Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

We are pleased to announce a new study that examines the value of adding batteries to wind and solar plants located in areas that face transmission congestion.

We examine two types of areas facing transmission congestion. These areas represent portions of Regional Transmission Organizations (RTOs) or Independent System Operators (ISO) territory selected based on particular pricing patterns: The first type, called a Variable Renewable Energy (VRE)-rich area, has high local deployment of renewable energy relative to local energy demand. The grid in this type of area becomes congested during hours when the local renewable generation is high relative to the available transmission capacity to neighboring areas. In those hours, local wholesale energy prices will decline compared to neighboring areas. The second type, Load Centers are areas with high demand for electricity relative to local generation sources, such as cities and suburban areas. Load Centers tend to see local prices spike when demand peaks relative to the available transmission capacity into the areas. Wind and solar plants are located in both types of congested areas, though there are more plants located in VRE-rich areas.

This study explores the value of adding batteries in both types of areas, how optimal configurations of hybrid VRE+battery plants might vary between areas types and between solar and wind, and how the plants can contribute to both energy and capacity markets. The findings from this work can help to refine long term planning processes and provide insight into future conditions as renewable energy and battery deployment expands over time.

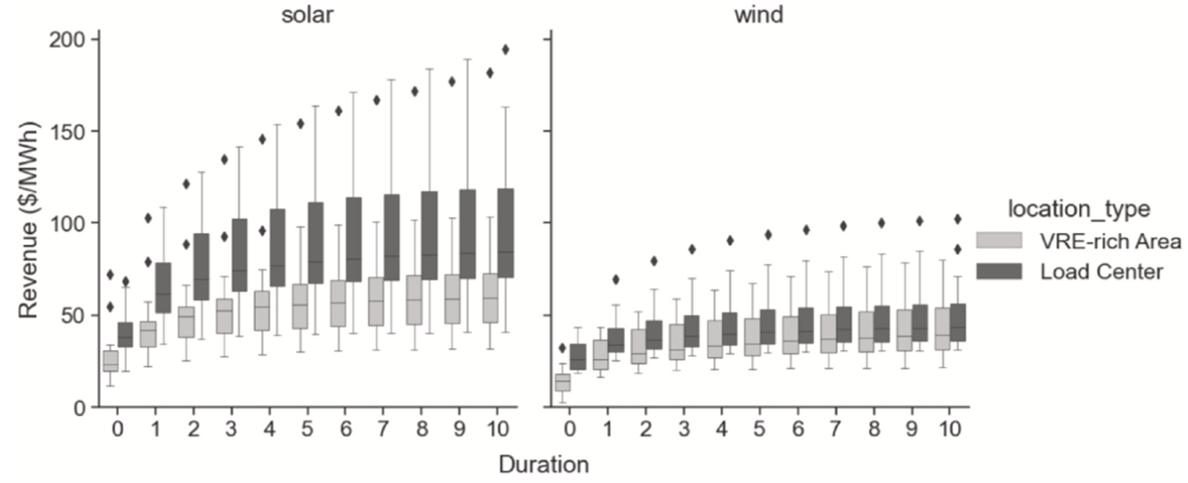

Figure 1. Annual hybrid plant energy revenues by battery duration and plant and location type across all markets. Standalone wind and solar plants are represented by zero duration for comparison. Outliers, represented by diamonds, are data points that fall outside the range of 1.5 times the inter-quartile range. Note, we excluded wind plants in ERCOT in this figure, due to outlier values that made the rest of the figure hard to read. The figure including all plants studied is available in the full text.

Key findings from the study include:

- Adding Up to 4 Hours of Storage Substantially Boosted Energy Value for Solar and Wind Plants: One metric examined was energy value, or the value plants could receive for selling their energy into the wholesale electricity spot market. In VRE-rich areas, wind and solar plants saw similar relative increases to value from adding storage. For example, in VRE-rich areas, adding one hour of storage boosted energy value for both wind and solar plants by ~80%, and extending storage from 1 to 4 hours duration boosted energy revenue by a further ~30%. One caveat is that storage value was based on the assumption that battery dispatch was optimized with perfect foresight into market prices, which represents an upper bound for the value boost – past research suggests that storage value estimates without perfect foresight may be 70% to 90% that of the value under perfect foresight, varying by the location and year.

- The Energy Value of Storage Plateaus After 4 Hours of Duration in Current Markets: Energy value increases notably when adding batteries with durations up to 4 hours. However, little additional energy value was found beyond 4 hours of battery duration in most locations and across both types of areas (Figure 1). Notably–and somewhat surprisingly–even in VRE-rich areas, batteries beyond 4 hours see relatively little gain in energy value.

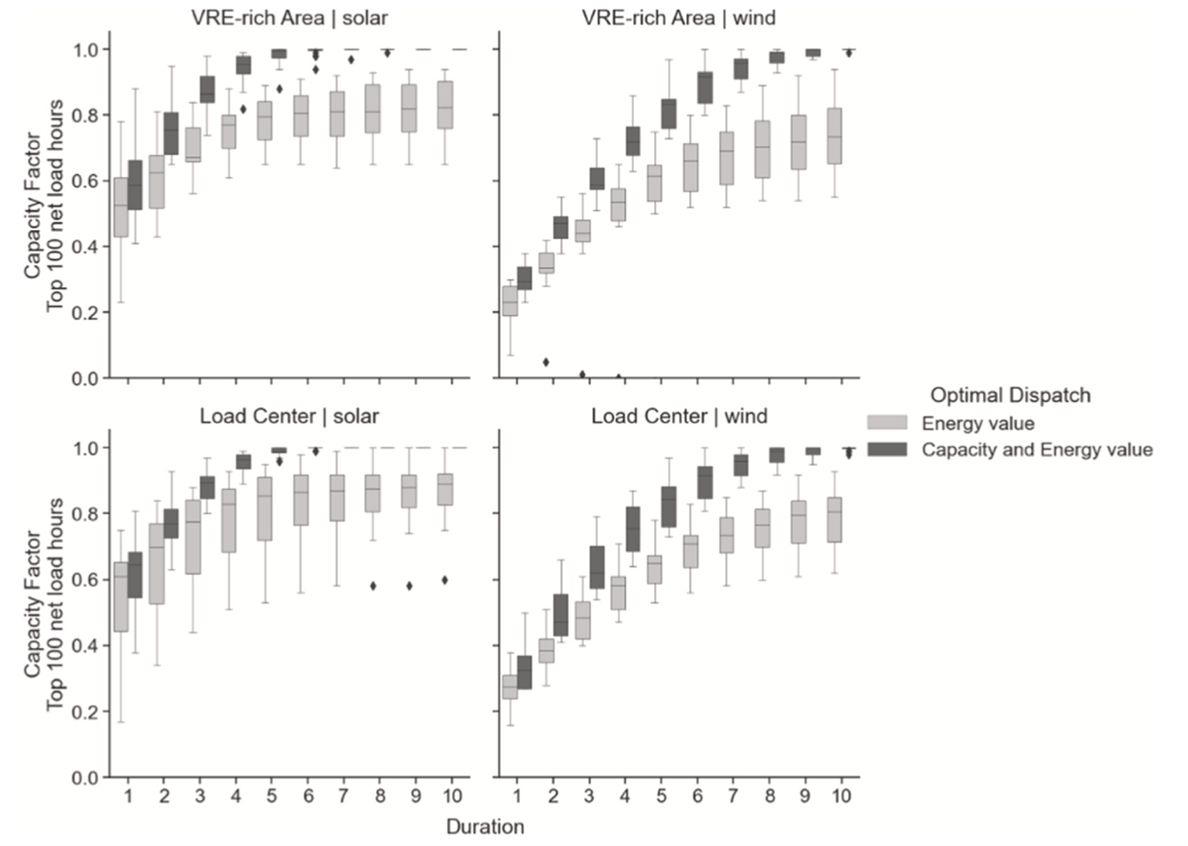

- Wind Requires Longer-Duration Storage to Earn Capacity Credit than does Solar: Capacity credit, measured here simply as the ability to supply energy to the grid during the 100 highest net-load hours per year, reaches 90% with four hours of battery duration for solar plants, but requires 8 hours of battery duration for wind plants. This was true in both types of areas (Figure 2).

- Battery Degradation Assumptions Impact Results: An important technical detail was that the value added of battery storage was sensitive to the imposition of dispatch limits designed to minimize battery degradation over time. When a $25/MWh threshold for temporal arbitrage was imposed, revenue estimates were reduced by roughly 15% to 20%, with larger revenue declines for some plants in VRE-rich areas. This is an important finding because it shows that there are important trade-offs between optimizing for battery longevity and short term revenue optimization. These trade-offs are often treated in a simplistic manner, such as with warranty requirements that limit battery usage to one cycle per day. More sophisticated treatment of battery degradation may allow for greater value maximization for hybrid power plant owners.

Figure 2. The capacity factor of hybrid wind and solar plants with batteries during the 100 most critical hours per year (as measured by the net-load, that is, the total electricity demand less wind and solar generation). The darker bars represent the capacity factor possible when plants are optimally dispatched to meet the top 100 hour hours.

Limitations include:

- This analysis focused on energy and capacity markets, but did not assess value from ancillary services. Many hybrid plants, especially in ERCOT, derive high value from ancillary services. However, we chose to ignore ancillary service value streams because the depth of the market for these services is low; as hybrid and storage resources are deployed in greater numbers, it is likely they will become much more dependent on energy and capacity revenue, as has already started to occur in CAISO.

- The energy value analysis was based on real time wholesale prices from 2018 – 2021, which will not reflect dynamics that have occurred over the most recent years. Natural gas prices, and therefore overall electricity prices, were particularly high in 2021 and 2022, and only high prices from 2021 are captured in this analysis.

- We modeled the dispatch of hybrid renewable and battery plants assuming perfect foresight of real time prices, whereas actual hybrid plants must plan battery charging and discharging based on imperfect forecasts. With imperfect foresight, the value of battery storage would be lower than described here. Therefore, this paper represents a theoretical maximum value of adding storage. Other research efforts have focused, and will continue to focus, on the difference between perfectly planned dispatch and actual dispatch.

To learn more details, see the full study as published in the journal Renewable Energy.

If you have any questions, contact Dev Millstein at Lawrence Berkeley National Laboratory. We appreciate the funding support of the U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy.

Courtesy of email from Dev Millstein, Lawrence Berkeley National Laboratory

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy