Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

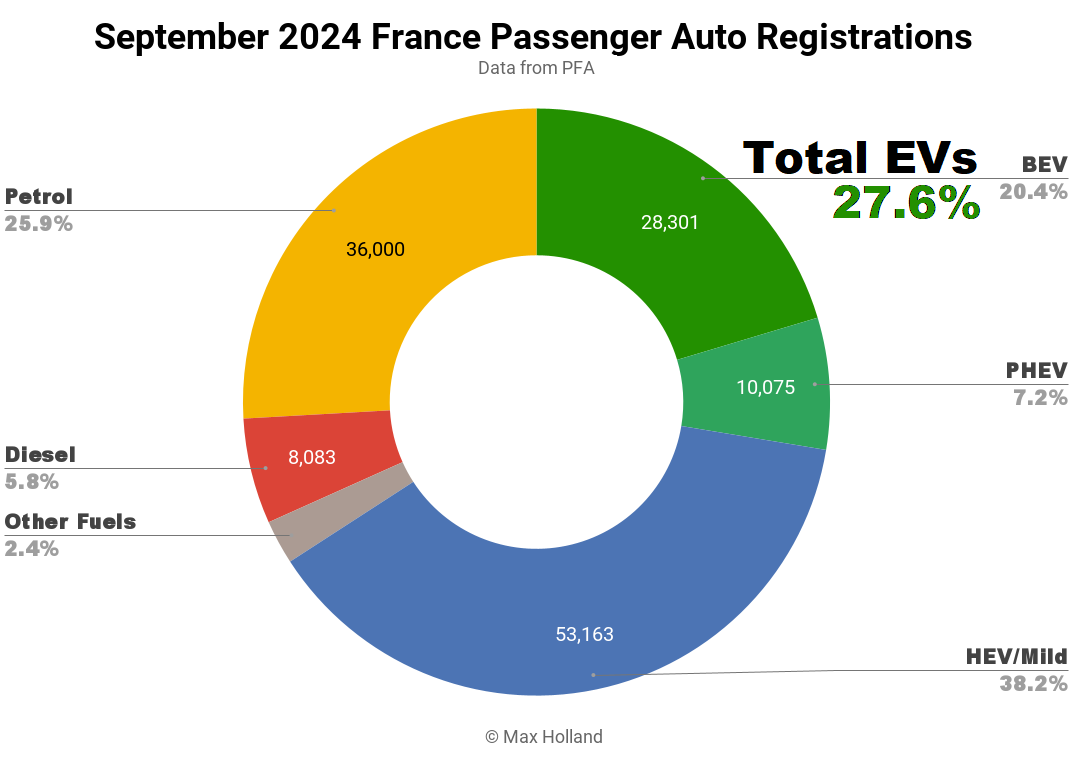

September’s auto sales saw plugin EVs take 27.6% share in France, a drop from 29.3% year on year. BEV share grew modestly YoY, while PHEV share fell. Overall auto volume was 139,003 units, down by some 11% YoY. The Tesla Model Y was the best selling BEV in September.

September’s market data saw combined plugin EVs take 27.6% share in France, with 20.4% full battery-electrics (BEVs) and 7.2% plugin hybrids (PHEVs). These compare with YoY figures of 29.3% combined, 19.3% BEV and 10.0% PHEV.

BEV volume actually reduced by some 6% YoY — though, in a broader market which saw an 11% drop, BEV share nevertheless increased marginally. PHEVs fared less well, with volume down some 26% YoY and share down to 7.2% from 10.0%. PHEV share has been remarkably steady at 7-something % for the past 6 months.

Year to date, BEVs have only taken an additional ~1.2% of market share compared to this point last year (17.1% vs 15.9%), which is obviously a weak growth trajectory. The good news is that both Citroen and Renault have finally started customer deliveries of their new somewhat-affordable BEVs in September, having only delivered small numbers of dealer-demonstration units previously.

The Renault 5 saw a decent 1,101 units in September, and the Citroen e-C3 made an impressive 3,626 registrations. If the coming few months could perhaps maintain (or increase) these kinds of volumes, it will give a boost to 2024’s overall BEV trajectory back into relatively positive territory, but it’s not yet a sure thing, as we will see below.

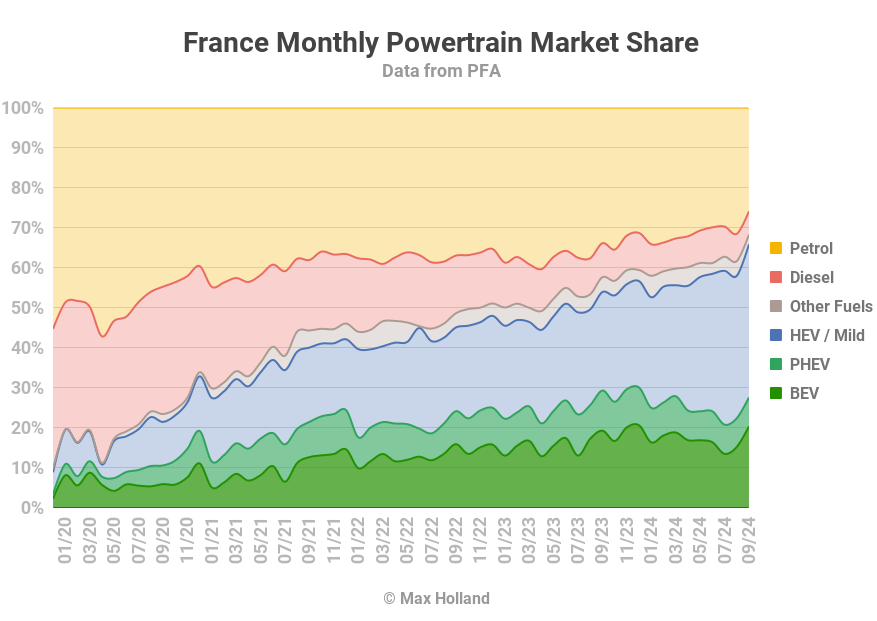

As we can see from the powertrain evolution chart below, petrol-only sales continue to be replaced by HEV sales, in almost direct proportion. However, almost half of these “HEVs” tallied up by the French auto industry body (the PFA) are in fact simply mild-hybrids that typically use a very modest electric motor supplement to an ICE engine and do light regen, rather than being able to drive in electric mode per se, even for a short distance (as full HEVs at least can do, to some extent).

These kinds of mild-hybrid HEVs do improve an ICE engine’s fuel economy modestly (by around 15% typically), but are only a quick-fix temporary stopgap on the way to mostly plugin powertrains, and eventually, almost entirely BEVs.

Diesel-only sales also continued to shrink, down to a new record low of 5.8% share (from 8.5% YoY), and 8,083 units.

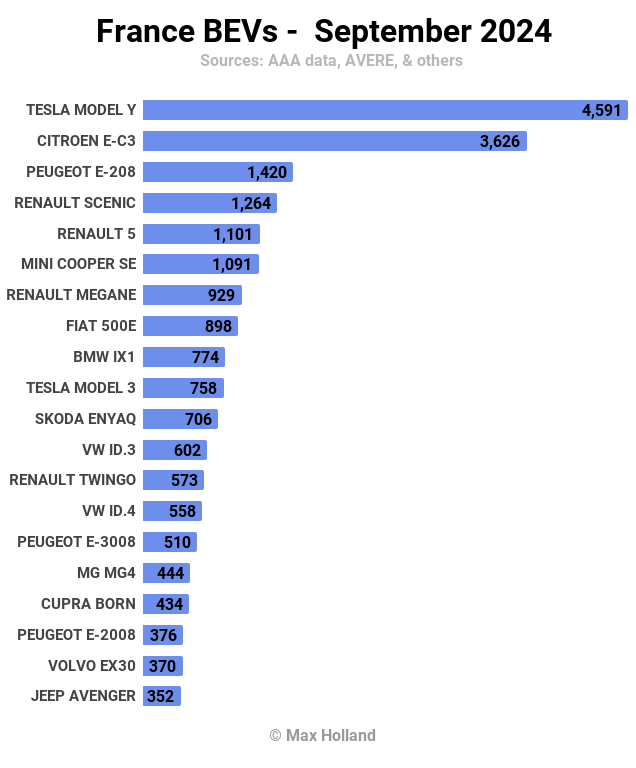

Best Selling BEV Models

The Tesla Model Y was back to the top of France’s BEV charts in September, with an impressive 4,591 registrations. This is its best result since December 2023, and only slightly below the YoY volume from September 2023. Given that there are now a much wider array of BEV models available compared to a year ago, this is an impressive result.

In second place was the new Citroen e-C3, with 3,626 units, and in third was the Peugeot e-208, with 1,420 units.

The Renault Scenic, in 4th, put in a record performance, 1,264 registrations, up from its previous best of 991 registrations in July. As we will see below, this means the Scenic has just overtaken its older sibling, the Megane, in the trailing 3-month rankings, as we recently predicted.

The Mini Cooper has also continued to grow, now landing in 6th spot with a new record of 1,091 registrations. Is this, in fact, the Cooper model? The AAA data source just names the “Mini – Mini” as the bearer of this tally, so this could in fact be any of, or perhaps some combination of, the new generation of Mini BEVs. Let us know in the comments if you have insights.

There wasn’t too much dramatic news in the top 20 ranks, except for the long-awaited volume arrival of the two new “affordable” BEVs from Citroen and Renault that I mentioned earlier. We only have access to limited model volume data, and it seems that below-the-radar numbers (low 3-digit volumes) of both of these new BEVs in fact started to be registered over the past two months, presumably for initial dealer-demonstration units.

There’s a mixed blessing in the impressive looking Citroen e-C3 numbers for September. From local reporting, it seems that this surprisingly large volume of 3,626 units was the result of a rush job by Citroen to try to meet the end-of-September deadline for delivering cars contracted under the the Social Leasing Programme, signed in early 2024.

In the event that Citroen did not meet the delivery deadline for the government programme (and enable consumers to claim the incentive), it would have to honour the discount pricing itself … and in the end, that unfortunate outcome happened. Although 3,626 units did meet the deadline, a further 2,000 to 2,500 contracted units did not, so Citroen had to honour the discount out of its own pocket. This apparently amounted to around €13,000 per vehicle, costing Citroen a tidy ~€30 million.

I’m not sure if a similar situation applied to the timing of the decent number of Renault 5 deliveries in September also, let us know if you have knowledge about that. Either way, though unfortunate, these missteps will likely fade from view in the long run, if the Citroen e-C3 lives up to its potential of being the brand’s best selling BEV, with many tens of thousands — perhaps even low hundreds of thousands — of units sold annually.

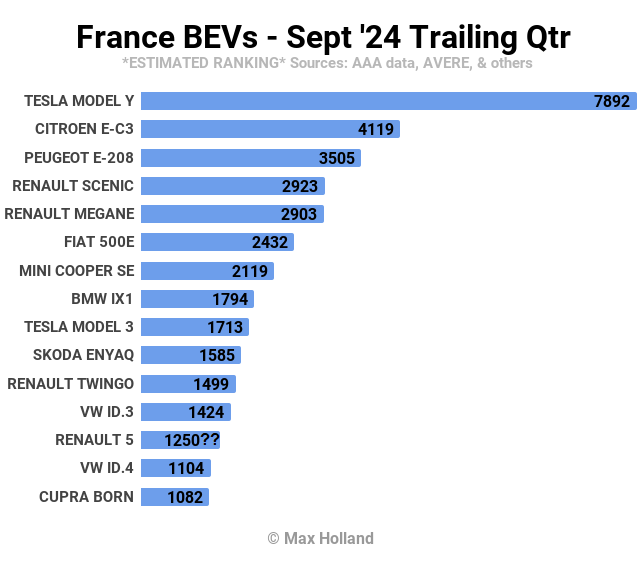

Let’s now look at the 3-month charts:

Despite its erratic monthly numbers, the longer-term view shows that the Tesla Model Y is still in a strong lead overall in the French BEV market.

The Citroen e-C3’s September rush-job immediately boosted it to second place, but this may be a temporary rank (at least in the short-term), once it starts delivering the initially modest monthly output to other European countries. In the long run, once fully ramped and with several price variants, the e-C3 could (should?) certainly be a regular member of France’s top 3.

The old local favourite, the Peugeot e-208, remains popular for now, and took third place.

As alluded to earlier, the Renault Scenic has now finally overtaken its older sibling, the Megane, by a slim margin (20 units), ending up in fourth place in September. We can expect this new family pecking-order to remain in place for the foreseeable future — at least until the Renault 5 starts to reach really significant production volumes over the next year or so.

Talking of the Renault 5, on top of September’s 1,101 units, there were a handful of units (of unknown quantity) delivered over the past couple of months, so I’ve given it an honorary 1,250 units in the 3-month chart, which puts it somewhere between the Volkswagen ID.3 and ID.4 siblings. Depending on its ramp-up and country allocation decisions, the new Renault 5 will likely stay in the top 15 spots in the next couple of months, and gradually rise, perhaps into the top 5 spots, over the next year or so. Let’s keep an eye on it.

Outlook

Somewhat clumsily in Citroen’s case, the new more-affordable small BEVs have finally arrived in substantial volumes in France, and should now help lift the EV trajectory for the remainder of the year. As mentioned several times recently, Europe’s BEV transition will only properly resume its upward journey in 2025, when tighter emissions regulations come into effect across the EU regulatory zone.

France’s broader economy remains tepid, but less weak than many of its neighbours’. Q2 2024 GDP output was just 1% up YoY, the latest inflation figures are at an improved 1.2%, and interest rates (from the ECB) reduced to 3.65%. Manufacturing PMI remains weak, however, at 44.6 points in September, from 43.9 points in August.

With the new Citroen e-C3 and Renault 5 now finally reaching consumers, what are your thoughts on the 2024 EV transition trajectory for France? As a reminder, 2021 full year saw 9.8% BEV share, 2022 saw 13.3%, and 2023 saw 16.8%. As of now, 2024 year to date stands at 17.1%. With these new models, will BEV share reach close to 19% for full year 2024? Let us know in the comments below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy