again. The official manufacturing PMI declined to 49.1 from 49.4 in July. The reading has been below the 50-mark separating growth from contraction for all but three months since April 2023,” a September 9 report from Dutch banking group noted.

Markets Have Begun Factoring in China’s Recent Stimulus

However, China’s September 24 economic stimulus announcement has helped iron ore firm up following a dismal summer. On that day, iron ore prices managed to reach $91.88.

The People’s Bank of China stimulus includes a 20-basis point cut in its seven-day interest rate to 1.5%. The PBC also announced plans to boost the real estate market in the world’s second-largest economy by lowering borrowing costs by up to $5.3 trillion in mortgages and relaxing the rules on purchases of second homes. As per the new policy, other Chinese banks can also hold lower cash reserves, reportedly the lowest amount since 2018.

Knowledge is key in knowing when sideways steel markets could suddenly shift. Don’t miss out on MetalMiner’s expert analysis and up-to-date information. Subscribe to MetalMiner’s free weekly newsletter.